Explore Trendscape

Our take on the interconnected global trends that are shaping the business climate for our clients.

The third Annual Report on the UK's National Security and Investment Act provides some valuable insights into the review process and how it continues to develop. We explore some of the key metrics and trends and what they mean for investors navigating a regime that has become a standard feature of M&A transactions with a UK nexus.

The National Security and Investment Act 2021 ("NSIA") Annual Report was published on 10 September 2024 (the "NSIA Report"), providing an overview of the regime's operations from April 2023 to March 2024 (the "NSIA Report Period"). This third report is the second to cover a full year of the NSIA's operations and it is therefore the first that can reliably cover year-on-year comparisons.

For a detailed overview of the NSIA, including its operation, notification triggers and timelines, please see our overview from its adoption, available here.

The NSIA Report

Notifications

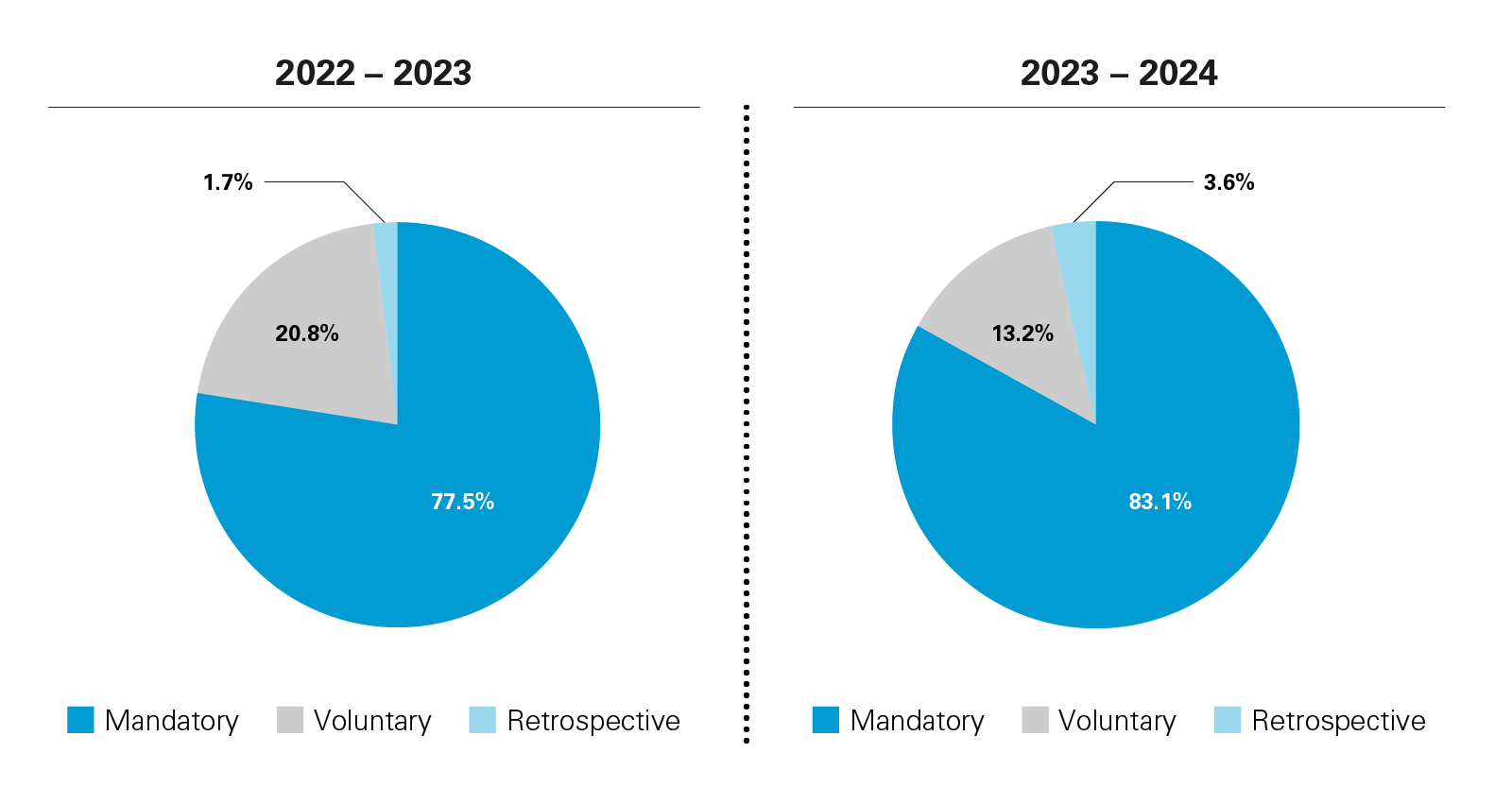

During the second full year of the NSIA's operations, the Investment Security Unit ("ISU") in the Cabinet Office received 906 notifications, of which about 13% were submitted on a voluntary basis. This is an increase from the 865 notifications that the government reported from the previous period.1 Retrospective notifications, a mechanism that allows completed transactions that should have been the subject of a mandatory notification to be retrospectively validated, have also more than doubled from 15 to 33.

Clearance remains very much the norm, with about 96% of notifications cleared following submission and without a call-in for a more detailed review.

Call-In Review

A call-in notice signifies that a transaction, whether notified or not, will be subject to more detailed national security review. This triggers a 30-working day "assessment period", which may be followed by another 45-working day "additional period" (that can be further extended with the notifying party's consent).

During the NSIA Report Period nearly 96% of notified transactions were cleared without a call-in review, up very slightly from 92.8% during 2022-23.

