Biography

Neeta Sahadev is an M&A partner based in our Silicon Valley office. She represents domestic and international clients in a wide range of transactions, including strategic acquisitions, cross-border transactions, SPACs, joint ventures, partnerships and private investments, in a broad range of industries, including technology, gaming, aviation, consumer goods and retail, cybersecurity, e-commerce, fintech, and fast-moving consumer goods.

Prior to joining White & Case, Neeta practiced as an M&A attorney in the Toronto office of a global law firm. Neeta has also been serving as a Board Member for the South Asian Bar Association of Northern California since 2021.

Experience

Representative matters include the representation of:

Interim general counsel of a cryptocurrency hosting and mining company during a client secondment.

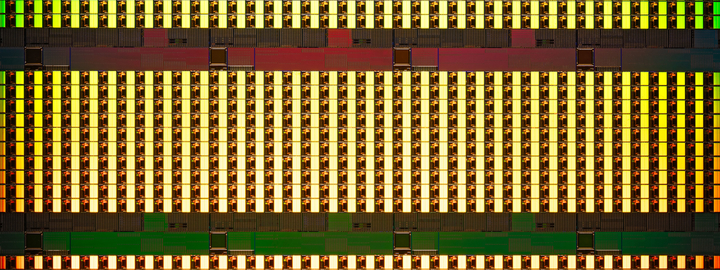

Intel Corporation in a series of acquisitions of technology companies.

Screaming Eagle Acquisition Corp. (NYSE: SEAC), a SPAC, in its US$4.6 billion business combination with the studio business of LionsGate.

EchoStar (NASDAQ: SATS), a globally, fully integrated communications and content delivery leader, on its entry into a definitive agreement with DIRECTV for the acquisition of EchoStar's video distribution business.

Transaction committee of the board of DigitalBridge Group, Inc., a global digital infrastructure investment firm, on its sale to SoftBank Group Corp. for a total enterprise value of approximately US$4 billion.

Danone, a leading global food and beverage company, in its acquisition of Functional Formularies, a leading whole foods tube feeding business in the US.

ConvergeOne, an advanced technology and solutions company now known as C1, on its prepackaged chapter 11 plan in the United States Bankruptcy Court

Flying Eagle Acquisition Corp. (NYSE: FEAC), a SPAC, in its US$4.3 billion business combination with Skillz Inc., a mobile-gaming company based in California.

Ascendant Digital Acquisition Corp. (NYSE: ACND), a SPAC, in its US$3 billion business combination with Beacon Street Group, LLC, a leading multi-brand digital subscription service platform that provides premium financial research, software, education and tools for self-directed investors.

Zanite Acquisition Corp. (NASDAQ: ZNTE, ZNTEU, ZNTEW), a SPAC, in its US$2.4 billion business combination agreement with Embraer S.A., a Brazilian multinational aerospace manufacturer, to acquire EVE UAM, LLC, an Urban Air Mobility business.

Fexjet, a global leader in subscription-based private aviation, on its entry into a US$3 billion business combination agreement with Horizon Acquisition Corporation II, a SPAC.

Cellebrite DI Ltd., the global leader in Digital Intelligence (DI) solutions for the public and private sectors, in its US$2.4 billion business combination with TWC Tech Holdings II Corp (NASDAQ: TWCT), a SPAC

dMY Technology Group, Inc. II (NYSE: DMYD), a SPAC, in its US$1.68 billion business combination with UK-based Genius Sports Group.

AutoLotto, Inc., a leading platform to play the lottery online, in its US$526 million business combination with Trident Acquisitions Corp. (NASDAQ: TDACU, TDAC, TDACW), a SPAC.

Vox Media Holdings, Inc., one of the nation's leading media production companies, in its stock-for-stock business combination with Group Nine Media, Inc., another prominent media production company.

Salesforce.org, the world's leading customer relationship management (CRM) provider for social good organizations, in its acquisition of roundCorner, a company specializing in CRM solutions for nonprofits, foundations and other social impact sectors.

Square, a leading digital payments company, on the founding of the Cryptocurrency Open Patent Alliance (COPA), a non-profit community formed to encourage the adoption and advancement of cryptocurrency technologies with the aim of removing patents as a barrier to growth and innovation.

Siemplify, an Israeli cybersecurity and security orchestration, automation and response (SOAR) provider, in its sale to Google LLC.

CyberArk Software Ltd. (NASDAQ: CYBR) in its US$42 million acquisition of Conjur, Inc.

Aixtron, Inc. in the sale of its ALD/CVD memory product line to Eugene Technology, Inc.

Advance Stores Company, Inc., a wholly owned subsidiary of Advance Auto Parts, Inc., a leading automotive aftermarket parts provider, in its acquisition of the DieHard brand from Transform Holdco LLC, a leading integrated retailer.

Biosight Ltd., a privately held pharmaceutical development company developing innovative therapeutics for hematological malignancies and disorders, in its reverse merger transaction with Advaxis, Inc. (NASDAQ: ADXS), pursuant to which the shareholders of Biosight will become the majority holders of the combined company immediately following completion of the transaction.

Elemental Holding SA, on its strategic partnership with Mitsubishi Corporation for platinum group metals (PGM) recycling.

Celestica Inc. (NYSE: CLS), a Canadian multinational electronics manufacturing services business, in its US$306 million acquisition of PCI Private Ltd., a Singapore-based South East Asian electronics manufacturing and service business, from Platinum Private Equity.

Magic Find Inc., a company that provides online gaming platforms for gamers and developers, in its acquisition of certain assets from Curse TV (a subsidiary of Twitch/Amazon).

Casino Group, a French retail conglomerate, and its subsidiary, Brazilian food retailer Grupo Pão de Açúcar (GPA), in the sale of their combined 47% stake in Grupo Éxito, a leading retailer in South America, to El Salvador-based food retailer Grupo Calleja.

Kobalt Group, an independent rights management and publishing company, in its acquisition of In2une Inc., a radio promotion and music marketing firm.

Sterigenics International LLC, a portfolio company of GTCR LLC, in its US$826 million cross-border acquisition of Nordion Inc.*

YM Biosciences Inc. in its US$510 million cross-border acquisition by Gilead Sciences, Inc.*

SAP AG of Germany in its cross-border acquisition of hybris based in Switzerland.*

Royal Vopak in its acquisition of Canterm Canadian Terminals Inc. from TransMontaigne Inc., a subsidiary of Morgan Stanley.*

ABW Partnership, a partnership of GE Energy Financial Services and Alterra Power Corporation, in its acquisition of three Ontario based solar projects from First Solar, Inc.*

PowerStream Inc. and, separately, its shareholders (the Ontario cities of Vaughan, Markham and Barrie) with respect to the CAD$607 million purchase of Hydro One Brampton Networks Inc. by

PowerStream, Enersource Corporation and Horizon Utilities Corporation.*

* Matters prior to joining White & Case.

Neeta is a recipient of a "Emerging Leaders Award" by The M&A Advisor, 2022

"Rising Star" for Mergers & Acquisitions, Euromoney, 2021

Co-author, "Technology M&A (United States chapter)", Getting the Deal Through, 2020-2024