Finally, the Final HSR Rules: Key Takeaways for the New HSR Pre-Merger Notification Form

15 min read

On October 10, 2024, the US Federal Trade Commission ("FTC") finalized significant updates to the Hart-Scott-Rodino ("HSR") Form and Instructions ("New HSR Rules").1 On November 12, 2024, the New HSR Rules were published on the U.S. Federal Register, making the changes effective on February 10, 2025, 90 days after publication.2 The last day to make HSR Filings under the current HSR Rules is Friday, February 7, 2025 at 5:00pm ET.3

While not as broad as initially proposed in 2023, the updates represent the most sweeping changes to the HSR Form for US premerger notification filings ("HSR Filings") in 48 years. While the changes are scheduled to go into effect on February 10, 2025, implementation may be delayed until March 2025 if President-Elect Donald Trump issues a "regulatory freeze" memorandum as expected once he takes office.

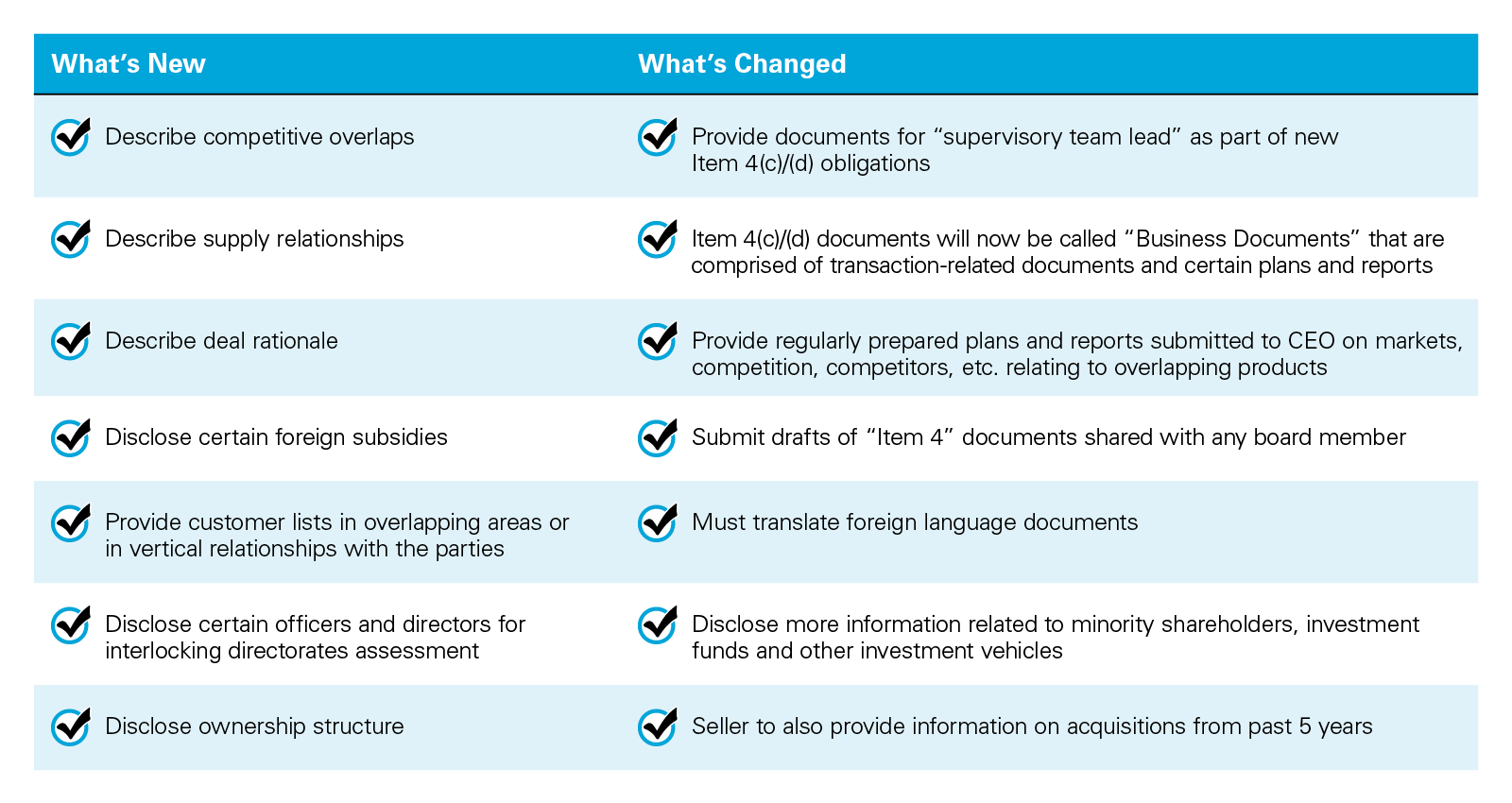

Highlights of Key Changes

The changes apply to every HSR-reportable transaction and will significantly increase the burden and time to prepare HSR Filings. The FTC estimates 105 hours per response, which is an average increase of 68 hours required to prepare an HSR Filing under the New HSR Rules, with an average high of 121 hours for filings from acquiring persons in transactions with overlaps or supply relationships.4

For transactions that do not involve competitive overlaps, for transactions involving a tender offer, and for certain sell-side filings, the increased burden will be lower.

The First 100 Days

Legal insights for a new era

"The First 100 Days" is a podcast that explores the legal, regulatory and policy implications that the new US administration may have on global businesses across industries. The series features our lawyers' views on the topics that matter most to our clients.

What's New?

Filing parties will need to provide more details and data upfront in their HSR Filings. Accordingly, parties should factor additional time, cost, and burden into their plans to collect and prepare for their HSR Filing.

New Competitive Overlap and Supply Relationship Descriptions

The New HSR Rules introduce two new HSR Forms and Instructions, one for the acquiring person (buyer) and another for the acquired person (seller/target). Both forms require a description of any competitive overlaps or supply relationships, specifically:

- A description of planned or known products or services that compete with those of the other party, consistent with the filing party's documents accompanying the HSR Filing, which must be cited.5

- The most recent year's sales data (by value) for all overlapping products or services.6

- A description of the categories of customers that purchase or use the overlapping product or services.7

- The top 10 customers in the most recent year (by units and sales) and the top 10 customers for each customer category in overlapping products or services.8

- A description of products, services, or assets representing at least $10M in sales that are (i) sold to or purchased from the other party or (ii) sold to or purchased from a business that competes with the other party or a business that uses such products as an input to compete with the other party.9