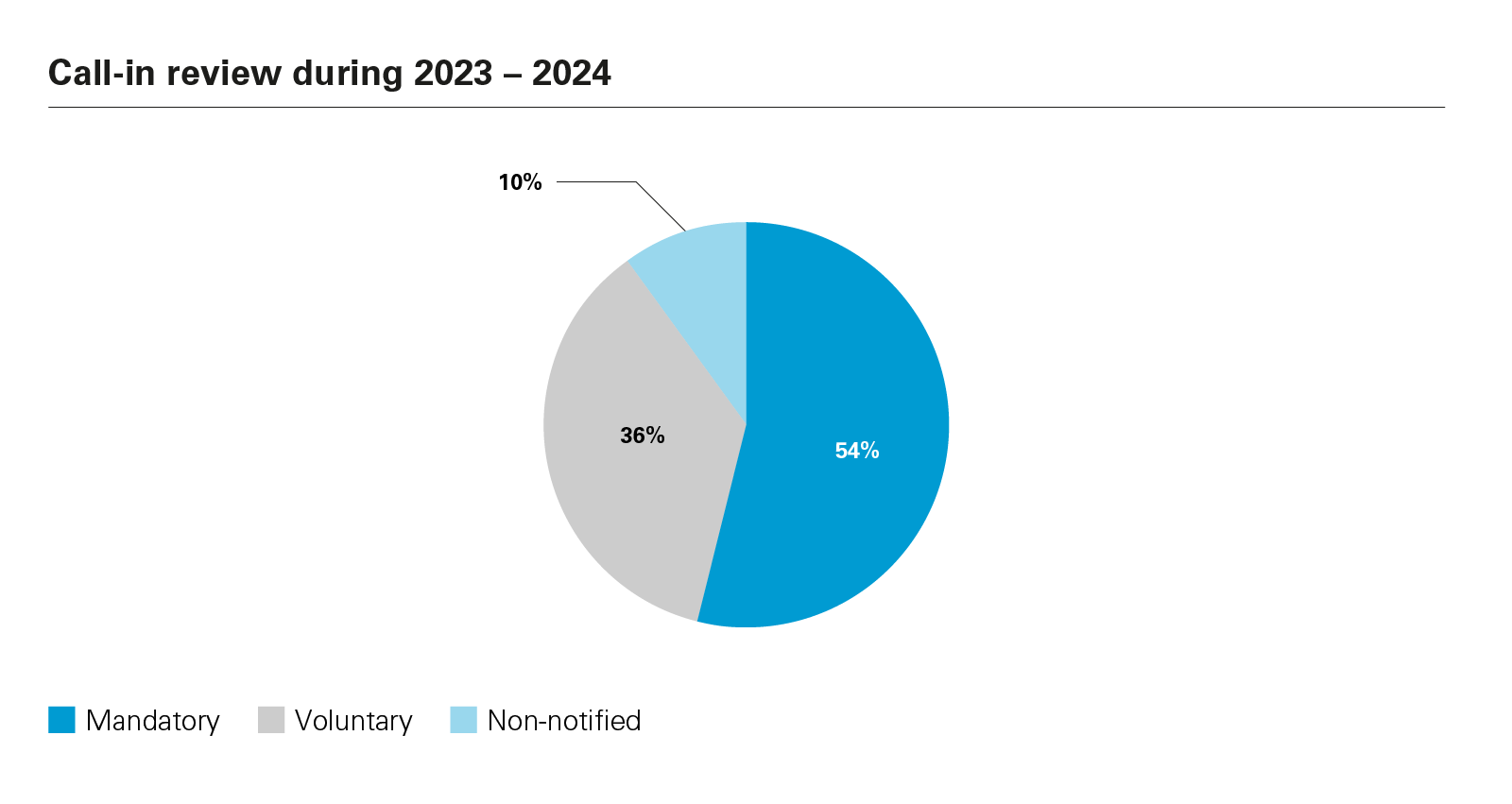

41 call-in notices were issued during the NSIA Report Period in total (i.e., about 4.5% of cases), a decrease from 65 in the previous twelve months. Of these, 22 were related to mandatory notifications, and 15 to voluntary notifications.

Four unnotified transactions were subject to call-in despite not being notified at all. No call-in notices were issued for retrospective notifications.

Final Orders: Conditional and Prohibition Decisions

If it is determined, following a call-in review, that a transaction poses a risk to national security, then a final order will be issued either imposing conditions on the deal, or prohibiting it entirely (which, in the case of unnotified deals that have completed, means unwinding of the transaction).

There were five final orders2 imposed overall during the NSIA Report Period, significantly fewer than the 15 final orders included in the previous Annual Report. All five imposed conditions, and unlike the position in 2022/2023, there were no prohibitions during the NSIA Report Period.

Overall, therefore, around 12% of all transactions subject to call-in (and only around 0.5% of total cases) resulted in a final order, down from 20% in the previous reporting period.

