Dawn Raid Analysis Quarterly: 2023 Q4

White & Case Dawn Raid Analysis Quarterly (DRAQ) is an information resource on surprise on-the-spot inspections (dawn raids) across Europe. Here, we guide you through the latest updates and legal developments for 2023 Q4.

11 min read

The White & Case Dawn Raid Analysis Quarterly (DRAQ) is an information and discussion resource regarding surprise on-the-spot inspections by antitrust authorities (dawn raids) across Europe. DRAQ provides updates on recent case law, enforcement activity and trends.

Q4 2023 at a glance

In Q4 2023, European competition regulators carried out a total of 18 dawn raids, which is six more than in Q3. The most active regulators in Q4 were the Spanish CNMC with four dawn raids, followed by the EC, French, Italian and Slovakian competition authorities with two dawn raids each.

The most targeted sectors in Q4 2023 were the health and safety, and construction sectors (three dawn raids per sector) carried out by the EC and Slovakian, Greek, Swiss and UK competition authorities. More than half of the dawn raids in the health and safety sectors were carried out in Q4 (three out of five), and all the dawn raids in the construction sector in 2023 were carried out in Q4 alone.

Noteworthy for Q4:

- In October 2023, the EC carried out dawn raids of construction chemical companies in cooperation with the UK, Turkish and US competition authorities. This is the second coordinated dawn raid in 2023, following the EC's dawn raid on fragrances manufacturers coordinated with the UK, US and Swiss competition authorities in March 2023. This evidences that cross-border enforcement is very much alive.

