Biography

Gabrielle is an associate in the Firm's Energy, Infrastructure, Project and Asset Finance group based in New York. Her practice focuses on advising lenders, borrowers and project sponsors on the development, acquisition and financing of energy and infrastructure projects with an emphasis on energy transition, including renewable power generation and mining/critical minerals projects. In 2023-24, she completed an eighteen-month secondment in the Firm's London office.

Experience

Select relevant matters include the representation of:

Power

West Burton Energy and its wholly owned subsidiary West Burton B Limited (together WBE) on the £350 million refinancing of its 1332MW Combined Cycle Gas Turbine (CCGT) and 49MW Battery Energy Storage System plant located in Nottinghamshire, UK, including the negotiation of new trading arrangements with EDF Energy and a tolling arrangement with Shell Energy Europe for a portion of the CCGT's generating capacity. Awarded "Europe Refinance Deal of the Year, Power" by IJGlobal 2023.

Talen Energy Corporation and its subsidiary Cumulus Growth Holdings LLC in connection with their $175 million strategic capital partnership with Orion Energy Partners. The investment represents an additional step forward in capitalizing and executing Talen's strategic transformation to a renewable energy and digital infrastructure growth platform, and will be used to fund common infrastructure for the Cumulus hyper-scale data center campus, located adjacent to Talen's 2.5 gigawatt Susquehanna carbon-free nuclear plant, as well as to fund Talen's previously announced bitcoin mining joint venture known as Nautilus Cryptomine. Awarded North American Alternative Deal of the Year by IJGlobal 2021.

EnCap Investments L.P., a leading private equity firm specializing in the energy industry, and its portfolio company Broad Reach Power LLC, one of the premier independent utility-scale energy storage and renewable energy platforms in the United States, in connection with the initial debt financing of Broad Reach's wind, solar and energy storage portfolio and the eventual US$1 billion sale of Broad Reach to the French multinational utility company ENGIE.

Calpine Development Holdings, LLC (CDH) in connection with a revolving commercial bank loan facility to fund the construction of wind, solar and natural gas fired power and energy storage projects.

Lenders in connection with a $209M initial refinancing and delayed draw of a portfolio of 44 operating commercial and industrial (C&I) solar power assets located in the southeastern and northwestern United States (aggregating 290 MW) owned and operated by one of the largest developers and operators of utility scale solar assets in the U.S.

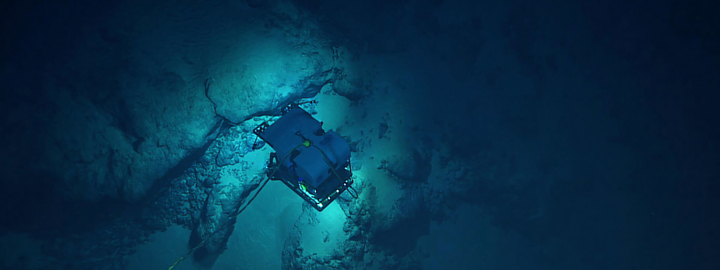

Geysers Power Company in the $1.1 billion climate bond certified financing of the Geysers geothermal power generating facilities in California, one of the largest portfolio of renewable energy assets in the United States, named "North America Renewables Geothermal Deal of the Year" by IJGlobal 2020.

Freeport LNG in connection with US $3.4 billion refinancing of the senior secured loans incurred by Freeport LNG to initially finance the development and construction of the third liquefaction train of the multi-train natural gas liquefaction and LNG export facility at Quintana Island near Freeport, Texas. Awarded "North America Refinancing Oil & Gas Deal of the Year" by IJGlobal 2020.

Mining and Minerals

Ivanhoe Mines in connection with US$420 million project financing of the Platreef platinum-nickel-palladium-gold-copper-rhodium project in South Africa, including a US$300 million streaming facility and US$150 million senior debt facility.

Lenders to Kenmare Resources on a US$200 million hybrid refinancing in relation to the Moma Titanium Minerals Mine in northern Mozambique.

The lenders, in connection with a US$110 million term loan facility provided to Sisecam Chemicals Resources LLC, one of the world’s largest producers of soda ash.

A major US-based global investment company in its 2020 secured debt and equity investment in a large portfolio of certain mining assets in the US, Canada, Peru, Brazil and Finland, and subsequent restructurings and project-level workouts through 2024.

Infrastructure

Ridgewood Infrastructure and IDE Technologies, a world leader in water treatment solutions, in the development of a state-of-the-art membrane-based water treatment facility in the City of Fort Lauderdale, Florida.

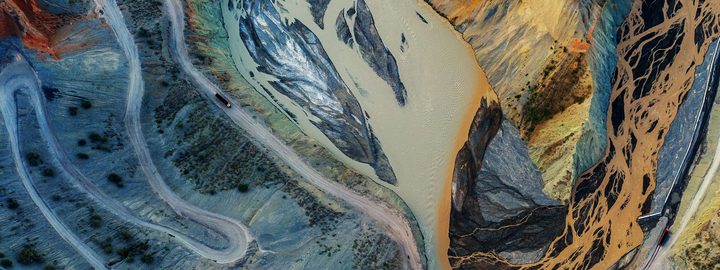

Ridgewood Private Equity Partners in connection with their acquisition of a majority equity interest in Vista Ridge LLC, the concessionaire for a 142-mile water pipeline in Texas, the offtaker of which is the San Antonio Water System. We have negotiated several amendments to the Water Purchase Agreement, navigated the Project through successful achievement of COD and advised on a $1.05 billion refinancing of the Project's construction financing at the end of 2020, implemented as a US private placement. The refinancing was awarded "Americas Water Deal of the Year" by IJ Global 2020. The original project was awarded "North America Water Deal of the Year" by IJGlobal 2017 and Project Finance International 2017, and "Water Deal of the Year" by Global Water Intelligence 2017 and "Best Utilities Project, Gold Award" P3 Bulletin 2017.