Mining & metals 2025: Poised on the chessboard of geopolitics

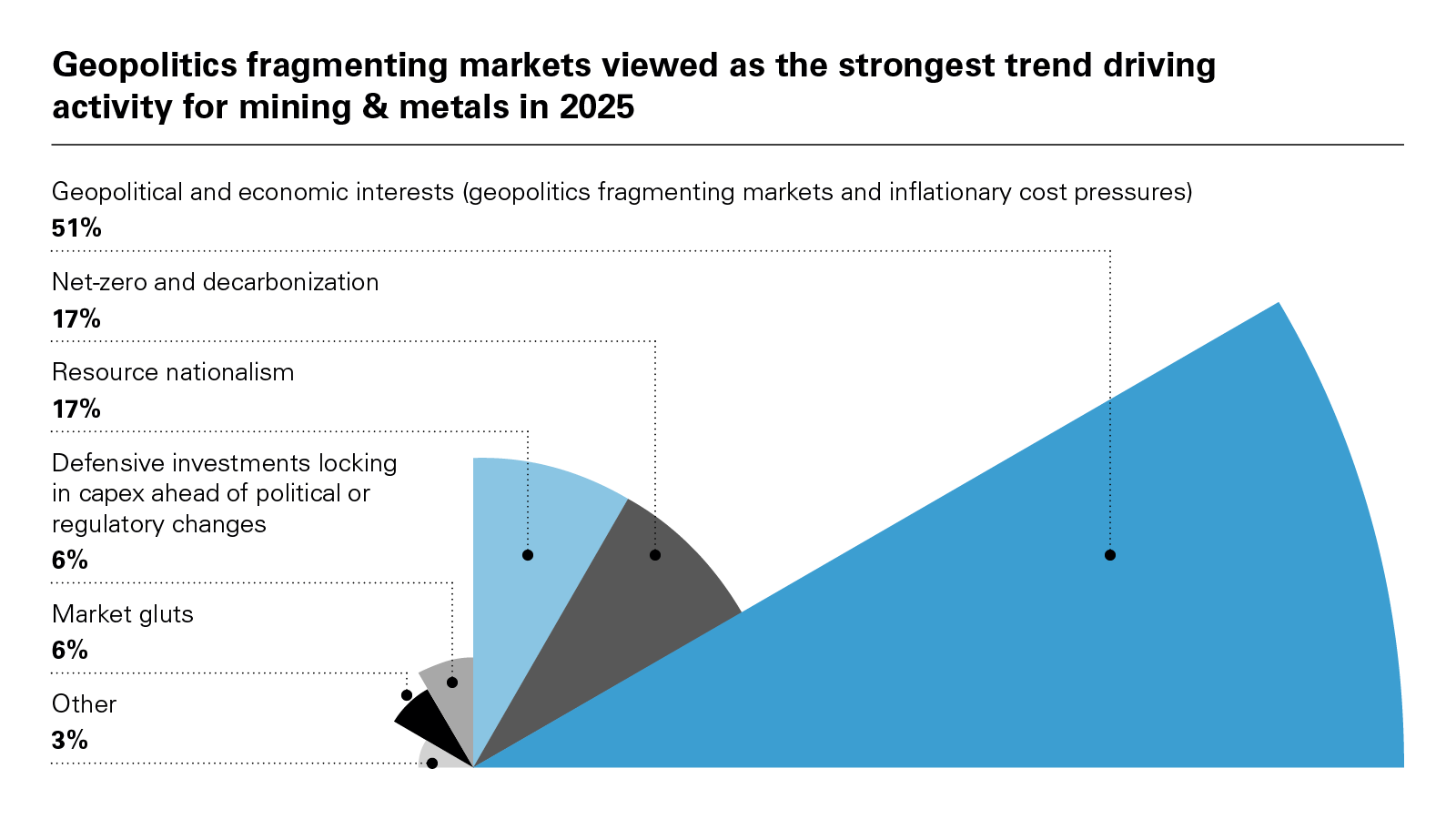

Geopolitics, which dominated mining & metals sentiment in 2024, promises to further fragment markets in 2025. To understand the market landscape, White & Case conducted its ninth annual survey of industry participants. Geopolitics remains the overwhelming factor affecting the mining & metals sector, evolving from a market with key "drivers" to one of disordered fragmentation.

14 min read

Our top takeaways

- Just 4% of respondents believe current support measures for the sector in the OECD are adequate to support investment

- 84% of respondents are somewhat or very optimistic about the sector's outlook despite market fragmentation and gluts

- 75% of respondents believe US and EU trade and critical minerals policies will diverge further

- 67% of respondents believe Trump's expected policy agenda will raise costs from supply chain fragmentation or slow investment from uncertainty

- 25% of respondents think miners will rely on government, ECA, or DFI for financing to deliver, nearly as much as the 28% who expect them to rely on equity capital markets amid higher interest rates

The last year saw geopolitics in the driver seat for the mining & metals sectors as a myriad of elections across developed and emerging markets (EMs) saw incumbent parties punished for high inflation and social frustration.

If 2024 was a race to lock in financing, projects, or partnerships ahead of volatility, in 2025 firms will operate on a chessboard with swiftly changing rules. Intensifying trade wars; growing scrutiny on M&A and FDI; and market gluts driven by weaker demand growth in China and Chinese sponsors' supply response. Though the IMF is still forecasting 3.2 percent global GDP growth in 2025, the synchronized slowdown of growth in China, the US, and Europe, a stronger dollar and slower US rate cuts, and potential yuan devaluation pose headwinds for metals prices and asset values.

