Dawn Raid Analysis Quarterly: 2024 Q2

White & Case Dawn Raid Analysis Quarterly (DRAQ) is an information resource on surprise on-the-spot inspections (dawn raids) across Europe. Here, we guide you through the latest updates and legal developments for 2024 Q2.

11 min read

The White & Case Dawn Raid Analysis Quarterly (DRAQ) is an information and discussion resource regarding surprise on-the-spot inspections by antitrust authorities (dawn raids) across Europe. DRAQ provides updates on recent case law, enforcement activity and trends.

Q2 2024 at a glance

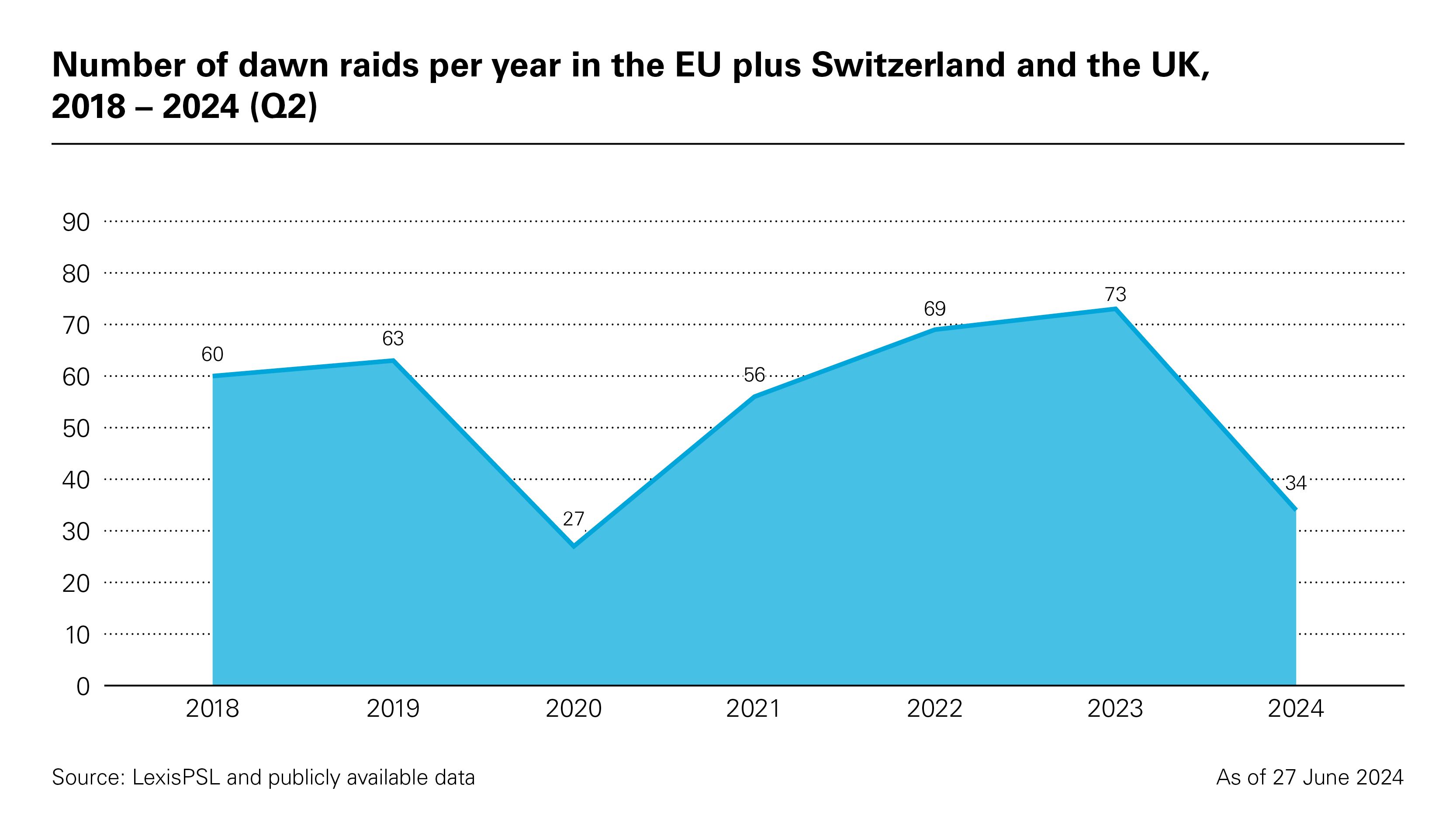

In Q2 2024, European competition regulators carried out a total of 17 dawn raids, two more than in the same period last year.

