Battery energy storage systems: a complex but promising route to clean-energy transition

6 min read

For investors, excitement in the renewable energy landscape is palpable. Renewable energy capacity is being added to the world's energy systems at the fastest rate in two decades, prompting the International Energy Agency to revise its forecasts for 2027 upwards by 33 per cent. However, further growth will depend on investment in a key technology: battery storage.

Finding ways to store energy is critical to stabilising the power grid as it accommodates increasing volumes of energy from sources with unpredictable outputs, such as wind and solar. A utility-scale battery energy storage system (BESS) can stabilise the unstable, build grid resilience and enhance efficiency. These capabilities have prompted predictions that the market will be worth $150bn by 2030.

Even so, the global BESS market is highly complex and is dependent on many players in multiple jurisdictions. Developers and investors face regulatory challenges, lack of standardisation and the need to adapt to unfamiliar business models. Countries also face potential disruptions due to highly concentrated supply chains. For example, the US imports 90 per cent of battery storage equipment from China, while for Europe the figure is 80 per cent. Accelerating domestic production of equipment would help increase supply chain diversification and resilience.

And while governments understand that rapid expansion of battery-storage infrastructure underpins the growth of their renewables sectors, the drivers of demand for BESSs vary by region. All this makes for a market that, while promising, is not for the faint-hearted.

Disparities in demand

The first challenge for developers and investors is diversity of demand. European renewables markets are highly fragmented, for example, with regional variations in supplies of wind and solar power driving demand for BESSs. Yet these regional and local complexities only serve to increase the need for BESS projects.

In Germany, for example, BESS projects are needed to balance a geographical split in supply and demand since wind-generated power is abundant in the north but not in the south. "There's high demand for battery storage to balance the system," says Florian Degenhardt, who heads White & Case's German project finance practice. "So, in Germany, big infrastructure investors are coming into the battery storage market."

Meanwhile, in the Middle East, the availability of land and sunshine have encouraged development of fewer but extremely large-scale solar projects. "Right now, for example, Abu Dhabi has two large plants not far from each other," explains UAE-based Yasser Riad, a partner in White & Case's project development and finance group. "So, if you have cloud cover in the area, you've taken off two gigawatts of capacity in one go."

Whether the need is balancing a geographic demand-supply mismatch in Germany or mitigating the risk of power outages in the Middle East, BESSs are an essential cog in the clean energy machine.

Policy complexity

While demand is high, regulatory uncertainties and varying use of the policy tools that promote renewable energy uptake can deter investors.

Variations in the use of policy tools often relate to differences in countries' levels of progress on the clean energy transition. For example, in the Middle East, ambitious net-zero pledges are driving governments to develop regulations that support BESS investments. Yet policy frameworks remain works-in-progress that, at this point, mainly take the form of high-level papers. "We'll see a lot of regulations coalescing around these shortly," says Riad. "But it's still nascent in the Middle East."

Meanwhile, in Europe, policy variations across jurisdictions can be challenging for investors. For example, capacity auction systems, which help governments secure clean power at competitive prices, are used to different degrees across Europe. "You have huge battery developments in the UK based on the capacity auction system," says Degenhardt. "But, so far, we do not have an EU-wide common approach that would help further the development of reliable revenue streams."

In the US, the Biden administration's Inflation Reduction Act has transformed investment prospects for clean energy, including in BESSs. For example, the IRA includes a tax credit for battery storage if it is part of a rooftop solar installation or another form of renewable energy investment.

However, even here, uncertainty looms. A change of administration in November's presidential election could dampen prospects for BESS investors if a new administration scraps the IRA's tax breaks and subsidies.

Business model diversity

Business models also vary widely. In Australia, interest in BESS projects first emerged as a response to power outages. Battery storage filled gaps in transmission and distribution infrastructure, which was originally built around the nation's coal-fired power stations but was straining to support the rapid deployment of variable wind and solar farms.

Things have progressed since then, says Ged Cochrane, executive partner in White & Case's Melbourne office, with investments in large-scale storage solutions helping to accelerate the country's energy-transition. Grid stability remains important, but investors are increasingly focused on using batteries to meaningfully shift daytime solar production into the evening peak and to open new commercial opportunities, such as long-term, fixed volume green energy supply agreements between generators and end-users, including mines, data centres and large industrial groups.

In the Middle East, business models tend to be relatively simple. Often, a single procuring entity purchases energy from all projects, whether renewable generators or battery storage systems. Projects are in their infancy, but Riad believes a capacity-based business model will emerge in which generators are paid to provide a predetermined amount of power, giving price certainty to developers or owners of the asset.

In European markets, where investors include project developers, infrastructure funds, asset managers, and utilities that are acquiring BESS projects, the challenge is unpredictable revenue streams. On the one hand, grid-balancing services, which ensure electricity demand matches supply at any given time, can mitigate these risks. On the other, relatively short battery storage revenue contracts, which provide flexibility to grid operators, can make it tough for European BESS projects to attract longer-term investment.

