What have we learned from COVID-19?

Epidemiologist Syra Madad says it’s critical to engage with local communities

Hugh Verrier

Chair

In 2021, the COVID-19 pandemic continued to affect nearly every aspect of our lives. Against this backdrop, our global teams worked on groundbreaking transactions, resolved high-stakes disputes and, through our global citizenship initiatives, responded to societal challenges around the world.

The role of business in society evolved as environmental, social and governance (ESG) issues entered the mainstream, concentrating on challenges including the energy transition and achieving greater diversity and inclusion. Like our clients, we looked for ways to create long term value and growth—a shared goal that created opportunities for collaboration.

It was in this context that we launched a new five-year strategy, focused on creating a distinctive experience for our clients.

Our emphasis on complex, cross-border matters helped us grow in all of the regions where we work and achieve outstanding results for our clients. As we look to the next five years, we are committed to building the capabilities our clients need, supported by a strong, resilient culture.

Guest speakers at Firm events talk about issues that made news in 2021

Epidemiologist Syra Madad says it’s critical to engage with local communities

Think tank CEO Chris Pinney is encouraged by moves to focus on impact, not just policies and procedures

Bill Emmott, who co-leads a nonprofit that studies the far-reaching effects of COVID-19, discusses the importance of business scenario planning

Developments that reshaped the world

Countries and companies are increasingly committing to net-zero goals that would require them to significantly reduce carbon emissions on relatively short timelines

The pandemic accelerated global concerns over climate change and inequality, pushing societal expectations around responsible business practices into the spotlight

Most of 2021 was characterized by free-flowing capital, as government aid in response to COVID-19 propped up economies

Globalization may be evolving, as nations and regions reassert their regulatory powers on a wide range of issues

Matters in eight practice areas that highlight our global impact for clients

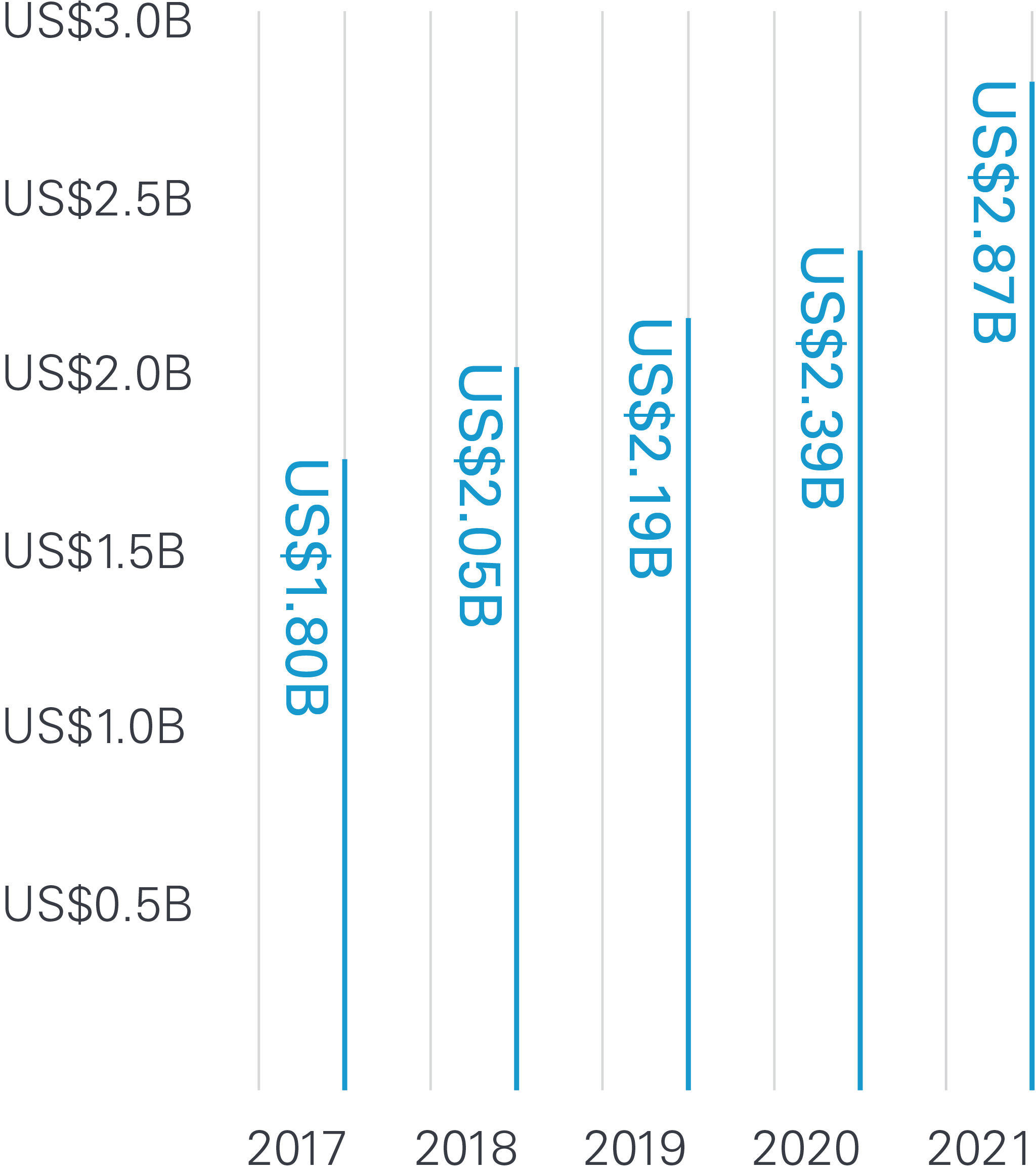

Our 2021 achievements cap an outstanding five-year success story

2,464 Total lawyers

An outstanding roster of talented lawyers strengthened our Firm in 2021

White & Case earned many of the legal industry’s top accolades for outstanding performance in 2021

White & Case is committed to fair and ethical operations that respect human rights and recognize the importance of our natural environment.

