Business sets the pace in a global order marked by risk and fragmentation

As governments grapple with regulation and national security priorities, the private sector has stepped into the breach

2023 was a year of change for White & Case, as I stepped into the role of Chair and my predecessor, Hugh Verrier, completed his successful 16-year tenure. The Firm began a new chapter well positioned for continued growth. This review highlights many of the achievements and pioneering initiatives that took place throughout the year.

As the world became increasingly fragmented, we focused on the global connections that matter to our clients. We collaborated across borders, providing integrated services and maintaining the strong personal and professional bonds that make a difference, particularly in uncertain times.

Our work on high-stakes deals, disputes and pro bono matters placed us at the center of industry trends related to energy transition, finance, technology and more. We contributed to the conversation on these issues, publishing insights that included a comprehensive report on the future of globalization. Our report, A world of clubs and fences: Changing regulation and the remaking of globalization, puts forward a new conceptual model to understand cross-border interconnectedness in a time of sweeping legal and regulatory changes.

We also increased our ability to serve clients, promoting 46 new partners and welcoming 36 lateral partners. We continued to find innovative solutions that enhance client services and foster efficiency. And as generative AI continues to make headlines, we developed tools that will enable us to embrace its possibilities, while carefully managing its risks.

Looking ahead, White & Case enters its next phase with a solid foundation and an ambitious growth plan that will keep us at the forefront of the rapidly changing legal industry. I look forward to what we and our clients will accomplish together in the coming years.

Guest speakers at Firm events share views on timely topics

As governments grapple with regulation and national security priorities, the private sector has stepped into the breach

Our learned behavior and ideas about work may keep us from operating at our best

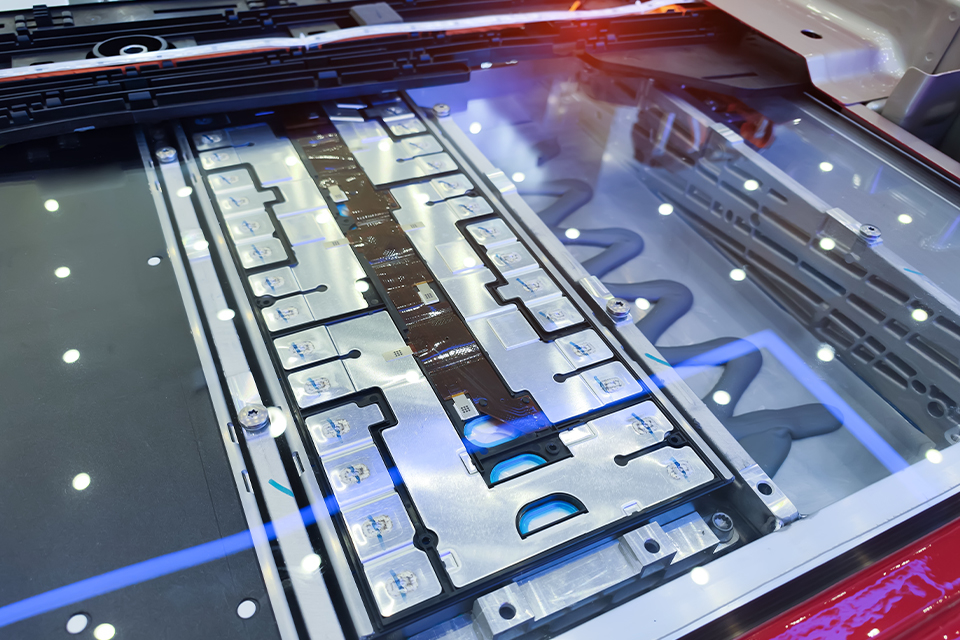

By uniting industry participants who may seem to have divergent interests, the Global Battery Alliance is paving the way for a sustainable battery supply chain

Developments that reshaped the world

The war in Ukraine and high energy prices challenged energy transition timetables, but governments and investors were determined to stay the course