Opportunities that are worth the risks

Batteries are getting larger and larger, and they're becoming more efficient every year, which is incredibly important for the bottom line

While the BESS market presents challenges for developers and investors, its growth looks unstoppable, propelled by regulators who recognise the need to create the right incentives for the private sector, and battery storage technologies, which are rapidly improving.

First, capacity concerns are fading. "Batteries are getting larger and larger," confirms Cochrane. "And they're becoming more efficient every year, which is incredibly important for the bottom line."

Meanwhile, one interesting option is co-location through strategic partnership or acquisition. When situated near or sharing a site with renewables generation, BESSs can share grid-connection points, improve pricing through arbitrage and increase revenue through the sale of ancillary services and firm volume offtake products.

Most compelling, however, is the inextricable link between clean energy expansion and BESSs. Shifting political winds and fragmented markets may not, in the end, disrupt the growth of a market that is meeting an essential need.

While opportunities and policy frameworks vary, one pressure point will continue to drive investment in BESSs: looming net-zero goals. "All sectors have to use green energy," says Degenhardt. "So, BESSs offer a great opportunity to invest for the next five to 10 years."

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2024 White & Case LLP

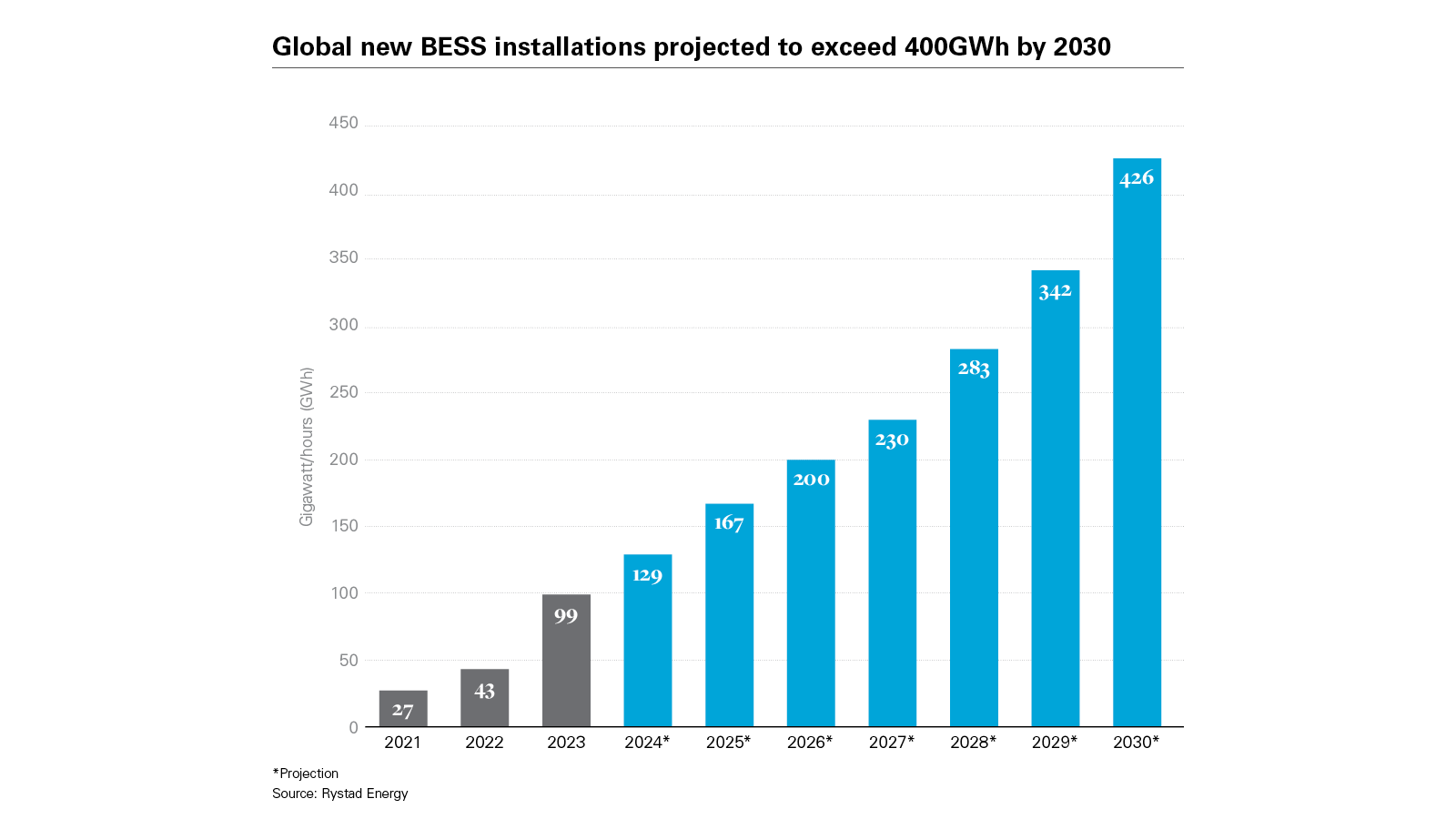

Global new BESS installations projected to exceed 400GWh by 2030 (PDF)

Global new BESS installations projected to exceed 400GWh by 2030 (PDF)