“Arlene is a trusted partner and adviser with deep expertise and experience across a range of industries”

Biography

Arlene is a partner and the Global Head of the Technology Transactions Practice within the Firm's Global M&A Group and Global IP Group. A recognized leader and pioneer in the industry, she represents clients in a variety of intellectual property and technology matters, including standalone technology transactions and the IP aspects of private equity, M&A, and other corporate transactions. Arlene has advised on thousands of transactions, ranging from formative license agreements and joint development agreements to initial start-up investments and whole business securitizations to some of the largest M&A deals in their respective industries.

Arlene has established an industry-leading reputation for her work on high-profile, first-of-a-kind technology transactions. She represents strategic and financial clients across sectors, including software, AI/ML, consumer products, energy/energy transition, pharmaceuticals, medical devices, financial services, power, media, semiconductors, fashion, and sports.

Arlene regularly oversees significant IP and commercial due diligence investigations and has extensive experience with standalone IP matters, including patent and technology licensing, technology transfer, joint ventures, joint development agreements, software licensing, outsourcing, content licensing, trademark coexistence, merchandising and brand licensing, and IP dispute settlements.

Arlene is a member of the Firm's Global Technology Industry Core Group. She is an elected member of the Firm's Partnership Committee and currently serves on the New Partner Committee. She previously acted as Co-Chair of the New York Women's Network, member of the Global Pension Plans Investment Committee, and Co-Chair of the NY Summer Associate Program, which was then-ranked the #1 summer program in the nation in a survey conducted by The American Lawyer.

Arlene's clients describe her as a brilliant practitioner who they retain for their most cutting-edge and complicated technology transactions and for her exceptional work and impact. Arlene is listed in Chambers USA, Intellectual Asset Management (IAM) Patent 1000, IAM Strategy 300, IFLR1000's Women Leaders, Legal500, and Euromoney's Women in Business Law Expert Guide. Arlene has also been recognized as a “leading individual” by Global Data Review's inaugural listing of “the world's best data law firms”.

Arlene has been a repeat featured television guest on BloombergTV's “Deals Report” to discuss Tech M&A and was individually profiled in The Deal's “Drinks with the Deal” podcast and by The Ms. Foundation's Annual Report. She has been quoted by numerous major publications, including The Washington Post, is a guest lecturer for Cornell Tech's Master of Laws Program for Law, Technology and Entrepreneurship. She has been a featured speaker or panelist at numerous conferences and has authored numerous articles and publications, including two highly-viewed articles on “Tech-Driven Energy Deals Require Focus on IP and Data Rights”, which was published by Bloomberg Law, and “Artificial Intelligence (AI) Considerations in Acquisition Agreements”, which was published by LexisNexis. Arlene is also Co-Contributing Editor and Co-Author of the U.S. chapter of the Getting the Deal Through Publication on Technology M&A (2018-2025), published by Lexology.

Experience

Select highlight transactions include:

Technology and Telecoms:

- EchoStar Corporation (NASDAQ: SATS) on several transactions, including:

- its merger with DISH Network at a fixed exchange ratio for a total enterprise value, including debt, of $28.4 billion.

- its terminated definitive agreement under which DIRECTV would have acquired EchoStar's video distribution business DISH DBS, including DISH TV and Sling TV

- CVC in its acquisition of a significant ownership position in Epicor Software, a global provider of industry-specific enterprise software to promote business growth.

- CrowdStrike Holdings (NASDAQ: CRWD), a global cybersecurity leader with an advanced cloud-native platform for protecting endpoints, cloud workloads, identities and data, on:

- its acquisition of Flow Security, the industry's first and only cloud data runtime security solution.

- its acquisition of Bionic.ai, the pioneer of application security posture management (ASPM).

- CVC Capital Partners in its US$1.8 billion acquisition of ConvergeOne Holdings, Inc. (NASDAQ: CVON), a leading global IT and managed services provider of collaboration and technology solutions. The transaction was named "M&A Deal of the Year (Over US$1 billion)" and "Information Technology Deal of the Year (Over US$1 billion)" by M&A Advisor (2020).

- Harvest Partners in its acquisition of MRI Software, a leading provider of real estate management software solutions globally.