The most active regulator in Q2 2024 was the Romanian competition authority that conducted four dawn raids during the three months. The most targeted sectors in Q2 were public utilities, construction, ICT and automotive sectors (two dawn raids per sector).

Noteworthy for Q2:

- In June 2024, the European Commission raided a consultancy firm in two EU Member States on the grounds that it may have facilitated or instigated suspected price coordination amongst tyre manufacturers. The raid was an extension of an investigation that was started in January 2024 when the European Commission raided a number of tyre manufacturers in several EU Member States. Warning: The EC is prepared to dawn raid third parties that are suspected of facilitating cartels, including consultancy firms.

- In June 2024, the European Commission fined International Flavors & Fragrances (IFF) EUR 15.9 million for obstruction of a dawn raid. The European Commission found that a senior employee had intentionally deleted during a dawn raid Whatsapp messages exchanged with a competitor containing business-related information. The European Commission detected the deletion itself after the employee's mobile phone was submitted for review. After the detection, the company proactively cooperated with the European Commission during and after the raid by helping the European Commission to recover the deleted data. The European Commission reduced the final amount of fine to acknowledge the cooperation. The fine illustrates the importance of training staff that mobile phones can be the target of a raid, and that data on them, including Whatsapp messages, should not be deleted during a dawn raid.

- In April 2024, the European Commission carried out its first-ever dawn raid under the EU Foreign Subsidy Regulation (FSR). It inspected premises of a company active in the production and sale of security equipment in the EU. According to a short press statement, the European Commission stated that it has indications that the inspected company may have received foreign subsidies that could distort the internal market pursuant to the FSR. The company is currently challenging the legality of the dawn raids before the Court of Justice of the European Union.

We provide more statistics below on the number of raids and the sectors impacted, including a country-by-country list, available through our Interactive Dawn Raid map.

Key Q2 2024 legal developments

Below is a selection of key developments in Q2 2024:

- Jurisdictional limits on domestic courts when challenging the dawn raid conduct of a foreign authority

- AG Medina indicates that an authorization by the Portuguese Public Prosecutor can be sufficient to seize and search emails during a dawn raid

- Czech Supreme Administrative Court prevents the Czech Competition Authority from using dawn raids for fishing expeditions

Jurisdictional limits on domestic courts when challenging the dawn raid conduct of a foreign authority

In May 2024, the Irish High Court considered whether it had jurisdiction in proceedings concerning Ryanair's challenge to a 'dawn raid ' on its Dublin headquarters by officials from the Italian competition authority (AGCM). The judgment provides a practical examination of the Recast Brussels Regulation (Regulation) in the context of a challenge against the dawn raid conduct of a foreign antitrust authority. The Regulation governs the assignment of jurisdiction in civil and commercial disputes.

Background

Ryanair is currently the subject of an investigation by the AGCM for an alleged abuse of a dominant position. In January 2024, the AGCM requested the Irish Competition and Consumer Protection Commission's (CCPC) assistance with this investigation. As a result, the CCPC obtained a warrant from the Dublin District Court in March 2024. Later that same day, officers appointed by the CCPC, six of whom were current AGCM staff, conducted a 'dawn raid' at Ryanair's headquarters. The AGCM officials subsequently returned to Italy with the seized material.

In late March, Ryanair issued High Court proceedings seeking to quash the search warrant. Ryanair also asked the Court to deem some of the seized materials 'legally privileged', while also seeking to prevent the CCPC and AGCM from reviewing the seized material. In response, the AGCM argued that the proceedings against it should be set aside on the basis that the Irish Courts lacked authority to hear the case.

