James Turner is a very efficient and capable deal manager in addition to being a great substantive attorney.

Biography

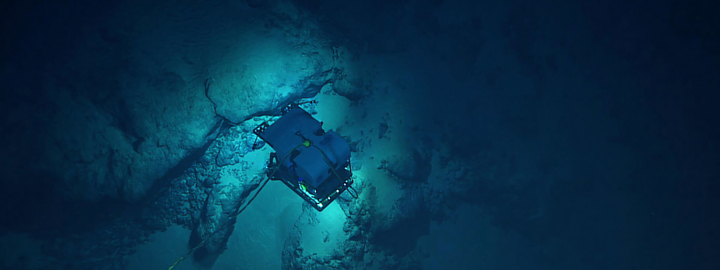

James M. Turner is an associate in the Asset Finance Group in the London office of White & Case. With a focus on aviation, maritime and offshore, James acts for clients including export credit agencies, banks and other financiers, equity investors, operating lessors, drilling companies, shipowners, and airlines on a full range of financing and leasing arrangements, including ECA and commercial debt financings, pre-delivery payments financings, aircraft operating leases, aircraft sale and leasebacks and aircraft and vessel sale and purchase transactions.

James also regularly advises on restructurings, capital markets (including securitisations), merger and acquisition and other equity investment transactions in the aviation and maritime sectors.

Experience

Aviation

Representation of AviLease in connection with its USD 2.5 billion unsecured term facility comprised of a USD 1.73 billion conventional facility and a Sharia-compliant Murabaha facility of USD 770 million.

Representation of ITA Airways on several note issuance financings with respect to the purchase of various Airbus A330neo aircraft.

Representation of an airline on the pre-delivery payments financing in respect of ten Airbus A321XLR aircraft.

Representation of a major US operating lessor in connection with the sale of multiple aircraft on lease to airlines in jurisdictions including the United States, Korea, Australia, China, Türkiye, Belgium and Spain.

Representation of the lenders in connection with the delivery financing of four Airbus A321NEO aircraft for an operating lessor and leased to a US airline.

Maritime and Offshore

Representation of Proman AG, one of the world's largest methanol producers, on a green loan ship financing in support of the launch of an industry-first sustainable shipping fund in partnership with Stena Bulk AB, an internationally recognized and leading European shipping company.

Representation of Deutsche Bank AG, New York Branch, as sole lead arranger and lender, in connection with a US$370 million exit facility for Hornblower HoldCo, LLC, a multi-national owner and operator of ferries and cruise vessels in the tourism and passenger transportation sector, as well as a provider of global travel experiences, in connection with their emergence from chapter 11 proceedings in United States Bankruptcy Court.

Representation of United Arab Shipping Company in respect of its business combination with Hapag-Lloyd AG, creating the world's fifth biggest liner shipping company.

Representation of the agent in connection with the restructuring of two loan facilities to a shipowner in the car carrier sector.

Representation of ExxonMobil and its affiliates in connection with acquisitions of, and financings relating to, various floating, production, storage and offloading (FPSO) units.

Named as a "Rising Star" in AirFinance Journal's Guide to Aviation Lawyers 2022