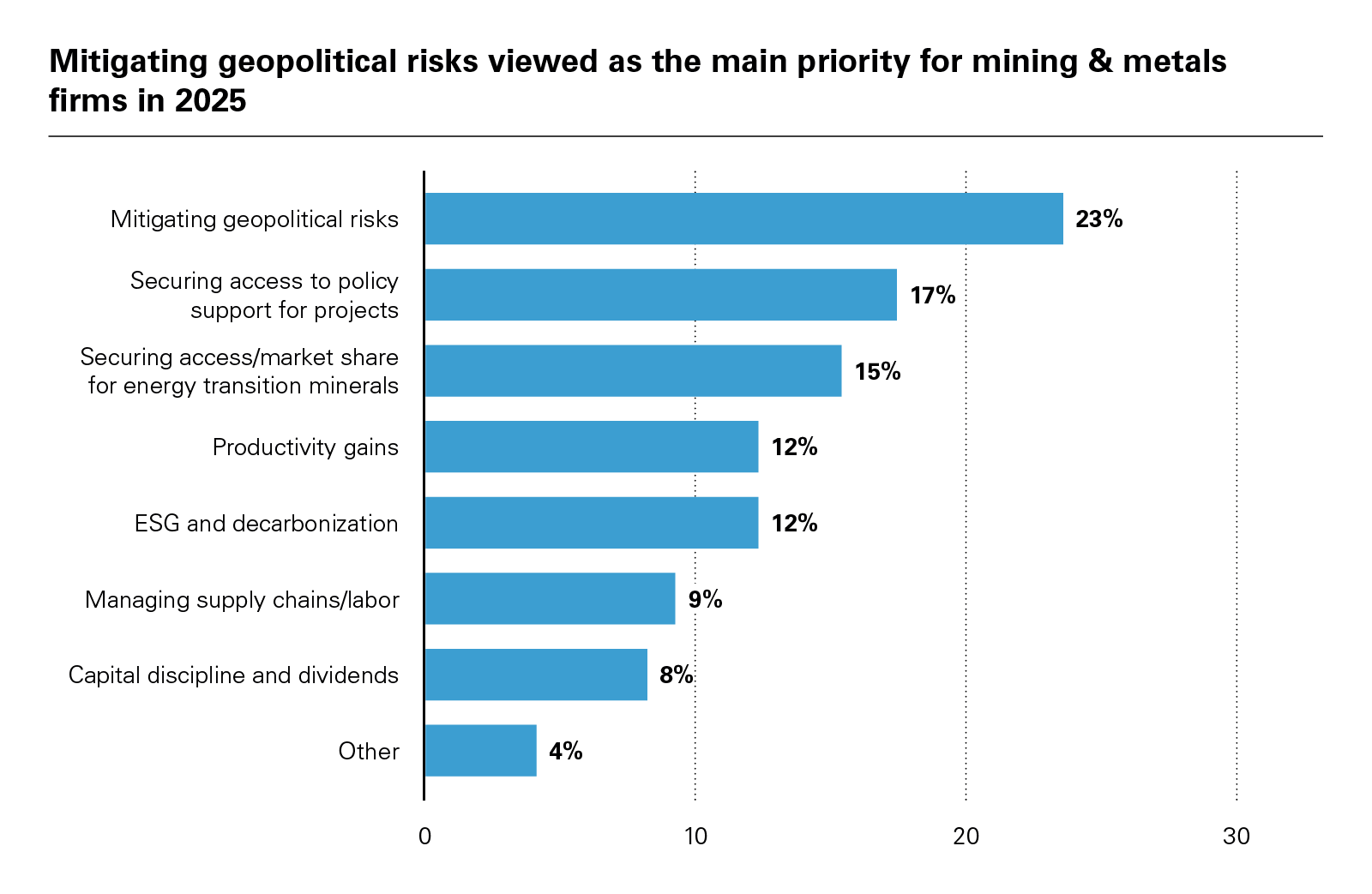

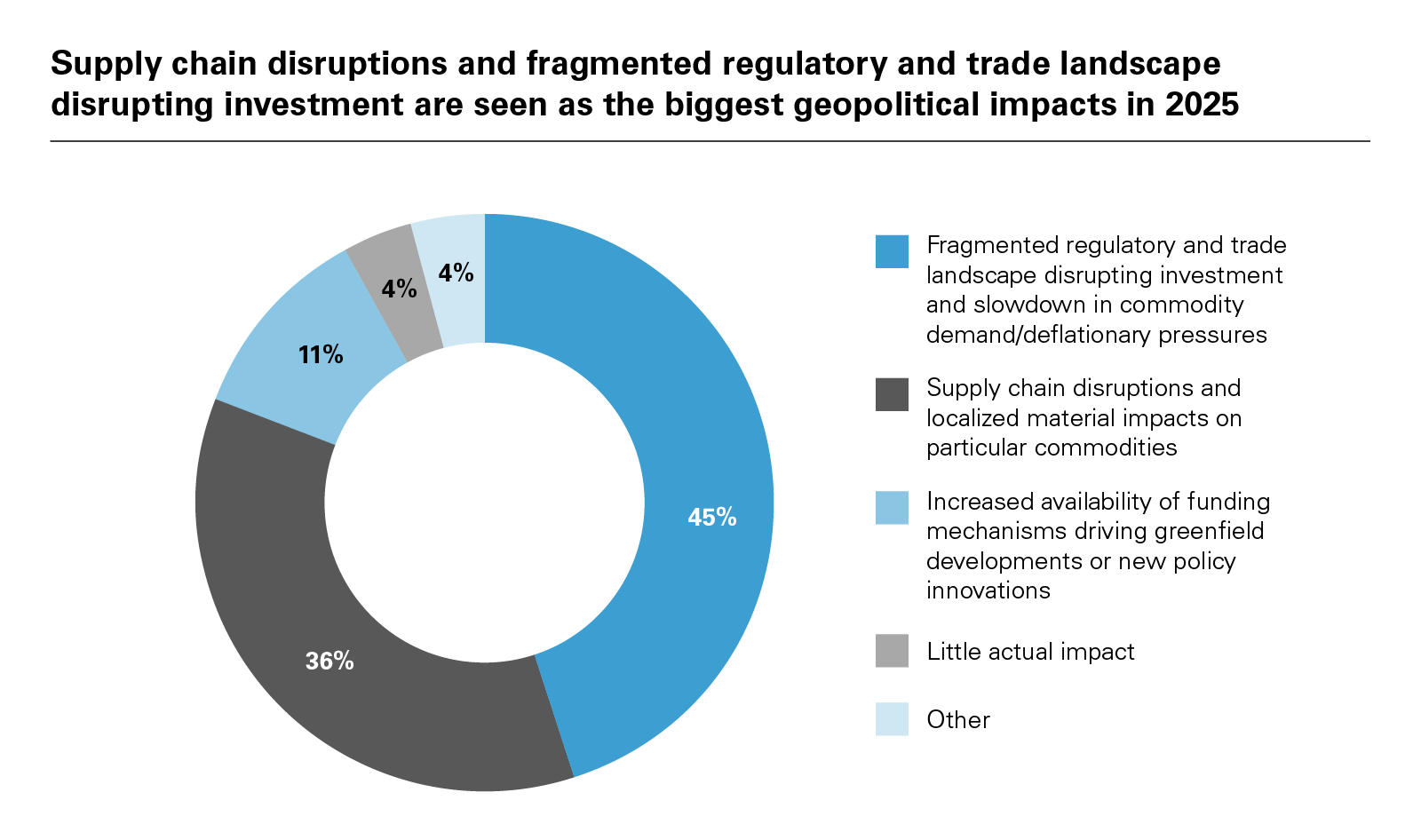

Unsurprisingly, nearly half of respondents cited geopolitical market fragmentation as their key driver for sector activity in 2025. While decarbonization, ESG, and related issues fall further down the priority list, the scramble for transition minerals is being replaced with much thornier questions of how to effectively operate on markets experiencing sustained gluts, deflationary pressures from China, and major miners still reticent to expand their investment programs into grassroots exploration . Precious metals are the exception, where heightened risk sentiment is driving healthy interest in gold and solar PV demand is driving more interest in silver after an extended period of supply underinvestment.