- Panasonic Corporation in its US$8.5 billion acquisition of the remaining 80 percent of the capital stock interests of Blue Yonder, a leading end-to-end, digital fulfillment platform provider. This transaction adds to the 20 percent stake of Blue Yonder which Panasonic acquired in July 2020, also represented by White & Case.

- PRO Unlimited Global Solutions Inc., a leader in contingent workforce management solutions and jointly held portfolio company of Harvest Partners, LP and Investcorp International, Inc., in:

- the sale of PRO Unlimited to EQT.

- its acquisition of PeopleTicker, a leading independent compensation software company.

- OpenText Corp. (NASDAQ: OTEX, TSE: OTEX), one of Canada's largest software companies, in its US$75 million acquisition of XMedius, a provider of secure information exchange and unified communication solutions.

- NICE Ltd. (NASDAQ: NICE), a leading provider of both cloud and on-premises enterprise software solutions, in its acquisition of Guardian Analytics.

- NTT DATA, Inc., a recognized leader in global technology services, in its acquisition of Net eSolutions Corp.

- Caisse de dépôt et placement du Québec (CDPQ), a global investment group managing funds for public retirement and insurance plans, in its acquisition of a majority ownership in Wizeline, Inc., a global technology services provider.

- Avast plc (LSE: AVST), one of the world's largest cybersecurity companies, on the carve-out disposal of its Family Safety Mobile Business to Smith Micro Software, Inc. (NASDAQ: SMSI).

- Al-Rayyan Holding LLC, an affiliate of Qatar Investment Authority (QIA), on its investment in the US$300 million equity financing round of Age of Learning, Inc., a privately held education company whose programs blend education best practices, innovative technology, and insightful creativity to create engaging and effective educational experiences, which was led by TPG.

- Sole Source Capital LLC, an industrial-focused private equity firm:

- and its portfolio company, Peak Technologies, a value-added reseller of barcoding and data collection solutions across North America, in its acquisition of Bar Code Direct, Inc., a value-added reseller of AIDC solutions for the manufacturing, retail, consumer and healthcare end-markets.

- and its portfolio company, Peak Technologies, in its acquisition of DBK Concepts, Inc., a value-added reseller of AIDC labels, media and hardware for healthcare, manufacturing and industrial end-markets.

- in its acquisition of I.D. Images, a manufacturer of high-quality durable and graphic intensive labels.

- in its acquisition of Digital Printing Concepts, Inc., a manufacturer of high-quality durable and graphic intensive barcode labels.

- and its portfolio company, Peak-Ryzex, a value-added reseller of barcoding and data collection solutions across North America, in its acquisition of Inovity, Inc., a value-added reseller of AIDC labels, media and hardware for healthcare, manufacturing and industrial end-markets.

- through its portfolio company Supply Chain Services, a premier provider of automatic identification and data capture and factory automation solutions, in its acquisition of Miles Data Technologies, a leading provider of barcode, RFID and mobility solutions.

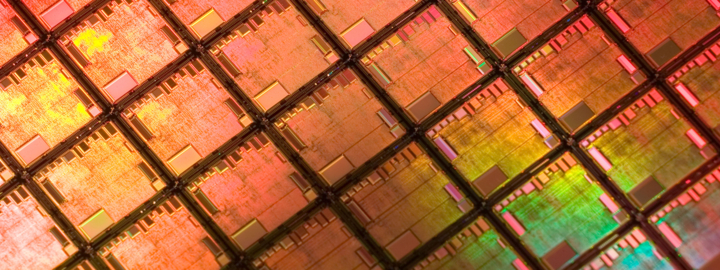

High Tech and Semiconductors:

- BYTE Acquisition Corp. (NASDAQ: BYTS) in its US$225 million acquisition of Airship AI Holdings, Inc. ("Airship AI")

- Intel Corporation in a series of acquisitions of technology companies innovating in sectors such as autonomous driving and Internet of Things (IoT).

- GlobalWafers Co., Ltd., a leader in the manufacture and sale of silicon wafers to the semiconductor industry, in its US$683 million acquisition of SunEdison Semiconductor Limited (NASDAQ: SEMI).

- Suzhou Dongshan Precision Manufacturing Co., Ltd. in its acquisition of the printed circuit board business from Flex Ltd.

