Our Public Takeover Report provides an overview of market trends and legal developments relating to public takeovers in Germany in 2024.

In this issue…

- A quick glance at the takeover market

- Key takeover market figures for 2024

- Reviewing the most significant takeover and delisting procedures in 2024

- Warning signs in advance of a takeover transaction

- Statements by the target company

- Changes to the legal framework in takeover law

- Judgments relevant for takeovers in 2024

- Outlook

A quick glance at the takeover market

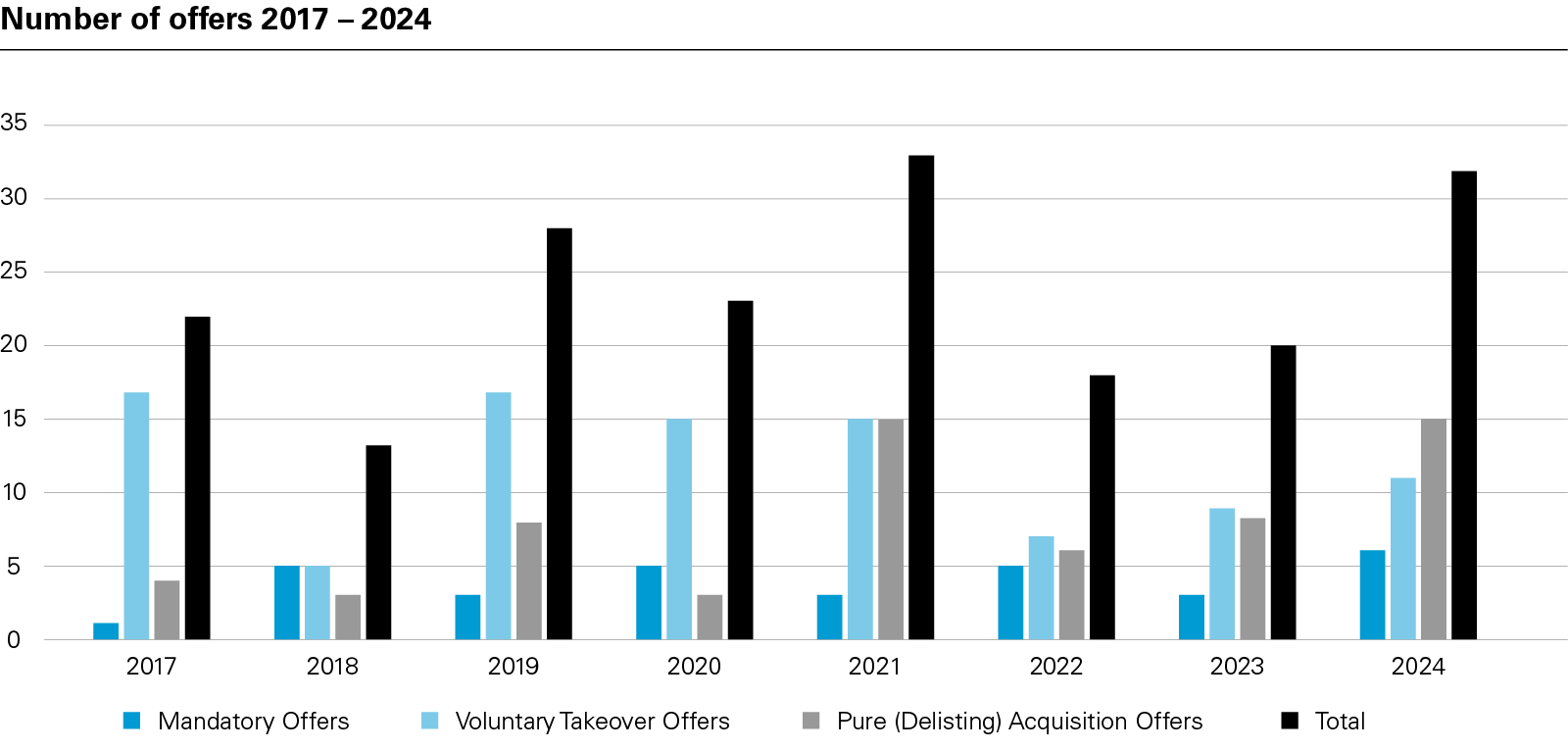

With six delisting offers and one mandatory offer, the German market for takeovers of listed companies (public takeovers) had a rather unspectacular start to 2024. Ultimately, there were 20 delisting offers (out of a total of 32 procedures) in 2024 - evidence of a stronger trend towards going private or at least downlisting. Significant takeover procedures were rare, but they received extensive coverage in the German financial media.

Takeovers of German listed companies in the media

The offer by Novartis for MorphoSys, announced in early April, was the first public takeover in 2024 to attract media attention. Valued at EUR 2.7 billion, the takeover offer was preceded by a bidding contest, although it did not result in the publication of any competing offers.

April also saw the first offer involving a financial investor: the multi-billion-euro takeover offer by KKR and Viessmann for Encavis, a wind and solar farm operator listed on the SDAX. Interestingly, KKR launched its offer in collaboration with a family-owned company, which is a rare combination in the German takeover market. Encavis's shareholder Abacon openly welcomed the offer and announced that it would retain a 13% shareholding. Following the successful takeover, the delisting offer to Encavis's shareholders was published in late 2024.

The offer by UAE-based ADNOC for Covestro, the DAX 40 group that originated from Bayer's spin-off of its former plastics division in 2015, attracted significant attention. This transaction, heralded as a milestone in German economic history, also faced intense public scrutiny.

In November, TA Associates, a U.S.-based financial investor, published a takeover offer with a transaction volume exceeding EUR 1 billion for Nexus, a software provider specialising in hospitals. Shortly before Christmas, CVC published a takeover offer for CompuGroup Medical, also exceeding EUR 1 billion, excluding non-tender agreements with certain shareholders.

In September 2024, Italy's UniCredit caused a stir by acquiring roughly 20 % of the shares of its competitor Commerzbank. An ownership control procedure (Inhaberkontrollverfahren) was initiated as a precaution, given UniCredit's intention to further expand its holding to 29.9%. Both the German government and Commerzbank have so far been opposed to a potential takeover by UniCredit.

