On 20 February 2025, Gina Cass-Gottlieb, Chair of the Australian Competition and Consumer Commission (ACCC) announced the ACCC's 2025-26 Compliance and Enforcement Priorities.1 The ACCC's priorities continue to target conduct that presents significant harm to consumers in sectors of critical importance to the community and the economy.

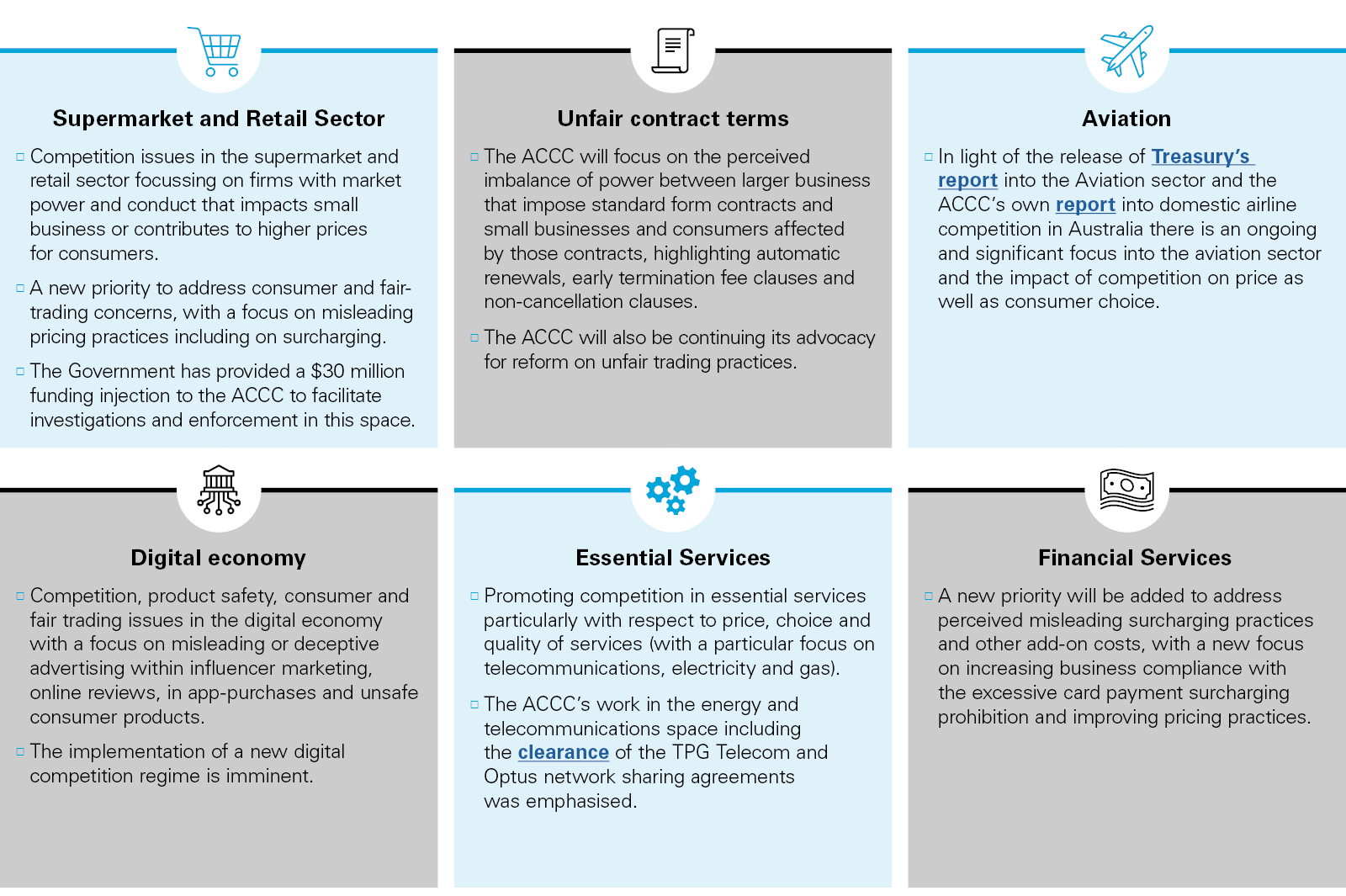

2025-26 Compliance and Enforcement Priorities

The ACCC's Compliance and Enforcement Priorities are consistent with its legislative mandate which aims to protect and promote competition and enhance the welfare of Australians. Key priority areas largely remain consistent with last year, with a significant focus on the promotion of competitive markets and on consumer protections, including the clear and accurate pricing information and representations for products and essential services. The ACCC's priorities are consistent with its previously stated approach of directing resources to those matters that cause the most widespread harm, with sectors including groceries and essential services being targeted as contributing to increased cost of living. Other sectors such as energy, telecommunications, aviation and the online digital economy were also identified as a particular focus.

Enduring priorities remain but cost of living pressures in the spotlight

The ACCC's enduring priorities to address anti-competitive agreements, misuse of market power and cartel conduct remain. However, there is a continued and prominent focus on cost-of-living pressures with the ACCC proposing to take investigation and enforcement action to address what the ACCC has identified as significant competition and consumer concerns in the supermarket and retail sectors.

This focus is unsurprising as the regulator approaches an end to its year-long supermarket inquiry, where pricing practices and the relationship between wholesale, including farmgate, and retail prices came under scrutiny. The final report is due for release no later than 28 February 2025.

To address cost of living concerns the ACCC has added new targeted cost of living priorities that include:

The cost of living focus continues to build on the action taken by the ACCC in the last year including:

- commencing Federal Court proceedings against Woolworths Group Limited and Coles Supermarkets Australia for allegations of misleading consumers through discount pricing claims.;

- the ongoing supermarkets and digital platforms inquiries;

- the recent $100 million penalty imposed on Qantas in the Federal Court of Australia, following admissions by Qantas that it had contravened the Australian Consumer Law with a consumer redress program of about $20 million; and

