“Under Pressure”: Walking the Fine Line of Section 13(d) Passive Investor Status

11 min read

On February 11, 2025, the staff of the Division of Corporation Finance ("Staff") of the U.S. Securities and Exchange Commission ("SEC" or the "Commission") issued new and updated Compliance and Disclosure Interpretations on Regulation 13D-G ("C&DIs") that address the circumstances under which a shareholder's engagement with an issuer's management would cause the shareholder to hold securities with the "purpose or effect of changing or influencing control of the issuer," and therefore lose eligibility to report on Schedule 13G.1

Prior to this latest guidance, investors relied on the previous C&DI Question 103.11, which stated that engagement on particular topics (executive compensation, environmental issues and, in certain circumstances, corporate governance topics2) "without more" and without the "purpose or effect of changing or influencing control," would not result in the loss of Schedule 13G status. This rather general standard, which emphasized the subject matter of the discussions, gave comfort to investors that rigorous discussion with management on these topics would not endanger 13G status, as long as there was no overt effort to influence or change control of the issuer. However, this prior C&DI did not provide guidance on specific actions that would constitute "changing or influencing control of an issuer," and thereby put 13G status at risk. The new C&DI is aimed at providing such guidance.

The guidance in new Question 103.12 highlights the context in which an engagement occurs, in addition to the subject matter, as an important factor in this determination, and is primarily meant to address scenarios where a shareholder "exerts pressure on management to implement specific measures or changes to a policy," by stating (or otherwise implying) to the issuer that if it does not implement the shareholder's desired changes on a particular topic, then the shareholder will take specific action against the issuer, such as voting "against" the issuer's directors. In such situations, the shareholder would lose eligibility to report on Schedule 13G and would instead be required to report on Schedule 13D.

Recent Impact of New Guidance

The new guidance has become the subject of intense scrutiny in recent weeks, after institutional investors initially canceled engagement meetings with US public companies due to concerns that such meetings could cause them to lose Schedule 13G eligibility. Investors have since restarted their meetings, and one institutional investor issued its 2025 voting policy with a statement that: "When engaging with and voting proxies with respect to the portfolio companies in which we invest our clients' assets, we do so on behalf of and in the best interests of the client accounts we manage and do not seek to change or influence control of any such portfolio companies."3

For issuers, cancellations of engagement meetings with large institutional investors initially can negatively impact their shareholder engagement strategy during proxy season, and for many issuers, the unintended implication of such cancellations may be to increase the influence of proxy advisory firms' recommendations or to require companies to spend more company resources to engage in solicitation efforts with their retail investors or smaller institutional investors. Additionally, companies with an activist investor in their stock may also find it more difficult to obtain meetings with passive or institutional holders who may want to protect their 13G eligibility and not engage on issues that are central to a proxy contest. As further clarification develops on the new Staff guidance, it is expected that institutional investors will continue to develop appropriate processes to protect their Schedule 13G filing status. Although the purpose of the C&DI was not to chill routine engagement meetings, it may take time for these processes to develop and for market participants to work out their approach to engagements going forward.

New Guidance on the Meaning of "Passive Investor"

New Question 103.12 ("Q 103.12")4 provides the Staff's guidance on the meaning of a "passive investor" and the circumstances under which investors engaging with issuers may lose eligibility to report beneficial ownership on Schedule 13G and be required to use Schedule 13D. Additionally, revised Question 103.11 ("Q 103.11") reaffirms the Staff's view that an investor's inability to rely on the Hart-Scott-Rodino Act's exemption from notification and waiting period requirements for an acquisition made "solely for the purpose of investment" does not preclude its ability to use Schedule 13G. Both questions also explicitly remind investors that whether they can report on Schedule 13G turns on a fact-specific analysis of whether they are acting with intent to change or influence "control" of the issuer, and that "control" means "the power to direct or cause the direction of the [issuer's] management and policies…whether through the ownership of voting securities, by contract, or otherwise" (as defined under Exchange Act Rule 12b-2).

Q 103.12 draws certain clear lines on "passive investor" status. It makes clear that Schedule 13G will be unavailable if a shareholder engages with the issuer's management to specifically call for the sale of the issuer or a significant amount of the issuer's assets, the restructuring of the issuer, or the election of director nominees other than the issuer's nominees. It also states that Schedule 13G will generally remain available where a shareholder simply discusses with management its views on a particular topic and how its views may inform its voting decisions.

However, if a shareholder goes beyond simply discussing with management its views on a topic and "exerts pressure on management to implement specific measures or changes to a policy," by explicitly or implicitly conditioning its support for director nominees on compliance with its recommendations, Schedule 13G becomes unavailable. This analysis looks at both the "subject matter of the…engagement" and "the context in which the engagement occurs" in order to determine whether the investor is exerting pressure on the issuer, as further discussed below.