- HighCape Capital Acquisition Corp. (NASDAQ: CAPA), a SPAC sponsored by HighCape Capital LP, a healthcare growth equity fund, in its US$1.46 billion business combination with Quantum-Si Incorporated, a pioneer in next generation semiconductor chip-based proteomics.

- FCX Performance, Inc. in its US$768 million sale to Applied Industrial Technologies, Inc. (NYSE: AIT).

- Softbank Vision Fund II and Eldridge in their up to US$235 million co-investment in Anyvision, an Israeli artificial intelligence-based facial recognition startup.

Entertainment and Media:

- Shutterstock, Inc., a leading global creative platform connecting brands and businesses to high-quality content, on several matters, including:

- its agreement to merge with Getty Images Holdings, Inc.

- its acquisition of Backgrid, and

- its US$245 million acquisition of Envato Pty Ltd.

- Flying Eagle Acquisition Corp. (NYSE: FEAC), a SPAC, in its US$4.3 billion business combination with Skillz Inc., a mobile-gaming company based in California.

- Landcadia Holdings II, Inc. (NASDAQ: LCA), a SPAC, in its US$745 million business combination with Golden Nugget Online Gaming, Inc.

- Sony Corporation of America, a subsidiary of Sony Corporation, in its US$400 million investment in Bilibili Inc., a China-based provider of online entertainment services, through subscription of new shares.

- Mr. Leslie Alexander and his affiliated entity in the US$2.2 billion sale of the Houston Rockets NBA team and its interest in the Toyota Center to Houston businessman Tilman J. Fertitta and his affiliated entity, Fertitta Entertainment, Inc.

- Ascendant Digital Acquisition Corp. (NYSE: ACND), a SPAC, in its US$3 billion business combination with Beacon Street Group, LLC, a leading multi-brand digital subscription service platform.

- dMY Technology Group, Inc. (NYSE: DMYT), a SPAC, in its US$1.78 billion business combination with Rush Street Interactive, LP, a US-based online casino and sports betting company.

- dMY Technology Group, Inc. II (NYSE: DMYD), a SPAC, in its US$1.68 billion business combination with UK-based Genius Sports Group.

- Golden Nugget Online Gaming, Inc. (NASDAQ: GNOG) and the Special Committee of its Board of Directors in the US$1.56 billion acquisition of GNOG by DraftKings Inc., a leading digital sports entertainment and gaming company.

- B. Riley Principal 150 Merger Corp. (NASDAQ: BRPM), a SPAC, in its US$1.0 billion business combination with FaZe Clan, Inc., a leading US gaming, lifestyle and digital content platform.

- AutoLotto, Inc., a leading platform to play the lottery online, in its US$526 million business combination with Trident Acquisitions Corp. (NASDAQ: TDACU, TDAC, TDACW), a SPAC.

- Outbrain Inc., a leading digital advertising platform, in its merger with Taboola, creating a combined company with revenue of more than US$2 billion.

- CVC Capital Partners in its acquisition, with minority co-investor Caisse de dépôt et placement du Québec (CDPQ), of a majority stake in the international agencies of BlueFocus Intelligent Communications Group Co., Ltd., a leading publicly traded Chinese marketing services conglomerate.

- CVC Capital Partners in its acquisition of Mediaocean, the leading global omnichannel advertising platform.

Energy, Energy Transition and Power:

- Calpine Corporation in its US$17 billion sale to Energy Capital Partners and a consortium of investors.

- Occidental Petroleum in forming a joint venture with Berkshire Hathaway–owned BHE Renewables.

- SES Holdings Pte. Ltd., a developer and manufacturer of high-performance hybrid lithium-metal rechargeable batteries for electric vehicles, in its US$3.6 billion business combination with Ivanhoe Capital Acquisition Corp. (NYSE: IVAN), a SPAC focused on electrification of society and industry.

- InterPrivate III Financial Partners Inc. (NYSE: IPVF), a SPAC, in its US$2.3 billion acquisition of Aspiration Partners, Inc., a global leader in Sustainability as a Service solutions for consumers and companies.

- Schneider Electric Ventures as lead investor in a Series A preferred stock equity investment in Energetic Insurance, Inc., an InsurTech startup with a novel, data-driven approach to developing new insurance products for the renewable energy industry.

