Canada

The Canadian government announced a strict framework to evaluate foreign investments in the critical minerals sector by state-owned enterprises and state-linked private investors, especially if from “non-likeminded” countries.

Now in its seventh year of annual publication, White & Case's Foreign Direct Investment Reviews provides a comprehensive look into rapidly evolving foreign direct investment (FDI) laws and regulations in approximately 40 national jurisdictions and two regions. This 2023 edition includes more than 15 new jurisdictions in addition to those covered in previous editions and summarizes high-level principles in the European Union and Middle East. Our expansion in coverage reflects the rapid global proliferation of FDI regimes and our market leading position in the field.

FDI regimes are wide-reaching in scope, from national security to public health and safety, law and order, technological superiority, and continuity and integrity of critical supply chains. They are divergent with respect to jurisdictional triggers across countries, and are almost always a black-box process.

The following are some general observations, in large part based on the 2022 CFIUS and EU annual reports:

Investors conducting cross-border business need to understand FDI restrictions as they are today—and how these laws are evolving over time—to avoid disruption to realizing synergies, achieving technological development and integration, and ultimately securing liquidity.

We would like to extend a special thank-you to all of our external authors, who have provided some insightful commentary on the FDI regimes in a number of important jurisdictions. The names of these individual contributors and their law firms are provided throughout this publication.

We would also like to extend a special thank-you to James Hsiao of our Hong Kong office and Tim Sensenig of our Washington, DC office for their tireless efforts and dedication to the publication of this edition.

The Canadian government announced a strict framework to evaluate foreign investments in the critical minerals sector by state-owned enterprises and state-linked private investors, especially if from “non-likeminded” countries.

Foreign direct investments, whether undertaken directly or indirectly, are generally allowed without restrictions or without the need to obtain prior authorization from an administrative agency.

Most deals are approved, but expanded jurisdiction, mandatory filings applying in certain cases, enhanced focus on national security considerations, and a substantially increased pursuit of non-notified transactions have changed the landscape.

Driven by the European Commission's guidance, Member States keep expanding their investment screening regimes. A similar trend is observed in Europe at large.

In Austria, the Austrian Federal Investment Control Act (Investitionskontrollgesetz or the ICA) introduced a new, fully fledged regime for the screening of Foreign Direct Investments (FDI) and came into effect on July 25, 2020. With its wide scope of application and extensive interpretation by the competent authority, the number of screened investments has soared.

The new Foreign Investments Screening Act took effect in May 2021, and completed its first full year in operation in 2022.

The scope of the Danish FDI regime is comprehensive and requires a careful assessment of investments and agreements involving Danish companies.

In France, FDI screening authorities have issued new guidelines to improve the transparency of the FDI process.

The Federal Ministry for Economic Affairs and Energy continues to tighten FDI control, but the investment climate remains liberal in principle.

The need for FDI screening remains in focus for deals with Hungarian dimensions.

Ireland anticipates adopting and implementing an FDI screening regime by Q1 2023.

Italian "Golden Power Law:" Ten years old and continuously expanding its reach.

The Russian Federation's invasion of Ukraine has precipitated the inclusion of provisions blocking Russian and Belarussian nationals from direct investment in a number of sectors.

All investments concerning national security are under the scope of review.

Luxembourg has introduced a bill of law to regulate foreign direct investments. The law is currently being discussed before the Luxembourg Parliament.

Malta's recently introduced FDI regime captures a substantial number of transactions that must be notified to the authorities and, in some cases, will be subject to screening.

The Middle East continues opening to foreign investment, subject to licensing approvals and ownership thresholds for certain business sectors or in certain geographical zones.

The Netherlands prepares for its first effective year of new FDI regulation.

Changes in the geopolitical situation have resulted in increased awareness of security threats caused by strategic acquisitions and access to sensitive technology. The ongoing review of the FDI regulations in Norway is expected to result in more effective mechanisms to identify and deal with security threats in transactions and investors should be prepared to take this into account when planning future investments in Norwegian companies that engage in sensitive activities.

The Polish FDI regime governing the acquisitions of covered entities by non-EEA and non-OECD buyers has been extended until July 2025.

Transactions involving foreign natural or legal persons that allow direct or indirect control over strategic assets may be subject to FDI screening.