Two other significant takeover transactions were announced in the third quarter of 2024. In November, Remondis subsidiary TSR Recycling and Papenburg declared their intention to acquire Salzgitter.

In December, ABOUT YOU Holding SE (ABOUT YOU) and Zalando SE announced that they had entered into a business combination agreement. White & Case is advising ABOUT YOU on the matter. On 20 January 2025, Zalando published a voluntary public takeover offer to ABOUT YOU shareholders for the purchase of all shares at EUR 6.50 per share. The total transaction value is approximately EUR 1.1 billion. ABOUT YOU's major shareholders, along with all three of its founders and management board members, had previously made an irrevocable commitment to sell all of their shares at the offer price.

Key takeover market figures for 2024

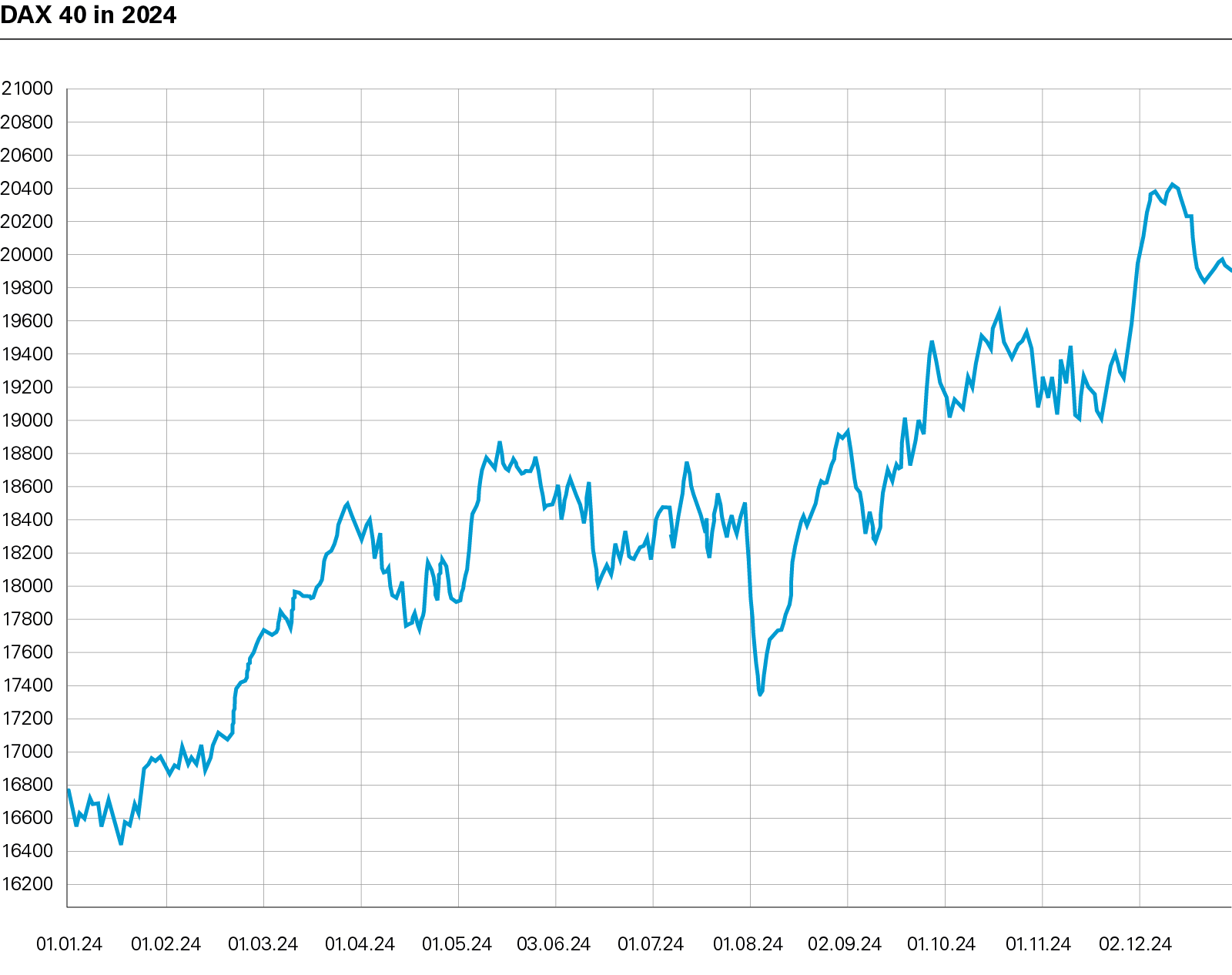

In 2024, the DAX 40 increased by over 20%, surpassing 3,500 points with steady growth despite occasional downturns. The market for public takeovers rebounded from recent weaker years and was notably more active in 2024, even with above-average stock prices increases.

The number of public takeover transactions increased to 32, representing a growth of more than one-third compared to the previous year (2023: 20 transactions). Of these, only 12 were voluntary takeover offers, while four were mandatory offers, remaining the exception in takeover procedures.

In recent years, the number of delisting procedures in the public takeover market has risen. This trend continued in 2024, with nearly half of the transactions involving pure delisting acquisition offers. There were also five combined delisting acquisition offers – three paired with a voluntary takeover offer and two with a mandatory offer. Overall, bidders planned a delisting in more than 60% of all takeover cases in 2024.