- EnCap Investments L.P., a leading private equity firm specializing in the energy industry, on its sale of a 50 percent stake in Broad Reach Power LLC, one of the premier independent utility-scale energy storage and renewable energy platforms in the United States and a portfolio company of EnCap, to affiliates of Apollo Global Management, Inc.

- B. Riley Principal Merger Corp. II (NYSE: BMRG), a SPAC, in its US$550 million business combination with Eos Energy Services LLC, a leading manufacturer of zinc hybrid cathode battery energy storage systems.

- Fortis Inc. (TSX: FTS) on several US public company acquisitions, including (i) its US$11.3 billion acquisition of ITC Holdings Corp. (NYSE: ITC); (ii) its US$4.3 billion acquisition of UNS Energy Corporation (NYSE:UNS); and (iii) its US$1.5 billion acquisition of CH Energy Group Inc. (NYSE: CHG), a transaction which was named "Energy Deal of the Year" by The M&A Advisor.

- Priority Power Management, LLC, a portfolio company of Ara Partners and provider of electricity management solutions, on its issuance of US$262.5 million of convertible preferred equity to an affiliate subsidiary of Oaktree.

- Schneider Electric Company, a world leader in energy technology, in its investment in AlphaStruxure, a joint venture with affiliates of The Carlyle Group, one of the largest global asset management companies, focused on development and execution of microgrid infrastructure projects and stand-alone EAAS microgrids.

- SoftBank Vision Fund in its investment in Energy Vault, a startup using ground-breaking technology to facilitate long term energy storage based in Switzerland.

- DIF Capital Partners, a leading global independent infrastructure investment fund manager, through its fund DIF Infrastructure VI, in its acquisition of Bernhard LLC, the largest privately-owned Energy-as-a-Service (EaaS) solutions company in the United States, from an affiliate of Bernhard Capital Partners.

- Sempra Energy (NYSE:SRE) in its US$3.37 billion sale to KKR of a non-controlling, 20 percent interest in Sempra Energy's new business platform, Sempra Infrastructure Partners, which integrates Sempra LNG, a leading developer of liquefied natural gas export infrastructure with IEnova (Infraestructura Energetica Nova, S.A.B. de C.V.), one of the largest private energy companies in Mexico. The transaction values Sempra Infrastructure Partners at approximately US$25.2 billion, including expected asset-related debt at closing of US$8.37 billion.

- Sempra Energy on several transactions, including (i) the US$3.59 billion sale of its equity interests in its Peruvian businesses, including its 83.6 percent stake in Luz del Sur, to China Yangtze Power International (Hongkong) Co., Ltd.; and (ii) the US$1.275 billion acquisition by Oncor Electric Delivery Company LLC, a subsidiary of Sempra, of InfraREIT, Inc. and concurrent acquisition of a 50 percent limited partnership interest in a holding company that will own Sharyland Utilities, LP, a Texas-based electric transmission utility owned by members of the Hunt Family.

- Diamond S Shipping Inc., one of the largest publicly listed owners and operators of crude and product tankers, in its US$2 billion merger with International Seaways, Inc., one of the largest tanker companies worldwide providing energy transportation services for crude oil and petroleum products.

- Exxon Mobil Corp. in its US$1.15 billion sale of its Stanoprene TPV Elastomer business, a manufacturer of rubbers used in the automotive, consumer and construction sectors, to Celanese Corp. The assets sold include two manufacturing facilities in Pensacola, Florida, and Newport, Wales, along with intellectual property and other commercial assets. Additionally, all the Santoprene customer and supplier contracts and agreements will be transferred to Celanese.

- ExxonMobil Chemical Company in its US$156 million acquisition of all shares of Materia, Inc., a company focused on manufacturing advanced materials.

- Macquarie Infrastructure Partners in several transactions, including (i) its US$1.212 billion sale of Gadus Holdings Corp., the parent company of WCA Waste Corp., to GFL Holdco (US), LLC, a subsidiary of GFL Environmental Inc.; (ii) the acquisitions of Epic Midstream LLC, Marlin Intermediate HoldCo Inc, and Netrality Data Centers; and (iii) its sale of Bayonne Energy Center.