M&A and debt market activity declined in 2023, as high interest rates and macroeconomic dislocation saw increasingly cautious dealmakers and lenders put deployment on hold

Growth and investment in generative artificial intelligence (GenAI) lifted the technology sector after a slowdown in transaction activity throughout 2023, but regulatory challenges loomed large

The relatively free cross-border flow of goods, capital, information and people that have characterized globalization for decades is being replaced by regulatory "clubs" and "fences"

Highlights of our work in 2023

Our achievements position us for success

US$2.95 billion in revenue

2,559 total lawyers

1,291EMEA

998Americas

271Asia-Pacific

1,220US-qualified lawyers

550English-qualified lawyers

In markets around the world, White & Case earned many of the legal industry’s top accolades

White & Case is committed to fair and ethical operations that respect the interests of our stakeholders and recognize the importance of protecting our environment. Our Responsible Business Subcommittee leads environmental, social and governance (ESG) and sustainability efforts across our global operations.

As a signatory to the UN Global Compact, we affirm our commitment to doing business responsibly by aligning our operations with the Compact’s ten principles on human rights, labor, the environment and anti-corruption. Our most recent Communication on Progress outlines the steps we are taking to continue to embed these principles into our Firm’s operations.

Our latest Environmental Sustainability Report includes information on our sustainable operations, scope 1, 2 and 3 greenhouse gas emissions data, and our most recent Environmental Management Systems survey. Highlights from 2023 include:

Committed to advancing diversity and inclusion across the Firm

11 global affinity networks

Our 11 affinity networks foster a sense of community among the Firm’s Black, Asia-Pacific, Latinx/Hispanic, Middle Eastern and North African, minority ethnic and LGBTQ+ lawyers, business services professionals and their allies. Each network sets its own agenda, initiatives and goals, which are specific to the issues it considers most important. Affinity networks create and enhance awareness of these groups within the Firm and its larger culture, drive community and connection across our global offices, and support their members with career and professional development opportunities.

24 local women’s networks

Our 24 local women’s networks are active in 40 offices across the Americas, EMEA and Asia-Pacific. These networks foster professional development and mentoring activities. They also provide a forum for our lawyers and business services professionals to share perspectives and create programs to support and retain our women while fostering and promoting gender equity.

42% of the Firm’s global management

50% of the Executive Committee

21% of other leadership roles

36% of our 2023 global partner promotions

25% of global Partnership

43% of our lawyers

42% of our lawyers self-identify as of color

7% of our lawyers self-identify as LGBTQ+

4% of our lawyers self-identify with disabilities

28% of our partners self-identify as of color

3% of our partners self-identify as LGBTQ+

4% of our partners self-identify with disabilities

32% of our lawyers self-identify as of color

10% of our lawyers self-identify as LGBTQ+

4% of our lawyers self-identify with disabilities

13% of our partners self-identify as of color

5% of our partners self-identify as LGBTQ+

2% of our partners self-identify with disabilities

125nationalities

92languages spoken

Our commitment to diversity and inclusion is recognized by leading publications and alliance organizations

White & Case women gather to build connections and advance career opportunities

6 continents

44offices

30countries

An internal guide addresses 20 areas of legislation in four Asia-Pacific countries

A transformative technology enables new ways of working

Photo by © ASF - Architect Simone Forconi

iBridge, an interactive pedestrian bridge submitted for a design competition. Sensors on the floor of the bridge allow it to transform pedestrian and cycling traffic into usable energy.

M&A and debt market activity declined in 2023, as high interest rates and macroeconomic dislocation saw increasingly cautious dealmakers and lenders put deployment on hold

M&A dealmakers, lenders and debt investors had a challenging year.

Global M&A fell 16 percent year-on-year in 2023, as an uncertain economic outlook and geopolitical concerns put the brakes on prospective deal flow.

Debt markets also came under pressure. Rising interest rates throughout the year pushed up borrowing costs and constrained the availability of liquidity. This saw leveraged loan issuance in the US and Europe suffer double-digit year-on-year declines in 2023, while APAC loan markets saw issuance dip by nearly a fifth.