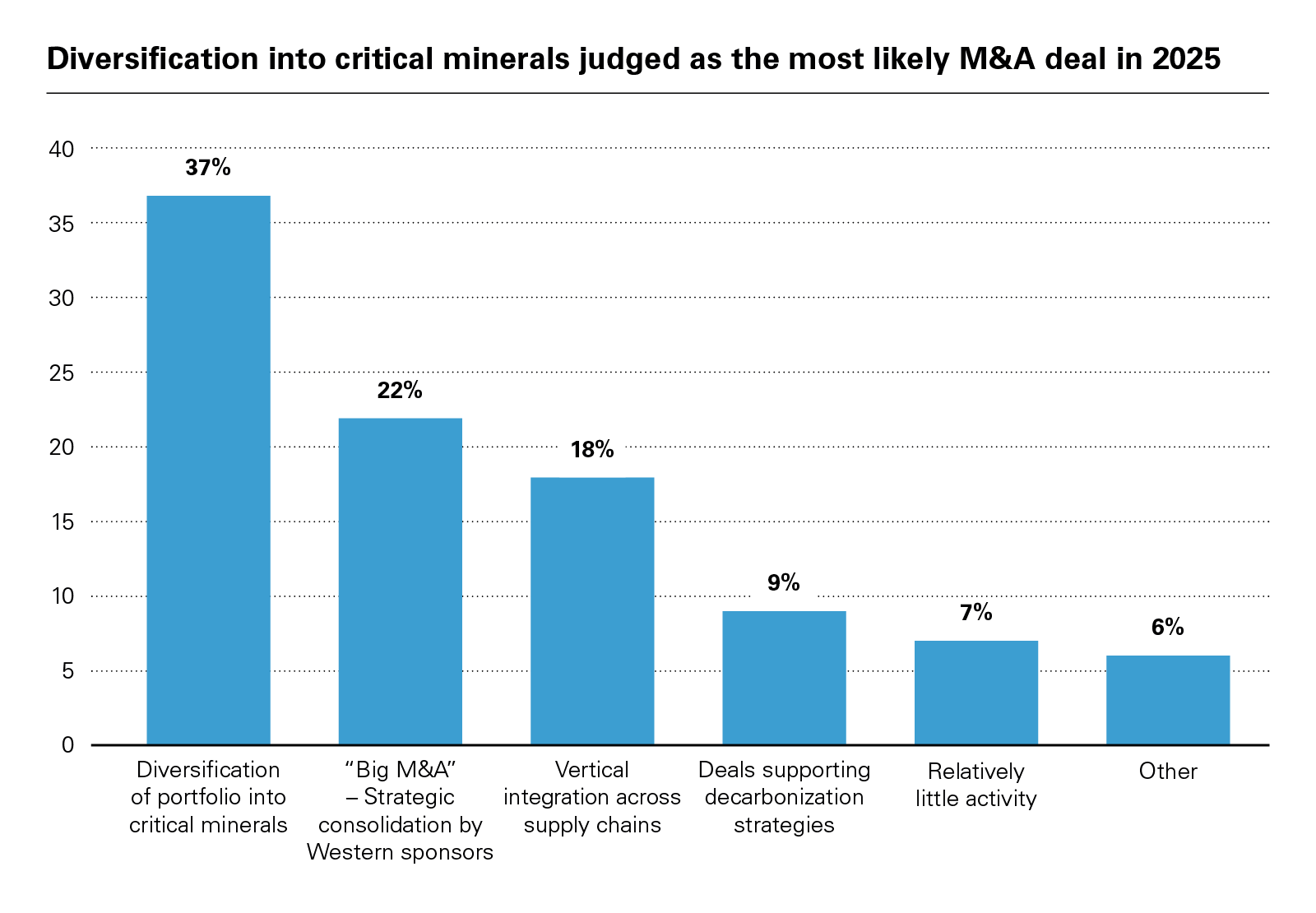

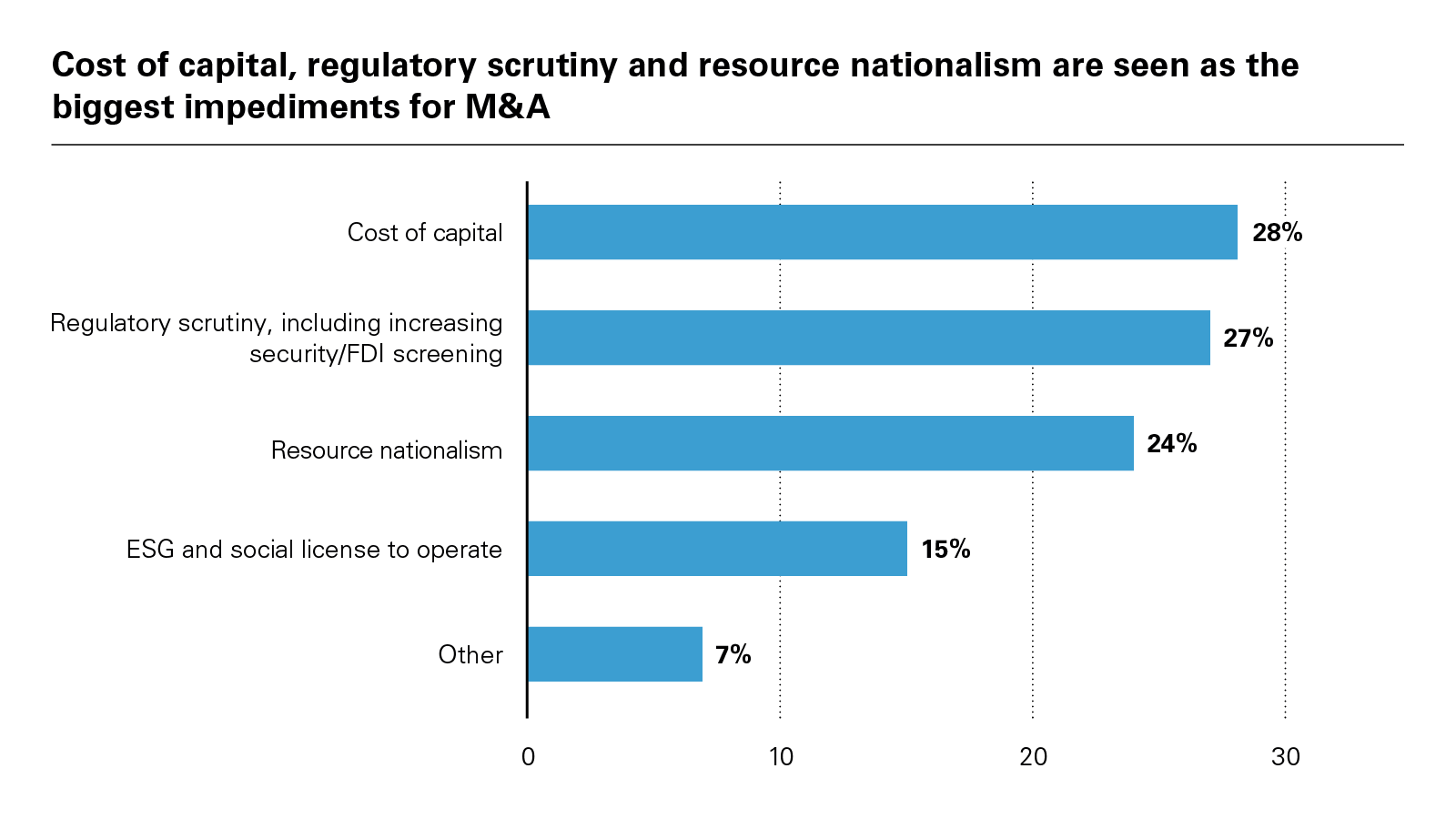

37 percent of our respondents see diversification into critical minerals as a key M&A driver, followed by 22 percent citing "big" strategic consolidation, most notably for copper with ongoing interest in Anglo American. However, the high costs of capital, increased regulatory scrutiny, and growing interventionism across EMs on a fragmented mark suggest greater obstacles to M&A in 2025. Despite the price environment and loosening financial conditions, sector M&A deal volumes remained at 15-year lows in 2024.

Waiting for Godot's bull market?

The post-pandemic link between global growth and mining & metals sector activity evolved over the course of 2024. The aftereffects of the 2022-2023 supply response have created a "two-speed" business environment. Chinese sponsors and partners sustain supply-side investments into mines, smelting, refining, and manufacturing aided by China's dominant share of end-demand. Western competitors face greater difficulty executing large investments without trade protections and support measures protecting returns.

Supply concerns from recent years have proven premature amid robust supply. The oversupply of nickel from Indonesia has proven so acute, a growing chorus of western miners have broached the idea of a dual pricing regime using green premia or some other mechanism. Lithium gluts pushed China's lepidolite producers to pare back output. Even copper—still the base metal of choice for market bulls—experienced price rallies driven by market idiosyncrasies rather than yawning deficits. Gold has benefited from elevated volatility as a hedge for investors. Most major metals traded sideways or fell in price in 2024.

The First 100 Days

Legal insights for a new era

"The First 100 Days" is a podcast that explores the legal, regulatory and policy implications that the new US administration may have on global businesses across industries. The series features our lawyers' views on the topics that matter most to our clients.

The geography of demand growth further complicates the landscape. While EV demand growth has slowed in Europe and the US, over half of new vehicles sold in China qualify as hybrid plug-in or fully electric vehicles. Where China accounted for over 75% of copper demand growth from 2020-2024 according to S&P Global Commodity Insights, accelerating renewables investments across OECD economies, data center construction, and electrification are likely to shift more marginal demand growth outside of China in 2025.