- Specific sales data of such products and a list of top 10 customers that use each party's products as an input to compete with the other party.10

- Disclosure of products in the party's R&D pipeline that could compete with the other party's business and identification of specific geographic overlaps.11

For both the competitive overlap and supply description, filers must include relevant information not only limited to the United States, but also on a global basis.12 Despite the new requirements, the FTC has stated in subsequent guidance that "these descriptions are not intended to be onerous or involve legal analysis."13 Notably, the filing parties cannot exchange information about how they will each describe their respective products or services, though it remains unclear from the New HSR Rules and subsequent FTC guidance as to whether this prohibition applies to counsel for the parties or only to the parties themselves.14

Disclosure of "Subsidies from Foreign Entities or Governments of Concern"

- Filing parties must now disclose whether the filing party has received within the past two years prior to the HSR Filing any subsidy (or a commitment to provide a subsidy in the future) from any "foreign entity or government of concern" and must also provide a brief description of any such subsidy.15 The exact definition of "foreign entity or government of concern" is complex and refers to other statutes which may shift as the underlying statutes are amended.16 For present purposes, however, the current definition identifies China, Iran, North Korea, and Russia.17

- The New HSR Rules note that the FTC may consider implementing a de minimis exemption to the foreign subsidy disclosure requirement in the future.18

Disclosure of Officers and Directors for Section 8 of the Clayton Act Assessment (Interlocking Directorates)

- If there is an overlap between the filing parties, the New HSR Rules will require the acquiring person to list officers and directors, serving within the three months prior to the HSR Filing, that have responsibility for the development, marketing, or sale of the overlapping products or services, and who also serve as officers or directors at the time of the HSR Filing (or will serve as officers or directors as a result of the transaction) in entities that directly or indirectly control or are controlled by the acquiring entity.19 Filing parties must also identify whether those individuals also serve as an officer or director of another entity within the acquiring party that derives revenue in the same NAICS20 codes as the acquired entity.21 The FTC believes this requirement will allow the antitrust agencies to more effectively investigate Section 8 interlocking directorate issues22 as well as improper information sharing.23

Disclosure of Ownership Structure

- The New HSR Rules will require a description of the ownership structure of the acquiring entity. Where private equity sponsors are involved, the acquiring person must provide an organizational chart, if it exists, that shows the relationships between a sponsor's affiliates and associates.

