The green edge of steel: Cutting through carbon

Steel is essential to every aspect of modern life, yet its future finds itself centre stage in the climate change debate. Can advances in green steel technologies, fuelled by innovative investments from miners and steel producers, become an age-defining development in the energy transition?

15 min read

Subscribe

Stay current on your favorite topics

The authors would like to thank Tadeu Carneiro, Chairman & CEO of Boston Metal for his contribution to this article.

Steel is essential to every aspect of modern life; it is also a crucial component for technologies of the future that will help tackle climate change

Steel production is among the world's most polluting industries, accounting for as much as 9 per cent of direct emissions from fossil fuels, more than all the world's cars and planes combined. The traditional method of making steel, where coking coal is combined with iron ore, is in direct tension with the Paris Accord and global efforts to curb temperature rises. Yet steel is also essential to every aspect of modern life. It's a crucial component for technologies of the future that will help tackle climate change, from electric vehicles to wind turbines, as well as being the bedrock of all existing infrastructure and manufacturing processes.

The future of steel therefore finds itself centre stage in the climate change debate, and this has also had implications for other substantial industries. The world's largest cement makers have taken up the challenge of cutting emissions from cement production, such as burning tires instead of coal to generate the energy needed to fuel factories. Given that cement is a partially substitutable material for steel, there is effectively a race emerging between these two industries to establish who can initiate more effective decarbonisation efforts faster—something that should ultimately benefit the planet. But unlike cement, steel is 100 per cent reusable.

Another heavily impacted industry is iron ore, one of the main profit drivers for the world's biggest miners. However, the majors are coming under increasing pressure from investors to both account for and tackle the emissions created when their customers make steel, so-called Scope 3 emissions.

While coal was a relatively small part of Rio Tinto's overall portfolio, the world's second-biggest miner made the first move in 2018 when it sold its last coal operations. BHP Group, the biggest miner, has unveiled plans to sell off its thermal coal mines by the end of 2022. Anglo American and Vale are seeking to withdraw from the coal industry and are taking steps to divest their remaining coal assets. Even Glencore, one of the biggest producers and champions of coal, has implemented a cap on its coal production. These moves by the majors have essentially resulted in the alignment of their interests towards low or zero-carbon steel production.

7%

Steel production accounts for about 7% of energy sector CO2 emissions (including process emissions)

Source: IEA

What's the problem with traditional steel?

The majority of steel is currently manufactured in blast furnaces. Iron ore and coke, made from coking coal, sinter and limestone, is fed into the top of the furnace. Hot air—approximately 1,000°C—is injected at the bottom of the furnace. As the coke burns, temperatures higher than 2,000°C are reached and this heat creates molten iron. This process, and the burning of coal, makes it one of the leading producers of CO2 on the planet.

According to the World Steel Association, in the last three decades the steel industry has reduced its energy consumption per ton of steel by about 50 per cent. Yet, many in the industry now agree that most of the easy gains have already been achieved and that there is only marginal room to achieve further progress with existing technologies. This means that for the industry to fall into line with a low-carbon economy, new technologies are required to shift current production methods towards new ways of making steel.

The industry's response to the challenges posed by traditional methods is green steel—metal produced without releasing carbon into the environment. There are various technologies being rolled out in pilots around the world, but the focus is on replacing coking coal in the process. So far, efforts are centred around either using hydrogen or electricity in its place. Other lower- carbon initiatives include using `blue' hydrogen, which relates to hydrogen production that involves carbon capture and usage or the storage of emitted carbon dioxide, and recycling more scrap. Major players in the industry have formalised their commitment to decarbonisation in the form of the Net-Zero Steel Initiative, which is finalising an industry-backed roadmap to net-zero emissions by 2050, set for release this summer.

2050

Net-Zero Steel Initiative, is an industry-backed roadmap to net-zero emissions by 2050.

Current initiatives across major nations

The scale of the challenge and the importance of solving it means that the governments and regulation ought to play a crucial role in finding a solution.

