The EU Commission releases its Fourth Annual FDI report showing continuity and heightened FDI regulation in the EU27

6 min read

Grace Hochstatter (White & Case, Law Clerk, Washington, DC) contributed to the development of this publication.

On 17 October, the European Commission (EC) issued its Fourth Annual Report under Article 5(4) of the Foreign Direct Investments (FDI) Screening Regulation (the Regulation) along with an EC Staff Working Document (SWD). The Report covers 2023 and provides an overview of FDI trends and screening in the 27 EU member states (EU27), as well as emerging developments in national screening mechanisms.

2023 Trends and Figures: Decline in Global FDI, Growth in the EU27

Global net FDI flows fell for the second consecutive year, totaling just over EUR 1 trillion, a 15% decline from 2022 where investment totaled EUR 1.2 trillion. In contrast to this global trend, the EU27 saw an increase in net FDI inflows in 2023, reversing a previous 2022 decline. Nevertheless, net inflow into the EU27 remained negative—EUR -50 billion in 2023 compared to EUR -135 billion in 2022. The Report points to the combination of restrictive monetary policies increasing effective interest rates and other geopolitical tensions around the world, contributing to an increase in uncertainty and adversely affecting FDI in the EU27. Acquisitions of equity by "Offshore Financial Centres" (i.e., private equity funds) continued to increase in 2023 (+26%).