- Schneider Electric, a global player in energy management and automation, in its US$2.1 billion (₹14,000 crore) acquisition of Larsen & Toubro Electrical & Automation and the subsequent consortium between Schneider Electrics partnership with Temasek Holdings Private Ltd. The transaction was named "Cross-Border M&A Deal of the Year (Over US$1 billion)" by the M&A Advisor (2020).

- Global Infrastructure Partners in its US$1.825 billion acquisition of Medallion Gathering & Processing, LLC.

- Abu Dhabi Future Energy Company (Masdar) in its acquisition of John Laing Group's stakes in two wind farms in the United States (the Rocksprings wind farm in Texas and the Sterling wind farm in New Mexico). The deal is Masdar's very first North American renewable energy investment.

- Priority Power Management, LLC, an independent energy management services and consulting firm, in its acquisition of Satori Enterprises LLC (d/b/a Satori Energy), a leading energy consulting firm based out of Chicago, Illinois serving more than 55,000 industrial, municipal and residential clients in 25 states, the District of Columbia, Canada and Mexico.

- Cogentrix Energy Power Management, LLC in its sale of Red Oak Power, LLC, the New Jersey-based power generation facility, to Morgan Stanley Infrastructure Inc.

Consumer Goods & Retail:

- Kohler Co. in the multi-jurisdictional carve-out and multi-billion-dollar sale of its energy business to Platinum Equity and its continued investment in its energy business in partnership with Platinum Equity.

- Landcadia Holdings III, Inc. (NASDAQ: LCY), a SPAC, in its US$2.642 billion acquisition of HMAN Group Holdings Inc., the parent company of The Hillman Group, Inc., a leading distributor of hardware and home improvement products, personal protective equipment and robotic kiosk technologies, from CCMP Capital Advisors, LP.

- Panasonic Corporation in its US$1.545 billion acquisition of Hussman Corporation, a manufacturer of high-tech refrigerated display cases and food distribution systems.

- CVC Capital Partners in a consortium of investors in the US$3.5 billion investment for a 22.55% stake in Authentic Brands Group LLC, a brand management company and owner of a portfolio of brand name companies.

- Dominus Capital, L.P. in:

- the sale of Intelliteach, a leading global provider of outsourcing solutions in the legal and accounting markets.

- the acquisitions of EMPG Holding Company; Lockmasters, Inc. and BluSky Restoration Holdings LLC. Arlene subsequently advised BluSky Restoration in its acquisition of Har-Bro, LLC.

- the sale of its portfolio company, BluSky HoldCo Restoration Contractors, LLC, a leading provider of restoration services to commercial properties nationwide, to an affiliate of Partners Group, a global private market firm, and Kohlberg & Company, a New York-based investment firm.

- the sale of its portfolio company, Masterbuilt Holdings LLC, a leader in outdoor residential grilling and cooking under the Kamado Joe and Masterbuilt brands, to the Middleby Corporation (NASDAQ:MIDD), a global leader in the foodservice equipment industry.

- the acquisition of Seaga Midco, Inc., a leading vending machine manufacturer based in Illinois.

- Toys "R" Us on WHP Global's significant minority investment in and strategic partnership with TRU Kids Parent LLC, parent company to the Toys "R" Us and Babies "R" Us brands.

- CVC Capital Partners on several transactions, including the US$1.425 billion acquisition of PDC Brands, as well as the acquisitions of Vitech Systems Group, United Lex, and OANDA Global Corporation.

- Dwyer Franchising LLC, one of the world's largest franchisor of home service brands, in the acquisition of Mosquito Joe, the leading franchisor in the mosquito control services industry.

- Neighborly, the world's largest franchisor of home service brands and a portfolio company of Harvest Partners, LP, in its acquisition of Precision Door Service, the leading garage door repair franchise in the United States.

- Harvest Partners, LP in its sale of Neighborly, a holding company of 21 service brands focused on repairing, maintaining and enhancing consumers' homes and businesses via various online platforms, to Kohlberg Kravis Roberts & Co. L.P.

- Harvest Partners in its numerous transactions, including the acquisitions of Material Handling Services; TDG Group Holdings Company; EyeCare Services Partners Holdings LLC; VetCor Group Holdings Corp.; DCA Investment Holding LLC, and PRO Unlimited. She also advised Harvest on the sale of a number of portfolio companies, including Document Technologies Holdings, LLC and TruckPro Holding Corp.