The Romanian regime regarding foreign direct investment has undergone a major change in 2022, when new legislation was enacted, and is aimed at implementing relevant European Union legislation.

The Federal Antimonopoly Service (FAS) tends to impose increased scrutiny in the sphere of foreign investments and has developed a number of amendments to the foreign investments laws that are aimed at eliminating legislative gaps in this sphere.

On November 29, 2022, Slovakia, for the first time, adopted full-fledged foreign direct investment legislation. This legislation is effective as of March 1, 2023.

Since May 31, 2020, certain foreign investments into Slovenian companies can be subject to review. Acquisition of real estate related to critical infrastructure may also be subject to review.

The restrictions imposed by the Spanish government on foreign direct investments during the COVID-19 outbreak have remained after the pandemic.

Other than security-related screening, Sweden is currently still without a general FDI screening mechanism.

Historically, Switzerland has been very liberal regarding foreign investments. However, there has recently been increased political pressure to create a more structured legal regime for foreign investment.

Making Türkiye an attractive investment destination continues to be a priority for the government.

Foreign direct investment is permissible in the UAE, subject to applicable licensing and ownership conditions.

The UK’s National Security & Investment Act has now been in place for a year and has already made its mark, prohibiting deals on national security grounds and also requiring remedies in cases that are not subject to the mandatory notification requirement. We expect a continued tough approach over the next year as global geo-political tensions bring national security concerns to the fore.

Australia requires a wide variety of investments by foreign investors to be reviewed and approved before completion of the investment.

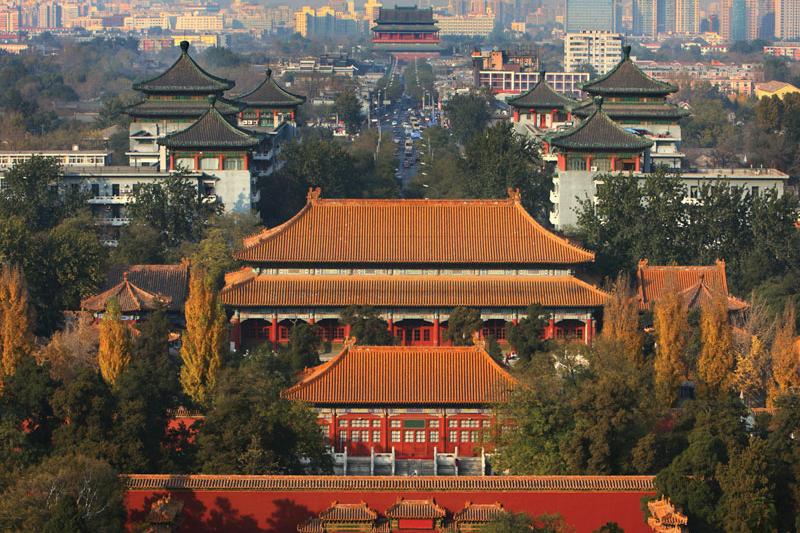

China has further developed its national security regulatory regime by promulgating measures on cybersecurity review and security assessment of cross-border data transfer.

India continues to be an attractive destination for foreign investment, ranking as the world's seventh-largest recipient of FDI in 2021.

The Japanese government continues to review filings and refine its approach under the FDI regime following the 2019 amendments.

Korea is increasing the level of scrutiny of foreign investments due to growing concerns over the transfer of sensitive technologies.

Recent legislative reforms have increased the New Zealand government's ability to take national interest considerations into account, but have also looked to exclude lower-risk transactions from consent requirements.

All FDIs are subject to prior approval, but the investment climate is welcoming and liberal.

The scope of the Danish FDI regime is comprehensive and requires a careful assessment of investments and agreements involving Danish companies.

Jesper Fabricius and Rikke Sonne (Accura Advokatpartnerselskab) authored this publication

The Danish Investment Screening Act (DISA) was entered into force on July1, 2021 and applies to foreign direct investments and "special financial agreements" (certain specified supplier, operating or service agreements and cooperative agreements on R&D) made or entered into on or after September 1, 2021. The DISA is administered by the Danish Business Authority (DBA).

There has been no evaluation of or changes to the DISA or the Executive Orders in 2022. There have also not been any official guidelines issued by the DBA in 2022.

