Europe's leveraged finance markets enter 2025 following a solid performance in 2024, with the syndicated loan and high yield bond markets rallying and private debt remaining active. European loan and bond issuance nearly doubled year-on-year. Refinancing and repricing drove activity, as issuers returned to the market to take advantage of lower interest rates and bring down borrowing costs. With base rates falling, investors with a renewed appetite for yield have been eager to provide their support.

Moreover, with the revival of the loan and bond markets, borrowers have jumped at the opportunity to push out maturities and lower financing costs, and have in some cases taken the opportunity to refinance pricier unitranche structures provided by private debt players with cheaper loan and bond options.

This has created a fluid market where quality borrowers have had a broader range of products to choose from and the ability to select the best possible financing options to match their specific requirements.

Although public debt markets have regained market share, private debt players remain as relevant and active as ever, with their ability to price risk and deliver rapid deal execution.

With all the lending channels open again, the competitive dynamic between public and private debt providers has intensified to the benefit of the borrowers. Private debt players have tightened margins and offered more covenant flexibility to win new business. Public debt markets have sharpened execution and broadened the types of facilities they offer.

The only missing piece of the puzzle in 2024 has been a steady pipeline of new M&A and leveraged buyout financing opportunities.

This has been more of a function of an only moderately improving M&A deal market than a lack of investor and lender appetite. However, there is a growing optimism that deal activity will grow within the next 12 months, as interest rates come down and vendors and buyers align on valuation.

If and when the M&A market picks up, financing markets will be well positioned to support dealmakers.

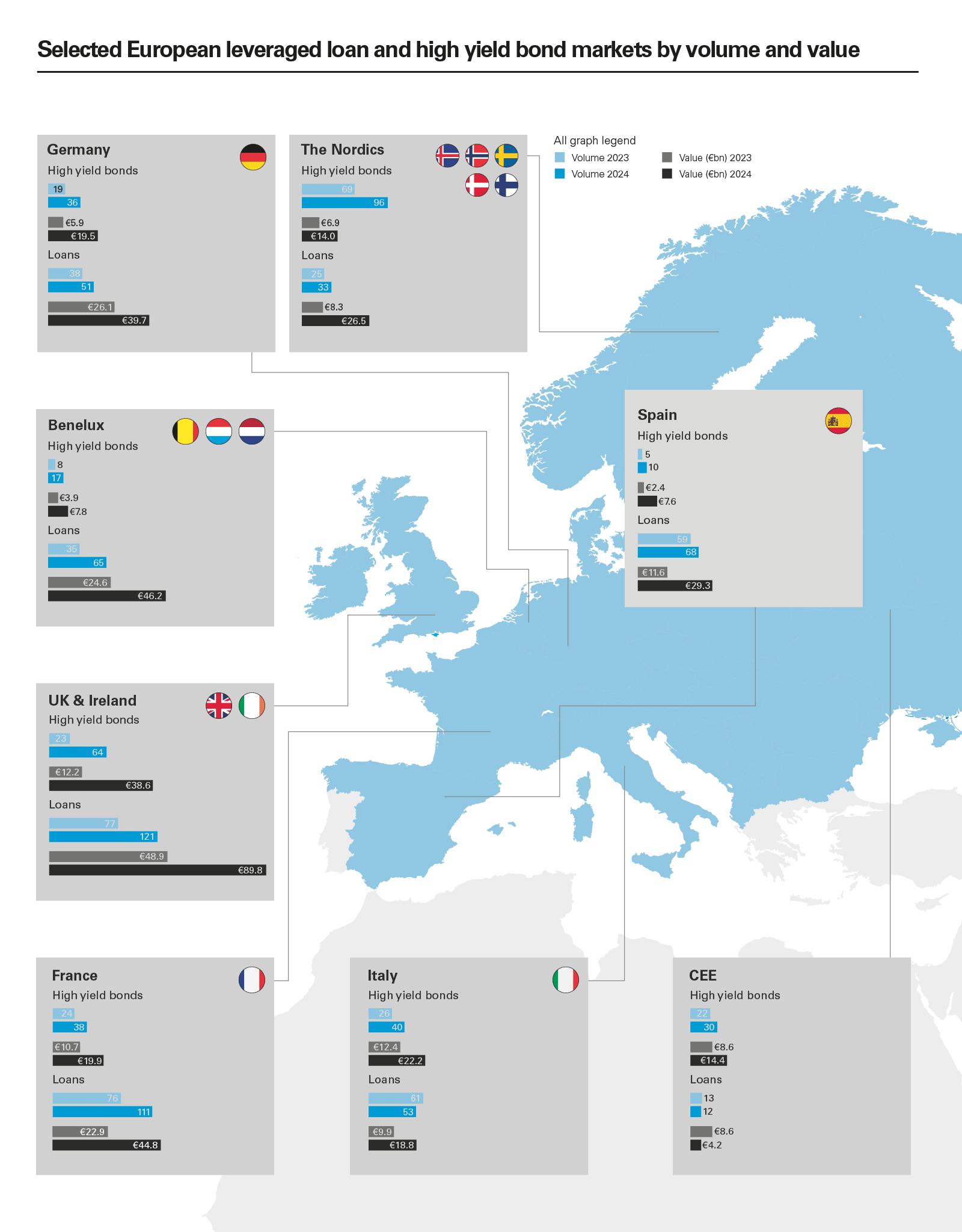

View full image: Selected European leveraged loan and high yield bond markets by volume and value (PDF)

View full image: Selected European leveraged loan and high yield bond markets by volume and value (PDF)