- Mill Rock Capital in the acquisition of Trojan Lithograph Corp., a full-service provider of high-end, graphic paper packaging, from Arbor Investments.

- Mill Rock Packaging Partners LLC and its affiliates in its acquisition of All Packaging Company, a cartons manufacturing company.

- Outdoor Holdings I, LLC and Kwik Tek Inc. d/b/a Airhead Sports Group, the #1 brand in the marine towable watersports and winter leisure activity product categories, on the sale of Airhead Sports Group to a subsidiary of Aqua-Leisure Recreation, LLC, a provider of outdoor branded products for recreational water sports and winter sports markets.

Food and Beverage:

- SodaStream International Ltd. (NASDAQ/TLV: SODA) in its US$3.2 billion sale to PepsiCo, Inc. (NASDAQ: PEP).

- Roark Capital Group and Inspire Brands, Inc., owner of the Arby's and Buffalo Wild Wings restaurant chains, in Inspire Brands' US$2.3 billion acquisition of Sonic Corp. (NASDAQ: SONC) and in the acquisition of Jimmy John's LLC, a fast food sandwich restaurant chain.

- Entrepreneurial Equity Partners in its acquisitions of Grecian Delight Foods, Inc. and Kronos Foods, Inc.

- Bioenergy Development Group, LLC and an affiliate of Newlight Partners LP, in the acquisition of certain assets from Perdue Farms, Inc. and its subsidiaries and in its negotiation of a 20-year agreement with Perdue Farms to process Perdue Farms' organic material.

- Pernod Ricard, SA, the world's second-largest distiller, in its acquisition of a majority interest in Rabbit Hole Spirits, LLC, a US premium bourbon brand. She also advised Pernod Ricard México, S.A. de C.V. in its investment in Mezcal Ojo de Tigre, S.A.P.I. de C.V., a Mexican entity dedicated to the manufacturing, distribution and sale of the mezcal brand "Ojo de Tigre", and a subsidiary of Casa Lumbre, S.A.P.I. de C.V.

Infrastructure, Transportation & Logistics:

- Alstom S.A., global leader in the rail industry of smart and sustainable mobility, in the €630 million sale of its North American conventional signaling business to Knorr-Bremse AG, the global market leader for braking systems and a leading provider of other rail and commercial vehicle systems.

- Hexatronic Group AB (publ) in its acquisition of Kevin M. Ehringer Enterprises, Inc., D/B/A Data Center Systems, a company based in Texas providing end-to-end fiber connectivity solutions to the US data center market.

- Colonnade Acquisition Corp. (NYSE: CLA), a SPAC, in its US$1.9 billion business combination with Ouster, Inc., a leading provider of high-resolution digital lidar sensors for the industrial automation, smart infrastructure, robotics, and automotive industries.

- Graf Industrial Corp. (NYSE: GRAF), a SPAC, in its US$1.8 billion business combination with Velodyne LiDAR, Inc., a developer of Lidar Technology for corporate and consumer markets.

- Forum Merger III Corporation (NASDAQ: FIII), a SPAC, in its US$1.4 billion business combination with Electric Last Mile, Inc., an electric vehicle company.

- ION Acquisition Corp 2 Ltd. (NYSE: IACB), a SPAC, in its US$1.3 billion business combination with Innovid, Inc., a global leader in connected TV ad delivery and measurement.

- Macquarie Infrastructure Partners in its acquisition of Aligned Energy Holdings, L.P., an infrastructure technology company.

- Electric commercial vehicle company VIA Motors International, Inc. on its acquisition (in an all-stock merger valued at up to US$630 million) by Ideanomics, Inc., a global company focused on driving the adoption of commercial electric vehicles and associated energy consumption.

- Brookfield Infrastructure, and its institutional partners and GIC, in the US$8.4 billion acquisition of Genesee & Wyoming Inc. (NYSE: GWR), a freight railroad owner. This transaction was named "Private Equity Deal of the Year" by IFLR (2020).

- Macquarie Infrastructure Corp. (NYSE: MIC) and its related entities in the sale of three businesses, including (i) the US$4.475 billion sale of its Atlantic Aviation business to KKR; (ii) the US$2.685 billion sale of International-Matex Tank Terminals to Riverstone Holdings LLC.; and (iii) the US$514 million sale of the MIC Hawaii businesses to Argo Infrastructure Partners, LP.