Foreign direct investments and certain special financial agreements are investments/agreements that are made or entered into by the following foreign investors/service providers (Foreign Investor(s)):

The Foreign Investor is responsible for digitally filing to the DBA

The Foreign Investor is responsible for digitally filing to the DBA, using the forms made available on the DBA's website.

The Foreign Investor must provide detailed information regarding the nature of the investment/agreement, the Foreign Investor and the Danish target company.

In addition to the application/notification form, the following documents must be submitted to the DBA:

The DISA distinguishes between foreign direct investments in and certain special financial agreements with Danish entities that operate:

Particularly sensitive sectors and activities include: 1) companies in the defense sector; 2) companies in the field of IT security functions or the processing of classified information; 3) companies producing dual-use items; 4) companies within the critical technology sector; and 5) companies within the critical infrastructure sector.

When assessing whether a foreign direct investment or a special financial agreement may constitute a threat to national security or public order, the DBA will take all relevant circumstances and available information into account with respect to the Danish target and the Foreign Investor, including, inter alia, the following criteria:

In 2023, the DBA is expected to issue further guidance

Within the Mandatory Application Scheme, the DBA has 60 business days from receipt of a complete application to decide whether or not the DBA will approve the investment/agreement or whether the investment/agreement must be submitted to the Minister of Business for further consideration. The DBA may extend the deadline to 90 business days, e.g., if the case requires further investigation. If the DBA exceeds these deadlines, it does not prima facie entitle the Foreign Investor to complete the investment/agreement. If the investment/agreement is submitted to the Minister for approval, there is no deadline for the Minister's approval. In practice, uncomplicated transactions are approved within 35 to 45 business days from the submission of a complete filing.

Within the Voluntary Notification Scheme, a notification may be made at any time, before or after completion of the investment/agreement. The DBA has 60 business days from receipt of a complete notification to decide whether or not the DBA will approve the investment/agreement or whether the investment/agreement must be submitted to the Minister of Business for further consideration. If no decision has been made by the DBA within the 60 business days, the investment/agreement is considered approved. The 60 business days deadline may be extended.

The scope of the DISA is very broad. In particular, the assessment of whether a Danish target can be considered to operate within the particularly sensitive sectors and activities requires a careful assessment and thorough insight into the target's business activities.

A pre-screening option is available, allowing a Foreign Investor to get a fast-track assessment from the DBA as to whether a Danish entity falls within the sensitive sectors of critical technology or critical infrastructure. This option still requires a digital application to the DBA with information on the Danish target as well as on the Foreign Investor. The information required for the application is limited, and a response from the DBA can generally be expected with two to three weeks. Pre-screening is only available to determine whether a Danish entity falls within the sensitive sectors of critical technology or critical infrastructure, not whether it falls into any of the other sensitive sectors and activities, and the DBA tends to request a full filing if it cannot easily determine if the Danish entity is not operating in critical technology or critical infrastructure.

It should be noted that the DISA also applies to a Foreign Investor's investment in targets outside Denmark, if the target has a Danish subsidiary operating within the particularly sensitive sectors and activities, and the Foreign Investor indirectly acquires at least a 10 percent interest in the Danish entity.

The DBA has a duty to offer reasonable guidance to citizens and businesses that are or may be subject to the DISA. Although the scope of this duty is relatively opaque, the DBA is generally quite forthcoming in rendering informal guidance on the application of the DISA. If circumstances are sensitive, however, very little upfront guidance can be expected.

There are no fines for not complying with the DISA. As regards foreign investment in ownership shares, the main sanction is that the Danish authorities may request that the foreign investor dispose of its investment —or in the alternative—may repeal any voting rights on such ownership shares. Depending on the circumstances, this could potentially end up in the Danish target being dissolved. As regards special financial agreements, these may eventually become null and void.

An evaluation of the DISA will be initiated in 2023 and a report will be submitted to the Danish Parliament. The report will form the basis for considerations of whether there is a need to amend the DISA.

In 2023, the DBA is expected to issue further guidance on areas where the DBA has now gained more experience from the practical handling of the DISA, including guidelines on the application of the DISA to intra-group transfers.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2023 White & Case LLP