Q 103.12 provides examples of investor behavior that results in Schedule 13G not being available, including:

- making a recommendation to the issuer on one of the following topics and, as a means of pressuring the issuer, explicitly or implicitly conditioning the investor's support of the issuer's director nominee(s) at the next director election on the issuer's adoption of the recommendation:

- removal of staggered board;

- switching to a majority voting standard in uncontested director elections;

- eliminating its poison pill plan;

- changing its executive compensation practices; or

- undertaking specific actions on a social, environmental, or political policy.

- discussing with the issuer the investor's voting policy on a particular topic and how the issuer fails to meet the investor's expectations on such topic, and, as a means of pressuring the issuer, explicitly or implicitly conditioning the investor's support of one or more of the issuer's nominees at the next director election on the issuer's meeting the shareholder's expectations.

Risk of Losing Passive Investor Status: High-Level Considerations

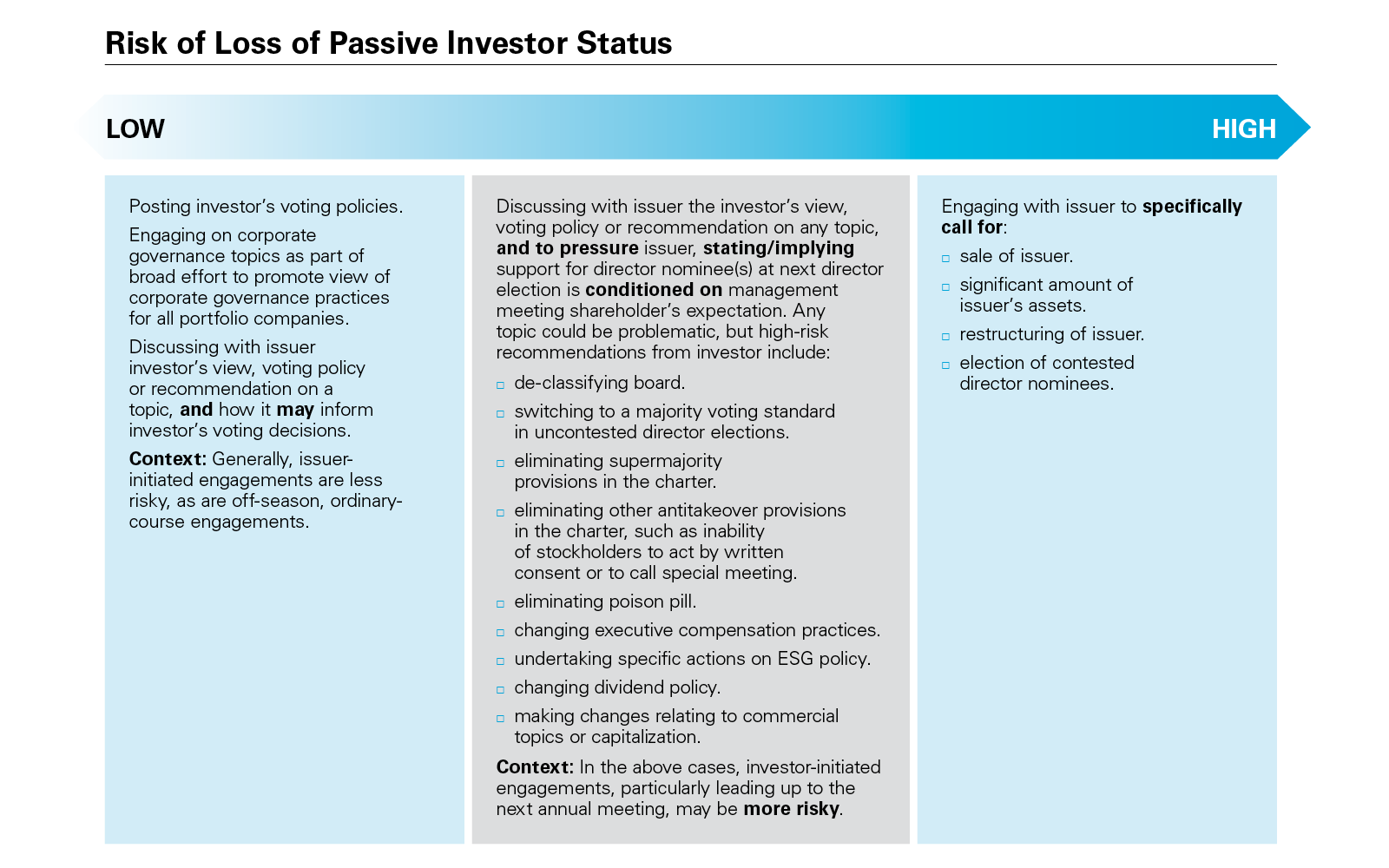

Based on the principles stated in Q 103.12, the following chart may help to capture at a high level the SEC's vision of the sliding scale of risk of loss of passive investor status. This chart is illustrative only, does not address all situations, and is intended as a convenient guide for mapping different common situations against each other. The determination on 13D and 13G filing status will ultimately be a facts and circumstances determination. For more information, see the discussion of considerations following the chart.