- Macquarie Infrastructure Partners in its acquisition of Lakeshore Recycling Systems, the largest private waste company in Illinois, specializing in recycling and waste diversion programs, roll-off container services, portable restroom rentals, mulch distribution, street sweeping, on-site storage options and comprehensive waste removal.

- Brookfield Asset Management in its CAD$4.3 billion acquisition of Enercare Inc., one of North America's largest home and commercial services companies.

- Quad-C Management, Inc. in its US$1.2 billion sale of AIT Worldwide Logistics Holdings, Inc., a leading global provider of transportation and logistics solutions, to The Jordan Company.

- Advance Stores Company, Inc., a wholly owned subsidiary of Advance Auto Parts, Inc. in its acquisition of the DIEHARD brand from Transform Holdco LLC.

- I Squared Capital Advisors (US) LLC in its acquisition of Star Leasing, a leading trailer lessor in the United States. Also represented I Squared Capital Advisors as sponsor on financing for the acquisition. The financing consisted of an asset-based revolving credit facility in an initial aggregate principal amount of US$300 million. Following the transaction, I Squared Capital's global transport and logistics portfolio has over 264,000 trailers or chassis and 123 workshops with 3,500 employees in 19 countries.

- I Squared Capital, and its portfolio company American Intermodal Management (AIM), in a joint venture with Castle & Cooke Investments and its portfolio company Flexi-Van Leasing, whereby AIM will be combined with Flexi-Van, the third-largest marine chassis provider in the United States.

- Itron Inc. in the sale of its subsidiaries comprising its manufacturing and sales operations in Latin America to buyers led by Instalación Profesional y Tecnologías del Centro S.A. de C.V., a Mexican company doing business as Accell in Brazil (Accell).

- Mubadala Investment Company in the sale of XOJET, the leading on-demand private aviation services platform in the US, to Vista Global Holding Limited.

Pharmaceuticals and Healthcare:

- Deerfield Healthcare Technology Acquisitions Corp. (NASDAQ: DFHT), a SPAC, in its US$614 million business combination with CareMax Medical Group, L.L.C. and IMC Medical Group Holdings LLC, creating a technology-enabled care platform providing value-based care and chronic disease management to seniors.

- HgCapital in its investment in Intelerad Medical Systems, a leading global provider of medical imaging software and enterprise workflow solutions.

- LifePoint Health, Inc. (NASDAQ: LPNT) in its US$5.6 billion merger with RCCH HealthCare Partners, which is owned by certain funds managed by affiliates of Apollo Global Management, LLC (NYSE: APO).

- CVC Capital Partners in its acquisition of a majority interest in ExamWorks, a global leader in independent medical examinations, peer reviews, document management, and related services.

- NovaQuest Capital Management LLC in its acquisition of Spectra Medical Devices, Inc., a leading manufacturer of procedural needles and distributor of generic injectable drug products.

- NeuroDerm Ltd., a clinical stage pharmaceutical company developing drug-device combinations for central nervous system (CNS) disorders, in its US$1.1 billion sale to Mitsubishi Tanabe Pharma Corporation.

- CITIC Capital in its US$770 million acquisition of GNC Holdings Inc. through its subsidiary Harbin Pharmaceutical Group Holding Co., Ltd. pursuant to Section 363 of the United States Bankruptcy Code.

- Zimmer Biomet (NYSE and SIX: ZBH) in its US$1 billion acquisition of LDR Holding Corporation (NASDAQ: LDRH).

- Partners Group in its US$1 billion acquisition of PCI Pharma Services, a leading global provider of outsourced pharmaceutical services.

- Takeda Pharmaceutical Company Ltd. in its US$825 million divestment of a portfolio of select over-the-counter (OTC) and prescription pharmaceutical products in Latin American countries within its Growth and Emerging Markets Business Unit to Hypera Pharma.

- The Carlyle Group in its US$490 million acquisition of a 20% in Piramal Pharma, the pharmaceutical division of India's Piramal Enterprises Limited.

- Enzymotec Ltd. (NASDAQ:ENZY) in its acquisition of all rights pertaining to five nutritional products from Union Springs Healthcare, LLC.