COP26—the UN Climate Change Conference—takes place in Glasgow this November, bringing together heads of state, climate experts and campaigners to agree upon coordinated action to tackle climate change. Emissions from steel manufacturing will be on the agenda, and it will be an opportunity to achieve international agreement on coping with the emissions from the continuing use of metallurgical coal, and showcasing the need for significant state support to successfully roll out the development of green steel.

Major nations have not been idle on this topic, with a range of approaches taken.

In the UK, for example, a £250 million Clean Steel Fund was set up in 2019—a long-term signal of support to the steel sector and its decarbonisation efforts. In December 2020, the UK government published the responses it received from a range of stakeholders in response to the plan, including UK Steel, Greensteel Council, Liberty Steel and Tata Steel, as well as several academics. The main issues raised fell into three categories: energy prices and other barriers, timing of the Fund, and decarbonisation technology options. The government is currently developing the detailed design of the Fund, incorporating this feedback and assessing the opportunities to be gained in overcoming these.

Majors are now making venture capital-type investments into a portfolio of projects that will ultimately fuel the energy transition in the steel sector

On the continent, launched in December 2019, the European Union's Green Deal has set a goal of becoming climate neutral by 2050. A May 2021 report from the Energy and Climate Intelligence unit said 23 hydrogen steel projects are either planned or under way across Europe, including plans to produce hundreds of thousands of tonnes of green steel by as early as next year. The region's steel industry has said it aims to reduce its emissions by 30 per cent by 2030 and by as much as 95 per cent by 2050. Industry lobby groups argue that while this is possible on a technical level, significant support will be required. Central to this would be safeguarding the industry from imports that aren't held to the same requirements and the provision of affordable power. The ‘carbon border adjustment mechanism' would impose a CO2 charge on certain goods entering the bloc in order to prevent cheap foreign products, including steel, that have a negative carbon impact and which in turn stymie investment in green tech.

China is the world's biggest steelmaker, producing about 50 per cent of global supply, and the industry accounts for about 15 per cent of its carbon emissions. The country has committed to becoming carbon neutral by 2060, but has yet to provide a clear roadmap on how it will achieve this, including with steel. China's Ministry of Information and Technology is readying a five-year plan for all domestic steel makers to lower emissions by switching to electric arc furnaces and recycling more scrap. China's largest steel producer, state-owned Baowu, has committed to achieving carbon neutrality by 2050, and peak emissions in 2023.

Russian steelmakers have also embarked on their green journey, with major companies Evraz and Severstal among those to have signed several agreements to implement green steelmaking at the 24th St Petersburg International Economic Forum earlier in June 2021. In Australia, Fortescue Metals Group chairman, Andrew Forrest, has revealed his ambitions to build Australia's first green steel pilot plant this year. Given its abundance of wind and solar, the country is well placed to produce the hydrogen a green steel industry needs, a point emphasised in last year's Grattan Institute report, which argued that a renewables-based steel industry could deliver strong action on global warming while also generating significant employment opportunities. Progress in South America is slower—perhaps due to the political incumbents in key nations, but the opportunity has been noted. Research from the World Resources Institute suggests that shifting to a low-carbon economy could boost Brazil's economic growth substantially while reducing carbon emissions by up to 33 per cent, helping reverse damage to Brazil's environmental reputation, and improving access to international capital markets.

In the US, the Biden administration's climate plan has put infrastructure at its heart, which ultimately puts steel centre stage. So far there has been limited detail on the country's plans for steel, but the White House has said implementing green hydrogen to forge the metal is key to meeting its 2030 targets. One significant advantage the US has is its existing dependence on recycled steel. Scrap accounts for about 70 per cent of the raw metal input into American steel production today, a far higher ratio than most major producers. Recycling is significantly less carbon-intensive than making primary steel.

50%

The steel industry has reduced its energy consumption per ton of steel by about 50 per cent in the last three decades.