Sectoral Focus

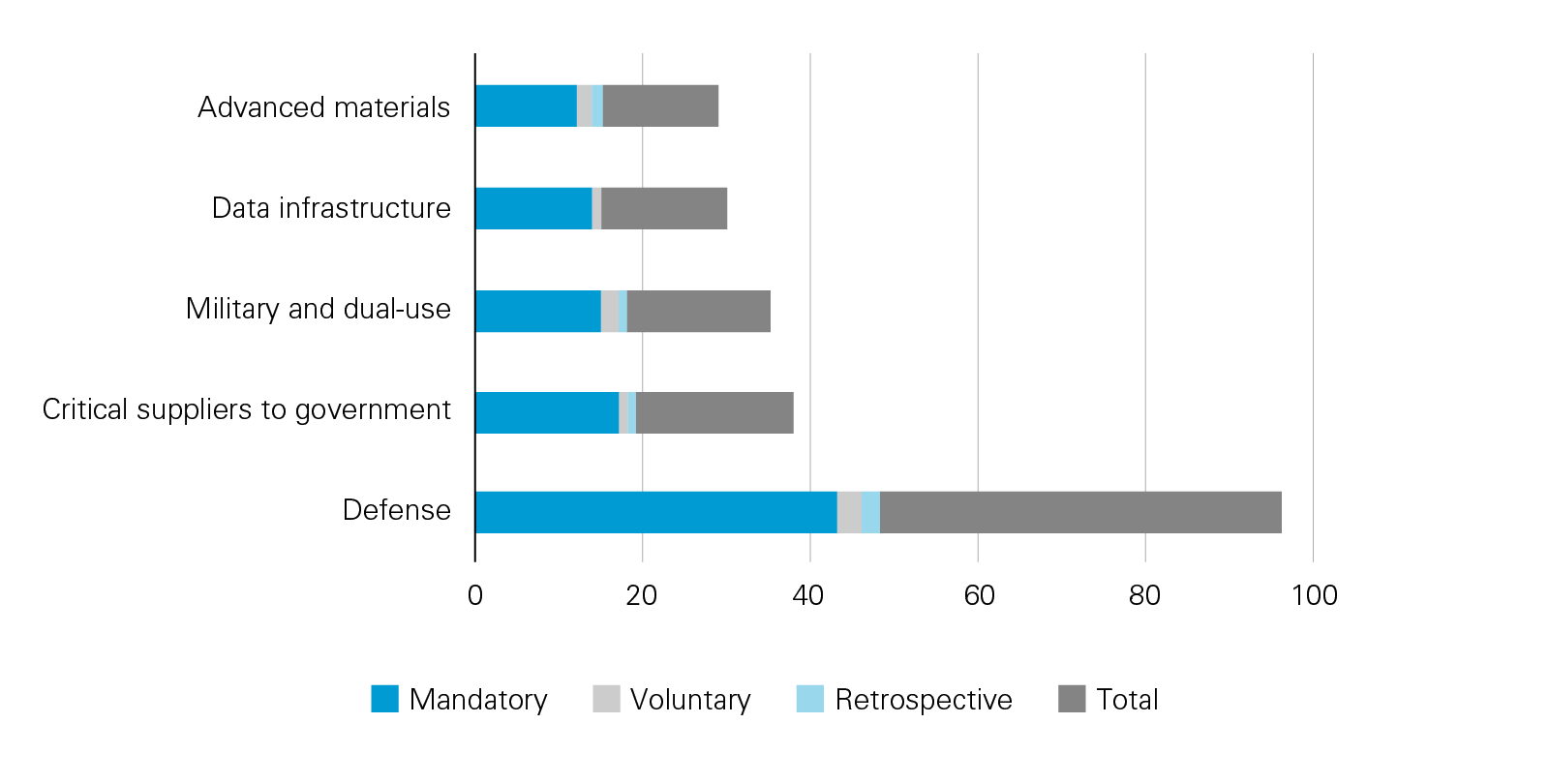

The NSIA Report provides a breakdown of the sectors triggering the most mandatory notifications, voluntary notifications, call-ins, final notifications (i.e., clearance after call-in), and final orders (i.e., the imposition of conditions or prohibition). Notifications were most common in relation to defence (48%), critical suppliers to government (19%) and military & dual-use (17%).

Transactions can be notified based on multiple sectors, with, for example, defence and military & dual-use often triggering simultaneously, so the figures by sector will be somewhat skewed due to the overlapping definitions.