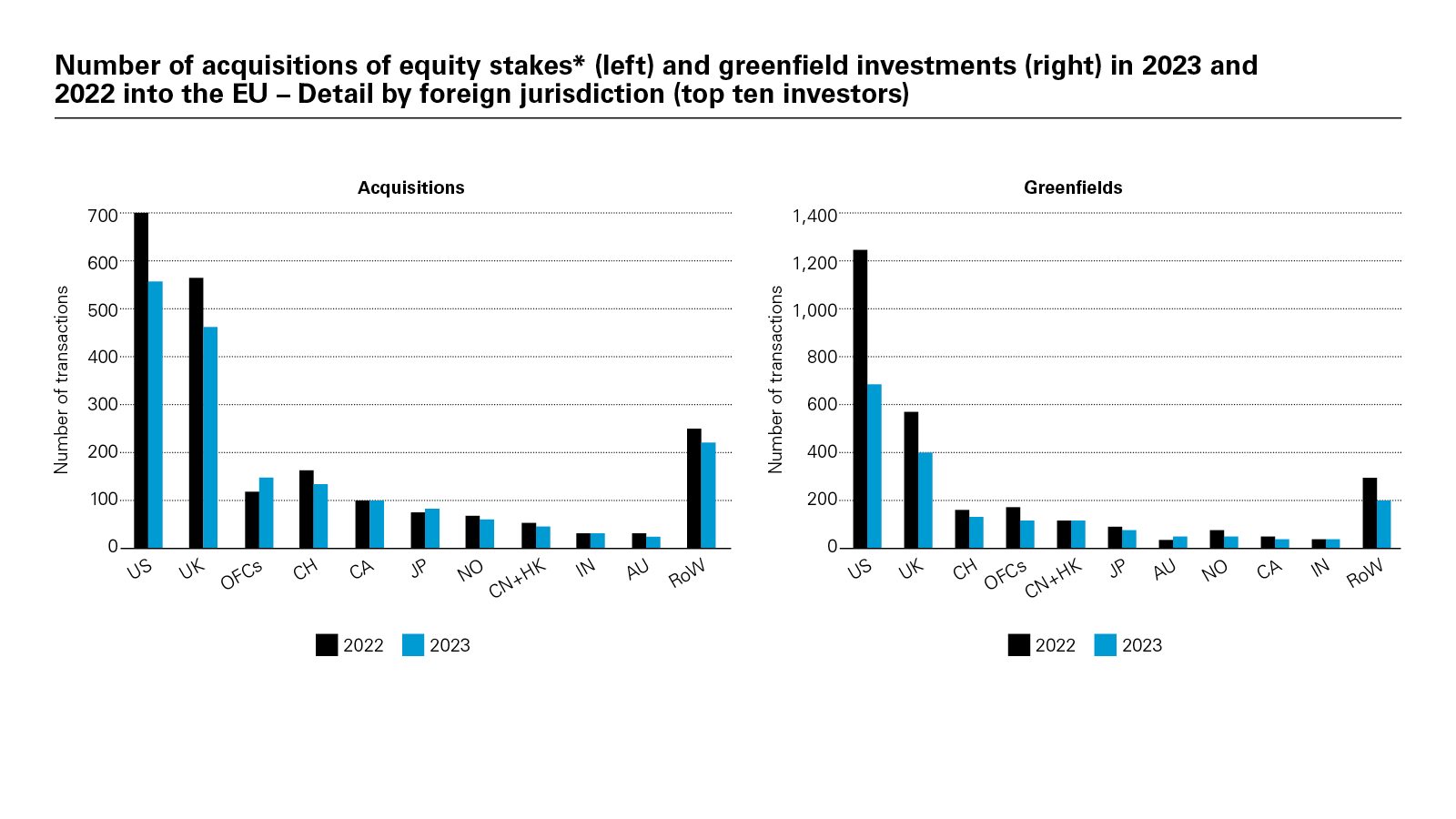

The US and UK Remain Top Investors Despite Investment Downturn

The US remained the leading foreign investor in the EU27, accounting for 30% of acquisitions and 36% of greenfield investments, despite the fact that both US investment categories saw a sharp year-over-year decline, -20% and -45% respectively. The UK followed as the second-largest investor, contributing to 25% of acquisitions and 21% of greenfield investments, despite UK investment declines of -17% and -29% annually in each category.

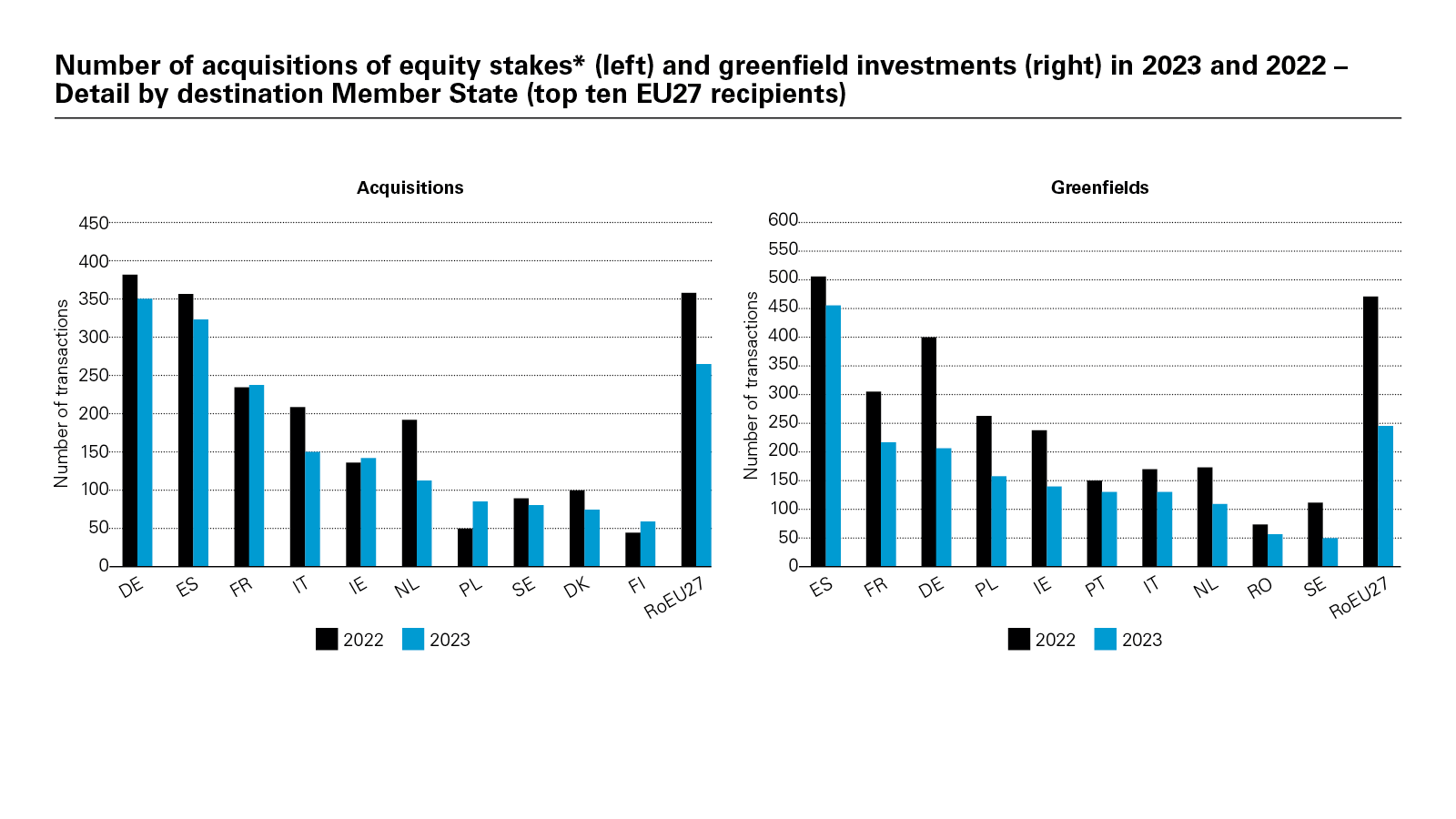

Germany and Spain Were Top Destinations for Foreign Acquisitions, While Spain, France, and Germany Led in Greenfield Investments