Transaction volume

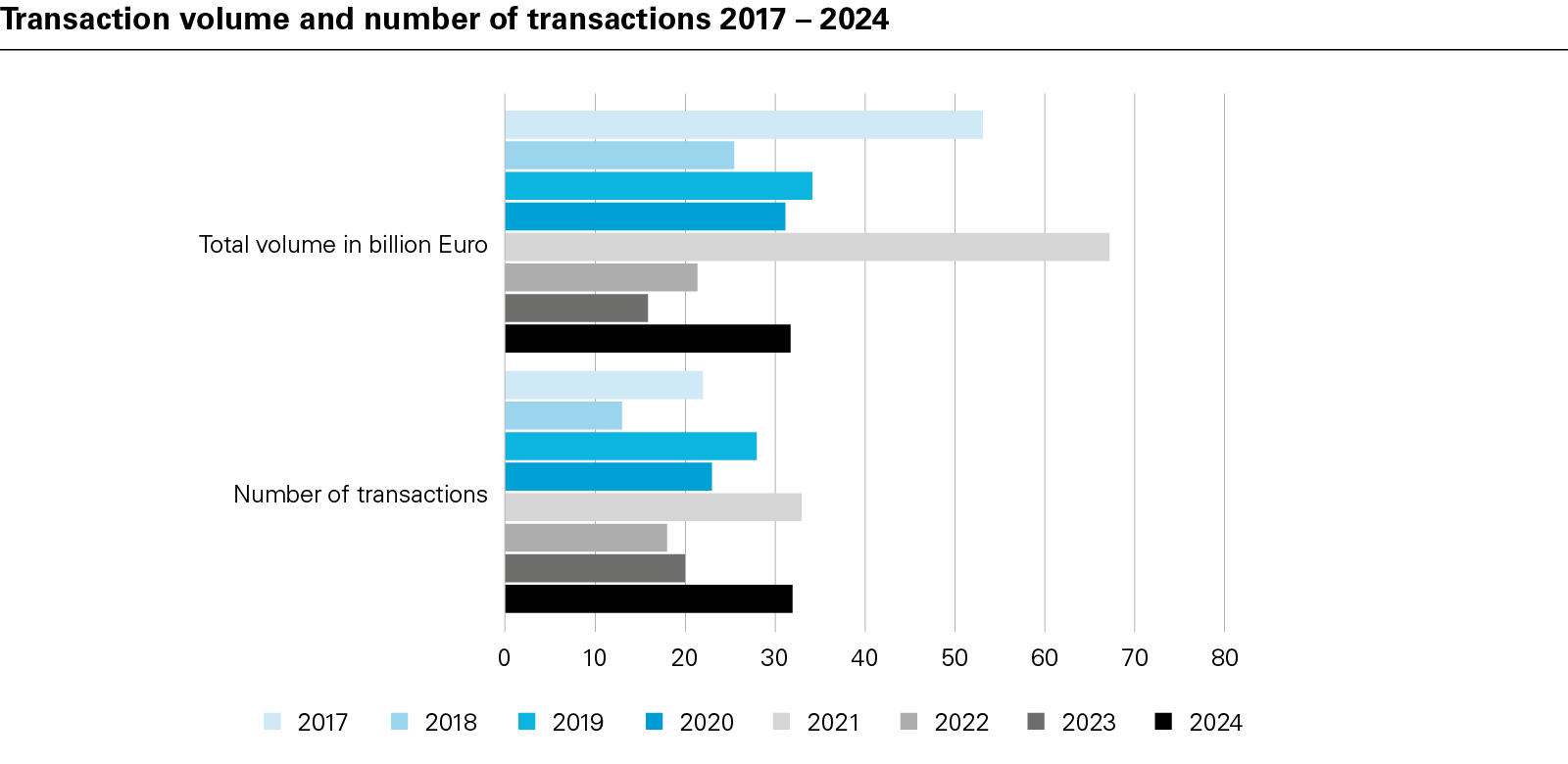

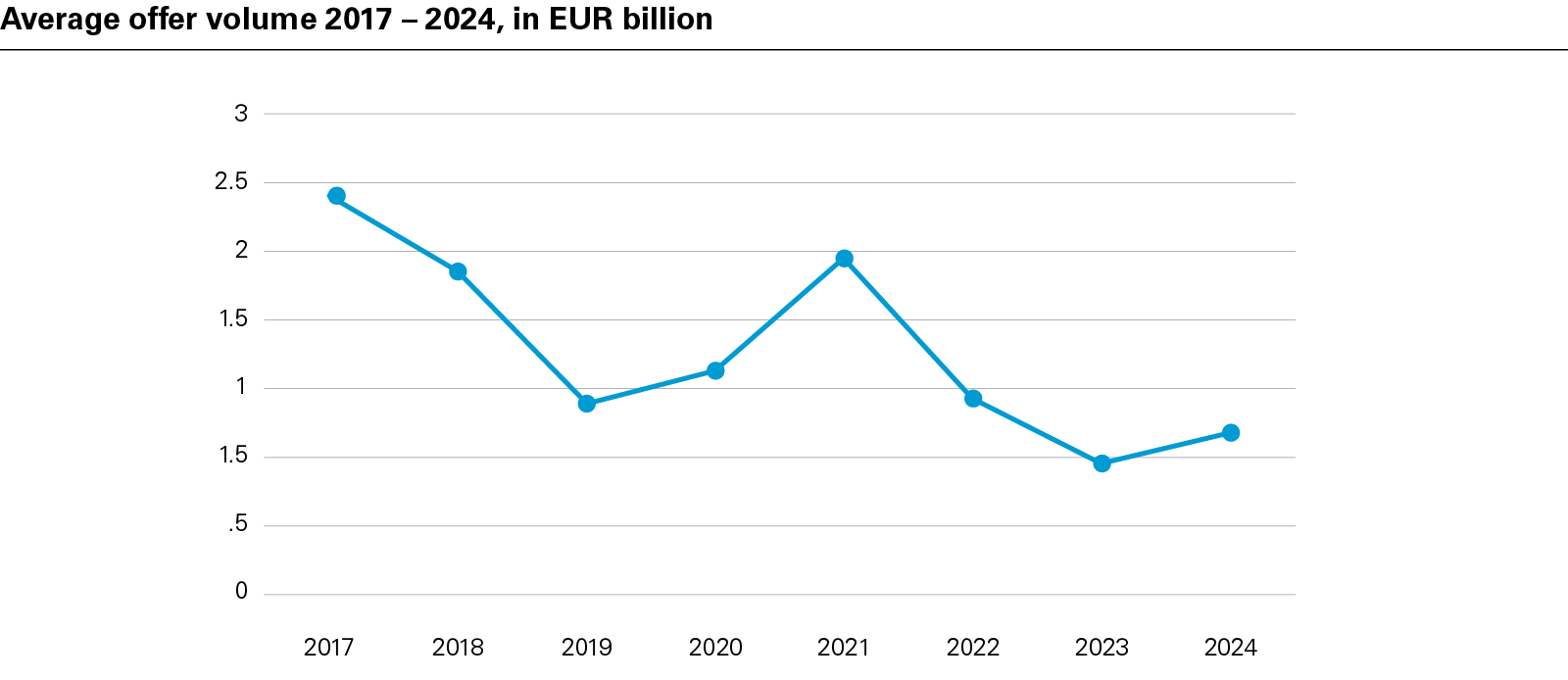

In 2024, the transaction volume in the public takeover market doubled year on year, increasing to EUR 31.78 billion (2023: EUR 15,9 billion).

