Biography

Tali Sealman is an experienced partner in our Global M&A and Corporate practice based in Silicon Valley and the Head of the firm's US Corporate Technology M&A Group. Recognized as one of the leading M&A lawyers in the United States, Tali works closely with strategic and financial buyers and funds and companies and their boards in private and public M&A and investment transactions across a full spectrum of transactions in the technology and life science sectors, including strategic acquisitions, cross-border transactions, Israeli-related transactions, option transactions, deSPAC transactions, unsolicited transactions, and reverse merger and other game-changing transactions.

Tali helps her clients achieve their most important strategic goals in an efficient manner while offering practical advice and solutions. She is also a prominent practitioner working on the forefront of Israel-related matters, with a deep understanding of Israel’s business, legal and political culture.

In addition to M&A, Tali provides general corporate representation to companies at all stages of their lifecycle and across a broad range of industries, including software, cyber, e-commerce, enterprise, security, digital health, fintech, gaming and blockchain. Tali also advises growth equity funds and strategic investors in their investments in growth equity technology and life science companies.

Regardless of the type of deal, Tali’s practice focuses on providing pragmatic approaches intended to help her clients achieve their business objectives in the most efficient and cost-effective manner.

Tali was named "M&A Legal Advisor of the Year" by The M&A Advisor in 2020 and was listed among The Deal's "Top Women in Dealmaking" for M&A in 2022. She is also listed a Euromoney's Women in Business Law Guide and Euromoney's Expert Guide for Corporate/M&A in the United States in 2021.

Experience

Recent representations include:

- Lightrock Climate Impact Fund SCSp ("Lightrock") as lead investor in the US$50 million Series C funding round in AiDash, a SaaS company making critical infrastructure industries climate-resilient and more sustainable through satellites and AI.

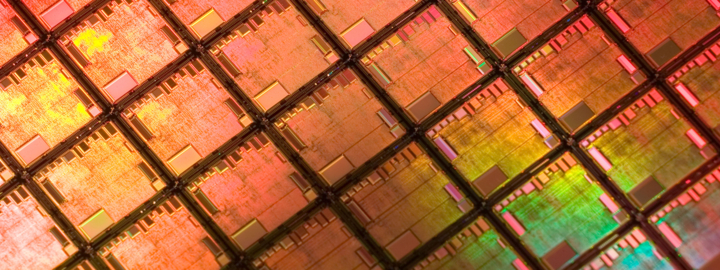

- Autotalks Ltd., an Israeli company that makes chips in technology aimed at preventing vehicle crashes, in its acquisition agreement by Qualcomm Inc.

- REE Automotive Ltd., an electric-vehicle technology startup based in Israel, in its US$3.6 billion go-public acquisition by 10X Capital Venture Acquisition Corp. (NASDAQ: VCVCU), a SPAC.

- Cellebrite DI Ltd., the global leader in Digital Intelligence (DI) solutions for the public and private sectors, in its US$2.4 billion business combination with TWC Tech Holdings II Corp (NASDAQ: TWCT), a SPAC.

- dMY Technology Group, Inc. II (NYSE: DMYD), a SPAC, in its US$1.68 billion business combination with UK-based Genius Sports Group.

- Graf Industrial Corp. (NYSE: GRAF), a SPAC, in its US$1.8 billion business combination with Velodyne Lidar, Inc.

- Siemplify, an Israeli cybersecurity and security orchestration, automation and response (SOAR) provider, in its sale to Google LLC.

- Biosight Ltd., a privately held pharmaceutical development company developing innovative therapeutics for hematological malignancies and disorders, in its reverse merger transaction with Advaxis, Inc. (NASDAQ: ADXS).

- Picus Security, the pioneer of Breach and Attack Simulation (BAS) technology, in its US$24 million Series B funding round.

- Softbank Vision Fund II and Eldridge in their up to US$235 million co-investment in Anyvision, an Israeli artificial intelligence-based facial recognition startup.

- NICE Ltd. (NASDAQ: NICE), the world's leading provider of both cloud and on-premises enterprise software solutions, in its acquisition of Guardian Analytics, a leading AI cloud-based financial crime risk management solution provider.

- OpenText Corp. (NASDAQ: OTEX, TSE: OTEX), a Canadian seller and developer of enterprise information management software and one of Canada's largest software companies, in its US$75 million acquisition of XMedius, a provider of secure information exchange and unified communication solutions with locations in the United States, Canada and Europe.