The level of risk involved in engagement with management is based in part on the following considerations stated in the relevant guidance:

"Subject matter of the engagement"

Q 103.12 makes clear that more obvious attempts to exercise control (e.g. a shareholder engaging with management to specifically call for the sale of the issuer or a significant amount of the issuer's assets, the restructuring of the issuer, or the election of director nominees other than the issuer's nominees) would be problematic. However, the other examples of potentially "non-passive" engagements provided in the guidance, such as executive compensation and ESG, reflect very common engagement practices and topics, and investors will presumably want to exercise caution when discussing such topics.

Certain engagement topics seem more likely than others to raise potential concerns under the new guidance. For example, talking about general governance issues, executive compensation or ESG considerations may be "less risky" (i.e. less likely to be considered an attempt to change or influence control of the issuer), while pushing for specific actions on ESG policies (and conditioning director support on such actions) would be more problematic. Similarly, engagement regarding general board composition, skills or refreshment considerations would likely be less problematic than targeted discussions regarding specific current directors.

Critically, the guidance is focused on an investor's actions to leverage their voting on director nominees, and therefore engagements involving other proposals, especially non-binding proposals, without implicitly connecting the outcome to director elections, should generally not be considered exerting pressure or attempting to control the issuer.5

"Context in which…engagement occurs"

Off-season, ordinary-course engagement may be less problematic than engagement in the period leading up to an annual meeting of shareholders (103.12 specifically references conditioning support for nominees at the "next director election" as problematic). Similarly, engagements that are initiated by the issuer itself, especially if the issuer specifies its desired topics of engagement, would be less likely to raise concerns regarding potential influence, as would an issuer inquiring about the application of certain voting policies. Finally, the way a question is posed during an engagement may inform the likelihood of it being considered exerting pressure or attempting to control. Investor questions at engagement meetings that are more open-ended and broadly worded are likely less problematic, allowing the issuer to respond and add the appropriate information for an investor to understand the company's position. Conversely, investors may be unwilling to answer more direct questions from the issuer, particularly about how it plans to vote.

Many investors have a policy of considering voting against board nominees who have not responded effectively to negative results on non-binding proposals, such as say-on-pay, at prior annual meetings. If an investor is discussing its policy with an issuer, the risk will vary depending on when discussions about the policy take place. If the discussion is before the meeting where the non-binding proposal goes to a shareholder vote, the investor is less likely to be influencing control. However, where the investor discusses the policy after the vote and before the subsequent year meeting, where directors will be at risk per the policy, there is increased risk of losing Schedule 13G status, because the investor may be seen as pressuring the issuer by conditioning support for its nominees on meeting expectations on the non-binding proposal.

The following White & Case attorneys authored this alert: Maia Gez, Erica Hogan, Scott Levi, Gregory Pryor, Michelle Rutta and Danielle Herrick.

1 Under Sections 13(d) and 13(g) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), investors that beneficially own more than five percent of an issuer's outstanding publicly traded voting equity are required to report that ownership with the SEC. Pre-IPO owners, among others, and certain "passive investors" may generally file on short-form Schedule 13G, which unlike the Schedule 13D, does not require a description of any plans or proposals of the shareholder that would result in significant transactions with the issuer. Many institutional investors report on Schedule 13G in reliance on these "passive investor" exemptions. However, "passive investors" lose their eligibility to file on Schedule 13G, and must file on the longer-form Schedule 13D, if their investment plan with respect to the securities is such that they have acquired or hold the securities for the purpose or effect of changing or influencing the control of the issuer.

2 Specifically, the old version of C&DI 103.11 had indicated that, without more, the following ordinary course engagement with companies generally would not preclude a finding that the investor is a passive investor:

-engagement with an issuer's management on executive compensation or social issues or public interest issues (such as environmental policies); or

-engagement on corporate governance topics, such as removal of a staggered board, majority voting standards in director elections, and elimination of poison pill plans, if undertaken as part of a broad effort to promote the shareholder's view of good corporate governance practices for all of its portfolio companies, rather than to facilitate a specific change in control in a particular company.

See Appendix A for a redline showing the changes made to C&DI 103.11.

3 The policy went on to state that "The State Street Global Advisors Global Proxy Voting and Engagement Policy (the "Policy") contains certain policies that State

Street Global Advisors will only apply in jurisdictions where permitted by local law and regulations. State Street Global Advisors will not apply any policies contained herein in any jurisdictions where State Street Global Advisors believes that implementing or following such policies would be deemed to constitute seeking to change or influence control of a portfolio company."

4 For the full text of C&DI 103.12, see Appendix B.

5 It is informative that the SEC's October 2023 Adopting Release for its rule amendments to Regulation 13D-G states that having conversations about or submitting a non-binding shareholder proposal jointly with others does not constitute activity that would give rise to formation of a Section 13(d) group.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2025 White & Case LLP

View full image: Risk of Loss of Passive Investor Status (PDF)

View full image: Risk of Loss of Passive Investor Status (PDF)