While it may appear at first glance that the takeover market was more active than the preceding year, only seven of the 32 offers exceeded a total volume of more than EUR 1 billion. Furthermore, just two transactions – the takeover offer for Covestro and the delisting offer made to the minority shareholders of Telefónica Deutschland, which together amounted to EUR 18.214 billion – accounted for approximately 60% of the total transaction volume in 2024. Accordingly, despite the slight year-on-year rise, 2024 represents a continuation of the long-term trend of low average transaction volume.

Bidder structure

A look at the bidder structure in the market highlights the significant role played by private equity firms in public takeovers. Private equity players were responsible for more than one-third of offer procedures (12 of 32 offers), including three of the seven offers with a transaction volume of more than EUR 1 billion (CVC Capital Partners for CompuGroup Medical, TA Associates for Nexus, and KKR for Encavis). However, strategic investors led in terms of transaction volume. Just four offers, totalling approximately EUR 23.4 billion – for Covestro (by ADNOC), MorphoSys (by Novartis – two offers: a takeover offer followed by a delisting offer) and Telefónica Deutschland (by Telefónica S.A.) – accounted for more than 70% of the total market in 2024. In terms of target company selection, there was no discernible sectoral focus in 2024.

Consideration

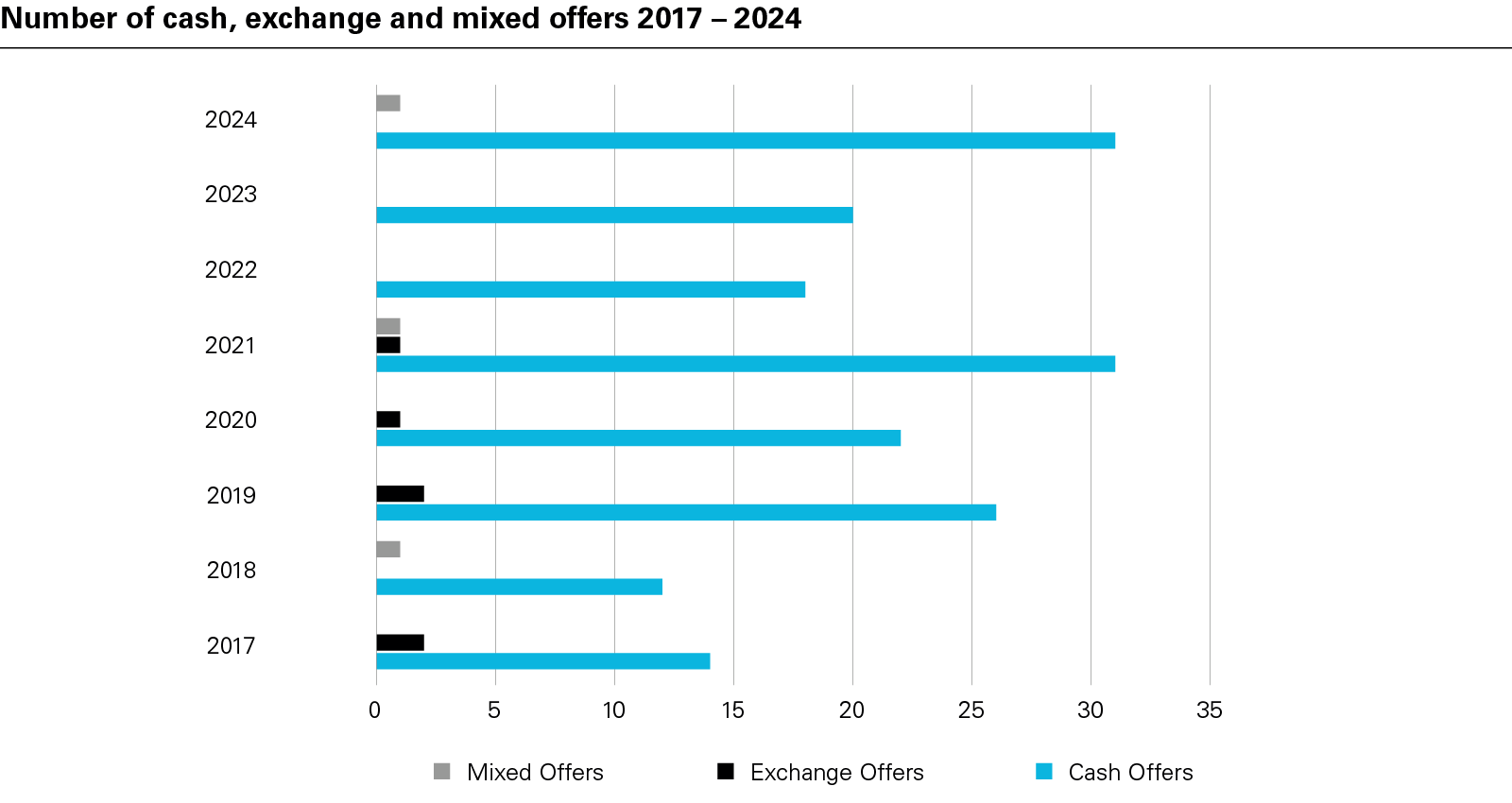

Cash offers remain the standard and exchange and mixed offers the exception. As in 2022 and 2023, no exchange offers were published last year, probably due to the stringent liquidity requirements when shares are offered as consideration. Only Kontron's combined mandatory and delisting offer to the shareholders of KATEK SE provided for mixed consideration – but with the special feature that different forms of consideration were offered as alternatives to meet the statutory requirement that delisting offers may be cash offers only. KATEK-shareholders could choose between the legally mandatory cash consideration and a "voluntary alternative consideration" in the form of shares of the bidder's company.

What premiums were paid by bidders?