Source: World Steel Association

Two leading green steel technologies

One of the current leading technologies being developed is replacing coking coal with hydrogen. When hydrogen is used instead of coke to remove the oxygen from iron ore, the by-product is water rather than carbon dioxide. And when hydrogen is produced using renewable sources, it can be a steady source of green energy.

There are multiple companies working on a hydrogen solution. Hybrit, a venture run by steelmaker SSAB, iron ore producer LKAB and energy supplier Vattenfall, is replacing coking coal with fossil-free electricity and hydrogen, and plans to deliver its first fossil-free steel to the market by 2026. Another Swedish venture, backed by the Agnelli and Maersk families, is H2 Green Steel. Using similar technology, the group is aiming to produce five million tonnes of emissions-free steel by the end of the decade. Sweden has found itself in pole position because of its ample supply of green power thanks to its wind turbines; while helpful for the nation, this does pose potential challenges for wider adoption.

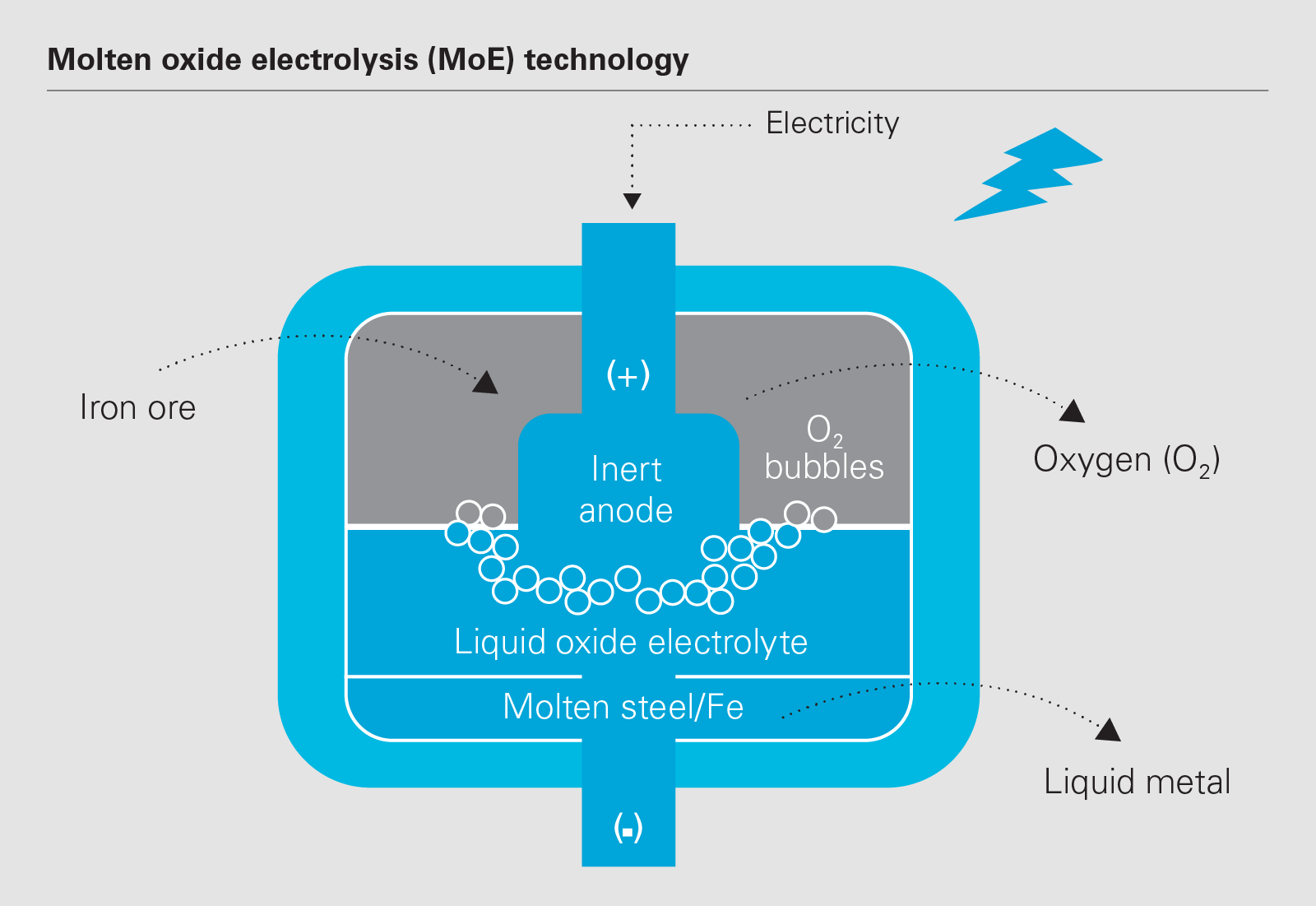

Molten oxide electrolysis can be deployed at iron ore mine or installed at steelmaking facilities, where it eliminates carbon intensive steps and produces liquid steel ready for ladle metallurgy. MOE technology will enable the production of high quality, green steel at a competitive cost with oxygen as a by-product.

Tadeu Carneiro,

Chairman & CEO of Boston Metal

European steelmaking rivals, such as Germany's Thyssenkrupp and ArcelorMittal, are also looking at using hydrogen to replace coking coal. But unlike some of their Nordic peers, they have less access to green power, with Germany especially dependent on coal.

The second approach is known as molten oxide electrolysis (MOE). This removes the need for coking ovens and blast furnaces. Instead, iron ore is dissolved in a liquid electrolyte solution at a temperature of about 1,600ºC before an electrical current is passed through the solution, reducing the iron ore into a liquid in an endothermic reaction. Boston Metal is one of the leading proponents of this technology, and its list of backers clearly shows the level of enthusiasm. Both BHP Group and Vale, two of the three biggest iron ore miners, have invested in the company, showing how seriously the biggest miners see the risk of not making green steel.

