The hydrogen promise: could a molecule shift hard-to-abate industries away from fossil fuels?

5 min read

In March 2023, a small plane took a 15-minute flight around an airfield in the US state of Washington. Despite the size of the aircraft and its brief time in the air, the flight was momentous: one of the plane's engines was powered by hydrogen.

The flight carried with it hopes that hydrogen – which gives off no emissions when it burns – could help decarbonise not only aviation but also other hard-to-abate sectors, such as steel or cement manufacturing which are heavily dependent on fossil fuels.

Decarbonising potential also lies in what some refer to as the hydrogen-ammonia nexus. Hydrogen can be used to produce ammonia, a key ingredient in fertilisers. Using hydrogen instead of fossil fuels to produce ammonia could significantly reduce agriculture's carbon footprint.

The shipping sector is also placing bets on ammonia which burns without producing emissions and is compatible with existing marine engines. If ammonia could be produced cleanly using hydrogen, it could become an alternative fuel powering what is now a carbon-intensive transportation mode.

An alternative form of clean energy

Hydrogen fuel cell technology is based on an electrochemical reaction which mixes hydrogen with oxygen from the air, creating electric power whose only by-product is water vapour. Crucially, hydrogen can be stored, which gives it a role in balancing the electricity grid when supplies of power sources such as solar and wind fluctuate.

The environmental benefits of hydrogen depend on how it is produced. In renewable — or green — hydrogen production, the electrolysers, which split water into hydrogen and oxygen, are run on renewable energy. Low-carbon — or blue — hydrogen production uses natural gas, but carbon emissions from pre- and post-combustion processes are captured and stored. While blue hydrogen is not renewable, its carbon footprint is significantly reduced compared with fossil fuel-based hydrogen production without carbon capture.

World leaders are exploring hydrogen

Governments around the world are moving quickly to develop hydrogen policies. In the US, for instance, the Biden administration's Infrastructure Investment and Jobs Act and Inflation Reduction Act provide billions of dollars in incentives to produce hydrogen and a tax credit of up to $3 per kg of clean hydrogen. "The magnitude of the incentives has already driven sizeable investment in the sector, particularly from foreign sponsors and investors," says Raymond Azar, a partner in White & Case's Project Development and Finance practice in New York. "We expect the trend to continue after the IRS releases final guidance on the tax credit."

The magnitude of the incentives has already driven sizeable investment in the sector

In Asia, some policymakers have ambitious net zero strategies. Japan adopted a national hydrogen framework in 2017, and South Korea announced its roadmap for large-scale adoption of hydrogen in 2019. Both of these countries could be major customers for clean hydrogen producers.

This could benefit the Middle East, says Dinmukhamed Eshanov, a partner in White & Case's Project Development and Finance practice in Abu Dhabi. The region is embarking on several large-scale clean hydrogen and ammonia projects, and it is targeting Asia as a buyer.

"If governments in countries like Japan and South Korea provide the subsidies and the infrastructure, demand and supply will reach an equilibrium," says Eshanov. This, he says, will make using hydrogen, as both a clean energy and a clean way to produce ammonia, more economically feasible.

A combination of regulatory regimes, natural resources and existing infrastructure will determine the type of clean hydrogen that is produced. With strong government backing and abundant resources, the Middle East will be able to produce both low-carbon and renewable hydrogen. In the US, production of low-carbon hydrogen is likely to dominate because natural gas resources are plentiful, the carbon capture technology exists, and the fossil fuel industry infrastructure can be used.

But will leaders' efforts be enough?

Despite clean hydrogen's potential, it faces several obstacles, including regulatory fragmentation. This is a challenge in Europe, where jurisdictional variations in everything from planning and competition laws to specifications for pipelines can hamper the implementation of hydrogen investments.

"While you have support at the macro level, when it comes to developing the projects there are significant regulatory burdens," says Ryan Gawrych, a London-based senior associate in White & Case's Energy, Infrastructure and Project and Asset Finance Group.

Other challenges come from hydrogen's physical properties. Its low density, for instance, means it must be stored at high pressures to compress it enough. It is also highly flammable. Leaks are another worry: a study by Norway's CICERO climate research centre showed that hydrogen leakage has a global warming effect 12 times more powerful than carbon dioxide.

Then there is cost. Maturing carbon capture technology makes large-scale low-carbon hydrogen production economically viable, but renewable hydrogen remains more expensive to produce than low-carbon and traditional fossil fuel hydrogen because its technology is evolving. "There's a huge cost gap at the moment," says Gawrych. "It's about how to reduce that so renewable hydrogen can become more competitive."

Falling renewable energy costs could help, and so could government subsidies and tax credits. But the most powerful way to speed up the development of clean hydrogen could be for governments to use a stick — not a carrot.