Significant premiums were once again the exception in 2024. In one-third of cases, shareholders received either no premium or only a small premium (<5%) over the statutory minimum price (i.e., the value of the highest consideration granted or agreed for shares in the target company by the bidder or a person acting jointly with the bidder in the six months preceding the publication of the offer document). Often, the consideration was dictated by the statutory minimum price. Exceptions which had positive implications for the shareholders concerned – with premiums above the legally relevant average price (i.e. the weighted average domestic stock exchange price during the last three months prior to the publication of the decision to make an offer) – were the offers for ABOUT YOU (107.01%; announced in December 2024 and published in January 2025), CompuGroup Medical (51.2%), NEXUS (35.32%), infas Holding (37.01%), Philomaxcap (49.25%), Stemmer Imaging (41.26%), Encavis (33.10%) and CropEnergies (36.74%). Notably, the voluntary takeover offer for MorphoSys AG published on 11 April 2024 offered a cash consideration of EUR 68.00, which exceeded the closing price on the Frankfurt Stock Exchange on the last trading day before the offer announcement by about 61.29%. Taking into account the volume-weighted three-month average price, which is decisive in setting the minimum price, the premium amounted to an impressive 136.11%.

Prohibitions and exemptions

As in 2023, no offers were prohibited by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin) in 2024 (there was one prohibition in 2022). BaFin published ten exemption decisions during the year, and none of them were noteworthy. In nearly half of these cases, the reason for the exemption was inheritance.

Reviewing the most significant takeover and delisting procedures in 2024

ADNOC acquires Covestro

The takeover of Covestro by the Abu Dhabi National Oil Company (ADNOC), with a transaction volume exceeding EUR 11.7 billion, dominated the takeover market in 2024 due to its size and media attention. ADNOC views the acquisition as part of its international growth strategy, aiming to become one of the world's largest chemical companies. Covestro and ADNOC concluded an investment agreement on 1 October 2024, outlining the main conditions of the transaction, mutual commitments and intentions, as well as a shared understanding of Covestro's future organisational structure, corporate governance and business operations. Covestro's management board and supervisory board expressed unanimous support for the offer in a joint statement, supported by four fairness opinions from Goldman Sachs, Perella Weinberg, Macquarie and Rothschild. The terms of the offer included a minimum acceptance threshold of 50% + one share, which was surpassed with an acceptance rate of 60.39% by the end of the acceptance period. By the conclusion of the additional acceptance period on 16 December 2024, the bidder had acquired a 91.32% stake in Covestro's share capital. However, the antitrust and foreign trade reviews are still ongoing. The offer document stipulated a long-stop date of 2 December 2025, by which all closing conditions must be met.

Novartis acquires MorphoSys

The offer for the pharmaceutical company MorphoSys was preceded by a behind-the-scenes bidding war. Novartis initiated talks with MorphoSys about a "strategic transaction" during the fourth quarter of 2023, signing a confidentiality agreement on 27 November 2023. On 22 December 2023, Novartis discovered that a third party (according to media reports, the pharmaceutical manufacturer Incyte) was preparing a takeover offer for MorphoSys. Novartis conducted due diligence and submitted a non-binding takeover offer to MorphoSys on 3 January 2024. This process led to an exclusivity agreement on 15 January 2024, followed by a merger agreement on 5 February 2024. The same day, the notification required by section 10 of the German Securities Acquisition and Takeover Act (Wertpapiererwerbs- und Übernahmegesetz, WpÜG) was published on BaFin's website. In April, Novartis published its takeover offer with a volume of EUR 2.607 billion. By the end of the additional acceptance period on 30 May 2024, the acceptance rate was 77.78%, with Novartis holding 89.47% of the voting share capital. The subsequent delisting offer of 4 July 2024 aimed to delist MorphoSys' stock from the regulated market of the Frankfurt Stock Exchange, as well as its stock and American depositary shares (ADS) from Nasdaq, which took place in early August 2024. MorphoSys' general meeting approved a squeeze-out on 27 August 2024.

Delisting of Telefónica Deutschland

The second largest offer by volume in 2024 was the delisting offer made by the Spanish Telefónica S.A. to the shareholders of Telefónica Deutschland Holding on 20 March 2024. The total offer volume amounted to EUR 6.446 billion. At the time of the delisting offer, the bidder, Telefónica Local Services GmbH, a wholly owned subsidiary of Telefónica S.A., held 7.86% of the target company as a result of a previous partial takeover offer on 5 December 2023. The bidder's parent Telefónica S.A. held 17.65% directly and 69.22% through UK-HoldCo, an indirect subsidiary. Consequently, through conclusion of non-tender agreements together with a custody blocking contract, only about 5.26% of the voting capital remained subject of the delisting acquisition offer, reducing the deal volume to EUR 372.92 million. The acceptance rate amounted to 1.58%. The delisting became effective on 18 April 2024.

UniCredit acquires Commerzbank stock

According to a voting rights notification on 20 December 2024, UniCredit increased its stake to 28.08%, just below the control threshold specified by takeover law. Market observers speculate that UniCredit intends to first complete the takeover of Banco BPM, Italy's fourth-largest bank. However, UniCredit may face defensive tactics, as takeover rumours surrounding Commerzbank have attracted other investors. In early January 2025, Blackrock increased its stake to 7.14%. In addition, Citigroup, Jefferies and the hedge fund D. E. Shaw each secured around 5% of Commerzbank stock.

Potential takeover of Salzgitter AG?

In early November 2024, Salzgitter, a steel producer, announced that its second-largest shareholder, GP Günter Papenburg AG, was considering a potential takeover. According to the announcement, GP Günter Papenburg, a corporate group headquartered in Hanover, Germany, was in negotiations with TSR Recycling, a metal recycler based in Lünen, Germany. The State of Lower Saxony, which is also a Salzgitter shareholder, announced that it would assess the takeover.

Warning signs ahead of a takeover transaction

The risk of stake-building from the target company's perspective

UniCredit's build-up of a significant stake in Commerzbank has reignited discussion about the risks of stake-building. According to sections 33 et seqq. of the German Securities Trading Act (Wertpapierhandelsgesetz, WpHG), parties acquiring holdings in listed companies are subject to notification requirements. Any party whose stake exceeds the legal thresholds must notify BaFin and the issuer concerned without undue delay (but within four trading days at the latest). The issuer must then publish this information without undue delay (but within three trading days at the latest). This is intended to enhance market transparency and prevent bidders from covertly acquiring stakes before a takeover offer.