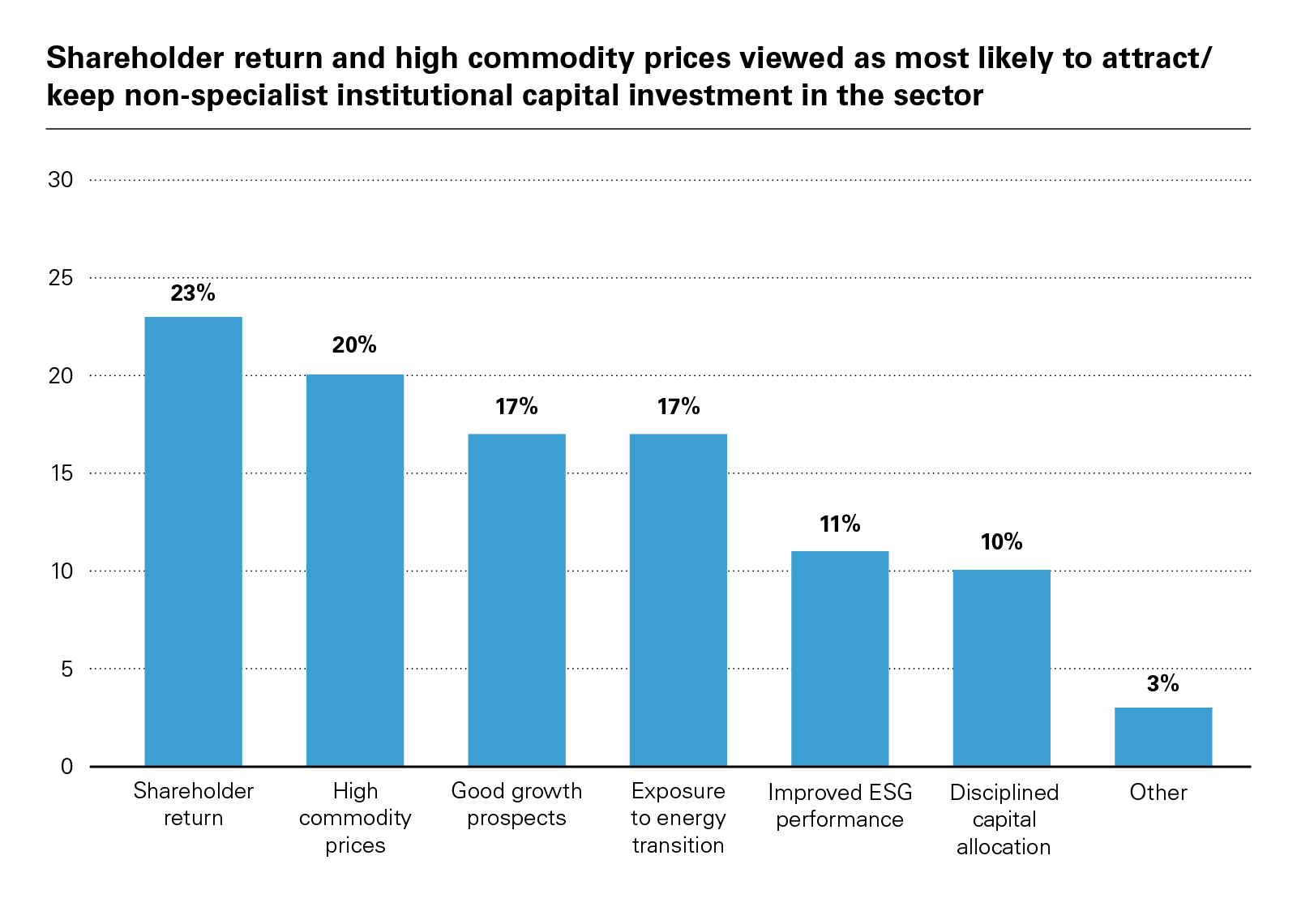

The lower-price environment impedes attracting non-specialist institutional capital to the sector. Returns are increasingly dictated by politics and policy. Diverging growth and monetary policy outlooks between the US, Europe, and Japan point to a changing operating environment. The Trump administration's trade agenda is likely to force market participants to reconsider where they raise capital, how it's allocated by jurisdiction, and how to maintain preferential access to a US market on the verge of applying universal tariffs to all imports of strategic goods unless a bilateral deal is struck.

Bottlenecks amid plenty

Concerns about supply chain disruptions have faded somewhat thanks to post-COVID "normalization" and adaptation to sanctions shocks and shipping disruptions in the Red Sea and Panama Canal. Escalating US tariffs, export controls, and trade exclusions—the Biden administration, US Department of Commerce, and US Trade Representative opened the door to complete bans of Chinese EVs and components in the spring—have prompted Chinese authorities to ratchet up export controls on rare earth elements (REEs) and critical inputs for semiconductors and military hardware. While China's exports of gallium and germanium to the US have halted, supply still reaches US end-users at a higher price point. But American firms dependent on Chinese cleantech or metals inputs face elevated risks of disruptions in 2025 despite market oversupply.

Due to expected worsening US-China tensions, supply chain disruptions still loom large for corporate planning. These are no longer the same supply "bottlenecks" markets previously warned of triggering shortages, so much as shifts in trade flows undercutting project economics. As lower prices encourage consolidation, vertically integrated operators with guaranteed, scaled end-demand have significant advantages committing capital at lower price points. Nowhere is this gap more evident than copper markets where western miners regularly cite prices of US$12,000 a ton or higher to justify investment whereas China's copper majors continue to invest into supply at current price levels.

Unsurprisingly, respondents expect base metals and transition minerals—both subject to the largest supply gluts after 2022-23—will face the most consolidation pressures in the year ahead. BHP's failed bid for Anglo American and its copper assets last April inspired speculation about "big" M&A as an M&A driver, a view supported by 22 percent of our respondents. Pure copper players have often seen their equity outperform market indices in the past 12 months. But M&A activity has yet to pick up. Regulatory scrutiny on national security grounds and continued resource nationalism seeking to retain more resource rents and value-added stages of production in mineral exporting countries are seen as the biggest impediments for M&A. Costs of capital continue to weigh on capital markets activity and acquisitions since interest rates remain elevated compared to 2021-22 levels, but the year ahead suggest divergence between Europe and North America depending on respective interest rate cuts. 78 percent of respondents expect greater divergence between the US and Europe in the year ahead over the use of tariffs, tax credits, and state aid, critical for investors allocating capital to the space.