Tadeu Carneiro, the Chairman and CEO of Boston Metal, believes Boston Metal's technology will reshape the steel industry. ‘Because of its intrinsic value and flexibility, MOE can be deployed at iron ore mines, allowing the shipment of a value-added metallic product. It can also be installed at steelmaking facilities where it eliminates carbon-intensive steps and produces liquid steel ready for ladle metallurgy. Another advantage for steelmakers is that the entire range of iron ores can be used successfully with MOE, not just premium grades. MOE technology will enable the production of high- quality green steel at a competitive cost with oxygen as a by-product,‘ says Carneiro.

70%

Scrap accounts for about 70 per cent of the raw metal input to American steel production today, far higher than most major producers

An age-defining development

If the world wants to meet its commitments to decarbonise, a solution for steel must be found. The technologies required are in the process of being proven, but there is still a large leap required to make them commercially viable, especially in the absence of cheap, fossil‑free power.

A further headwind comes in the form of cost. Even the developers of the new technologies accept that higher prices for carbon emissions and coking coal will be needed to make hydrogen steel commercially viable. The market for green steel does not yet command a premium, mirroring the experience to date in other metals such as aluminium, where a green product does not command significant premium pricing.

The issue of cost must be addressed; one clear example of this is Germany, one of Europe's biggest makers of steel and its most important manufacturing economy. The government has pledged €5 billion to help decarbonise the industry, yet the total cost of achieving this is forecast at €35 billion. The steel industry has struggled to be consistently profitable in the last decade, meaning it's unlikely that existing producers alone will be able to foot the costs associated with the transition.

Against this backdrop, a debate is emerging as to whether the carbon-intensity of steel will be the next regulatory battleground in the trade, tariff and anti-trust arenas.

