What have we learned from COVID-19?

Epidemiologist Syra Madad says it’s critical to engage with local communities

Hugh Verrier

Chair

In 2021, the COVID-19 pandemic continued to affect nearly every aspect of our lives. Against this backdrop, our global teams worked on groundbreaking transactions, resolved high-stakes disputes and, through our global citizenship initiatives, responded to societal challenges around the world.

The role of business in society evolved as environmental, social and governance (ESG) issues entered the mainstream, concentrating on challenges including the energy transition and achieving greater diversity and inclusion. Like our clients, we looked for ways to create long term value and growth—a shared goal that created opportunities for collaboration.

It was in this context that we launched a new five-year strategy, focused on creating a distinctive experience for our clients.

Our emphasis on complex, cross-border matters helped us grow in all of the regions where we work and achieve outstanding results for our clients. As we look to the next five years, we are committed to building the capabilities our clients need, supported by a strong, resilient culture.

Guest speakers at Firm events talk about issues that made news in 2021

Epidemiologist Syra Madad says it’s critical to engage with local communities

Think tank CEO Chris Pinney is encouraged by moves to focus on impact, not just policies and procedures

Bill Emmott, who co-leads a nonprofit that studies the far-reaching effects of COVID-19, discusses the importance of business scenario planning

Developments that reshaped the world

Countries and companies are increasingly committing to net-zero goals that would require them to significantly reduce carbon emissions on relatively short timelines

The pandemic accelerated global concerns over climate change and inequality, pushing societal expectations around responsible business practices into the spotlight

Most of 2021 was characterized by free-flowing capital, as government aid in response to COVID-19 propped up economies

Globalization may be evolving, as nations and regions reassert their regulatory powers on a wide range of issues

