White & Case Global Antitrust Merger StatPak

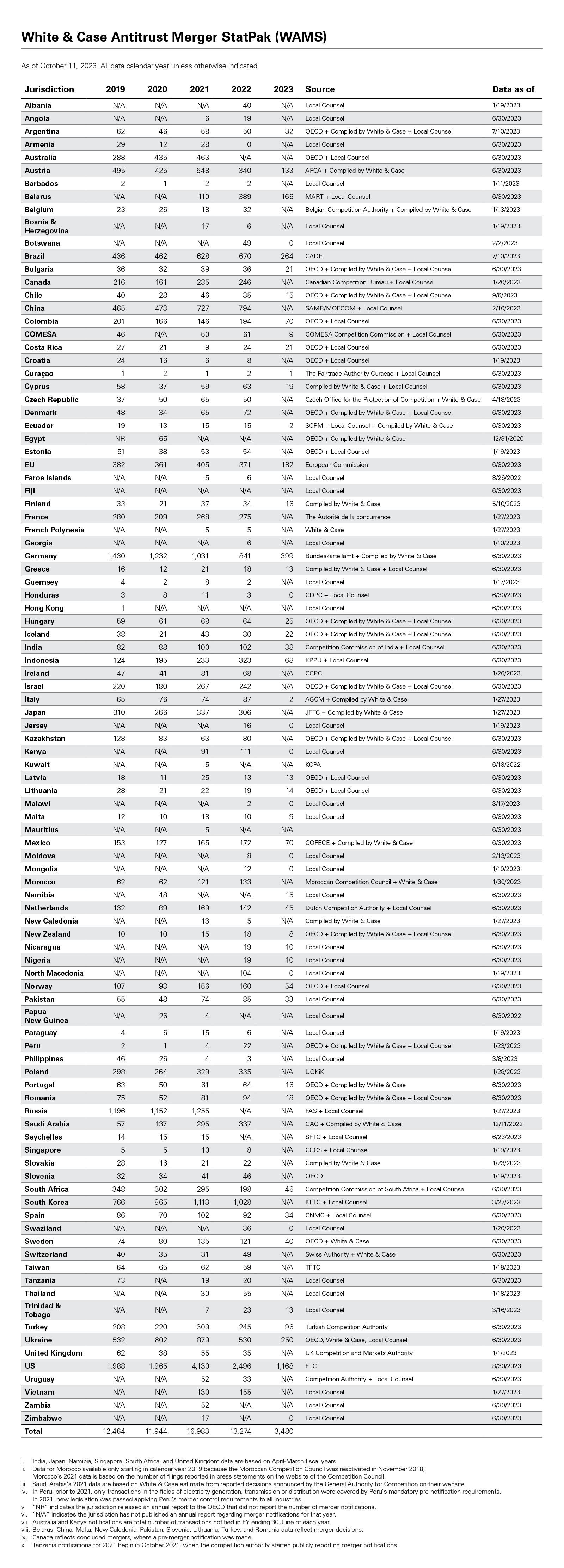

White & Case's Global Antitrust Merger StatPak (WAMS) is a resource providing information on merger control filing activity by competition authorities around the world. The WAMS survey currently includes filing data from 100 of the most active merger control jurisdictions in the world.

More from WAMS

Read our latest insights: Middle East & North Africa review

Interested in a jurisdiction not yet covered? Contact us

Stay current on your favorite topics. Subscribe

White & Case Global Antitrust Merger StatPak (WAMS)

as of October 29, 2025

The latest HSR data show competing influences of New HSR Rules and new administration on merger filings, but yearly HSR filings are steady YTD 2025

Overall, the number of H1 HSR filings has remained consistent over the last three years. From 2023 H1 to 2024 H1 HSR filings increased by 10%, and from 2024 H1 to 2025 H1 they decreased by 3%. However, the distribution of those HSR filings throughout the year varies considerably.

Two major shifts in HSR could explain the 2025 trends in the data. First, the New HSR Rules went into effect in February 2025. Second, the new presidential administration appears to be taking more of a pro-merger approach to antitrust reviews.

On February 10, 2025, the New HSR Rules implemented the biggest overhaul of premerger notification filings in the United States in the nearly 50 years since the enactment of the Hart-Scott-Rodino Act in 1976. The New HSR Rules substantially increased the amount and types of information merging parties must provide, including, among others, reports regularly prepared for the CEO of a merging party, drafts of transaction-related documents shared with any board member, and English translations of foreign language documents.

Merging parties viewed the looming implementation of the New HSR Rules as a deadline by which to complete their HSR filings under the earlier rules. As a result, January and February of 2025 both saw increases in HSR filings compared to the previous two years, with a massive spike of 70% in February 2025 compared to February 2024.

Not surprisingly, after the New HSR Rules went into effect, there was a large decline in HSR filings in March, reflecting the acceleration of filings under the old regime. From February 2025 to March 2025 HSR filings decreased 61%, and there were 35% fewer HSR filings in March 2025 compared to March 2024.

Once parties adjusted to the New HSR Rules the HSR merger filings stabilized in Q2 2025. While not quite at the highs of 2024, monthly HSR filings in Q2 2025 tracked the same period in 2023 closely. By August 2025, monthly HSR filings increased 128% from the low in March 2025, reflecting the familiarity with the new regime.

One potential factor contributing to the steady increase in HSR filings throughout Q2 2025 and into Q3 2025 is the new administration's stated pro-merger attitude, particularly towards remedies where needed. FTC Commissioner Melissa Holyoak explained "where a divestiture can successfully preserve lost competition from the underlying merger, the agencies should consider it, and should focus on the potential benefits to innovation from the remainder of the merger." Since the administration change, the FTC and DOJ have announced at least seven remedies including divestures in the aerospace, communications hardware, and software industries, and one behavioral fix. This contrasts with the previous administration's litigation-focused strategy.

With the initial disruption of the New HSR Rules weathered, it would seem as though the general trend of increasing HSR filings will continue, as parties pursue transactions under a more merger-friendly administration.

White & Case Global Antitrust Merger StatPak (WAMS) Reports

White & Case Merger Control Publications

White & Case keeps clients up-to-date on merger control developments.

View full image: White & Case Antitrust Merger StatPak (WAMS) (PDF)

View full image: White & Case Antitrust Merger StatPak (WAMS) (PDF)

US monthly merger notifications 2023 - 2025 YTD* (PDF)

US monthly merger notifications 2023 - 2025 YTD* (PDF)