Buying the "dip"

Lower metals prices, lower equity valuations, and the opportunities created by market fragmentation make it an ideal time for investors to rotate capital into the sector. More than two-thirds of respondents reported that they were more likely to recommend people invest in mining & metals than 12 months ago. Uncertainty about the Trump administration's approach to the Inflation Reduction Act (IRA) and regulatory support encouraging EV adoption pose risks for battery metals producers targeting the US market. Europe's EV demand slowdown and pivot to partnerships with Chinese battery makers reflects similar uncertainties among OEMs.

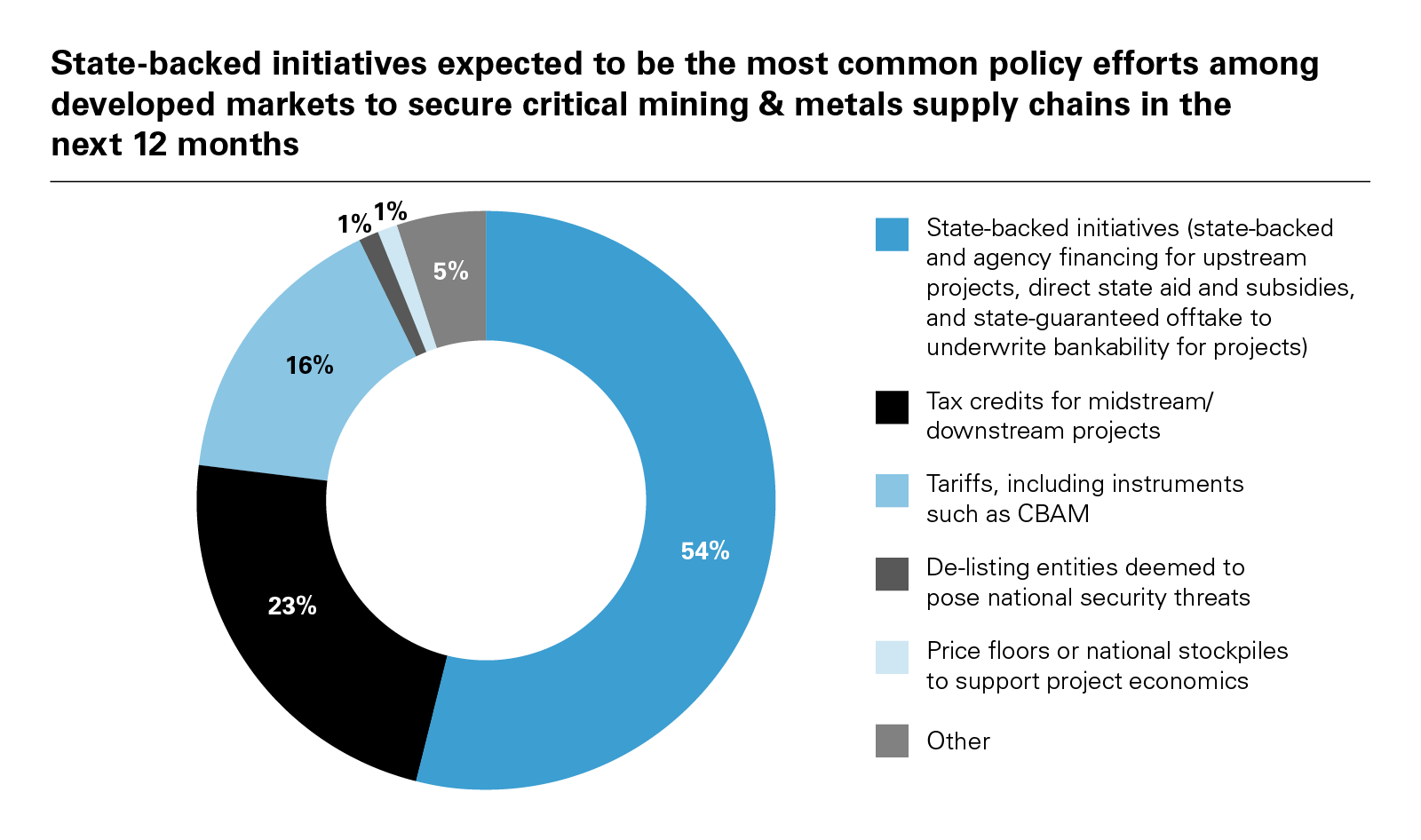

Despite this, Trump's trade agenda builds on existing policy support for solar PVs, which now account for 15 percent of silver demand and are forecast by the IEA to break 30 percent by 2030. Silver closed out 2024 trading at post-2012 highs. More broadly, market fragmentation affects pricing regimes as tariffs and trade interventions establish new price floors on national markets . Interestingly, 36 percent of respondents see state-backed financing of various kinds for upstream projects as the likeliest intervention in 2025.

Trading places

Saudi Arabia and the UAE’s diversification plans will continue to translate into outbound FDI in the sector in 2025.

Another renegotiation of the USMCA and bilateral metals trade and tariff agreements per the text of the IRA is likely to accelerate alternative multilateral trade efforts to hedge against political volatility in the US. On December 6, the EU and Mercosur finally reached a trade agreement after 25 years of negotiation that currently awaits ratification, nudged forward by Trump's re-election. Should it be ratified, it will ease European investment into lithium and other critical minerals projects in Argentina and Brazil. Indonesia, the primary driver of global nickel supply since 2019, has progressed accession to the Trans-Pacific Partnership and engaged the EU in trade talks. 22 percent of respondents see US policy as the prime cause of the uptick in multilateral trade negotiations.

Despite the considerable political interest and upside for cleantech, critical minerals, and metals demand in the OECD, the focus on demand-side interventions risk inflating demand without adequately addressing supply needs . Meanwhile, markets further left on the adoption curve of various technologies are less encumbered in their willingness to partner with Chinese sponsors and license Chinese IP, deepening the bifurcation of markets between the US and its closest partners, and China and the Global South. Europe, with its more limited resource endowments, and high dependence on trade, is caught in the middle.