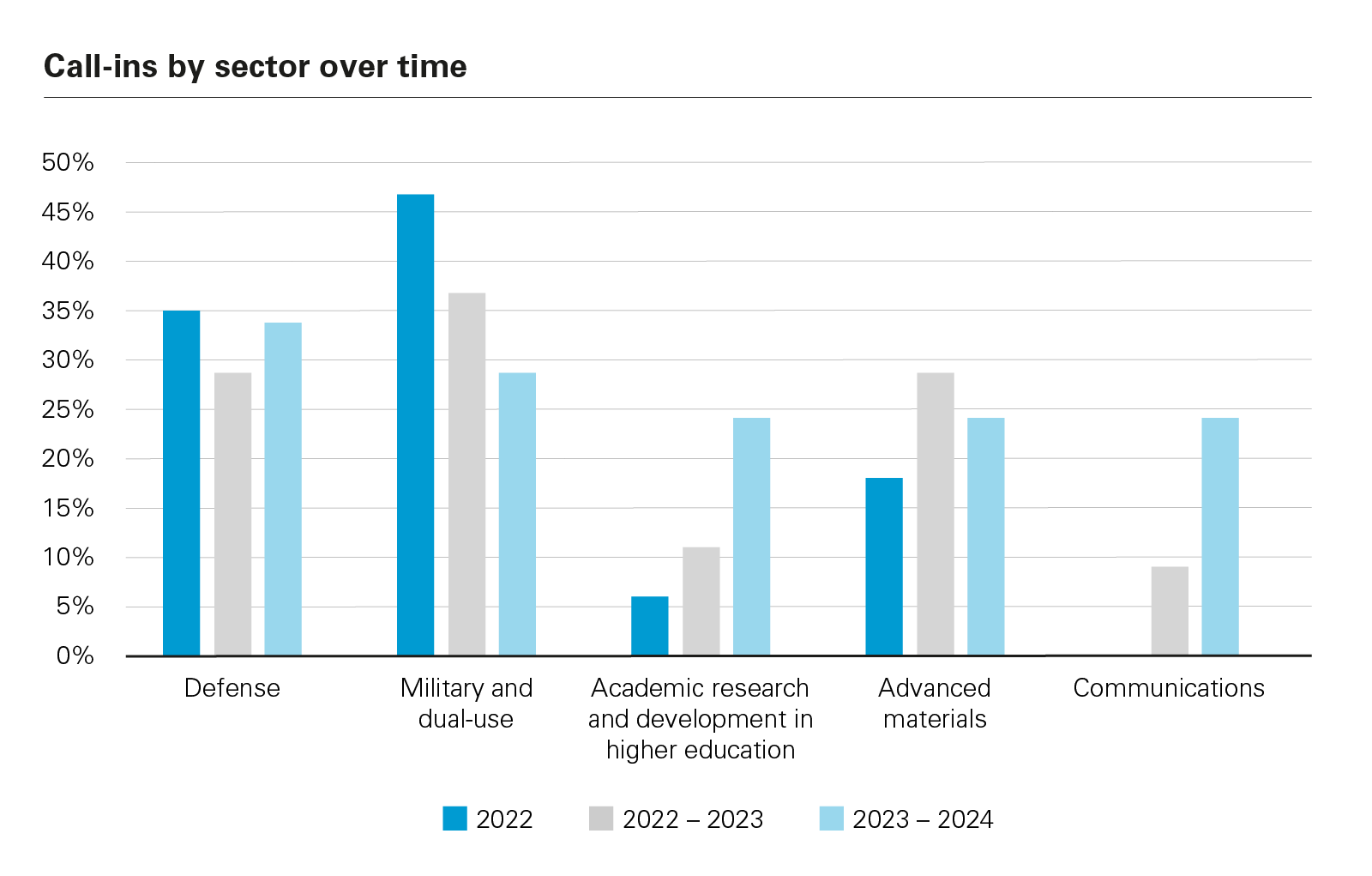

Of called-in transactions, unsurprisingly, once again notifications relating to defence (34%) comprise the largest group, closely followed by military & dual-use (29%) and other sectors including academic research and development in higher education, advanced materials, and communications together accounting for 24% of the call-ins. Trends over time show that, for the most part, the sectors receiving call-ins are stable with only growth showing in the area of academic research and higher education. This is notable because, although academia and higher education is not itself a ‘sensitive sector', the ISU has taken a keen interests in university research including via dedicated guidance for higher education institutions and the establishment of a dedicated team in the Research Collaboration Advice Team, to provide advice to institutions on the national security risks linked to international research.