Nevertheless, UniCredit managed to acquire a substantial stake in Commerzbank, even before the auction of the share package (4.49%) held by the German Financial Market Stabilisation Fund, without the German government's awareness. The first voting rights notification by Commerzbank regarding UniCredit, issued on 13 September 2024, revealed that the acquisition of the share package on 11 September 2024 resulted in a stake totalling 9.21%, comprising 7.29% held directly and 1.92% indirectly through derivatives. Therefore, not including the newly acquired share package, UniCredit had acquired a stake of 4.72% (2.8% held directly, 1.92% through derivatives) prior to the auction, which was below both the 3% threshold in accordance with section 33 para. 1 WpHG, which applies to shareholdings, and the 5% threshold in accordance with sections 39 para. 1 and 38 paras. 1 and 4 WpHG, which applies to combined shareholdings and derivatives.

While statutory requirements aim to make covert stake-building ahead of a takeover offer difficult, it remains possible to exploit notification periods and thresholds – at least by using financial instruments. This is a risk from the standpoint of the target company, which has prompted political discussion about lowering the individual notification thresholds or at least shortening the notification periods.

Conclusion of an investor agreement prior to transactions – including delistings

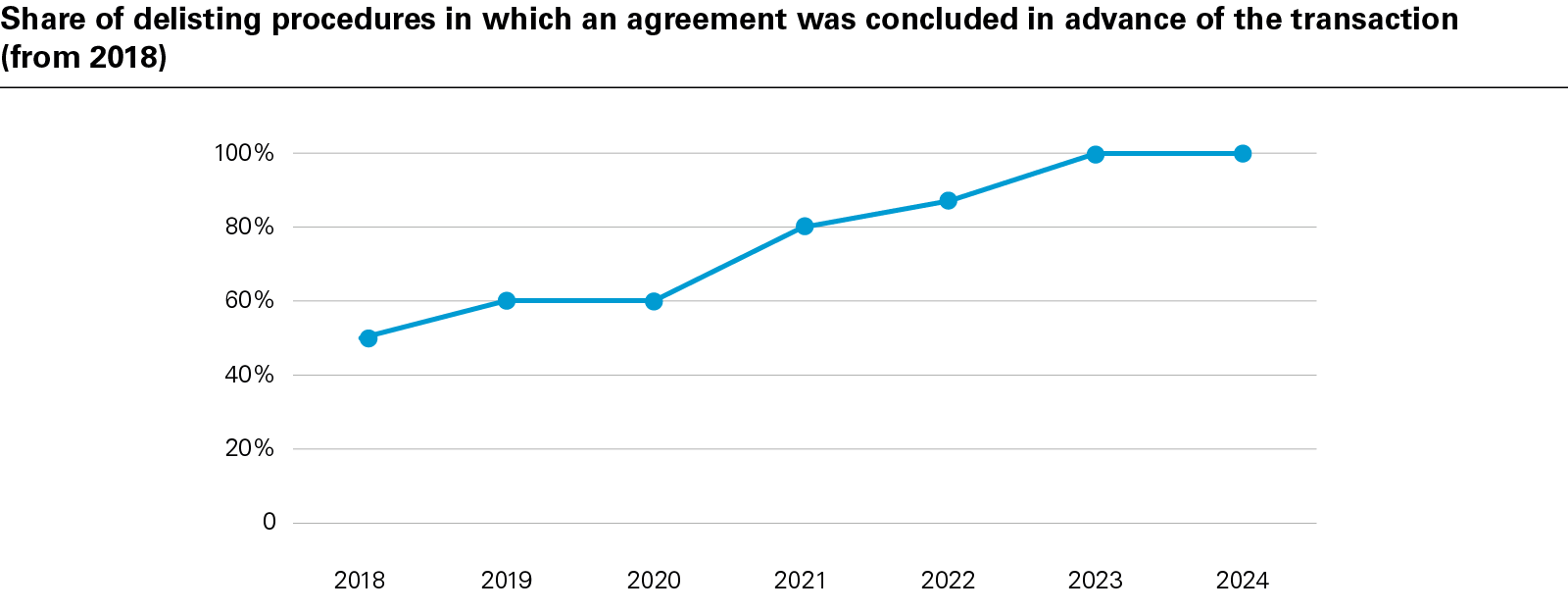

An analysis of the market practice undertaken in 2024 showed that even prior to the decision to make an offer, which requires publication under section 10 WpÜG, the bidder, the target company and in some cases also individual shareholders had reached an understanding as to the key parameters of the transaction. Such agreements were concluded in 27 of 32 transactions last year.

This practice is particularly prevalent in delisting offers, where agreements have become increasingly common in recent years. In all 20 delisting procedures in 2024, an agreement was concluded in advance of the transaction, with 18 of these being explicit delisting agreements.

A delisting agreement typically outlines the amount of cash consideration and the term and execution of the offer. It also generally requires the management board and supervisory board of the target company to support the offer and obligates the parties to take steps that are necessary and appropriate for the delisting (or downlisting), including submitting the required delisting application. Most delisting agreements have a defined term and provide for termination rights under certain conditions. In the case of takeover offers, investor agreements often contain an undertaking by the management board and supervisory board to support the offer with a positive statement. Notably, in eight of the 20 delisting offers in 2024, the management board and supervisory board issued only a neutral statement. This may be due to the fact that delisting offers often specify consideration equal only to the statutory minimum price and do not provide for any premium. For instance, in the case of the delisting of Software AG, the management board and supervisory board supported the transaction strategically – in line with the concluded investor agreement – but considered the offer price to be too low.

Defence readiness remains important

As shown by UniCredit's stake-building in Commerzbank, listed companies must expect to become the target of a takeover at any time – even though hostile takeovers are rare in the German public takeover market. It is therefore essential for potential target companies to be prepared. Once the takeover procedure is started, WpÜG rules significantly limit the actions management body can take to fend off a takeover due to the legal restrictions on efforts to frustrate an offer.

Therefore, every listed company should have a defence readiness plan in place (including a defence manual) to ensure they remain agile and capable of responding effectively if needed.