Stockpiling is becoming part of the policy intervention toolkit in OECD markets, led by South Korea's state procurements of lithium hydroxide and carbonate to supply domestic manufacturers. Growing bipartisan interest in the US Congress concerning the creation of a national critical minerals stockpile may lead the way forward. Should a bill pass in the new congress, stockpiling ores could provide a more liquid benchmark for futures contracts driven by a US market posting stronger growth than other major economies. Other OECD markets, particularly Europe, may learn from and adopt their own version of these policies.

Capital and deal flows are likely to become even more (geo)politicized in 2025 as Korean, Japanese and European OEMs gauge the safety of continued investment into the US and extra-territorial risks from US policy. Should the wedge between US and European interest rates widen, Europe's ECA and development finance lenders may offer better rates for mining, processing, and refining projects in sub-Saharan Africa and Latin America while US counterparts take an increasingly transactional focus.

Respondents identify the US as a bigger "winner" for investment flows from the escalation of trade protections, most likely benefiting precious metals, copper, lithium, and unconventional projects producing REEs at the expense of investment that would otherwise go to more traditional jurisdictions in Latin America and other EMs.

The Middle East, led by Saudi Arabia and the UAE, is a significant exception in an environment where US policy affects investment flows elsewhere. Manara Minerals, a JV between Ma'aden and the Saudi Public Investment Fund, became a major financing source last year, acquiring a 10 percent equity stake of Vale Base Metals for US$2.5 billion and seeking opportunities elsewhere. In parallel, Saudi Arabia has expanded the issuance of exploration licenses to onshore a greater share of metals value chains supporting the country's economic diversification and industrialization into cleantech. In 2024, the UAE became Africa's largest investor, including a slew of deals in the mining space such as the acquisition of a 51 percent stake in Zambia's Mopani Copper Mines and interest in iron ore projects in Angola, nickel production in Burundi, and critical and rare metals in Tanzania and Kenya. Saudi Arabia and the UAE's diversification plans will continue to translate into outbound FDI in the sector in 2025.

Remaining political hangovers from the anti-incumbent, anti-inflationary political wave seen in 2023-24 and reactions to changes of government will matter for mineral-rich jurisdictions this year. Government interventions across EMs have become higher stakes in the current political climate, expanding to include hostage-taking of executives as a negotiating tactic to retain more profits or control over assets. Elections in Canada and Australia will be impactful for the arc of relations with the US and preservation, expansion or reduction in existing policy support for mines boasting FTA access to the US market and significantly reduced lead development times compared to their US peers.

“decarbonization, whilst important, ranks behind other social license initiatives”

Survey respondent

(De)politicizing ESG — ESG's return to social license to operate

Investors' and capital markets' ongoing retreat from ESG categories has had little bearing on the day-to-day realities of mining & metals operations. As one respondent put it, "decarbonization, whilst important, ranks behind other social license initiatives" , returning ESG to its "roots" focused on governance, social needs, and relationships with host governments. A whopping 73 percent of respondents believe that the so-called pullback from ESG is likelier to encourage the harmonization of standards or have no impact. These practices are now embedded operationally, aided by the expansion of miners' litigation risks to any jurisdiction where they are listed, and compliance requirements driven by the EU corporate sustainability reporting directive (CSRD). Going forward, the depth of the "China supply shock" to western mining & metals firms and manufacturers is creating a geopolitical basis for premia and pricing structures traditionally associated with emissions targets.

At present, only European consumers have shown significant willingness to pay "green premia" for lower-carbon metals, chiefly steel and aluminum. No such mechanisms have a functioning market for other intermediate or refined metals products. But the comparative speed of supply expansions led by Chinese sponsors have put Australian, Canadian and other miners on the backfoot. With price formation so dependent on spot markets in China, the bankability of western projects amid gluts would materially benefit from new benchmarks that not only provide a premium, helping projects further up the cost curve, but also transparent benchmarks for futures contracts in comparatively illiquid markets such as lithium.

Junior miners dependent on offtake financing have the most to benefit from pricing innovations providing premia and futures liquidity. More than half of our respondents would alter their investment plans if green premia and relevant state support were available. A higher-than-expected interest rate environment will drive more capital raises on equity markets, which pose significant risks for businesses navigating the capital-intensive "orphan period" bringing an asset to production. Market gluts and the potential price divergences driven by ESG or other standards disguising explicitly geopolitical aims complicate project valuations, creating premiums or discounts for assets based on the operators, jurisdiction, FTA market access and sponsors' eligibility for various forms of support.