Germany and Spain were the primary destinations for foreign acquisitions, accounting for 19% and 17% of total deals respectively. Both nations, however, experienced a roughly -9% year-over-year decline in foreign acquisitions. Italy and the Netherlands saw the largest decreases in deals, at -29% and -40%, respectively, while M&A activity increased in Ireland (+4.4%), Poland (+70%), and Finland (+33%). In terms of foreign greenfield investments, Spain, France, and Germany were the top destinations, receiving 24%, 11%, and 11% of projects, respectively, although it is relevant to note that greenfield investments are not covered by FDI screening rules in these jurisdictions. Interestingly, Chinese greenfield investments into the EU27 experienced a year-to-year increase in the field of "professional and scientific activities" (+29%).

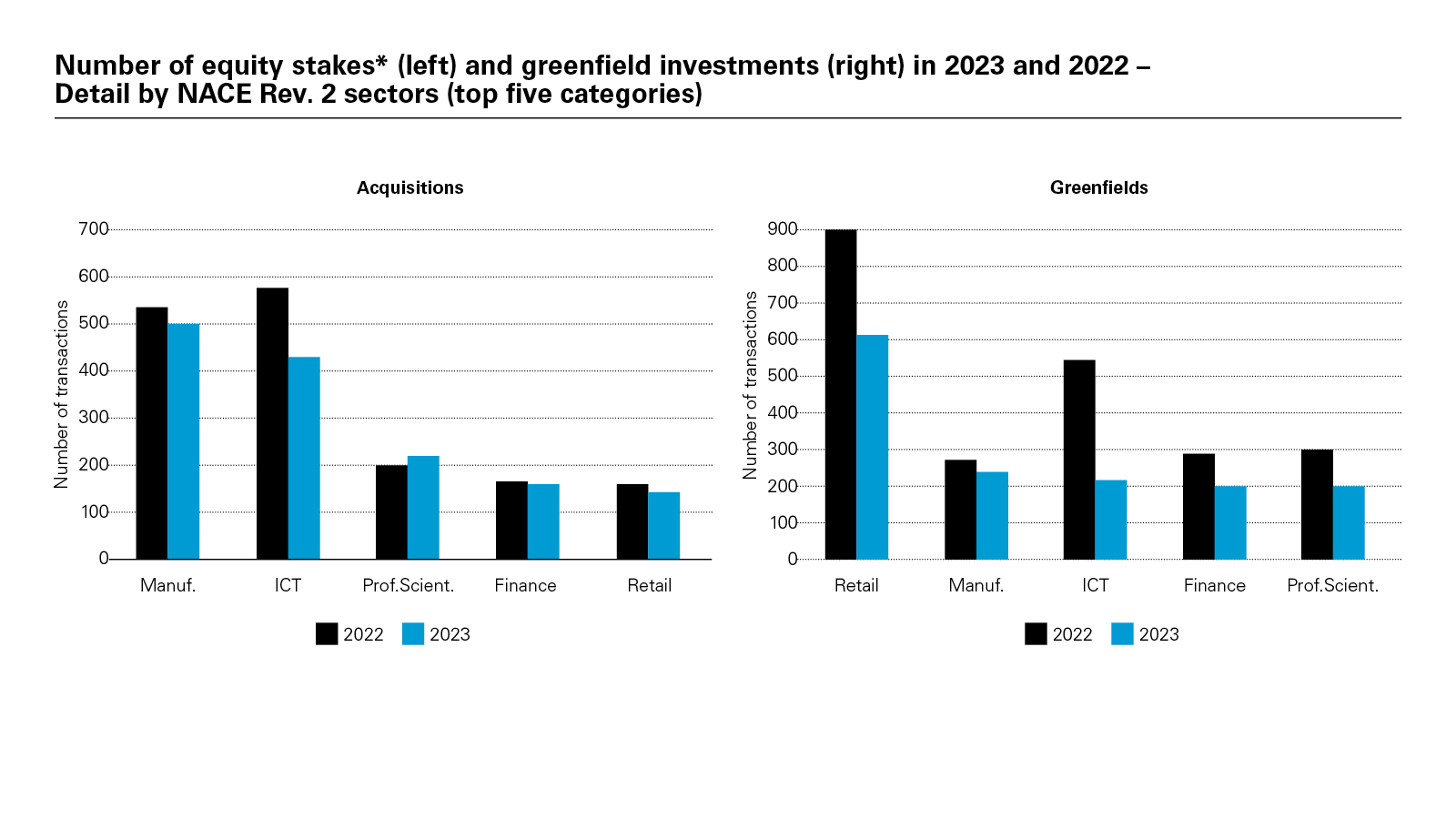

Top FDI Sectors in the EU27

In 2023, all but one top sector category saw declines in foreign investments compared to 2022. (Professional, scientific, and technical (PST) activities defied the trend with a 12% year-over-year increase.) Manufacturing became the leading sector for foreign acquisitions with a 26% share, surpassing Information and Communication (ICT), which dropped by 25% in 2023. For greenfield investments, retail activities dominated with 33% of projects, while manufacturing rose to the second position with a 12% share, replacing ICT, which saw the largest decline of 59%. Manufacturing had the smallest decline in greenfield investments at 10%.