Matters in eight practice areas that highlight our global impact for clients

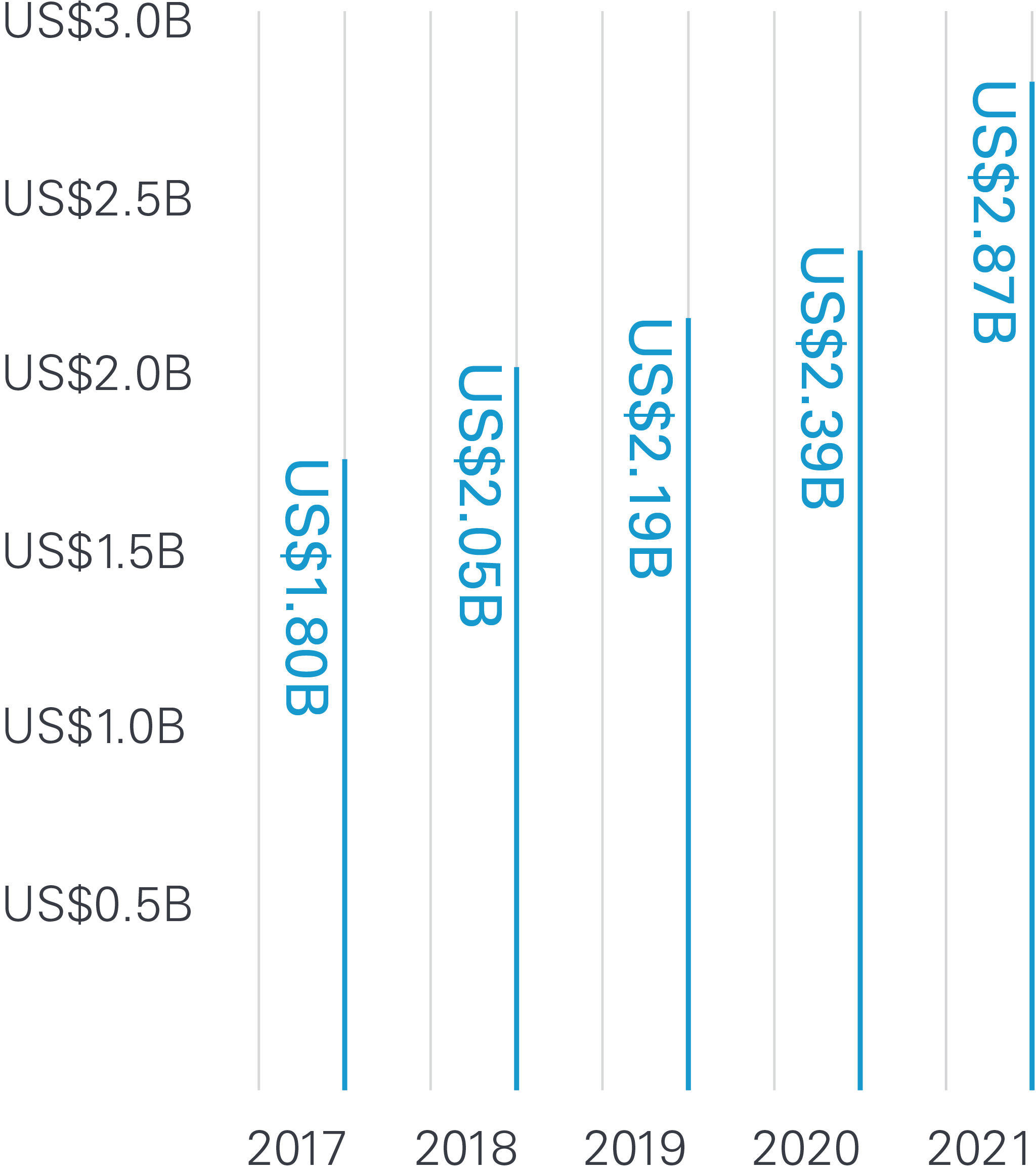

Our 2021 achievements cap an outstanding five-year success story

2,464 Total lawyers

An outstanding roster of talented lawyers strengthened our Firm in 2021

White & Case earned many of the legal industry’s top accolades for outstanding performance in 2021

White & Case is committed to fair and ethical operations that respect human rights and recognize the importance of our natural environment.

As a signatory to the UN Global Compact we affirm our commitment to doing business responsibly by supporting the Compact’s ten principles on human rights, labor, the environment and anti-corruption. The steps we are taking to continue to embed these principles into our Firm are outlined in our most recent Communication on Progress.

Our latest Environmental Sustainability Report includes information on our environmental policies, footprint, key actions and goals.

Where White & Case is a longtime leader — and we're just getting started.

10 global affinity networks

Our ten global affinity networks foster a sense of community among the Firm’s Black, Asian, Latinx/Hispanic, Middle Eastern, minority ethnic and LGBT+ lawyers, business services professionals and their allies. Each network sets its own agenda, initiatives and goals, which are specific to the issues it feels are most important. Affinity networks also create and enhance awareness of these groups within the Firm and its larger culture, drive community and connection across our global offices, and support their members with career and professional development opportunities.

26 local women’s networks

Our 26 local women’s networks are active in 40 offices across the Americas, EMEA and Asia-Pacific. These networks foster professional development and mentoring activities, and support business-related client partnerships. They also provide a forum for our lawyers and business services professionals to share perspectives and create programs to support and retain our talent while fostering and promoting gender equity.

For more than a decade, leading publications and alliance organizations have recognized White & Case’s commitment to diversity and inclusion.

We continued to advance toward our diversity and inclusion goals, narrowing the gap between thought and action with new trainings

Like our clients, we are seeking ways to sustainably create long-term value and growth, a shared goal that presents opportunities to collaborate

We set out to ensure we provide our clients with an experience that emphasizes the attributes they seek in a trusted advisor

Buenos Aires US$7.1 billion debt restructuring

We advised the Ad Hoc Group of Buenos Aires Bondholders on the Province of Buenos Aires’s restructuring of US$7.1 billion of external debt. The deal concluded 17 months after the province launched its first restructuring offer, which was rejected by the bondholder group and other investors. Following months of negotiations and the commencement of legal action on behalf of bondholders against the province in New York court, an agreement provided for the exchange and/or amendment of 11 series of outstanding bonds for new bonds maturing in 2037.

Nubank US$2.6 billion dual-nation IPO

We advised the underwriters on Nubank’s US$2.6 billion dual initial public offering in New York and São Paulo. At the offer price, Nubank had a market capitalization of approximately US$42 billion, making it the most valuable listed financial institution in Latin America, the largest IPO by a Brazilian company since 2017 and the largest IPO by a Latin American company in 2021.

Screaming Eagle SPAC IPO

We advised Screaming Eagle Acquisition Corp., a SPAC, on its US$750 million IPO on the Nasdaq Global Market under the symbol SCRMU. It was the largest SPAC IPO since March 2021.

State of Israel SEC-registered retail bond shelf

We advised the State of Israel on the update of its US$5 billion SEC-registered retail bond shelf and the concurrent updates to the institutional and Canadian bond programs of the State of Israel. The retail bond shelf is the only SEC-registered retail bond program operated by a sovereign country, and offers a means of raising capital and of maintaining a connection with small investors.

