Business sets the pace in a global order marked by risk and fragmentation

As governments grapple with regulation and national security priorities, the private sector has stepped into the breach

2023 was a year of change for White & Case, as I stepped into the role of Chair and my predecessor, Hugh Verrier, completed his successful 16-year tenure. The Firm began a new chapter well positioned for continued growth. This review highlights many of the achievements and pioneering initiatives that took place throughout the year.

As the world became increasingly fragmented, we focused on the global connections that matter to our clients. We collaborated across borders, providing integrated services and maintaining the strong personal and professional bonds that make a difference, particularly in uncertain times.

Our work on high-stakes deals, disputes and pro bono matters placed us at the center of industry trends related to energy transition, finance, technology and more. We contributed to the conversation on these issues, publishing insights that included a comprehensive report on the future of globalization. Our report, A world of clubs and fences: Changing regulation and the remaking of globalization, puts forward a new conceptual model to understand cross-border interconnectedness in a time of sweeping legal and regulatory changes.

We also increased our ability to serve clients, promoting 46 new partners and welcoming 36 lateral partners. We continued to find innovative solutions that enhance client services and foster efficiency. And as generative AI continues to make headlines, we developed tools that will enable us to embrace its possibilities, while carefully managing its risks.

Looking ahead, White & Case enters its next phase with a solid foundation and an ambitious growth plan that will keep us at the forefront of the rapidly changing legal industry. I look forward to what we and our clients will accomplish together in the coming years.

Guest speakers at Firm events share views on timely topics

As governments grapple with regulation and national security priorities, the private sector has stepped into the breach

Our learned behavior and ideas about work may keep us from operating at our best

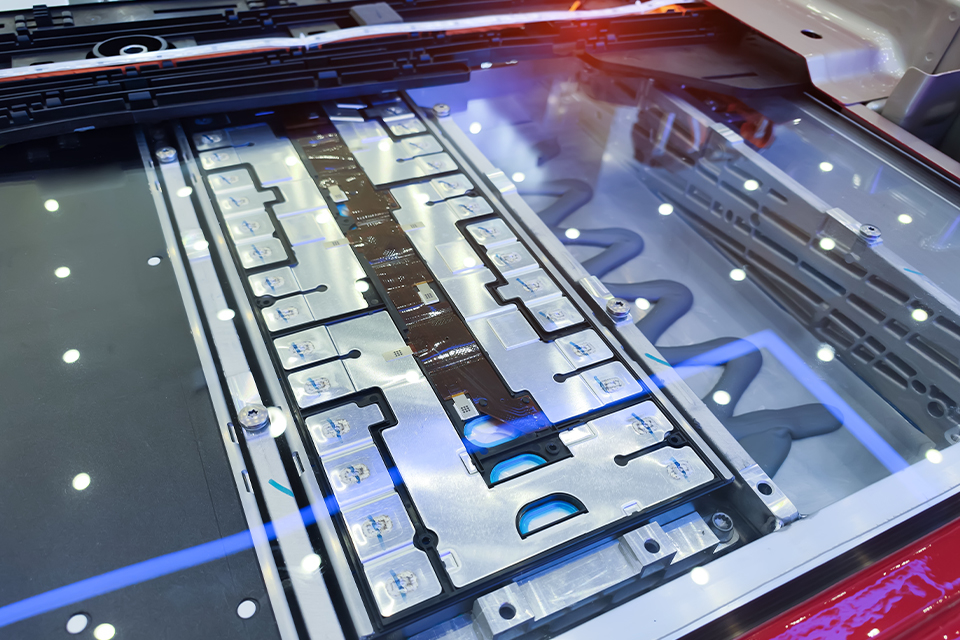

By uniting industry participants who may seem to have divergent interests, the Global Battery Alliance is paving the way for a sustainable battery supply chain

Developments that reshaped the world

The war in Ukraine and high energy prices challenged energy transition timetables, but governments and investors were determined to stay the course

M&A and debt market activity declined in 2023, as high interest rates and macroeconomic dislocation saw increasingly cautious dealmakers and lenders put deployment on hold