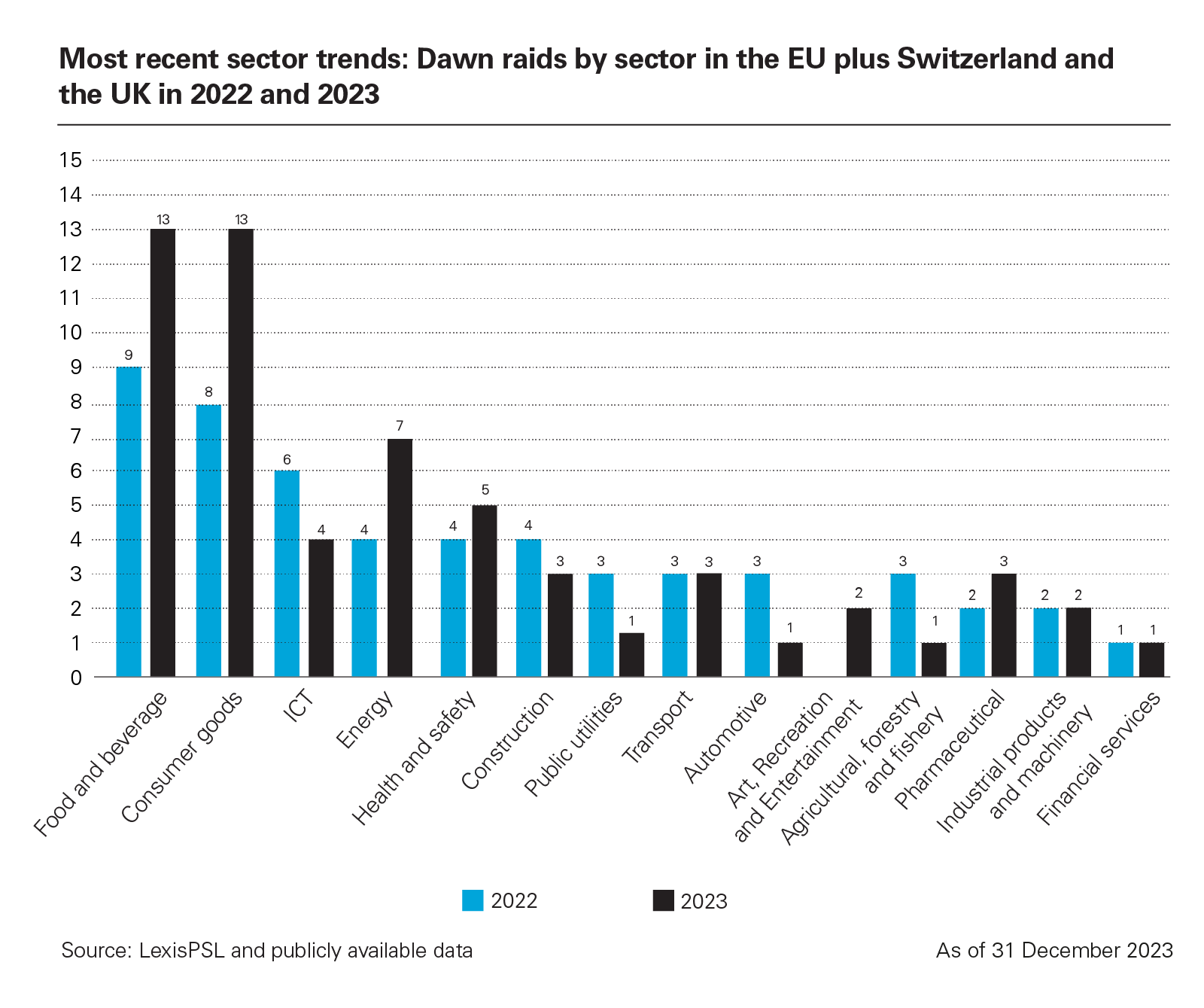

- Comparing 2023 and 2022 numbers, the number of dawn raids carried out in 2023 and 2022 are broadly in line. European competition authorities carried out 62 dawn raids in 2023, which is just two fewer than in 2022 (64 dawn raids).

Outlook for 2024:

- There was an increase of dawn raids in consumer industries in 2023 in comparison to 20221, and we expect this trend to continue in 2024. Throughout 2023, the EC has been promising an "increased focus on cases that are relevant for the cost-of-living crisis." The 2023 data suggests that these promises were not empty, as regulators have indeed been targeting consumer industries, likely in recognition of the cost-of-living crisis. One of the causes for the cost-of-living crisis has been spikes in inflation. The ECB expects inflation to reach a target of 2 per cent only at the end of 2025, which can be an indicator that dawn raids will continue in 2024.

We provide more statistics below on the number of raids and the sectors impacted, including a country-by-country list, available through our Interactive Dawn Raid map.

Key Q4 2023 legal developments

Below is a selection of key developments in Q4 2023:

- The French Constitutional Council rejects the proposal to extend LPP to in-house lawyers

- Labour market-related anti-competitive restrictions are increasingly on the antitrust watchdog radar

- UK CAT confirms a higher standard of proof must be met for dawn raids of domestic premises

- Can antitrust investigators access correspondence during a dawn raid? Bulgarian preliminary ruling request regarding seizure of personal chats from Viber application

The French Constitutional Council rejects the proposal to extend LPP to in-house lawyers

As reported in the Q3 issue of the DRAQ, the French Parliament adopted a bill including provisions aiming to protect, under certain conditions, the confidentiality of certain in-house legal consultations. For the law to come into force, this must first be validated by the French Constitutional Council and then promulgated by the French President.

In November 2023, the Constitutional Council rejected this proposal, on the basis that the provisions were not compliant with the French Constitution. The Constitutional Council held that the inclusion of these provisions in the law were a "legislative rider" (cavalier législatif). The Constitutional Council found that the extension of the LPP to in-house lawyers did not have a sufficient connection to the original purpose of the bill, which it construed narrowly. However, this does not mean that the proposal is dead. It is expected that the provisions will be re-introduced in a new bill and re-adopted, and hopes for the LPP extension remain high.

Labour market-related anti-competitive restrictions are increasingly on the antitrust watchdog radar

In the period between 2022 and 2023, European regulators initiated or concluded 22 investigations in relation to labour market-related anti-competitive practices, in comparison to four in the period between 2020 and 2021. This clearly evidences that there is an increasing consensus among European competition authorities that labour market-related restrictions can breach competition law. This includes non-poach agreements, wage-fixing, exchange of information about terms and conditions of employment, and non-compete clauses.

The EC's first-ever dawn raid in relation to non-poach deals in November 2023 underlines this trend. The EC investigated companies active in the online food delivery sector over allegations that they had agreed not to poach each other's employees. This is the third labour market-related investigation of Q4. In November 2023, the French Competition Authority sent a statement of objections to various businesses in the engineering, technology, consulting and IT service sectors over alleged non-poach arrangements aimed at restricting each other from soliciting and hiring the firms' respective personnel. In October 2023, the Czech Competition Authority concluded an investigation in relation to possible employment-related anti-competitive restrictions contained in the Association of Czech Travel Agencies' code of ethics.