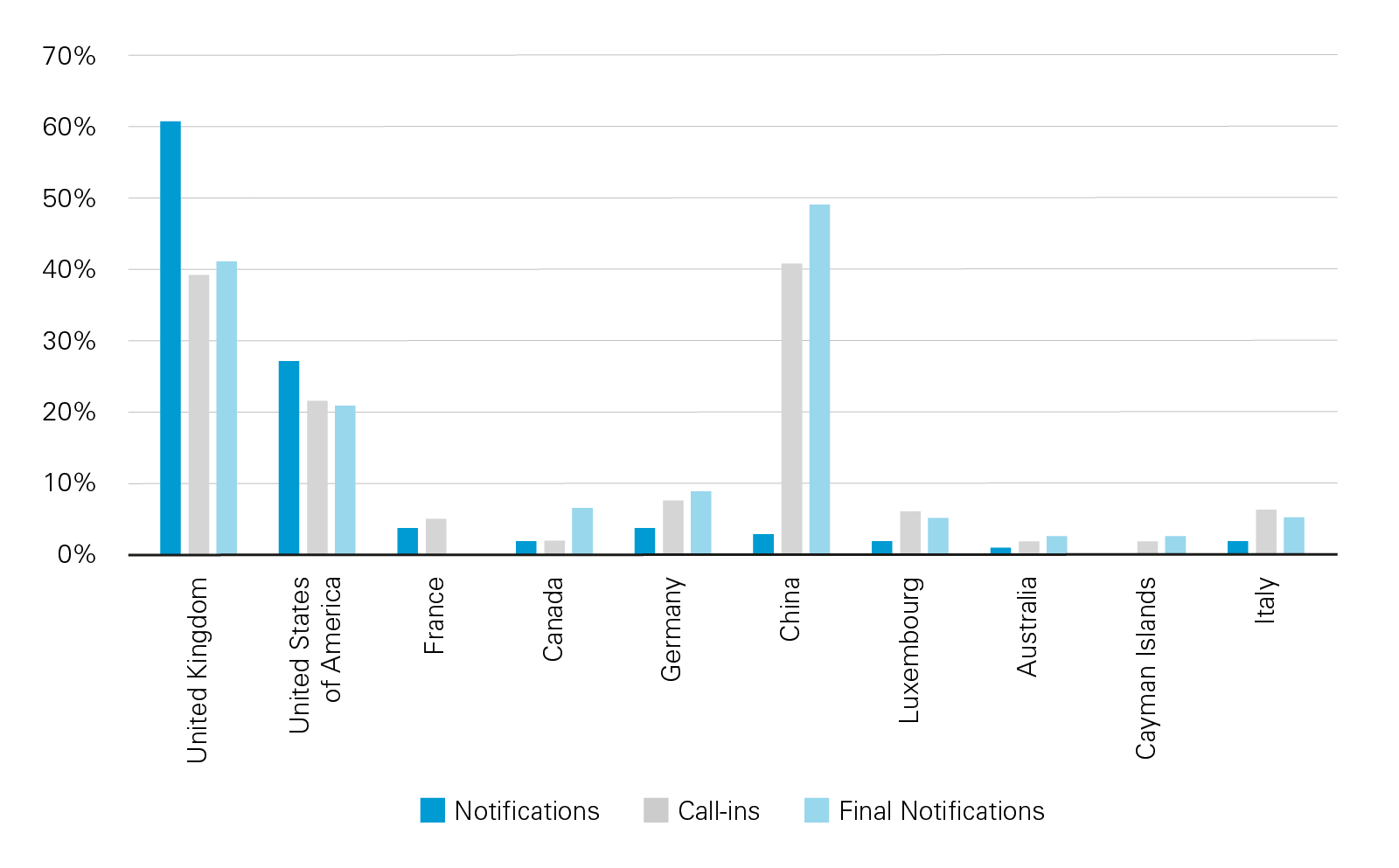

Investor Origin

Unlike many other FDI regimes, the NSIA is agnostic as to an investor's origin when it comes to the obligation to notify a transaction. UK investors are, therefore, subject to the same notification requirements as overseas investors. Indeed, UK investors are behind the majority of notifications under the NSIA, accounting for 61% in the NSIA Report Period, up slightly from 58% in 2022-23.

Consistent with the previous reporting period, China remains the country of origin seeing the most call-ins. Chinese investors represented just 3% of notifications yet China was once again the country of origin subject to the largest share of call-ins at 41%.

Investors from the UK and close allies can also expect scrutiny irrespective of their country of origin where targets are deemed sufficiently sensitive. The NSIA Report reveals that 39% of the call-ins were from the UK, and 22% from the USA. In fact, of the 5 final orders, 2 were related to investors from the UK, 2 from the USA and 1 each were related to investors from the UAE, France, and Canada.