Exercise of Public Law Powers

The Court noted that if the proceedings commenced by Ryanair are civil and commercial matters, it has jurisdiction to hear the challenge under the Regulation. However, its jurisdiction does not extend to proceedings concerning revenue, customs, administrative matters, or regarding an EU Member State's liability for acts and omissions in exercising its authority.

The applicable test, thus, has two parts:

- Was the AGCM exercising public law powers?

- And if so, was it doing so only in a way available to any private individual?

The Court found that, under the Regulation, if the answers are 'yes' and 'no', the case falls outside its jurisdiction. The AGCM's actions were regarded as public law powers of investigation which were not available to private persons. Therefore, the case falls outside the jurisdiction of the Courts.

The Court emphasised the Regulation does not deny Ryanair a remedy, but rather any such remedy should be sought in the Italian courts.

Broader Consequences

This judgment provides a boost for the possibility of co-operation between national authorities regarding the enforcement of EU and/or national competition laws. It shows the potential effectiveness of the relevant provisions of Regulation 1/2003 and the ECN+ Directive in allowing for the co-operation between national competition authorities in the EU regarding purely domestic matters.

Provided by Cormac Little SC, Partner, William Fry LLP (Dublin)

AG Medina indicates that an authorization by the Portuguese Public Prosecutor can be sufficient to seize and search emails during a dawn raid

On 20 June 2024, Advocate General (AG) Medina delivered her Opinion in IMI/Synlabhealth/SIBS1 concerning three requests for a preliminary ruling from the Portuguese Competition Tribunal (Tribunal) regarding the interpretation of Article 7 of the Charter of Fundamental Rights of the European Union (Charter). The central question was whether the Portuguese Competition Authority (PCA) can, during a dawn raid, search and seize internal emails between an employee and a company on an authorisation of a Public Prosecutor as opposed to a warrant from a judge. According to the AG, EU law does not prevent Member States from requiring a national competition authority to obtain a judicial warrant to seize emails. However, the requirement should not undermine the effective application of EU competition law.

As reported in the Q3 2023 DRAQ, these requests follow a ruling by the Portuguese Constitutional Court from March 2023, declaring that e-mails are protected by the right to privacy of correspondence and that the search and seizure of e-mails in a pending competition investigation should always be authorised by a warrant issued by a judge and not merely by a Public Prosecutor. In July 2023, a second ruling by the Portuguese Constitutional Court confirmed this understanding.

AG Medina concluded:

- The fact that an email may be classified as "professional" does not deprive it of the protection which Article 7 of the Charter affords to communications. Such a protection relates to both the content of the email and the personal data relating to the traffic generated.

- A national competition authority can search and seize emails provided those emails are relevant to the subject matter of the inspection.

- There needs to be a balance between privacy rights afforded by the Charter and the importance of protecting public interest' goals. Safeguarding effective competition on a market justifies the interference with privacy rights.

- Member States are at liberty to apply a higher level of national protection for privacy rights than the one provided by EU law, i.e., by rendering it necessary for a national competition authority to obtain a prior judicial authorisation to search and seize emails during a dawn raid. However, the AG cautioned that the higher bar cannot undermine the effective application of EU competition law.

The AG proposes that the Tribunal considers two complementary paths:

- The Tribunal should make use of all the possibilities offered by national law, including, where appropriate, the possibility of an ex post judicial review of the measures in question to counterbalance the lack of prior judicial authorisation.

- In order to give full effect to Articles 101 and 102 TFEU, the referring court should also consider disapplying a national rule that would allow the interpretation adopted by the Portuguese Constitutional Court in its 2023 rulings to have a retroactive effect, the consequence of which would be to 'create a systemic risk of impunity for such offences'.

The final ruling by the Court of Justice of the European Union is expected to have an impact on limits with respect to an NCA's investigative powers and the conditions under which inspections may be deemed lawful both under national and EU law. The impact on Portuguese case-law and enforcement is substantial, potentially leading to the annulment of several PCA's decisions adopted in the last ten years, including antitrust fines imposed on companies.

Provided by Nuno Calaim Lourenço, Partner, SRS Legal (Lisbon)

Czech Supreme Administrative Court prevents the Czech Competition Authority from using dawn raids for fishing expeditions

In June 2023, the CCA carried out a dawn raid at the business premises of electronics retailer company HP Tronic Zlín, based on a mandate issued by the CCA's Chairman. The alleged anticompetitive conduct under the investigation consisted of the conclusion and implementation of prohibited resale price maintenance agreements with its customers.