- proceedings against Optus for allegations of unconscionable conduct including in the sale of telecommunications goods and services to consumers.

Protecting and promoting competition through Australia's new merger regime

Successful implementation of Australia's new merger control regime will be a key priority for the ACCC in 2025 to 2026. The historic merger reforms are set to commence from 1 January 2026, with voluntary notification available from 1 July 2025. As previously reported, the reforms will shift Australia from a voluntary, enforcement model to a mandatory, suspensory administrative regime. The Chair emphasised that the notification obligations would be enforced and the ACCC is prepared to take action against merger parties who fail to comply with the new regime. The Chair also revealed that the ACCC would release guidelines on transition arrangements in the coming weeks. Draft process guidelines and draft analytical guidelines will also be released for consultation prior to the end of Q1 2025.

While not a specific compliance and enforcement priority, ensuring compliance with the mandatory statutory requirements of the new regime once it comes into effect will be a key focus of the regulator. As the demands on the ACCC's resources increase, this has the potential to impact the enforcement of non-merger matters as the transition into a mandatory merger control regime stretches the regulator. Emphasising the critical role of the reforms in strengthening both the protection and the promotion of competition in Australian markets, the Chair noted that the new merger regime will operate most effectively where the merger parties approach the ACCC early and co-operatively.

Conclusion

The ACCC's compliance and enforcement priorities for 2025-26 demonstrate its broad legislative mandate of protecting and promoting competition across the Australian economy, in a year that is set to be one of historic change for Australian competition law. For businesses and their advisors, the ACCC's public commitment to successful implementation of the new merger control regime and its public consultation on its key procedural aspects are welcome. However, whether a smooth transition period will transpire for mandatory merger control with competing enforcement priorities will be a challenging transition to competition law enforcement in Australia.

1 Ms Gina Cass-Gottlieb spoke at the Committee for Economic Development of Australia (CEDA) on Thursday 20 February 2025 on the ACCC's '2025-26 Compliance and Enforcement Priorities' – [ACCC's compliance and enforcement priorities update 2025-26 address | ACCC]

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2025 White & Case LLP

View full image: Compliance and Enforcement Priorities for 2025/26 (PDF)

View full image: Compliance and Enforcement Priorities for 2025/26 (PDF)