Statements by the target company

In 2024, the management bodies of target companies published joint statements on all submitted offers. They supported the offer in 22 of the 32 published takeover procedures. In eight cases, their vote was neutral, meaning they made no explicit recommendation to the shareholders.

A negative statement was published for one delisting offer and one mandatory offer. Specifically, KD Investment & Consulting's delisting offer to the shareholders of NSI Asset AG received a negative vote from the corporate bodies, even though a delisting agreement had been concluded beforehand. They advised the shareholders not to use the planned downlisting as a "reason to get out" and recommended rejecting the offer. On the other hand, the management board and supervisory board considered the offered consideration to be adequate, and they welcomed the downlisting for strategic reasons.

All of the eight takeover offers published in 2024 received positive recommendations from the management bodies, as did three of the four published mandatory offers. The exception was the mandatory offer made to the Surteco Group shareholders, where the management board and supervisory board did not recommend acceptance of the offer ("no basis for recommending acceptance of the offer"). Supported by a fairness opinion, they deemed the consideration offered by the bidder Banasino Investments – which was the minimum price – to be too low.

Changes to the legal framework in takeover law

Planned amendments concerning delisting

Less than one year after entry into force of the first German Financing for the Future Act (Zukunftsfinanzierungsgesetz, ZuFinG), the draft bill for a second Financing for the Future Act (Zukunftsfinanzierungsgesetz II, ZuFinG II) was published on 27 August 2024, followed shortly thereafter by the corresponding government draft on 27 November 2024.

The proposed modifications in the WpÜG – along with other statutes – were intended to implement EU requirements relating to ESAP (European Single Access Point). Under Regulation (EU) 2023/2859, the European Securities and Markets Authority (ESMA) is to establish and operate a European single access point (ESAP) by 10 July 2027 to provide centralised electronic access to an entity's public financial, capital market and sustainability information. In Germany, BaFin would act as the collection body for WpÜG publication obligations. In addition, the draft proposed amending sections 10, 14 and 27 WpÜG to ensure that notification and reporting obligations to BaFin would coincide with the corresponding publications.

The proposed amendments concerning delistings were particularly relevant to the takeover market, especially in view of the growing significance of delisting offers. One amendment would have made the adequacy of the offered compensation no longer subject to review in a civil proceeding but instead through a valuation proceeding (Spruchverfahren) in accordance with the provisions of the German Act on Valuation Proceedings under Corporate Law (Gesetz über das gesellschaftsrechtliche Spruchverfahren, SpruchG).

However, further action on the draft law ceased when the German Bundestag was dissolved on 27 December 2024, and it has continued to languish in advance of the snap elections. Because of the principle of discontinuity, proposed legislation is required to be cancelled when the respective legislative period ends. It therefore remains to be seen if and to what extent the amendments proposed in the second Financing for the Future Act will be taken up again in the current year.

Passive acquisition of control after expiration of shares with multiple voting rights

Since the first Financing for the Future Act (Zukunftsfinanzierungsgesetz) came into force on 15 December 2023, it has once again become possible to issue shares with multiple voting rights following the amendment and restatement of section 12 of the German Stock Corporation Act (Aktiengesetz, AktG). In accordance with section 135a para. 1 sentence 2 AktG, such shares may have up to 10 times the voting rights. As specified by section 135a para. 2 AktG, such multiple voting rights expire when the shares are sold, but no later than 10 years after the company becomes listed on a stock exchange. Upon expiration, the relative voting weight of the remaining shares increases. Such "passive acquisition" could result in a shareholder exceeding the 30% control threshold of section 29 para. 2 WpÜG without any involvement on their part, which in takeover law would in turn require publication of a mandatory offer in accordance with section 35 para. 2 WpÜG.

The legislator acknowledged this issue and, in its explanatory memorandum accompanying the legislation, referenced the possibility for the affected shareholder to obtain an exemption in accordance with section 37 WpÜG in conjunction with section 9 sentence 1 no. 5 of the German Regulation on Offers under the Securities Acquisition and Takeover Act (WpÜG-Angebotsverordnung, WpÜGAngebV). The viability of this solution has been the subject of academic debate, ranging from a blanket rejection of an exemption in order to protect outside shareholders, to elimination of BaFin's discretion in such cases for the benefit of shareholders affected by the passive acquisition. It remains to be seen how BaFin will respond to such cases in future and whether the legislator will then see a need to address the effect that shares with multiple voting rights have in takeover law.

Judgments relevant for takeovers in 2024

BGH takes a critical look at "acting in concert otherwise" by referring a question to the European Court of Justice for a preliminary ruling

With its order published on 13 December 2024 (Order of 22 October 2024, Az. II ZR 193/22), the German Federal Court of Justice (Bundesgerichtshof, BGH) referred the following question to the European Court of Justice for a preliminary ruling:

Is Article 3(1a) subpara. 4 No. iii of Directive 2004/109/EC to be interpreted as being in conflict with section 34 para. 2 sentence 1 alternative 2 WpHG, according to which an agreement between the party subject to a notification requirement and the third party with respect to the exercise of voting rights is not necessary for an attribution of voting rights, but instead that acting in concert otherwise based on factual circumstances is sufficient?

Even though the case before the court concerns a small company (Valora Effekten AG), the question is now whether the Federal Court of Justice will change its current standard for assessing "acting in concert otherwise". The outcome will be relevant, for example, in the case of collaborative engagement by investors on ESG issues, which might constitute acting in concert in certain cases. BaFin had issued guidelines on this topic in March 2023.

The legal background to the question referred for a preliminary ruling is a difference of opinion as to whether section 34 para. 2 WpHG aligns with the directive, particularly regarding the attribution of voting rights without an agreement as specified in section 34 para. 2 sentence 1 alternative 2 WpHG. This provision allows voting rights to be attributed based on parties acting in concert otherwise, which may extend beyond the scope of Article 10(a) of Directive 2004/109/EC (the "Transparency Directive"). The core issue is whether the broader national rule falls under the proviso set down in Article 3(1a) of the Transparency Directive, according to which more stringent national provisions are permissible in relation to takeover bids, merger transactions and other transactions affecting the ownership or control of companies, supervised by authorities on the basis of the Takeover Directive.

BaFin has stated that it complies with the rulings of the Federal Court of Justice when assessing whether parties are potentially acting in concert. If the Federal Court of Justice changes its established case law on acting in concert, any ESG-related aspects of investor understandings will also need to be reassessed.

