What have we learned from COVID-19?

Epidemiologist Syra Madad says it’s critical to engage with local communities

Hugh Verrier

Chair

In 2021, the COVID-19 pandemic continued to affect nearly every aspect of our lives. Against this backdrop, our global teams worked on groundbreaking transactions, resolved high-stakes disputes and, through our global citizenship initiatives, responded to societal challenges around the world.

The role of business in society evolved as environmental, social and governance (ESG) issues entered the mainstream, concentrating on challenges including the energy transition and achieving greater diversity and inclusion. Like our clients, we looked for ways to create long term value and growth—a shared goal that created opportunities for collaboration.

It was in this context that we launched a new five-year strategy, focused on creating a distinctive experience for our clients.

Our emphasis on complex, cross-border matters helped us grow in all of the regions where we work and achieve outstanding results for our clients. As we look to the next five years, we are committed to building the capabilities our clients need, supported by a strong, resilient culture.

Guest speakers at Firm events talk about issues that made news in 2021

Epidemiologist Syra Madad says it’s critical to engage with local communities

Think tank CEO Chris Pinney is encouraged by moves to focus on impact, not just policies and procedures

Bill Emmott, who co-leads a nonprofit that studies the far-reaching effects of COVID-19, discusses the importance of business scenario planning

Developments that reshaped the world

Countries and companies are increasingly committing to net-zero goals that would require them to significantly reduce carbon emissions on relatively short timelines

The pandemic accelerated global concerns over climate change and inequality, pushing societal expectations around responsible business practices into the spotlight

Most of 2021 was characterized by free-flowing capital, as government aid in response to COVID-19 propped up economies

Globalization may be evolving, as nations and regions reassert their regulatory powers on a wide range of issues