Growth and investment in generative artificial intelligence (GenAI) lifted the technology sector after a slowdown in transaction activity throughout 2023, but regulatory challenges loomed large

The relatively free cross-border flow of goods, capital, information and people that have characterized globalization for decades is being replaced by regulatory "clubs" and "fences"

Highlights of our work in 2023

Our achievements position us for success

US$2.95 billion in revenue

2,559 total lawyers

1,291EMEA

998Americas

271Asia-Pacific

1,220US-qualified lawyers

550English-qualified lawyers

In markets around the world, White & Case earned many of the legal industry’s top accolades

White & Case is committed to fair and ethical operations that respect the interests of our stakeholders and recognize the importance of protecting our environment. Our Responsible Business Subcommittee leads environmental, social and governance (ESG) and sustainability efforts across our global operations.

As a signatory to the UN Global Compact, we affirm our commitment to doing business responsibly by aligning our operations with the Compact’s ten principles on human rights, labor, the environment and anti-corruption. Our most recent Communication on Progress outlines the steps we are taking to continue to embed these principles into our Firm’s operations.

Our latest Environmental Sustainability Report includes information on our sustainable operations, scope 1, 2 and 3 greenhouse gas emissions data, and our most recent Environmental Management Systems survey. Highlights from 2023 include:

Committed to advancing diversity and inclusion across the Firm

11 global affinity networks

Our 11 affinity networks foster a sense of community among the Firm’s Black, Asia-Pacific, Latinx/Hispanic, Middle Eastern and North African, minority ethnic and LGBTQ+ lawyers, business services professionals and their allies. Each network sets its own agenda, initiatives and goals, which are specific to the issues it considers most important. Affinity networks create and enhance awareness of these groups within the Firm and its larger culture, drive community and connection across our global offices, and support their members with career and professional development opportunities.

24 local women’s networks

Our 24 local women’s networks are active in 40 offices across the Americas, EMEA and Asia-Pacific. These networks foster professional development and mentoring activities. They also provide a forum for our lawyers and business services professionals to share perspectives and create programs to support and retain our women while fostering and promoting gender equity.

42% of the Firm’s global management

50% of the Executive Committee

21% of other leadership roles

36% of our 2023 global partner promotions

25% of global Partnership

43% of our lawyers

42% of our lawyers self-identify as of color

7% of our lawyers self-identify as LGBTQ+

4% of our lawyers self-identify with disabilities

28% of our partners self-identify as of color

3% of our partners self-identify as LGBTQ+

4% of our partners self-identify with disabilities

32% of our lawyers self-identify as of color

10% of our lawyers self-identify as LGBTQ+

4% of our lawyers self-identify with disabilities

13% of our partners self-identify as of color

5% of our partners self-identify as LGBTQ+

2% of our partners self-identify with disabilities

125nationalities

92languages spoken

Our commitment to diversity and inclusion is recognized by leading publications and alliance organizations

White & Case women gather to build connections and advance career opportunities

6 continents

44offices

30countries

An internal guide addresses 20 areas of legislation in four Asia-Pacific countries

A transformative technology enables new ways of working

Photo by © ASF - Architect Simone Forconi

iBridge, an interactive pedestrian bridge submitted for a design competition. Sensors on the floor of the bridge allow it to transform pedestrian and cycling traffic into usable energy.

David Miliband is president and CEO of the International Rescue Committee (IRC), a nongovernmental organization that supports people affected by humanitarian crises around the world. He was British foreign secretary from 2007 to 2010 and a Member of Parliament from 2001 to 2013. In June 2023, he delivered the keynote address at Regulating globalization: Clash and cohesion, a White & Case webinar that examined an emerging new paradigm of globalization.

In fall 2023, we talked to Miliband about the ongoing challenges to traditional globalization, the role of "pacesetter" companies in today's world and what de-risking might mean for business. An edited version of that conversation follows.

You've said that the model of businesses as "takers" that pursue their own interests, or as "pressure-makers" that try to influence government, is being replaced with a model of businesses as "pacesetters" that shape everyday life, often well ahead of government. How has this happened?

