What have we learned from COVID-19?

Epidemiologist Syra Madad says it’s critical to engage with local communities

Hugh Verrier

Chair

In 2021, the COVID-19 pandemic continued to affect nearly every aspect of our lives. Against this backdrop, our global teams worked on groundbreaking transactions, resolved high-stakes disputes and, through our global citizenship initiatives, responded to societal challenges around the world.

The role of business in society evolved as environmental, social and governance (ESG) issues entered the mainstream, concentrating on challenges including the energy transition and achieving greater diversity and inclusion. Like our clients, we looked for ways to create long term value and growth—a shared goal that created opportunities for collaboration.

It was in this context that we launched a new five-year strategy, focused on creating a distinctive experience for our clients.

Our emphasis on complex, cross-border matters helped us grow in all of the regions where we work and achieve outstanding results for our clients. As we look to the next five years, we are committed to building the capabilities our clients need, supported by a strong, resilient culture.

Guest speakers at Firm events talk about issues that made news in 2021

Epidemiologist Syra Madad says it’s critical to engage with local communities

Think tank CEO Chris Pinney is encouraged by moves to focus on impact, not just policies and procedures

Bill Emmott, who co-leads a nonprofit that studies the far-reaching effects of COVID-19, discusses the importance of business scenario planning

Developments that reshaped the world

Countries and companies are increasingly committing to net-zero goals that would require them to significantly reduce carbon emissions on relatively short timelines

The pandemic accelerated global concerns over climate change and inequality, pushing societal expectations around responsible business practices into the spotlight

Most of 2021 was characterized by free-flowing capital, as government aid in response to COVID-19 propped up economies

Globalization may be evolving, as nations and regions reassert their regulatory powers on a wide range of issues

Matters in eight practice areas that highlight our global impact for clients

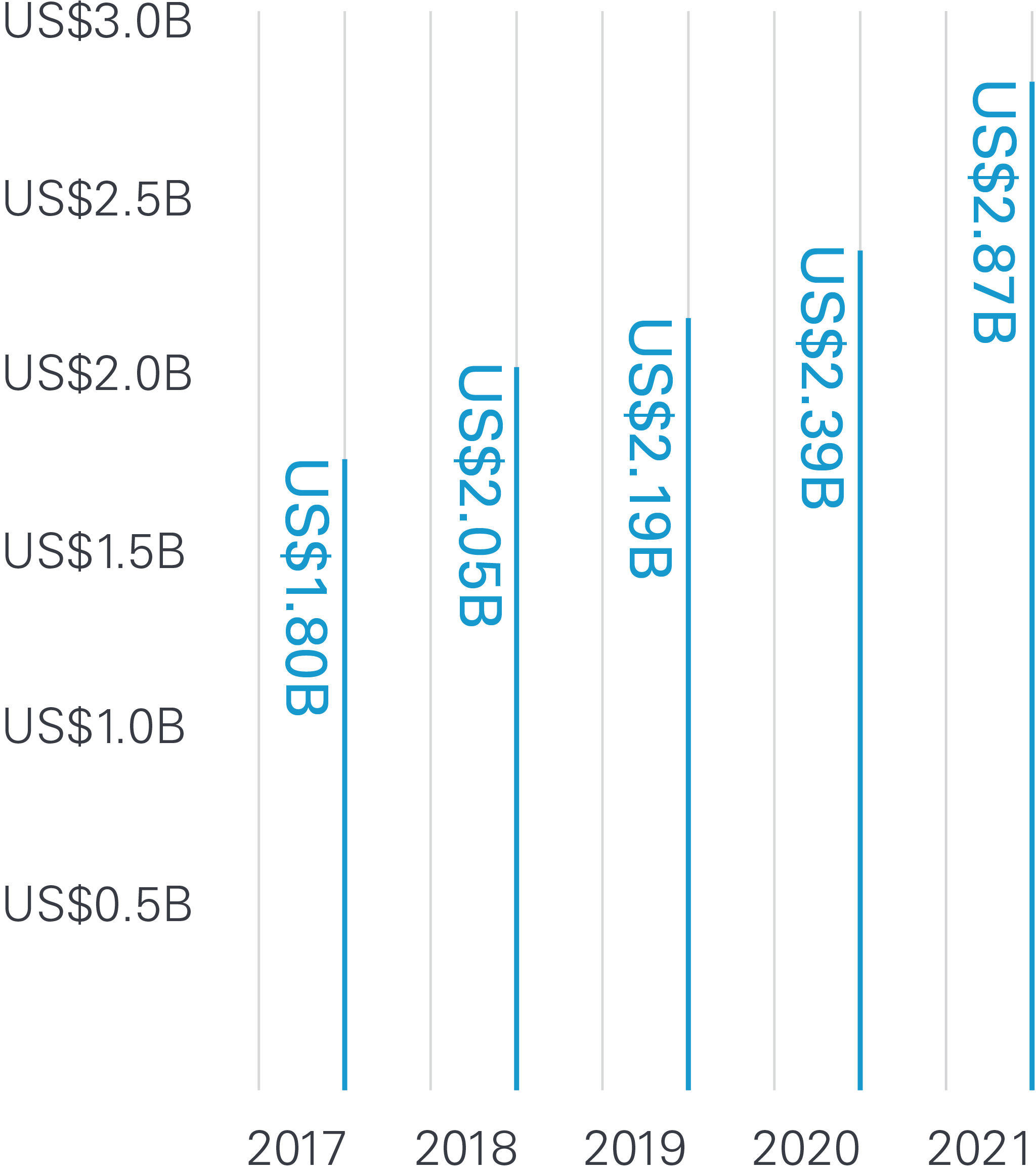

Our 2021 achievements cap an outstanding five-year success story

2,464 Total lawyers

An outstanding roster of talented lawyers strengthened our Firm in 2021

White & Case earned many of the legal industry’s top accolades for outstanding performance in 2021

White & Case is committed to fair and ethical operations that respect human rights and recognize the importance of our natural environment.