What's Changed?

The New HSR Rules also expand existing requirements, notably to the scope of Item 4(c)/(d) documents24 that must be included with the HSR Filing. Importantly, Item 4(c)/(d) documents will now be called "Business Documents" that are comprised of "transaction-related documents" and certain "plans and reports."

More Documents

- Supervisory Deal Team Lead Documents: Filing parties must submit transaction-related documents related to certain competitive topics from the "supervisory deal team lead." The "supervisory deal team lead" is defined as the individual with primary responsibility for supervising the strategic assessment of the deal, and who would not otherwise qualify as a director or officer.25

- Regularly Prepared Plans and Reports For CEO: The New HSR Rules require filing parties to submit all regularly-prepared plans and reports (i) that are dated within one year of the HSR Filing; (ii) that were provided to the CEO; AND (iii) analyze certain competitive topics related to any overlapping products or services.26 The competitive topics include market shares, competition, competitors, and markets relating to products or services for which the filing parties have current or potential future competitive overlap.27 The New HSR Rules clarify that regularly-prepared plans and reports are those prepared at regular intervals, meaning annual, semi-annual, or quarterly, but not weekly or monthly. Finally, this requirement applies to the CEOs of the target or the acquiring entity and all entities they control or are controlled by.28

- All Plans and Reports for Board of Directors: Similarly to the above, the New HSR Rules require filing parties to submit plans and reports dated within one year of the HSR Filing that were provided to the Board of Directors if the document analyzes certain competitive topics related to any overlapping products or services.29 This rule requires the production of all responsive documents provided to the Board of Directors, not only those prepared at regular intervals.30 As for CEOs, this rule applies to the Board of Directors of the target or the acquiring entity and all entities they control or are controlled by.31

- Drafts of Transaction-Related Documents Shared with Any Board Member: Any responsive transaction-related document that is shared with any member of the Board of Directors (or a similar body) should not be considered a draft and must be submitted with the HSR Filing.32 Notably, this requirement does not apply to ordinary course plans and reports.33 Under the currently HSR Rules, only a draft that is shared with the entire Board of Directors (or similar body) or an entire sub-committee of the Board of Directors is considered final and must be submitted.

Mandatory English Translations of Foreign Language Documents

- The New HSR Rules require that the filing parties translate verbatim all foreign language documents into English. While the New HSR Rules do not require any particular method of translation, they provide that "verbatim translations must be readily understood, materially accurate, and complete."34

More Information on Minority Shareholders and Other Corporate Relationships

- One of the key changes in the New HSR Rules is the expanded requirement for disclosing minority shareholders, investment funds, and entities that hold indirect stakes in either the acquiring or acquired parties. This reflects the FTC's increased focus on private equity transactions.

- The New HSR Rules require the disclosure of minority shareholders of the acquiring entity, all entities positioned between the ultimate parent entity (UPE) and the acquiring entity, any entities that the acquiring entity controls, and any entities created for purposes of the transaction.35 The acquired person must also provide minority shareholder information of the acquired entity, as well as entities controlled by the acquired entity only if those entities will continue to hold minority interests post-transaction.36

- The current HSR Form allows limited partnerships to disclose only the general partner, without requiring the disclosure of any limited partners. The New HSR Rules require parties to disclose the limited partner minority holders of limited partnerships if those limited partners have the rights to serve as, nominate, appoint, veto, or approve board members, or individuals with similar responsibilities, of entities related to the acquiring entity.37

Additional Information on Geographic Overlaps

- The current HSR Form requires certain geographic information related to overlapping products and services. Under the New HSR Rules, filing parties must identify the entity or entities that have US operations in the overlapping NAICS codes.38 Filing parties must also provide the "doing business as" names that entities with US operations in overlapping NAICS codes have used within the last three years.39

Requirement to Provide Information on Acquisitions from Past 5 Years for Both Parties

- The New HSR Rules require reporting by both parties of certain relevant prior acquisitions from within 5 years of the filing. Previously, this requirement only applied to the acquiring party. This is limited to transactions where a filing party derived revenue in an identified 6-digit NAICS industry code overlap or produced a competitive overlap product or service.40