Matters in eight practice areas that highlight our global impact for clients

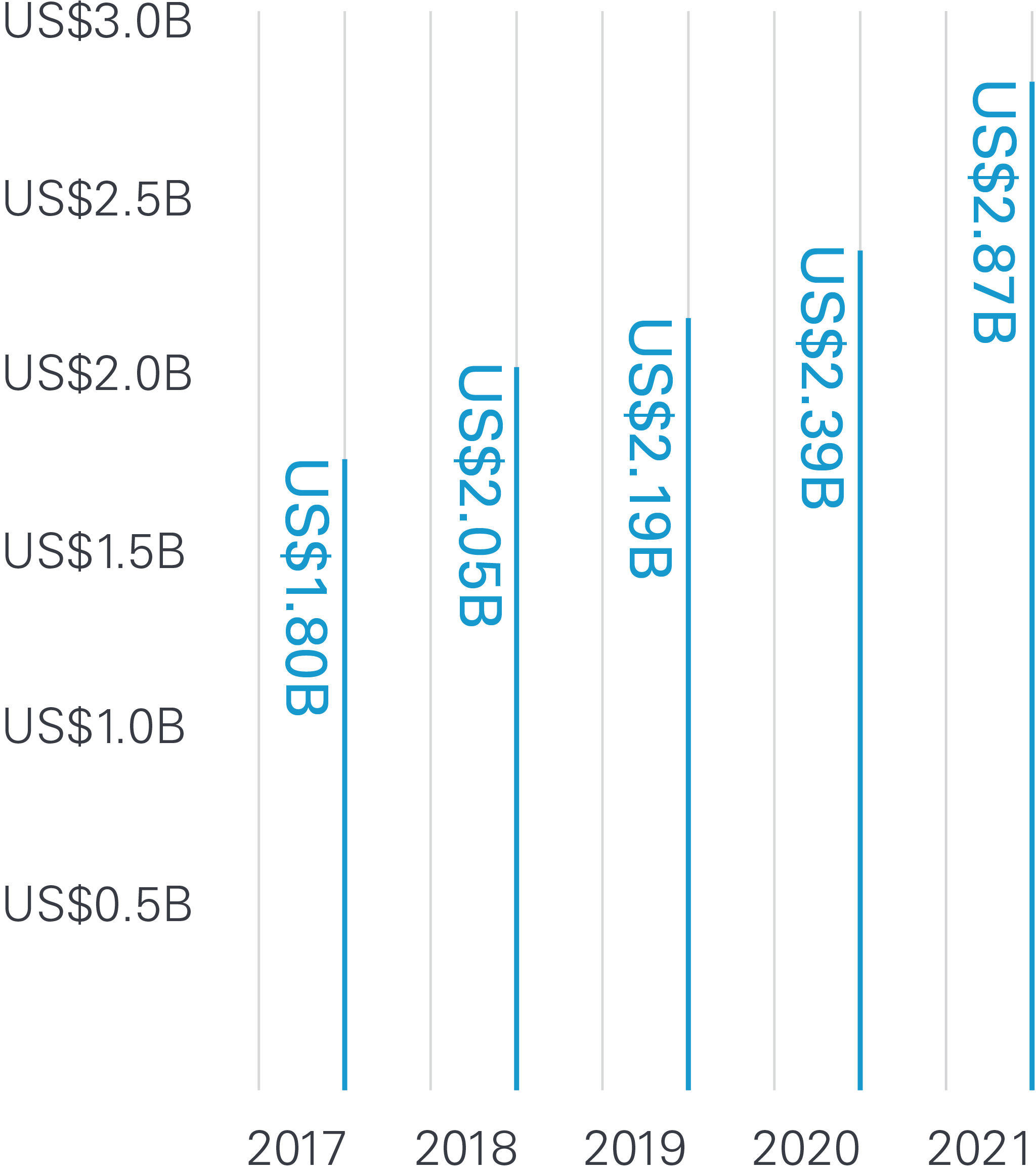

Our 2021 achievements cap an outstanding five-year success story

2,464 Total lawyers

An outstanding roster of talented lawyers strengthened our Firm in 2021

White & Case earned many of the legal industry’s top accolades for outstanding performance in 2021

White & Case is committed to fair and ethical operations that respect human rights and recognize the importance of our natural environment.

As a signatory to the UN Global Compact we affirm our commitment to doing business responsibly by supporting the Compact’s ten principles on human rights, labor, the environment and anti-corruption. The steps we are taking to continue to embed these principles into our Firm are outlined in our most recent Communication on Progress.

Our latest Environmental Sustainability Report includes information on our environmental policies, footprint, key actions and goals.

Where White & Case is a longtime leader — and we're just getting started.

10 global affinity networks

Our ten global affinity networks foster a sense of community among the Firm’s Black, Asian, Latinx/Hispanic, Middle Eastern, minority ethnic and LGBT+ lawyers, business services professionals and their allies. Each network sets its own agenda, initiatives and goals, which are specific to the issues it feels are most important. Affinity networks also create and enhance awareness of these groups within the Firm and its larger culture, drive community and connection across our global offices, and support their members with career and professional development opportunities.

26 local women’s networks

Our 26 local women’s networks are active in 40 offices across the Americas, EMEA and Asia-Pacific. These networks foster professional development and mentoring activities, and support business-related client partnerships. They also provide a forum for our lawyers and business services professionals to share perspectives and create programs to support and retain our talent while fostering and promoting gender equity.

For more than a decade, leading publications and alliance organizations have recognized White & Case’s commitment to diversity and inclusion.

We continued to advance toward our diversity and inclusion goals, narrowing the gap between thought and action with new trainings

Like our clients, we are seeking ways to sustainably create long-term value and growth, a shared goal that presents opportunities to collaborate

We set out to ensure we provide our clients with an experience that emphasizes the attributes they seek in a trusted advisor

Saudi Aramco US$15.5 billion sale and leaseback

We advised Saudi Aramco on a US$15.5 billion sale, and a lease and leaseback arrangement involving its gas pipeline network, with a consortium led by BlackRock Real Assets and Hassana Investment Company, the investment management arm of the General Organization for Social Insurance in Saudi Arabia.

Consortium acquisition of Authentic Brands stake

We advised CVC Capital Partners in a consortium of investors in the purchase of a stake in Authentic Brands Group LLC, a brand management company and owner of a portfolio of brand name companies, including Forever 21, Brooks Brothers, Barneys New York, Lucky Brand and Juicy Couture. Following the investment, Authentic Brands held a US$12.7 billion enterprise value.