- Abu Dhabi Catalyst Partners on its US$50 million Series F investment into Lookout Inc., a fast-growing Silicon Valley-based cyber security company with a pre-money valuation of approximately US$1.5 billion.

Representative matters prior to joining White & Case include:

- Zeltiq's US$2.4 billion sale to Allergan.

- Sale of publicly traded SteadyMed Ltd. to United Therapeutics for up to US$216 million.

- BioTime's acquisition of publicly traded Asterias.

- Multiple acquisitions by OpenText (NASDAQ:OTEX), including:

- US$163 million acquisition of Recommind; and

- acquisition of Hightail.

- Venus MedTech's acquisition of Keystone Heart Ltd.

- Clearlake Capital in Calero Software's sale to Riverside Partners.

- VM Pharma's sale of VM-902A to Purdue Pharma for a consideration of up to US$213 million.

- Misfit Wearable's US$260 million sale to Fossil.

- Marlin Equity Partners' acquisition of BlueHornet Networks.

- MindMeld's US$125 million sale to Cisco.

- Satmetrix's sale to Nice Systems.

- Coherex Medical's sale to Biosense Webster (J&J).

- EigerBio's merger with Celladon Corporation.

- Multiple acquisitions by Nemetschek, including:

-

acquisition of Bluebeam for over US$100 million; and

-

acquisition of RISA Technologies.

-

- Multiple acquisitions by Stratasys, including US$295million acquisition of Solid Concepts and the acquisition of GrabCAD.

- Coverity's US$375 million sale to Synopsys.

- The sale of Epocrates to athenahealth Inc. for US$293 million.

- The sale of Volterra Semiconductor to Maxim Integrated Products Inc. for US$605 million.

- Become's sale to Connexity, Inc.

- Battery Venture's acquisition of a physical security business from Nice Systems for up to US$100 million.

- Revionics' acquisition of Marketyze Ltd.

- Multiple acquisitions by Yelp, including:

- acquisition of Qype in a stock and cash transaction valued at approximately US$50 million; and

- acquisition of SeatMe in a stock and cash transaction.

- The sale of the women's health business of Jazz Pharmaceuticals to Meda for US$95 million.

- The sale of Surpass Medical to Stryker Corp. for US$135 million.

- Alvine Pharmaceuticals' option sale arrangement by AbbVie, Inc. for an option price of US$70 million.

- Multiple acquisitions by Benu, including:

- acquisition of SynchHR; and

- acquisition of ClearBenefits.

- The sale of a business unit of Inflection to Ancestry.com.

- Multiple acquisitions by Power Integrations (NASDAQ: POWI), including:

- US$115 million acquisition of CT-Concept Technologie AG;

- acquisition of CamSemi, a fabless company that designs and manufactures energy-efficient power conversion products;

- acquisition of Qspeed Semiconductor, a supplier of high-performance high-voltage diodes; and

- acquisition of Velox Semiconductor, a developer of gallium nitride transistors and diodes.

- Silicon Graphics, Inc.'s acquisition of Silicon Graphics Ltd.

- PGP Corporation's acquisition of Chosen Security.

- PGP Corporation's US$330 million sale to Symantec.

- Open Feint's US$104 million sale to Gree, Inc.

- Symyx Technologies' US$485 million merger of equals with Accelrys.

- Leo Pharma's US$287 million acquisition of Peplin, Inc.

- Merger of equals between publicly traded Oclaro, Inc. and publicly traded Avanex.

- Cardio Mems' US$375 million option sale arrangement and US$60 million investment by St. Jude Medical, Inc.

- eBay's acquisition of Fraud Sciences for US$169 million.

- Jazz Pharmaceutical's acquisition of Azur Pharma and reorganization on a combined value of US$2.1 billion.

Harlan Fiske Stone Scholar

Listed among The Deal's "Top Women in Dealmaking", 2022, 2023

Leading Individual for M&A in the United States, Euromoney, 2022

Listed in Euromoney's Women in Business Law Guide for Corporate/M&A, 2022

Listed among IFLR1000's Women Leaders Guide for M&A in the United States, 2022

Named "M&A Legal Advisor of the Year", The M&A Advisor, 2020