Univision high yield notes offering

We advised J.P. Morgan Securities LLC, Deutsche Bank Securities Inc., Goldman Sachs & Co. LLC, Morgan Stanley & Co. LLC., BofA Securities, Inc., Barclays Capital Inc. and Citigroup Global Markets, Inc. on Univision Communications Inc.‘s offering of US$1.05 billion aggregate principal amount of 4.5 percent senior secured notes due 2029. The total financing also comprised a senior secured term loan facility in an aggregate principal amount of US$1.050 billion, for a total financing of US$2.1 billion.

Republic of Indonesia US$25 billion trust certificate program

We advised the arrangers and managers on the update of the Republic of Indonesia's Rule 144A/Regulation S US$25 billion trust certificate issuance program and subsequent US$3 billion sukuk offering. The offering involved the issuance of a tranche of US$1.25 billion sukuk due 2026, a tranche of US$1 billion sukuk due 2031 and a tranche of US$750 million green sukuk due 2051, the proceeds of which were used to finance and re-finance eligible green projects as set out in Indonesia’s Green Bond and Green Sukuk Framework.

PT Bukalapak.com US$1.5 billion unicorn IPO

We advised the joint global coordinators on the US$1.5 billion IPO of PT Bukalapak.com Tbk on the Indonesian Stock Exchange (IDX), which includes a Rule 144A/Regulation S offshore tranche. This was the largest IPO in Indonesian stock exchange history. Bukalapak is the first Indonesian unicorn technology startup company listed on the IDX.

Amaggi sustainability bond issuance

We advised the Amaggi Group on its offering of US$750 million aggregate principal amount of 5.250% notes due 2028. This debut cross-border bond issuance by Amaggi was structured as a sustainability bond. Net proceeds will be invested in Amaggi’s sustainability bond framework and will be used to finance or refinance eligible projects in categories including renewable energy, socioeconomic advancement and empowerment, preservation of natural resources and biodiversity, climate change mitigation, and food security and sustainable food systems.

Hertz securitization financing and IPO

We advised The Hertz Corporation (THC) on the establishment of a securitization facility by a special purpose vehicle subsidiary of THC, Hertz Vehicle Financing III LLC, and the issuance of approximately US$6.8 billion aggregate principal amount of term and variable funding rental car asset-backed securities. The notes were issued as part of the Second Modified Third Amended Joint Chapter 11 Plan of Reorganization of THC, Hertz Global Holdings, Inc. and certain of their direct and indirect subsidiaries, which was confirmed by the US Bankruptcy Court for the District of Delaware and became effective on June 30, 2021. We also advised Hertz on its US$1.3 billion re-IPO on the Nasdaq stock exchange. The selling stockholders sold 37.1 million shares of common stock.

High yield bond offering by MGM China

We advised the initial purchasers on the Rule 144A/Regulation S offering of US$750 million 4.75% senior notes due 2027 by MGM China Holdings Ltd., a developer, owner and operator of gaming and lodging resorts in Macau.

Faurecia sustainability-linked high yield bond

We advised Faurecia S.E., one of the world’s largest automotive equipment suppliers, on its inaugural sustainability-linked high yield bond issuance of €1.2 billion 2.750% notes due 2027, helping to fund its acquisition of a similarly sized supplier based in Germany. The transaction featured an innovative sustainability-linked structure for a manufacturing company focused on ESG and sustainability.

Neuberger Berman innovative ESG-positive CLO

We advised Morgan Stanley & Co. as the arranger of Neuberger Berman’s first euro CLO since the 2008 global financial crisis. The transaction was the first ESG-positive CLO with objectively measured ESG features, including provisions to encourage borrowers to help advance the United Nations’ Sustainable Development Goals, following a model first proposed by White & Case in 2019.

Air France-KLM recapitalization

We advised Air France-KLM on its €4 billion capital-strengthening measures to address the consequences of the COVID-19 pandemic. The recapitalization included a capital increase for up to €1 billion, through a public offering with a priority subscription period for shareholders, as well as the conversion of the €3 billion French State loan from 2020 into deeply subordinated hybrid securities.

H&M sustainability-linked bond

We advised H&M Hennes & Mauritz AB (publ) on the issuance of €500 million sustainability-linked notes under its €2 billion euro medium-term note (EMTN) program. The transaction was one of the first such transactions in the Nordics and Europe.