The company successfully secured an order from the Regional Court in Brno declaring that the dawn raid was an unlawful interference on the basis of the CCA acting beyond the scope of the investigation. In November 2023, the Regional Court confirmed that the CCA went beyond the scope of its mandate which was limited to investigating anti-competitive conduct "from at least 2020 and in relation to the Bosch, Jata a Sogo electrical appliances". The CCA challenged this judgement before the Czech Supreme Administrative Court. In March 2024, the Supreme Administrative Court affirmed the conclusions of the Regional Court. In particular, the Supreme Court confirmed that during the dawn raid the CCA secured communication from before 2020 that was unrelated to the subject matter of the investigation. The Supreme Administrative Court highlighted that despite objections from HP Tronic Zlín, the dawn raid authorization did not justify the CCA's course of action.

The judgement of the Supreme Administrative Court comes in the context of a proposal by the CCA to extend the CCA's dawn raid powers. Therefore, and perhaps unsurprisingly, the CCA's Chairman criticized the judgment. In his keynote speech in May 2024 that the CCA will be forced to respond to this ruling. He stated that he finds it "incomprehensible" that cases in which the CCA finds as part of a dawn raid a large amount of evidence of anti-competitive conduct unrelated to the original subject-matter of the investigation, risks the court treating this as an unlawful interference on the part of the CCA. He criticized the courts for trying to impose a criminal law standard on the CCA, thereby thwarting the will of the Czech legislator.

The judgment is good news for businesses. Despite the CCA's criticism, it is expected that the authority will be more cautious in observing the boundaries of its mandated powers in any future dawn raids.

Interactive Dawn Raid map

Hover over the highlighted countries to get a closer look at the enforcement activity of the respective National Competition Authorities since 2021.