As noted in the sector section, these statistics may double-count investor origin as co-investors from other jurisdictions are considered individually.

Penalties

The NSIA sets out various offences, including the completion of a notifiable transaction without approval. Such offences can attract penalties of up to £10 million or 5% of turnover (whichever is the higher). The NSIA Report states that once again no penalties were issued during the NSIA Report Period. The NSIA Report states that 34 offences were identified where a notifiable acquisition was completed without approval, but the government did not impose a penalty in any of those cases, doubtless because several were remedied via retrospective validation.

This means that since its introduction in January 2022, no penalty has been imposed under the NSIA.

Efficiency

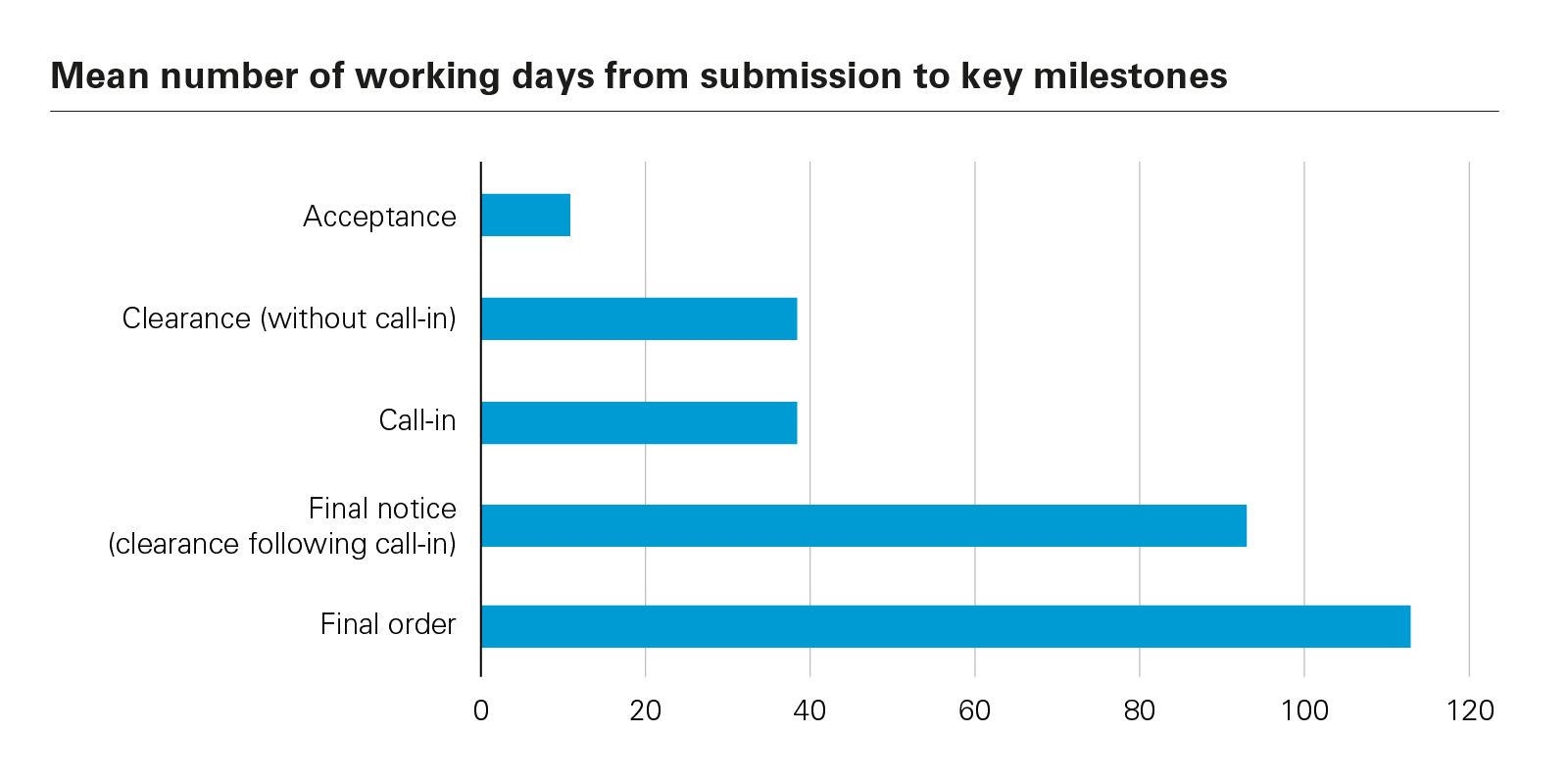

Usefully, this NSIA Report includes, for the first time, information on the timescales associated with key milestones in calendar days. This gives a better understanding of real timeframes including, for example, the number of days that lapse following issuance of information notices; and confirms that the issuance of information notices will ‘stop the clock' on the statutory timeframe. That clock will remain stopped until the ISU confirms that the responses sought are satisfactory, a process that will typically take around a week from the submission of responses.

Once again, the NSIA Report confirms that all cases "were either called in or cleared within the statutory time limit". But the statutory time and calendar time for considering a case can vary greatly. For example, statutory time limits run from the date that a notification is ‘accepted' by the ISU. However, although the ISU "aims to do this in 5 working days"3 in our experience delays are increasingly common. This is borne out by the NSIA Report which confirms that the average number of working days from receipt of a mandatory notification to acceptance is 7 days for mandatory notifications, and 10 days for voluntary notifications.

In terms of total transaction timelines, therefore, the average number of working days between receipt of a notification and the issue of a final order (e.g., imposing conditions or a prohibition) was 113 working days. This includes days when a response to an information notice was outstanding.

Outlook