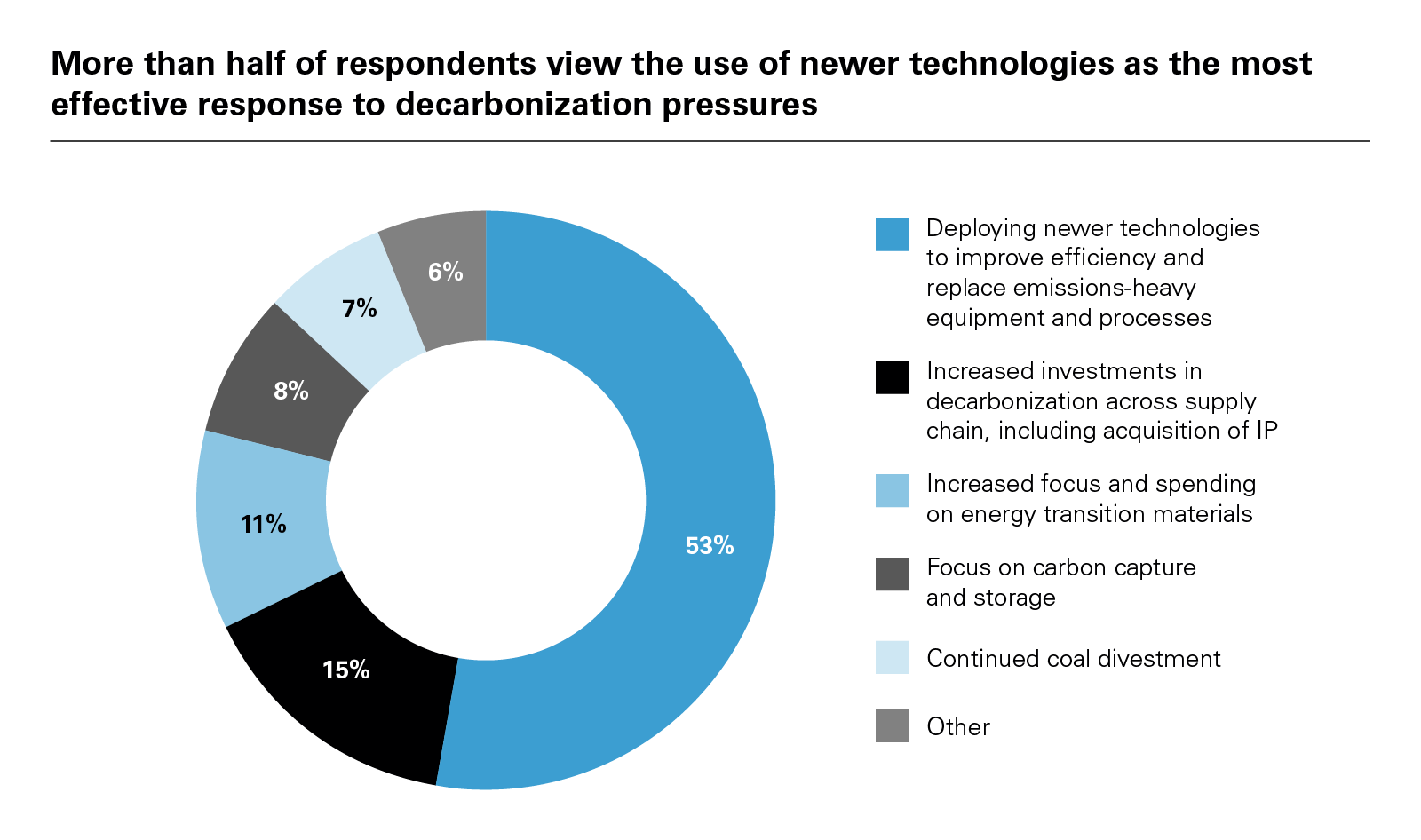

Mining & metals firms are also part of the AI boom, incorporating it into mine planning, smelting and refining optimization, safety, and exploration technologies. Tech is at the heart of miners' investment plans for their social license to operate. 76 percent of all respondents cite some form of tech deployment, investment, and IP acquisition as the most effective responses to decarbonization pressures. Improvements to productivity will be critical for miners practicing capital discipline and protecting dividends given market prices and balances, but the potential to increase supply from existing operations and improve yields at brownfield expansions or greenfield projects will help close expected supply gaps for copper and other metals forecast to fall into deficit in the medium-term.

AI's potential to realize operational gains for production and mitigate accidents and other risks adds another wrinkle to the management of market gluts. One respondent notes miners will conduct more VC tech acquisitions because "VC deals are critical to secure access to disruptive technologies used for greenfield projects." A majority of respondents see miners further investing into the tech space, though their capital spend will grow from a low base.

As markets fragment, sector participants face a new reality: There is no single "market," nation, or unifying trend driving activity. Companies and sector investors face competing, diffuse push-and-pull factors. Plan accordingly.

1 HSBC – Metals, Mining & Transition Materials Monthly Statement, January 2025; Mergermarket and Dealogic.

2 S&P Global Commodity Insights, Copper CBS December 2024 – Prices settle at lower levels amid strong dollar, databook.

3 BlackRock says $12,000 copper is needed to incentivize new mines; S&P Global Commodity Insights, Investing in Energy – China gluts shape investors' cleantech positioning.

4 IEA, Solar PV Global Supply Chains, Solar PV Global Supply Chains: Executive summary; LBMA spot price.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2025 White & Case LLP

View full image: Geopolitics fragmenting markets viewed activity for mining & metals in 2025 (PDF)

View full image: Geopolitics fragmenting markets viewed activity for mining & metals in 2025 (PDF)

View full image: Diversification into critical minerals judged as the most likely M&A deal in 2025 (PDF)

View full image: Diversification into critical minerals judged as the most likely M&A deal in 2025 (PDF)

View full image: Mitigating geopolitical risks viewed as the main priority for mining & metals firms in 2025 (PDF)

View full image: Mitigating geopolitical risks viewed as the main priority for mining & metals firms in 2025 (PDF)

View full image: Shareholder return and high commodity prices viewed as most likely to attract/ keep non-specialist institutional capital investment in the sector (PDF)

View full image: Shareholder return and high commodity prices viewed as most likely to attract/ keep non-specialist institutional capital investment in the sector (PDF)

View full image: Supply chain disruptions and fragmented regulatory and trade landscape disrupting investment are seen as the biggest geopolitical impacts in 2025 (PDF)

View full image: Supply chain disruptions and fragmented regulatory and trade landscape disrupting investment are seen as the biggest geopolitical impacts in 2025 (PDF)

View full image: Cost of capital, regulatory scrutiny and resource nationalism are seen as the biggest impediments for M&A (PDF)

View full image: Cost of capital, regulatory scrutiny and resource nationalism are seen as the biggest impediments for M&A (PDF)

View full image: State-backed initiatives expected to be the most common policy efforts among developed markets to secure critical mining & metals supply chains in the next 12 months (PDF)

View full image: State-backed initiatives expected to be the most common policy efforts among developed markets to secure critical mining & metals supply chains in the next 12 months (PDF)

View full image: Do you think OECD governments are taking adequate measures to support the construction of parallel value chains for the energy transition? (PDF)

View full image: Do you think OECD governments are taking adequate measures to support the construction of parallel value chains for the energy transition? (PDF)

View full image: Respondents generally agree that “dual price” regimes with green premia or price floors for critical minerals would significantly change their investment plans (PDF)

View full image: Respondents generally agree that “dual price” regimes with green premia or price floors for critical minerals would significantly change their investment plans (PDF)

View full image: More than half of respondents view the use of newer technologies as the most effective response to decarbonization pressures (PDF)

View full image: More than half of respondents view the use of newer technologies as the most effective response to decarbonization pressures (PDF)