Austria2024

2023

2022

2021

Belgium2025

2024

2023

2022

2021

Bulgaria2025

2024

2023

2022

2021

Croatia2025

2024

2023

2022

2021

Cyprus2023

2022

2021

Czech Republic2025

2024

2023

2022

2021

Denmark2025

2023

2022

2021

Estonia

Finland2025

2024

2023

2022

2021

France2025

2024

2023

2022

2021

Germany2024

2023

2022

2021

Greece2025

2024

2023

2022

2021

Hungary2025

2023

2022

2021

Ireland2025

2024

2023

2022

2021

Italy2025

2024

2023

2022

2021

Latvia2025

No dawn raids for the period 2021 – 2023 Lithuania

Luxembourg2025

2024

2023

2022

2021

Netherlands2025

2023

2022

2021

Norway2025

2023

2022

2021

Poland2025

2024

2023

2022

2021

Portugal2024

2023

2022

2021

Romania2025

2024

2023

2022

2021

Slovakia2025

2024

2023

2022

2021

Slovenia2024

2023

2022

2021

Spain2025

2024

2023

2022

2021

Sweden2023

2022

2021

Switzerland2025

2024

2023

2022

2021

United Kingdom2023

2022

2021

EU2025

2024

2023

2022

2021

|

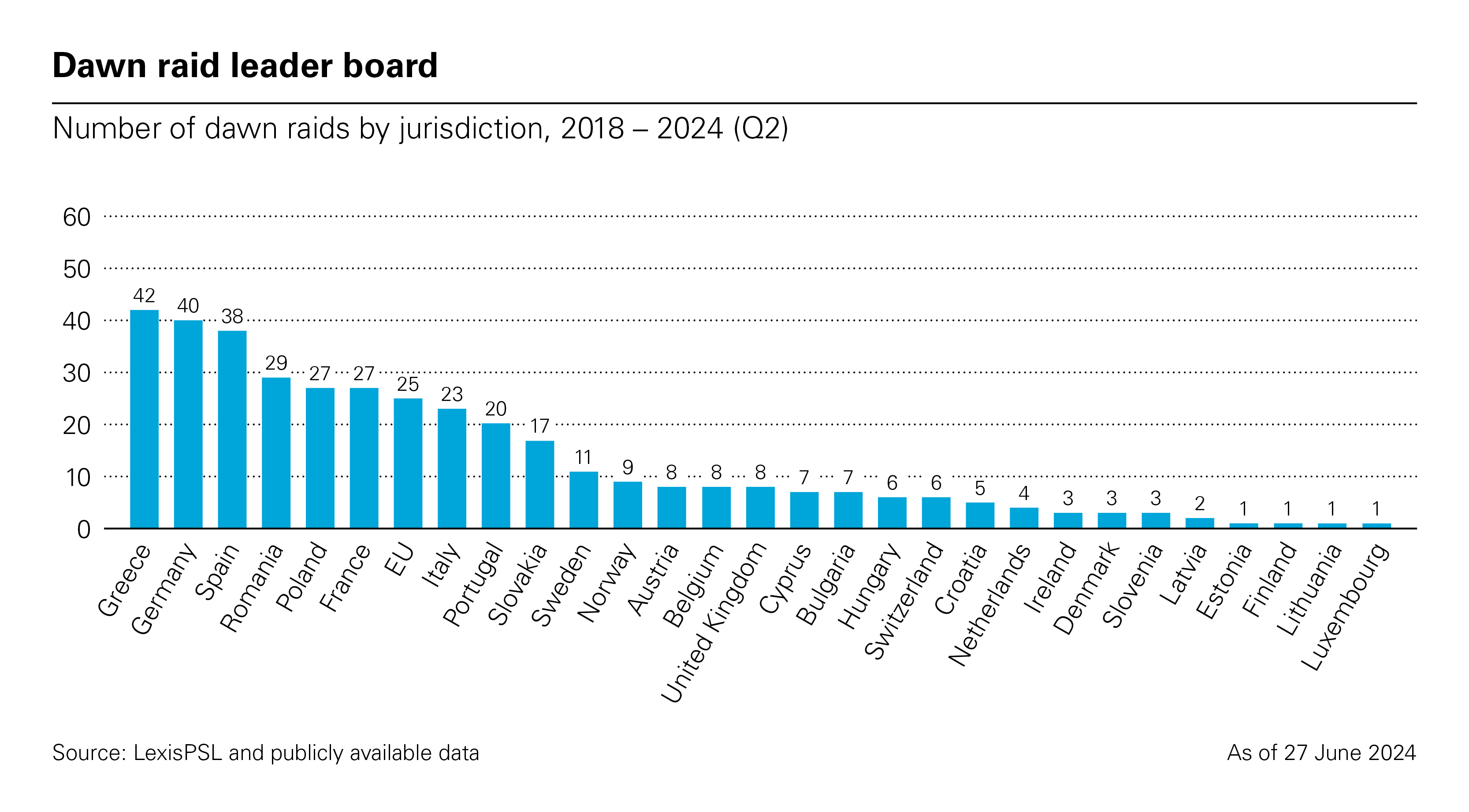

A look at the statistics

The information below has been sourced from LexisPSL, and is based on dawn raids that have been publicly announced by competition authorities. The LexisPSL information was supplemented from public sources in jurisdictions where further information was available. Since not all competition authorities announce every dawn raid, the data below likely underestimate the number of raids. The sector charts reflect dawn raids in which the sectors were identified by the competent authorities. In some jurisdictions (e.g., Germany), the authority publishes the number of raids without identifying the sector. As a result, the statistics in the charts below may underestimate the actual number of dawn raids by sector and country.

As of 27 June 2024

Source: LexisPSL and publicly available data

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

View full image: Number of dawn raids per year in the EU plus Switzerland and the UK, 2018 – 2024 (Q2) (PDF)

View full image: Number of dawn raids per year in the EU plus Switzerland and the UK, 2018 – 2024 (Q2) (PDF)

View full image: Dawn raid leader board (PDF)

View full image: Dawn raid leader board (PDF)

View full image: Number of dawn raids per year and during 2018 – 2024 (Q2) in the EU plus Switzerland and the UK (PDF)

View full image: Number of dawn raids per year and during 2018 – 2024 (Q2) in the EU plus Switzerland and the UK (PDF)