Other Notable Updates

Changes to "Pulling and Refiling" an HSR

- The FTC has amended the requirements for "pulling and refiling" an HSR.41 The New HSR Rules no longer require the filing parties to provide updated financials, but the parties must submit updated transaction-related documents, updated transaction agreements, and updated information about subsidies from foreign entities or governments of concern.42

Return of Early Termination

- Early terminations of the HSR waiting period will resume as soon as the final rules go into effect, according to the accompanying statements issued by the FTC Commissioners.43

Tender Offers

- The New HSR Rules lessen the burden for tender-offer transactions.44 For example, parties in tender offers do not need to provide competitive overlap descriptions or an overview of supply relationships. They also do not need to provide regularly prepared reports, among other requirements that will not apply to them.

What Does This Mean for My Next Deal?

- Filing Under the Current Rules and Filing on Letters of Intent: The New HSR Rules are currently scheduled to go into effect on February 10, 2025 (i.e., 90 days after their publication on the Federal Register on November 12, 2024), though implementation is likely to be delayed until March 2025 if President-Elect Donald Trump issues a "regulatory freeze" memorandum as expected once he takes office. If you are planning to sign your transaction in the short term, consider whether you can accelerate your HSR Filing to file under the current rules, including whether it may be appropriate to file an HSR with a letter of intent or term sheet.

- Analyze Antitrust Risks Early: Consider analyzing the antitrust risks and competitive overlaps early in transaction planning. This will allow parties to draft the newly required competition analysis and enable the parties to consider any additional timing implications. Depending on the level of antitrust risk and transaction certainty, parties should consider preparing the HSR Filing earlier in the process to allow sufficient time.

- Regulatory Clauses: In negotiating deal documents, parties should consider adding flexibility for timing around HSR Filings. It is now typical to include 5 or 10 business days as the period for completion of an HSR Filing after executing a transaction agreement. Going forward, as is common for transactions reportable in other jurisdictions, consider using "as promptly as practicable" or a longer time limitation to allow more time to complete a more detailed filing.

- Exercise Awareness in Document Creation: Parties should be mindful that they may have to submit an expanded set of documents with the HSR filing. Parties should always accurately describe competitors, competition, market shares, and markets and avoid bombastic language that does not reflect competitive dynamics and market realities. HSR filings will now include certain ordinary course documents regarding competition that were shared with a party's CEO.

- Identify a Supervisory Deal Team Lead: Parties should consider identifying the relevant supervisory deal team lead for each transaction early in the process since filing parties will need to also submit certain document about competitive topics from that individual, in addition to officers and directors.

- Consider Implications of Submitting an HSR Filing on a Letter of Intent: Parties considering filing an HSR with an executed letter of intent will need to provide more details about their transaction than are required under the current rules. If parties file on an executed letter of intent, but that document does not provide the key terms of the agreement, the parties must submit a dated document that contains additional detail on the transaction's scope. Examples of such a document would be a term sheet or the most recent draft agreement as long as the document provides information about the structure of the transaction, the scope of what is being acquired, a calculation of the purchase price, an estimated closing timeline, employee retention policies, post-closing governance, and transaction expenses or other material terms.45

- Spotlight on Private Equity: Private equity sponsors should work with counsel early to collect additional structure information with the added information requirements in the HSR Form. Private equity buyers will have expanded disclosure obligations, including disclosing the structure of entities involved in private equity investments.

- Labor: Although the New HSR Rules do not require filing parties to provide detailed employee and other labor-related information (as described here) in the FTC's proposed changes to the rules, the FTC emphasized that it may still require such information during in-depth investigations. Parties should continue to consider the implications of their transactions on employees, even those employees who are not part of the initial HSR Filing.46

- FTC to Provide Additional Guidance: The FTC's January 2025 Filing Guide left many questions unanswered. However, the FTC's Premerger Notification Office stated that its Filing Guide was intended to start a dialogue around the HSR Form changes. We will continue to monitor any additional guidance from the FTC. White & Case will provide further updates at that time.

1 Fed. Trade Comm'n, Final Rule on Premerger Notification; Reporting and Waiting Period Requirements (Oct. 10, 2024) [hereinafter New HSR Rules], https://www.ftc.gov/system/files/ftc_gov/pdf/p110014hsrfinalrule.pdf.