For more information, see White & Case heatmap of antitrust and labour developments (the WHALD).

UK CAT confirms a higher standard of proof must be met for dawn raids of domestic premises

In October 2023, the Competition Appeal Tribunal (CAT) heard an ex parte application by the Competition and Markets Authority (CMA) for warrants to dawn raid business and domestic premises.

The applications for warrants for the business premises were ultimately granted but the CAT has made some important observations on the standards necessary to allow a dawn raid of a domestic premises, which is all the more relevant in the era of hybrid and home working.

The CMA can apply to the court for a search warrant where it had "reasonable grounds" to suspect an infringement of Chapter I or Chapter II of the Competition Act 1998. The CAT was happy that this requirement was clearly met in this case and was also satisfied that the CMA had reasonable grounds for suspecting that there were documents at both the domestic and business premises in question that fell within the CMA's search powers.

At issue, therefore, was whether the CMA had successfully satisfied the CAT that there were reasonable grounds for suspecting that the documents at issue would not be produced if they required them but rather "would be concealed, removed, tampered with or destroyed".

As the suspected infringement involved a secret cartel, the CAT was satisfied that there were such grounds in respect of the business locations. However, the CAT was clear that the search of domestic premises "obviously requires a higher order of scrutiny" both generally and under Article 8 of the European Convention on Human Rights, as incorporated in the Human Rights Act 1998, which guarantees a right to respect for private and family life.

The CMA sought only to rely on the nature of the cartel, it had no supplementary evidence of the documents in question being imperilled. Whilst acknowledging that this was a very high burden to satisfy, the CAT nonetheless required that "something more to suggest a propensity to destroy" when the CMA is planning to dawn raid someone's home.

As recognised by the CAT, this is a very high burden to meet. Nevertheless, the CAT pointed out that given the evidence at issue was realistically contained in electronic devices belonging to the individual in question, the CMA had other means of restoring them if deleted (with the costs to fall on the deleting party) and could draw inferences against any failure to produce in full.

Interestingly, the CMA also applied to the CAT to request that the judgment not be published on grounds that it would undermine the CMA's ability to obtain warrants for domestic premises in future. The CAT rejected that application.

The case shows that Courts will continue act to protect fundamental rights – something that may limit the global trend of increased enforcement powers for competition authorities. Going forward, even in secret cartel cases, domestic warrants will not be granted lightly. To get warrants to search people's homes, the CMA will need to show that there are good grounds for suspecting destruction of evidence. This would notably be the case if some documents exist only in hard copy or if they are only on someone's personal devices and not backed up on the company’s server.

Can antitrust investigators access correspondence during a dawn raid? Bulgarian preliminary ruling request regarding seizure of personal chats from Viber application

The Court of Justice of the European Union (the CJEU) has recently opened proceedings on Case C-619/23 (Ronos) following the receipt of a request for a preliminary ruling by the Administrative Court of Sofia District. The referring court requested interpretation of the scope of powers of the Bulgarian national competition authority, the Commission on Protection of Competition (the CPC) to access personal correspondence during dawn raids carried out at premises of undertakings investigated for alleged cartel infringements.

In particular, the referring court requested clarification of the relationships between the safeguards for fundamental rights enshrined in the Bulgarian Constitution and provisions of EU law. The Bulgarian Constitution provides a higher standard of protection of correspondence as compared to EU law. Pursuant to the Bulgarian Constitution, the inviolability of correspondence may be limited only if two cumulative prerequisites exist: (i) the authorisation to access correspondence is granted by a judge, and (ii) the purpose of the authorisation is to prevent serious criminal offences.

In the Ronos case, inspectors from the CPC reviewed the laptop of the company's managing director and made screenshots of Viber messages containing personal communication. Later, during the inspection, the CPC inspectors found out that the chat in the Viber application was deleted from the laptop. It turned out that the deletion was made remotely from the managing director's mobile phone linked to the Viber application. In subsequent proceedings, the CPC imposed penalties for obstructing the dawn raid.