The NSIA Report does not cover the tenure of the current decision-maker for the NSIA, Pat McFadden MP, the Chancellor for the Duchy of Lancaster, who took office on 5 July 2024 following the UK general election and after the period covered by the NSIA Report. The NSIA Report instead covers the tenure of the previous office holder, Oliver Dowden CBE. Mr McFadden has imposed three final orders since taking office, but concrete trends will likely not emerge until he has been in office for at least a little more time.

Before the current UK government took office, the previous government updated various pieces of NSIA guidance following a call for evidence process that concluded in April 2024. Further updates touted following the call for evidence included a new consultation on the sectors meriting mandatory notification under the NSIA. Originally scheduled for ‘summer 2024' these plans were disrupted by the general election, but an overview of our key predictions, including new mandatory requirements for semiconductor and critical minerals deals is accessible here.

Ruth Benbow (White & Case, Knowledge Manager, London) contributed to developing this publication.

1 The Annual Report from 2023 incorrectly included a test notification that has now been removed from the statistics.

2 (1) Acquisition of assets belonging to the University of Southampton by Voyis Imaging Inc. (8 June 2023), (2) Acquisition of Connect Topco Limited by Viasat, Inc (10 July 2023), (3) GE Oil & Gas Marine & Industrial UK Ltd and GE Steam Power Ltd by EDF Energy Holdings Ltd via its wholly owned subsidiary, GEAST UK Ltd (7 August 2023), (4) In respect of the rights and interests conferred to Emirates Telecommunications Group Company PJSC under the Strategic Relationship Agreement with Vodafone Group PLC (24 January 2024) and (5) Acquisition of Iceman Holdco, Inc., by TransDigm Inc. (28 February 2024).

3 According to the Cabinet Office's guidance on NSIA notifications (last updated on 21 May 2024), and accessible here.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2024 White & Case LLP

View full image (PDF)

View full image (PDF)

View full image: Call-in review during 2023 – 2024 (PDF)

View full image: Call-in review during 2023 – 2024 (PDF)

View full image (PDF)

View full image (PDF)

View full image: Call-ins by sector over time (PDF)

View full image: Call-ins by sector over time (PDF)

View full image (PDF)

View full image (PDF)

View full image: Mean number of working days from submission to key milestones (PDF)

View full image: Mean number of working days from submission to key milestones (PDF)