2 Fed. Trade Comm'n, As Published Final Rule on Premerger Notification; Reporting and Waiting Period Requirements (Nov. 12, 2024), https://www.federalregister.gov/documents/2024/11/12/2024-25024/premerger-notification-reporting-and-waiting-period-requirements.

3 On January 2, 2025, the FTC issued a "Filing Guide," which summarized and clarified select changes in the New HSR Rules. Fed. Trade Comm'n, 2025 HSR Form Updates: What Filers Need to Know (Jan. 2, 2025) [hereinafter January 2025 Filing Guide], https://www.ftc.gov/system/files/ftc_gov/pdf/HSR-Form-Updates-FINAL-POSTED-01-02-25.pdf.

4 New HSR Rules, pp. 379-80, pp. 437 (Appendix B – Acquiring Person, p. 12, 17), 453 (Appendix B – Acquired Person, pp. 11, 15).

5 New HSR Rules, pp. 315-20.

6 New HSR Rules, pp. 321-22.

7 New HSR Rules, pp. 322-25.

8 New HSR Rules, p. 322.

9 New HSR Rules, pp. 326, 331.

10 New HSR Rules, pp. 437 (Appendix B – Acquiring Person, p. 10), 453 (Appendix B – Acquired Person, pp. 8-9).

11 New HSR Rules, p. 320.

12 New HSR Rules, p. 321.

13 January 2025 Filing Guide, p. 9.

14 See New HSR Rules, pp. 436 (Appendix B – Acquiring Person, p. 9), 452 (Appendix B – Acquired Person, p. 8) (both stating that the "acquiring and acquired person should not exchange information for the purpose of answering this item.").

15 New HSR Rules, pp. 442 (Appendix B – Acquiring Person, p. 15), 457 (Appendix B – Acquired Person, p. 13).

16 New HSR Rules, p. 399 (defining "foreign entity or government of concern" in 16 C.F.R. § 801.1(r)(1), which cites to 42 U.S.C. § 18741(a)(5), which in turn cites several other statutes).

17 See 10 U.S.C. § 4872(d)(2).

18 New HSR Rules, pp. 355-56.

19 New HSR Rules, pp. 370-71; January 2025 Filing Guide, p. 7.

20 The North American Industry Classification System (NAICS) is the system used to classify business establishments for the purpose of collecting, analyzing, and publishing statistical data. It is currently used to report revenues in Item 5 of the HSR Form.

21 New HSR Rules, p. 371.

22 Subject to certain de minimis exceptions, Section 8 prohibits persons from being an officer or director at competing corporations due to the potential for anticompetitive effects.

23 New HSR Rules, pp. 241-54.

24 Under the current HSR Rules, Item 4(c)/(d) documents are the documents that filing parties must provide to the relevant antitrust authorities that address competition, markets, competitors, synergies, etc.

25 New HSR Rules, pp. 202-05.

26 New HSR Rules, pp. 276-77.

27 January 2025 Filing Guide, p. 9.

28 January 2025 Filing Guide, p. 9.

29 January 2025 Filing Guide, p. 9.

30 January 2025 Filing Guide, p. 9.

31 January 2025 Filing Guide, p. 9.

32 New HSR Rules, pp. 272-73.

33 January 2025 Filing Guide, p. 6.

34 New HSR Rules, p. 192.

35 New HSR Rules, pp. 28-32; 211-34.

36 January 2025 Filing Guide, p. 7.

37 January 2025 Filing Guide, p. 7.

38 New HSR Rules, p. 342-43.

39 New HSR Rules, p. 342-43.

40 New HSR Rules, pp. 347-55.

41 Pulling and refiling is voluntary and allows the acquiring person to restart the initial waiting period without paying a second filing fee, giving the Agencies an additional 15 or 30 days to review the transaction.

42 New HSR Rules, p. 193.

43 Statement of FTC Commissioner Melissa Holyoak, Oct. 10, 2024, p. 2; Concurring Statement of FTC Commissioner Andrew N. Ferguson, Oct. 10, 2024, p. 1.

44 New HSR Rules, pp. 200-02.

45 January 2025 Filing Guide, p. 5.

46 New HSR Rules, pp. 332-34.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2025 White & Case LLP