Avast US$9.2 billion merger with NortonLifeLock

We advised Avast plc, the FTSE 100 global leader in digital security and privacy, on its US$9.2 billion merger with NortonLifeLock to form the market-leading cybersecurity company.

Panasonic acquisition of Blue Yonder

We advised Panasonic Corp. on its US$5.8 billion acquisition of the remaining 80 percent of the capital stock interests of Blue Yonder, a leading end-to-end digital fulfillment platform provider. The transaction adds to the 20 percent of Blue Yonder Panasonic acquired in 2020, also with White & Case’s representation.

Macquarie Infrastructure sales of major US infrastructure businesses

We advised Macquarie Infrastructure Corp. (NYSE: MIC) and its related entities on three sales: the US$4.475 billion sale of its Atlantic Aviation business to KKR; the US$2.685 billion sale of International-Matex Tank Terminals to Riverstone Holdings LLC; and the US$514 million pending sale of the MIC Hawaii businesses to Argo Infrastructure Partners, LP.

SES Holdings US$3.6 billion SPAC combination with Ivanhoe

We advised SES Holdings Pte. Ltd., a developer and manufacturer of high-performance hybrid lithium-metal rechargeable batteries for electric vehicles, on its US$3.6 billion business combination with Ivanhoe Capital Acquisition Corp. (NYSE: IVAN), a SPAC focused on electrification of society and industry.

Sempra US$3.37 billion sale of Sempra Infrastructure Partners stake

We advised Sempra Energy (NYSE: SRE) on its US$3.37 billion sale to KKR of a non-controlling 20 percent interest in Sempra Energy’s new business platform, Sempra Infrastructure Partners, which integrates Sempra LNG, a leading developer of liquefied natural gas export infrastructure, with IEnova (Infraestructura Energetica Nova, S.A.B. de C.V.), one of the largest private energy companies in Mexico. White & Case also represented Sempra Energy in its US$1.785 billion sale of a 10 percent interest in Sempra Infrastructure Partners, LP, to a wholly owned affiliate of the Abu Dhabi Investment Authority.

Soaring Eagle US$15 billion SPAC combination with Ginkgo Bioworks

We advised Soaring Eagle Acquisition Corp. (Nasdaq: SRNG), a SPAC, on its US$15 billion business combination with Ginkgo Bioworks, Inc., a synthetic biology company that uses technology to program cells for a wide variety of uses, including fragrances and sweeteners, mRNA vaccines and animal-free proteins.

Brookfield US$10.773 billion acquisition of Inter Pipeline

We advised Brookfield Infrastructure Partners on its US$10.773 billion acquisition of Inter Pipeline Ltd., a Canadian company traded on the Toronto Stock Exchange.

Faurecia US$8.7 billion acquisition of HELLA

We advised Faurecia S.E., one of the world’s largest automotive equipment suppliers, on its US$8.7 billion acquisition of HELLA GmbH & Co. KGaA, a family-owned listed company developing and manufacturing lighting technology and electronic products for the automotive industry.

PT Indosat US$6 billion merger with PT Hutchison 3 Indonesia

We advised Ooredoo Group, a leading international telecommunications company, on its US$6 billion merger of PT Indosat, an Indonesian subsidiary of Ooredoo Group, with PT Hutchison 3 Indonesia, an Indonesian subsidiary of CK Hutchison Holdings Ltd.

VPC US$4 billion SPAC combination with Dave

We advised VPC Impact Acquisition Holdings III, Inc. (NYSE: VPCC), a SPAC sponsored by Victory Park Capital, on its US$4 billion business combination with Dave Inc., a financial platform.

PayPal US$2.7 billion acquisition of Paidy

We advised PayPal Holdings, Inc. on the ¥300 billion (approximately US$2.7 billion) acquisition by PayPal, Inc. of Paidy Inc., a leading two-sided payments platform and provider of buy now, pay later solutions in Japan.