"If countries put a real cost on carbon, there will be much more incentive for big industrial users to purchase large quantities of low-carbon or renewable hydrogen to reduce their overall carbon footprint," says Gawrych. "That is what will really drive uptake globally."

The promise of hydrogen as a transformative energy source for hard-to-abate industries is significant. Technological advancements and strong government policies, including financial incentives and carbon pricing will be essential to drive the global uptake of clean hydrogen and shift away from fossil fuels.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2024 White & Case LLP

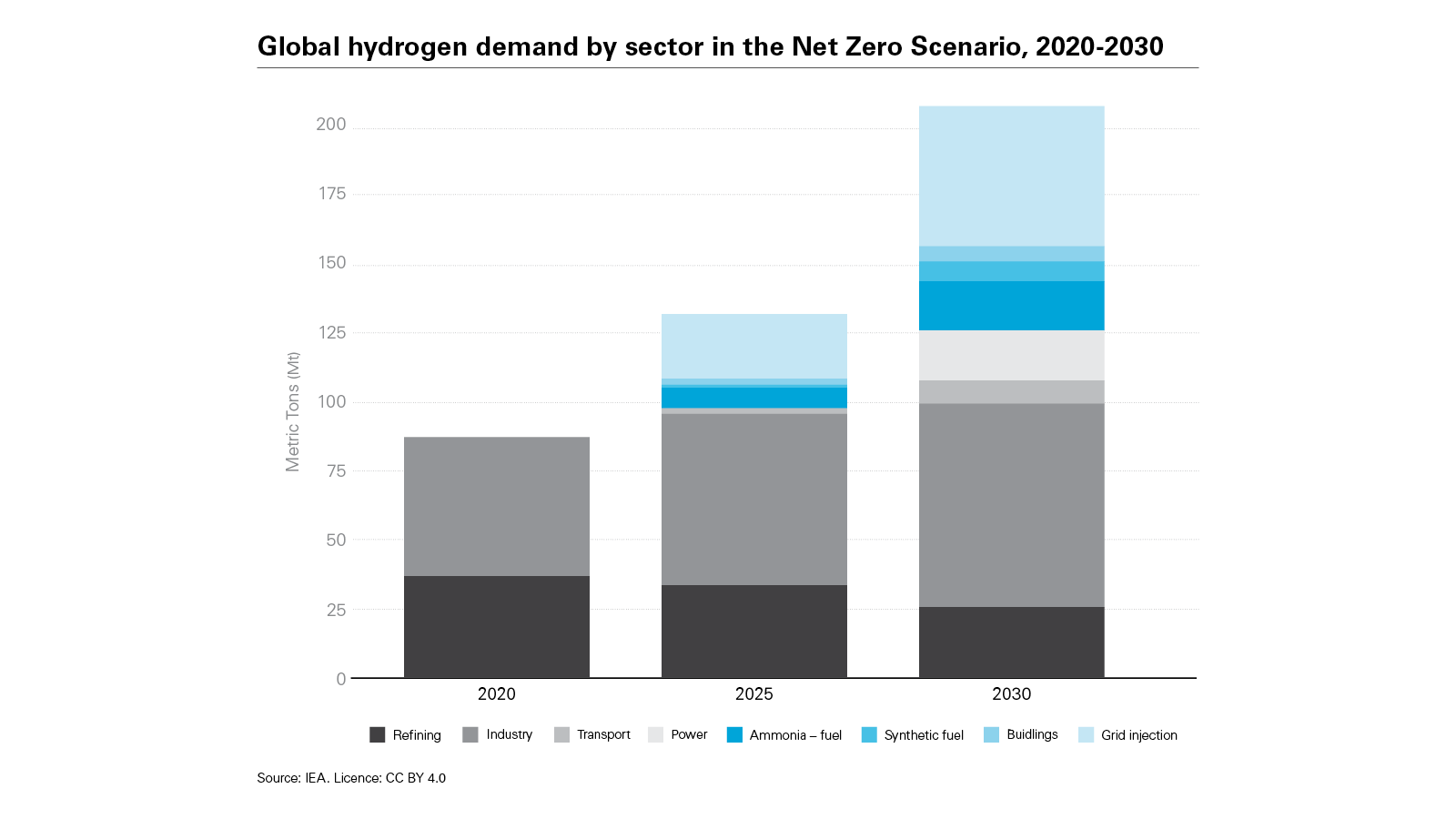

Global hydrogen demand by sector in the Net Zero Scenario, 2020-2030 (PDF)

Global hydrogen demand by sector in the Net Zero Scenario, 2020-2030 (PDF)