In the context of appeals of the fining decision by the CPC, the referring court established that although alleged cartel infringements constitute the most serious form of violation of competition law, they are not criminal offences within the meaning of Bulgarian law. Therefore, the powers of the CPC inspectors to access and copy correspondence during cartel investigations contradict the standard of protection enshrined in the Bulgarian Constitution. The referring court however also noted that if it were to apply the constitutional standard of protection, it would also disapply the relevant provisions of EU law (namely Article 6 in conjunction with Article 3 of Directive (EU) 2019/1), thereby failing to comply with its obligation to ensure the full effectiveness of those provisions.

Although the referring court seeks interpretation of the relevant rules with respect to private communication only, the proceedings before the CJEU may have broader consequences because the context of the referral and the reasoning of the referring court does not seem to be limited to private correspondence only. At a minimum, the outcome of the proceedings may limit the ability of the CPC to actively seek access to data carriers for personal communication and review their content (even if personal communication is thereafter excluded from the pool of evidence, which has been the practice of the CPC to date). However, since the Bulgarian Constitution does not limit the protection which it affords to private correspondence only, what might be at stake in the proceedings is more broadly the ability of the CPC to access correspondence, either private or business, in the context of antitrust investigations.

Contributed by Dessislava Iordanova and Nikolai Gouginski, DGKV, Bulgaria

1 13 dawn raids each in food and beverage and consumer goods in 2023 in comparison to eight and nine in 2022.

Interactive Dawn Raid map

Hover over the highlighted countries to get a closer look at the enforcement activity of the respective National Competition Authorities.

Austria2024

2023

2022

2021

Belgium2025

2024

2023

2022

2021

Bulgaria2025

2024

2023

2022

2021

Croatia2025

2024

2023

2022

2021

Cyprus2023

2022

2021

Czech Republic2025

2024

2023

2022

2021

Denmark2025

2023

2022

2021

Estonia

Finland2025

2024

2023

2022

2021

France2025

2024

2023

2022

2021

Germany2024

2023

2022

2021

Greece2025

2024

2023

2022

2021

Hungary2025

2023

2022

2021

Ireland2025

2024

2023

2022

2021

Italy2025

2024

2023

2022

2021

Latvia2025

No dawn raids for the period 2021 – 2023 Lithuania

Luxembourg2025

2024

2023

2022

2021

Netherlands2025

2023

2022

2021

Norway2025

2023

2022

2021

Poland2025

2024

2023

2022

2021

Portugal2024

2023

2022

2021

Romania2025

2024

2023

2022

2021

Slovakia2025

2024

2023

2022

2021

Slovenia2024

2023

2022

2021

Spain2025

2024

2023

2022

2021

Sweden2023

2022

2021

Switzerland2025

2024

2023

2022

2021

United Kingdom2023

2022

2021

EU2025

2024

2023

2022

2021

|

A look at the statistics

The information below has been sourced from LexisPSL, and is based on dawn raids that have been publicly announced by competition authorities. The LexisPSL information was supplemented from public sources in jurisdictions where further information was available. Since not all competition authorities announce every dawn raid, the data below likely underestimate the number of raids. The sector charts reflect dawn raids in which the sectors were identified by the competent authorities. In some jurisdictions (e.g., Germany), the authority publishes the number of raids without identifying the sector. As a result, the statistics in the charts below may underestimate the actual number of dawn raids by sector and country.

As of 31 December 2023

Source: LexisPSL and publicly available data

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

View full image: Number of dawn raids per year, 2018 – 2023 ytd (PDF)

View full image: Number of dawn raids per year, 2018 – 2023 ytd (PDF)

View full image: Number of dawn raids by jurisdiction, 2018 – 2023 ytd (PDF)

View full image: Number of dawn raids by jurisdiction, 2018 – 2023 ytd (PDF)

View full image: Number of dawn raids per year, 2018 – 2023 ytd (PDF)

View full image: Number of dawn raids per year, 2018 – 2023 ytd (PDF)

View full image: Dawn Raid tracker by sector, 2018 – 2023 ytd (PDF)

View full image: Dawn Raid tracker by sector, 2018 – 2023 ytd (PDF)

View full image: Most recent sector trends: Dawn raids by sector in the EU plus Switzerland and the UK in 2022 and 2023 (PDF)

View full image: Most recent sector trends: Dawn raids by sector in the EU plus Switzerland and the UK in 2022 and 2023 (PDF)