The Report notes that the number of foreign investments in EU semiconductor companies (68) has remained stable from 2022 to 2023. Most of these investments took the form of venture capital and the US is by far the main foreign investor in terms of number of transactions (49% share of total investments in 2023).

FDI at the Member State Level

The EC continues to encourage Member States to adopt and implement effective national screening mechanisms to protect collective security interests. As of 2023, 24 EU Member States have enacted relevant legislation, with Croatia, Cyprus, and Greece currently taking concrete steps to establish their own mechanisms.

The following table gives an overview of all 27 Member States' legislative situation and developments as of 31 March 2024:

| National FDI Screening Mechanism in Place – No Legislative Changes in 2023 | Amended an Existing Mechanism in 2023 | Adopted a New National FDI Screening Mechanism in 2023 | Had a Consultative or Legislative Process in 2023 Expected to Result in the Adoption of a New Mechanism |

|

Austria Czechia Finland Lithuania Malta Portugal |

Denmark France Germany Hungary Italy Latvia Netherlands Poland Slovenia Spain |

Belgium Bulgaria Estonia Ireland Luxembourg Romania Slovakia Sweden |

Croatia Cyprus Greece |

FDI Screening Activities

The Report shows a similar picture of 2023 compared to 2022 with an interesting stability of Member States screening activities. Out of the 1808 requests made to national FDI authorities, only 55% had been formally screened, the rest were deemed out of scope of review. The vast majority of the transactions reviewed was authorized without conditions (85%) and, compared to 2022, there was a slight increase in formally screened cases without conditions. The proportion of approved decisions with conditions is a bit higher at 10% against 9% in 2022. Finally, the share of transactions blocked remains nominal, around 1%, and 4% of the filings reported as withdrawn by the parties before a formal decision was taken. Overall, these trends confirm that the EU has remained open to FDI.

While there is no FDI screening mechanism at the EU level, the Regulation introduced a coordination mechanism whereby the Member States notified certain transactions to the EC and FDI authorities of other Member States that can flag certain concerns. The EC may issue non-binding opinions on FDI reviews performed in Member States. "Non-reviewing" Member States may provide comments to the "reviewing" Member States. Member States and the EC may also provide comments on a transaction that is not being reviewed because it takes place in a Member State with no FDI regime, in a Member State in which the transaction does not meet the criteria for an FDI review by the government, or the reviewing Member State decided to waive screening of a particular investment. In the latter case, the Member State concerned with the FDI must provide a minimum level of information to the other relevant Member States and/or the EC on a confidential basis without undue delay.

The Report points out the continued increasing number of EU notifications in 2023 (18% in the 2021-2023 period) originating from the same Member States with an important level of concentration (85% of the of all notifications originating from seven Member States). Similar to the national trends, only 8% of the notified cases raised national security concerns with a main focus on critical technologies related to manufacturing activities in defence, aerospace, and semiconductors. The Report also observes the growing number of multi-jurisdictional deals.

Outlook and Projections for Foreign Investors

To address identified shortcomings and enhance the current system, the EC presented a legislative proposal in January 2024 to revise the Regulation. The proposal aims to make FDI screening mechanisms mandatory for all EU Member States and to address the main shortcomings of the current system (lack of harmonization and fragmentation). The proposal is currently under consideration by the Council of the EU and the European Parliament and could become effective in the first quarter of 2025.

Overall, the EU27 outlook remains geared towards increased FDI regulation and enforcement. As the EU27 continues to increase in number of FDI regimes and enhance the robustness of established processes, investors should expect a corresponding impact on transactions in 2025. Investors should stay abreast of developments in EU27 FDI framework expansions (including the adoption of new FDI regimes by Croatia, Cyprus, and Greece), and work closely with experienced FDI counsel to ensure a comprehensive, up-to-date multijurisdictional strategy for their transactions. The EU27 will only increase attention on potential risks associated with certain third-country investments, particularly those that could impact the security or public order in the EU or affect EU projects and programmes of public interest.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2024 White & Case LLP

View full image (PDF)

View full image (PDF)

View full image (PDF)

View full image (PDF)

View full image (PDF)

View full image (PDF)