As a signatory to the UN Global Compact we affirm our commitment to doing business responsibly by supporting the Compact’s ten principles on human rights, labor, the environment and anti-corruption. The steps we are taking to continue to embed these principles into our Firm are outlined in our most recent Communication on Progress.

Our latest Environmental Sustainability Report includes information on our environmental policies, footprint, key actions and goals.

Where White & Case is a longtime leader — and we're just getting started.

10 global affinity networks

Our ten global affinity networks foster a sense of community among the Firm’s Black, Asian, Latinx/Hispanic, Middle Eastern, minority ethnic and LGBT+ lawyers, business services professionals and their allies. Each network sets its own agenda, initiatives and goals, which are specific to the issues it feels are most important. Affinity networks also create and enhance awareness of these groups within the Firm and its larger culture, drive community and connection across our global offices, and support their members with career and professional development opportunities.

26 local women’s networks

Our 26 local women’s networks are active in 40 offices across the Americas, EMEA and Asia-Pacific. These networks foster professional development and mentoring activities, and support business-related client partnerships. They also provide a forum for our lawyers and business services professionals to share perspectives and create programs to support and retain our talent while fostering and promoting gender equity.

For more than a decade, leading publications and alliance organizations have recognized White & Case’s commitment to diversity and inclusion.

We continued to advance toward our diversity and inclusion goals, narrowing the gap between thought and action with new trainings

Like our clients, we are seeking ways to sustainably create long-term value and growth, a shared goal that presents opportunities to collaborate

We set out to ensure we provide our clients with an experience that emphasizes the attributes they seek in a trusted advisor

Global concerns over climate change and inequality highlighted by the COVID-19 pandemic contributed to the growing demand for, and prominence of, societal expectations around responsible business practices. As governments, investors, interested communities and other stakeholders pushed environmental, social and governance (ESG) concerns into the spotlight, companies across sectors sought to balance efforts to measure, report on and address these challenges while maximizing long-term stability and growth.

We advised clients, including companies, sovereigns and investors, on issues that ranged from evolving ESG reporting and regulatory requirements to sustainability-linked financing. Below we discuss some of the concerns that were top-of-mind for our clients in 2021.

Climate change, and the regulations and policies designed to mitigate industrial activity’s effects on the climate, have underscored the importance of environmental protection, often overshadowing the importance of the “S” in ESG. But there is a growing recognition that a company’s failure to address social factors, including human rights, labor practices, community relations, and diversity and inclusion, carries serious risks. For example, supply chains can expose companies to risks that can have a negative impact on ESG goals, creating potential for reputational damage, which can impact share price.

Lawmakers are also increasingly stepping in to encourage action, particularly in Europe. As the regulatory landscape continues to evolve, so do the considerations for companies that want to meet their social obligations.

In a range of sectors, investors are seeking projects that make sense from both a financial and sustainability perspective. For example, ensuring that borrowers weigh ESG considerations has become a priority for many mining investors and financiers. As a result, mining companies routinely identify ESG issues, including environmental risks, community relations and their social license to operate, as among their most important challenges.

Infrastructure investors surveyed in 2021 told a similar story. In both the US and the Asia-Pacific region, a clear majority of investors said ESG considerations are important when selecting among infrastructure projects.

In the US, where the infrastructure bill paved the way for large-scale spending, investors planned to back more social infrastructure projects, including schools and healthcare facilities, in addition to the more traditional road, bridge and tunnel projects. Helped along by the lessons of COVID-19, ESG concerns also influenced investors surveyed in the Asia-Pacific region, who, likewise, described plans to invest in social infrastructure at an increased rate.

The agreements that regulate international trade largely presume that companies operate solely to make a profit. Companies focused on broader benefits, including ESG goals, will need to weigh how current trade laws may help or hinder them, both in trade disputes and in their ability to remain competitive while pursuing ESG objectives.

Some countries have trade policies that support ESG principles by offering incentives that could run afoul of US trade laws, including anti-dumping laws, which seek to prevent products from being sold in the US at less than fair value. On the other hand, many companies in the US and elsewhere may be disadvantaged because they do not receive ESG-related inducements from their governments and, instead, must assume added costs to meet international ESG standards.

On the US antitrust front, amid heightened merger scrutiny and policy calls to use antitrust laws to spur social change, companies should weigh social factors—such as a deal’s impact on the environment and jobs—when seeking merger clearance. While it is unlikely that social factors alone will determine merger clearance outcomes, they could play a role in US enforcement agencies’ decisions on which transactions to investigate.

In 2021, ESG features became increasingly prominent in deals and investments across all asset classes. The growing focus on ESG filtered into debt markets, as borrowers recognized that presenting a clear ESG strategy to investors opened up access to new pools of capital and opportunities to lock in favorable pricing. Deals included the largest-ever sustainability-linked financing. Although European and North American issuers accounted for the bulk of ESG-linked issuance, sustainability and ESG debt are rapidly gaining traction across all regions, including Latin America and Asia-Pacific.

A range of ESG-linked debt products made strides. Green bonds, which raise capital specifically for climate-linked and environmental projects, and sustainability-linked bonds and loans, which are not linked to specific green projects but are issued to incentivize sustainability performance objectives, all saw growing investor interest throughout 2021. As sustainability-linked financing products proliferate, the next challenge for borrowers and issuers will be standardization, to make it possible to compare the value of deals that cover different environmental and social impacts.

Photo by Liyao Xie / Moment © Getty Images

A highway overpass in Beijing