Against this backdrop, White & Case worked closely with lenders, private capital dealmakers, companies and sovereigns to navigate the deepest slowdown in transaction activity and lending since the 2008 global financial crisis.

These are some of the key themes that reshaped M&A and debt markets throughout the recent downturn.

The macroeconomic headwinds that hit dealmaking in 2023 reconfigured the M&A market and changed the strategic rationales for doing deals.

Private equity dealmaking was directly impacted by rising rates, which pushed up debt costs and constrained access to the leverage and inexpensive debt that helped to finance buyouts and enhance returns at the peak of the market in 2021.

On the corporate side, meanwhile, barring a few exceptions (such as the mining sector), the majority of M&A shifted from expansive, big-ticket deals targeting growth to transactions informed by a refocusing on core operations, strengthening balance sheets and adapting to long-term secular shifts in certain sectors.

Carve-out deals, where businesses divest assets deemed to be non-core, progressed as companies trimmed portfolios to focus on their most profitable divisions or raise cash and reduce debt as expensive refinancings came into view.

Businesses, however, not only turned to M&A when playing defense. They also pursued deals that addressed key long-term strategic objectives that extend way beyond the current interest rate cycle.

The oil & gas sector is a case in point, with companies using M&A to diversify away from carbon-intensive assets into renewables and green energy. The last year saw oil companies invest in an array of wind, green hydrogen, hydroelectricity, carbon capture and electric vehicle deals, as the industry moved to decarbonize.

Although the slowdown in M&A markets was challenging across the board, some stakeholders emerged from market dislocation in a strong position and saw opportunities to do deals.

Sovereign wealth funds (SWFs), for example, continued to rely on M&A as a tool to lock in growth, diversify economies and build influence on the international stage. With deep pockets and longer-term investment horizons, SWFs did not have to cut back on deployment and participated in more than 100 deals worth more than US$50 billion in 2023.

Other pockets of the M&A market also proved resilient. For example, major food sector companies did not shy away from big-ticket investments to diversify portfolios, consolidate categories and respond to shifting consumer preferences; while emerging, fast-growing sectors, such as generative AI, enjoyed a boom in M&A investment.

While deal markets were challenging, fund buyers were willing to pay good prices for high-quality assets with long-term strategic value.

As in M&A, leveraged finance markets were significantly quieter throughout 2023. Issuance in Western markets contracted in the face of higher interest rates, while a liquidity crunch in the key Chinese real estate sector saw debt issuance in the Asia-Pacific region (APAC) decline.

The failure of Silicon Valley Bank and the sale of California-based First Republic to JPMorgan Chase in a deal pulled together by regulators also dampened lender and investor appetite. Banking system distress was also seen in Europe.

Amid this turbulence, borrowers had to be nimble and explore all avenues for sourcing liquidity and protecting balance sheets.

Private equity sponsors drilled down into loan documents to ensure that rising interest rate costs did not erode headroom or compromise financial covenant compliance.

All borrowers tried to maximize the financing options available to them. In the US, for example, issuance of US convertible bonds, which can be converted into shares at pre-agreed price thresholds, surged as pools of mainstream liquidity contracted. Borrowers with large revenue from exports, meanwhile, found term loan C debt—which is used to fund cash collateral accounts that support the essential letters of credit that exporters rely on—to be an especially attractive option at a time when credit markets have been volatile.

Despite tough market conditions, lenders have been pragmatic and offered companies support where possible. Private credit players, who have become increasingly influential in private equity deal financings, have been open to supporting companies and sponsors by extending maturities and amending terms to help borrowers through periods of market disruption.

In a challenging year, lenders and borrowers showed their willingness to be patient, do their best to preserve value and be ready to rebound when market conditions improve.

Photo by © Afonkiin Yuriy / GettyImages

An abstract pattern of triangular polished metal panels on a building in Russia