- Grünenthal Group in connection with a licensing agreement and supply agreement with AstraZeneca for the exclusive rights to Zurampic™ (lesinurad) in Europe and Latin America, a drug approved for the treatment of adjunctive hyperuricemia in adult patients with uncontrolled gout.

- Roivant Sciences Ltd. in the launch of Genevant Sciences Ltd., a joint venture with Arbutus Biopharma Corporation (NASDAQ: ABUS), focused on the discovery, development and commercialization of a broad range of RNA-based therapeutics enabled by Arbutus' proprietary lipid nanoparticle (LNP) and ligand conjugate delivery technologies.

Other notable transactions include:

- Fusion Acquisition Corp. (NYSE: FUSE), a SPAC, in its US$2.2 billion business combination with MoneyLion Inc., America's leading digital financial platform.

- FG New America Acquisition Corp. (NYSE: FGNA), a SPAC, in its US$800 million business combination with Opportunity Financial, LLC, a leading financial technology platform that focuses on helping middle income, credit-challenged consumers build a better financial path through affordable personal loans.

- Avon Rubber p.l.c., a UK-listed innovative technology group, in acquisition of 3M's ballistic-protection business in the United States and the rights to the Ceradyne brand.

- JTC PLC on its acquisition of SALI Fund Services, a provider of fund services to the Insurance Dedicated Fund and Separately Managed Account market, with US$15.8 billion of assets under management.

- ICR, LLC, a global leader in strategic communications and advisory services, on a significant investment in ICR by Caisse de dépôt et placement du Québec (CDPQ). CDPQ will join with existing shareholders Investcorp International, Inc. and the ICR management team.

- Certares, L.P. in multiple investments, including in: Guardian Alarm, Guardian Medical Monitoring, and AmaWaterways.

- Investcorp in its majority investment in ICR, LLC, a leading strategic communications and advisory company; and in its acquisition of Multivision, LLC, an IT solutions and training provider.

- Motiva Enterprises LLC in its acquisition of Flint Hills Resources Port Arthur, LLC.

- Quad-C Management, Inc. and its portfolio companies in a number of deals that include:

- the acquisitions of AIT Worldwide

- the auction sale of Vaco Investor Holdings LLC.

- the investment in Pharm-Olam International, Ltd.

- REE Investment, LLC, in its sale to KinderCare Education LLC.

- the acquisition of Village Gourmet Holdco, LLC and its subsidiaries, specialty producers of fine meat and snacking options.

- the sale of its investment in EFC International, a leading value-added distributor of highly engineered specialty fasteners to the automotive and industrial end-markets.

IAM Strategy 300, "The World's Leading IP Strategists" (2025)

Ranked for Technology (New York), Chambers USA, 2025

Leading Partner for Technology Transactions, Legal 500 USA, 2025

Recognized Leading Lawyer, IAM Strategy 300, 2024

Recognized Individual, Intellectual Asset Management (IAM) Patent 1000

Recognized for TMT and Technology in the United States, Euromoney's Women in Business Law Expert Guide, 2021

Recognized for M&A in the United States, Euromoney, 2021

Listed among IFLR1000's Women Leaders Guide for M&A in the United States, 2021

Recognized a "leading individual" by Global Data Review (GDR)'s inaugural listing of "the world's best data law firms."

Panelist, "The Gig Economy and M&A – Traps for the Unwary", 2021 ABA Business Law Section Annual Meeting, September 2021

Featured Guest, "SPACs Speed Well-Suited for Tech M&A," Bloomberg TV (Live), New York, November 2020

Featured Guest, "The Legal Side of Tech M&A", Bloomberg TV (Live), New York, April 2019

Speaker, "The Value of Nothing – How to Reinforce Due Diligence and Valuation of Intangible Assets," The 20th Annual Canadian Private Equity Summit, Toronto, ON, November 2018

Panelist, "Developing Your Strengths & Most Productive Workstyle," CenterForce USA's The Women in Law & Leadership Summit: NYC, New York, NY, November 2018

Speaker, "Beware the Poison Pills: Preparing for Technology Driven M&A Transactions", Annual Meeting of the Association of Corporate Counsel of Israel, Tel-Aviv, Israel, August 2017

Lecturer, "Intellectual property aspects of commercial transactions", ATLAS Information Group, 2010