Over the past 20 years, the traditional agenda-setters of the global system—essentially the United States and other Western countries—have been under challenge not only from the rise of alternative economic powers, notably China, but also from within. You see that in the Brexit referendum, in the election of former President Donald Trump and in the so-called "populist," anti-system parties of the right, and sometimes left, that have challenged the status quo. This has pushed governments into retreat.

And so, businesses have been left with a clear choice: Either they lead, or no one leads. If Western business wants to defend the gains of globalization, then it's going to have to argue for it. Another factor is that employees, especially younger ones, expect their employer to articulate and defend their value system. We have seen this on issues of social, economic, racial and climate justice, which has pushed many businesses to take stands they would likely have steered around in years past.

Obviously, different sectors play different roles, and each has its own culture, but there are some common factors. Despite such commonalities, the debate about the future of AI, for example, shows how hard it is to square the circle when governments don't know what to do.

With legislators scrambling to keep up, how can governments incentivize self-regulation to protect the public interest while they figure out their own regulatory approach?

It is hard enough for governments to regulate, and harder indeed to incentivize, self-regulation. Considering the competing interests and views within the Western tech sector—never mind the challenges from China, Russia and the Gulf—the idea that the industry will have a single point of view that coheres into effective self-regulation seems far-fetched.

The fear of government regulation might induce some common purpose, but the European Union is already hard at work on its approach, and the US has President Biden's executive order on AI, so the space is filling up fast. I am not an expert, but the dramatic removal and reinstatement of Sam Altman at OpenAI shows that even within one company there can be irreconcilable views. This is why we have government and legislatures.

How has the private sector set the pace in terms of decarbonization?

We have all failed to set the pace on decarbonization. It's been a 40-year failure to follow the writing on the wall. Arguably, the greatest advances so far—in price reduction—have come from China and its massive renewables drive. There has also been significant innovation in spaces like offshore wind, incentivized by government regulations like the UK's Contracts for Difference.

What we have seen in the past couple of years, however, is significant. Western governments have woken up to the need to sweeten the pill for private investors in decarbonization. This has been done most extensively through the US's Inflation Reduction Act, which has a US$350 billion price tag, though many suggest it will be north of US$1 trillion. There is also the EU's Fit for 55 program, China's continued subsidies for its own industry and India's decarbonization commitments. This is some kind of new "competitive leapfrogging" that is not being driven by global regulation, but instead by the search for competitive advantage and climate crisis fears.

How will business be affected by the growing national security trend of de-risking, in which governments seek to limit economic ties that present vulnerabilities?

It's a mixed picture. De-risking will be costly, which in the short term may have some businesses looking forward to the prospect of windfall gains from increased prices. But it carries risks, too, in the form of blowback from consumers, who have not really had to face the consequences of de-risking and will struggle to see its rewards.

We do not know how far it will go, but it seems prudent to understand that post-pandemic, post-Ukraine and in the wake of great power competition between the US and China, there will be a greater premium on domestic or "friendshored" production, which will likely drive up prices. This is obviously a threat to business. Globalization has been a phenomenon, and while there is scant evidence of it going into full-scale reverse, the global business model is built on a bias toward free trade and free movement of people and capital. Grit in those wheels creates a whole new level of risk.

You've said that the mismanagement of globalization has been a feature of the past 30 years—what do you mean by that, and how can the consequences of this mismanagement be mitigated?

I mean that public goods on which globalization depends—the management of risks like pandemics, economic or climate challenges, or the conflicts and consequent refugee flows—have not been well managed. There is too much insecurity, inequality and instability to sustain the system in a steady way, and this lays the groundwork for backlash.

If you ignore problems, they get bigger, and that is what is happening. We have 50-plus conflicts going on in the world, a rampant climate crisis and weakening global norms—all exacerbated by great power competition. Risk plus fragmentation is a bad and unstable combination. We need to address both: the risks (whether health or refugees) and the fragmentation (for instance, by ensuring that there is space for cooperation, as well as competition, with China). This is what we should be doing.

Photo by © Anzeletti / GettyImages

Staircases on the facade of a building