As a signatory to the UN Global Compact we affirm our commitment to doing business responsibly by supporting the Compact’s ten principles on human rights, labor, the environment and anti-corruption. The steps we are taking to continue to embed these principles into our Firm are outlined in our most recent Communication on Progress.

Our latest Environmental Sustainability Report includes information on our environmental policies, footprint, key actions and goals.

Where White & Case is a longtime leader — and we're just getting started.

10 global affinity networks

Our ten global affinity networks foster a sense of community among the Firm’s Black, Asian, Latinx/Hispanic, Middle Eastern, minority ethnic and LGBT+ lawyers, business services professionals and their allies. Each network sets its own agenda, initiatives and goals, which are specific to the issues it feels are most important. Affinity networks also create and enhance awareness of these groups within the Firm and its larger culture, drive community and connection across our global offices, and support their members with career and professional development opportunities.

26 local women’s networks

Our 26 local women’s networks are active in 40 offices across the Americas, EMEA and Asia-Pacific. These networks foster professional development and mentoring activities, and support business-related client partnerships. They also provide a forum for our lawyers and business services professionals to share perspectives and create programs to support and retain our talent while fostering and promoting gender equity.

For more than a decade, leading publications and alliance organizations have recognized White & Case’s commitment to diversity and inclusion.

We continued to advance toward our diversity and inclusion goals, narrowing the gap between thought and action with new trainings

Like our clients, we are seeking ways to sustainably create long-term value and growth, a shared goal that presents opportunities to collaborate

We set out to ensure we provide our clients with an experience that emphasizes the attributes they seek in a trusted advisor

Think tank CEO Chris Pinney is encouraged by moves to focus on impact, not just policies and procedures

Chris Pinney is president and CEO of High Meadows Institute, a think tank focused on the role of business in creating a sustainable society. In October 2021, he participated in a Financial Times Moral Money Summit panel discussion on partnerships between business and financiers. The event was sponsored, in part, by White & Case.

We caught up with Pinney to talk about the questions companies should be asking, the need for consistency on sustainability issues and moving beyond goal-setting. An edited and condensed version of that conversation follows.

When it comes to creating a more sustainable world, how are the roles of government and business shifting?

We’re in the process of renegotiating the social contract. The old model was: Pay your taxes; obey the law; and the government takes care of the rest. That model no longer works. To use an analogy: New music is playing; we’re on stage; and we don’t yet know who leads. Is it government? Business? Civil society? How do these players interact in a different way?

What led to this change?

In a global economy, governments have lost their ability to control their economic future and are proving increasingly incapable of ensuring social welfare. Global businesses, on the other hand, have prospered, and they have a profound effect on the societies in which they operate. As a result, trust in government has dropped dramatically, and people are looking to global firms to take more of a leadership role in helping to address social challenges. Businesses must now develop more robust corporate governance and leadership frameworks.

How can businesses find the best path forward as expectations evolve?

They can start by asking the right questions. The first would be whether they have an ESG strategy that identifies which social issues have the potential to materially affect the business. These issues need to be factored into their long-term corporate strategy. Businesses will also need to learn how to weigh and track their financial performance against ESG issues and report their progress to their internal and external stakeholders, among other considerations.

Can we make the necessary progress without governmental support?

No. Government also has to do its job. But as business becomes a political actor, part of the challenge will be supporting governments as they try to advance sensible initiatives around climate change and other sustainability issues. Businesses are starting to understand that they can’t do their nice sustainability work on the one hand, and on the other hand lobby against those very same measures. Investors are paying a lot more attention to the political role that large firms play, looking at whether their lobbying is consistent with their stated sustainability goals.

How do the motivations of institutional investors and politicians differ as to sustainability?

Politicians, particularly in this increasingly populist environment, are mainly concerned with their local constituents and reelection. This limits their ability to focus on the long term. Institutional investors, on the other hand, are looking 30 years out. That’s why we see large institutional investors start to play the role that governments used to play, ensuring that companies operate for the long-term benefit of both their shareholders and stakeholders in ways that are sustainable, environmentally responsible and good for their employees.

Are institutional investors taking any steps you find especially encouraging?

On the ESG front, I’m most encouraged by the move to focus on impact, not just policies and procedures, and the growing realization of the need to address the credit market, which is larger than the equity market and the primary source of funding for carbon-intensive industries.

Why are we beginning to see this shift to the credit markets?

In addition to the fact that they are the primary source of financing for carbon-intensive industries, credit markets are also the next opportunity for ESG-focused investment managers with many new green bond issues that are oversubscribed as soon as they hit the market.

How can companies move beyond goal-setting?

One lesson of COP26 (the November 2021 UN global climate summit in Glasgow) was that you absolutely have to focus on transition strategies. Absent a transition strategy, you’ll have problems if you move too fast without considering the social consequences. We saw that with the yellow vest protests in France—the populist backlash against rising gas prices following a green tax on carbon-based fuel. So, you’re going to see investors spending much more time focusing on companies’ transition strategies, not just their goals.

What might an effective transition strategy look like?

There is no one magic bullet. For example, if you’re an airline, you’re not going to get there through more energy efficiency. You’ll have to invest in sequestration to offset your emissions. If you’re a food company, you have enormous potential to change your business model so the business creates less carbon and more value. You have to assess your particular firm’s impacts and what, if anything, can be mitigated through business model transformation or, if not, offset through the purchase of carbon credits.

Photo by Sholikhul Bakhmid © Getty Images

A road winds through hills in Indonesia