One sector that does have the financial firepower is the iron ore industry. The world's biggest iron ore miners have a direct stake in solving the problem of steel emissions. Already there is evidence of this, with BHP committing US$400 million to help fund new technologies and Rio Tinto forming partnerships with some of China's biggest steelmakers. Vale has agreed with Kobe Steel and Mitsui & Co to establish a new venture to supply low-CO2 iron metallics and iron-making solutions to the steel industry, while it has also provided investment to Boston Metal, along with BHP. This marks a tangible shift from the paradigm of the last 20 years, which had seen major miners shy away from investment in downstream industries.

In essence, major miners are now making venture capital-type investments into a portfolio of projects that will ultimately fuel the energy transition in the steel sector. ArcelorMittal has launched its XCarb innovation fund, which will invest in companies developing breakthrough technologies that will accelerate the steel industry's transition to carbon-neutral steelmaking, while another BHP venture is its US$15 million, five-year partnership with Japan's JFE Steel to jointly study technologies and pathways capable of making material reductions to emissions from steel-making. Companies conscious of where the regulatory environment is moving will be better placed in the next decade compared to those that are more tentative. If green steel becomes a proven resource and used widely, it could represent an age-defining development in the energy transition.

Recent private investments into green steel

|

Vale |

Vale has invested US$6 million in Boston Metal, a US-based startup developing steel decarbonisation technologies. They are developing a Molten Oxide Electrolysis (MOE) technology, which reduces metal oxides such as iron ore with the use of electricity. Vale, Kobe Steel and Mitsui & Co agree to combine green ironmaking solutions. The new venture will use existing and new low-CO2 iron-making technology such as Tecnored® technology and the MIDREX® Process. |

|

BHP |

BHP partners with JFE to address decarbonisation in the steel industry. BHP is prepared to invest up to US$15 million over the five-year partnership. BHP backs Boston Metal in a Series B funding round. BHP Ventures is the internal venture capital unit within BHP, which is seeking to solve critical global challenges through its investments. |

|

ArcelorMittal |

ArcelorMittal launched XCarb™, designed to bring together all of their reduced, low and zero-carbon products and steelmaking activities, as well as wider initiatives and green innovation projects, into a single effort focused on achieving demonstrable progress towards carbon-neutral steel. |

|

Rio Tinto |

Rio Tinto teams up with Paul Wurth and SHS-Stahl-Holding-Saar on low-carbon iron in Canada. The partnership will explore the viability of transforming iron ore pellets into low-carbon hot briquetted iron (HBI), a low-carbon steel feedstock, using green hydrogen generated from hydro-electricity in Canada. |

|

EIT InnoEnergy and other strategic investors |

These companies have helped H2 Green Steel raise US$105 million in its first round of venture capital financing. The Swedish group aims to start production just below the Arctic Circle in 2024 and plans to produce five million tonnes of emission-free steel by the end of the decade by using hydrogen produced with renewable energy to make the alloy rather than the traditional way of burning coke. |

|

SSAB, LKAB and Vattenfall |

The joint initiative has commenced building a rock cavern storage facility for fossil-free hydrogen gas on a pilot scale next to HYBRIT's pilot facility for direct reduction in Luleå, North of Sweden. This is an important step in the development of a fossil-free value chain for fossil-free steel. The investment cost of just over SEK 250 million is divided equally across the holding companies and the Swedish Energy Agency, which provides support via Industriklivet. |

Green steel: An age-defining development in the energy transition

|

|

Click here to download the full report: The green edge of steel: Cutting through carbon (PDF)

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2021 White & Case LLP

View the full PDF: Evolution of steelmaking: Scrap steel is a stepping stone towards carbon neutrality

View the full PDF: Evolution of steelmaking: Scrap steel is a stepping stone towards carbon neutrality

View the full PDF:Green steel initiatives around the world: A snapshot

View the full PDF:Green steel initiatives around the world: A snapshot

View the full PDF: Traditional steelmaking vs hydrogen/HYBRIT manufacturing process

View the full PDF: Traditional steelmaking vs hydrogen/HYBRIT manufacturing process

View the full PDF: Molten oxide electrolysis (MoE) technology

View the full PDF: Molten oxide electrolysis (MoE) technology