Conclusion of the legal proceedings brought by former Postbank shareholders against Deutsche Bank

The litigation of the claims against Deutsche Bank brought by former Postbank shareholders stemming from the takeover procedure in 2010 has concluded with the judgment by the Higher Regional Court (Oberlandesgericht, OLG) of Cologne on 13 October 2024 (Az. 13 U 231/17) after nearly 15 years.

The background to this legal dispute is that Deutsche Bank concluded a contract with Deutsche Post in September 2008 (the "Original Contract") for the acquisition of a minority stake of 29.75% in Postbank at the price of EUR 57.25 per share. The parties also agreed on mutual options for a share package of 18% (call option at EUR 55 per share) and 20.25% plus one share (put option at EUR 42.80 per share). Deutsche Bank and Deutsche Post agreed in late December 2008 to postpone the closing under the original purchase agreement due to changed market conditions. Then, in January 2009, they concluded a supplementary agreement under which the acquisition of Postbank was to take place in three stages: First, Deutsche Bank was to purchase 50 million shares (22.9% of the share capital of Postbank) at a price of EUR 23.92 per share, then 60 million shares (27.4% of the share capital) at a price of EUR 45.45 per share using a mandatory exchangeable bond maturing on 25 February 2012, and finally 26,417,432 shares (12.1% of share capital) based on mutual options (EUR 48.85 per share for the call option and EUR 49.42 per share for the put option). The options could be exercised between 28 February 2012 and 25 February 2013. In December 2008 and January 2009, Deutsche Post AG pledged shares in Postbank to Deutsche Bank as collateral for EUR 3.1 billion.

The former Postbank shareholders argued that Deutsche Bank AG should have published a mandatory offer at the price of EUR 57.25 per share based on the Original Contract because the contract resulted in acquisition of control in accordance with section 29 para. 2 WpÜG. The takeover offer was published on 7 October 2010, under which Deutsche Bank offered the Postbank shareholders EUR 25 per share. In the legal dispute, the claimants demanded payment of the difference between that amount and the amount that in their opinion would have been payable at an earlier point, when the price of Postbank stock was significantly higher (i.e. EUR 57.25). Furthermore, the claimants asserted that Deutsche Bank had been obligated to make a takeover offer as early as 2008 because it had acquired control over Postbank at that time.

The Higher Regional Court of Cologne, to which the proceedings were remanded by the Federal Court of Justice in 2022, agreed with this line of argument based on the legal requirements set by the Federal Court of Justice in the appeal on points of law (Revision) concerning the substance and reach of the rule in section 30 para. 1 sentence 1 no. 2 WpÜG. It held that the material opportunities and risks under the shares originally purchased at the price of EUR 57.25 in the amount of 29.75% of the share capital were to be attributed to Deutsche Bank by reason of the purchase contract of September 2008 alone. According to the court, Deutsche Post AG thereafter held the shares "for the account" of Deutsche Bank. Because the parties had agreed on a fixed price for the shares, Deutsche Bank bore the risk of price changes prior to the closing date.

The Higher Regional Court did not allow an appeal on points of law, thereby bringing the legal dispute between the former Postbank shareholders and Deutsche Bank to a definitive conclusion. Following the preliminary decision of the Federal Court of Justice on appeal, which formed the basis of the decision by the Higher Regional Court, the legal assessment of complex advance-acquisition structures and their impact on the takeover price has now been definitively settled.

Higher Regional Court of Frankfurt on the application for a squeeze-out of remaining shareholders in accordance with section 39a WpÜG prior to closing

In March 2022, the Spanish healthcare and pharmaceutical company Grifols S.A. applied to the Regional Court (Landgericht, LG) of Frankfurt in accordance with section 39a WpÜG for a squeeze-out of the minority shareholders of Biotest. The court approved the application by order of 27 October 2022. The complaint (Beschwerde) against that order was dismissed by the Higher Regional Court of Frankfurt on 27 May 2024 (WpÜG 1/23).

However, the order of the Higher Regional Court is not final and binding, because it granted leave to file a complaint on points of law (Rechtsbeschwerde). In its reasoning for granting leave, the court cited not only the fundamental importance of the squeeze-out, but also the need for the law to evolve in this area.

The proceedings raised the question of when the bidder is required to lodge an application for the transfer of shares for a squeeze-out and whether this depends on whether closing has taken place. In the opinion of the Higher Regional Court of Frankfurt, the bidder may even lodge the application for a squeeze-out of the minority shareholders before closing, provided that at least the takeover offer or the mandatory offer has been accepted to the extent that at least 95% of the voting share capital or at least 95% of the entire share capital of the target company will belong to the bidder after closing. The court held that the requirement "will belong to" specified in section 39a para. 4 sentence 2 WpÜG must be read together with section 39a para. 2 WpÜG, according to which section 39a para. 1 WpÜG and section 16 paras. 2 and 4 AktG apply mutatis mutandis to the determination of the necessary stake (calculation of the share capital of the target company held by and attributed to the bidder). Shares subject to a temporary loss of rights in accordance with section 20 para. 7 sentence 1 AktG are to be included in the acceptance rate referred to in section 39a para. 4 sentence 2 WpÜG. The court held that the law does not require any causal link between the offer procedure preceding the transfer application and the reaching of the 95% threshold in section 39a para. 1 sentence 1 WpÜG. Accordingly, it is irrelevant how the bidder attained the required threshold of 95% after the takeover offer procedure. Acquisitions made in advance of the formal offer procedure are also to be included for the purposes of reaching the 95% threshold, at least as long as such an acquisition has not yet resulted in the bidder gaining control. The Division for Securities Acquisition and Takeover Matters (Senat für Wertpapiererwerbs- und Übernahmesachen) at the Higher Regional Court concurs with this view, at least in the case where an advance acquisition that has not yet closed is closely linked in time with the formal offer procedure.

The Higher Regional Court of Frankfurt also commented on the adequacy of the compensation paid in a squeeze-out procedure. The court stated that a causal link between acquisition and offer is required for a presumption of adequacy in section 39a para. 3 sentence 3 WpÜG, according to which the consideration in a takeover offer is to be considered adequate if the bidder has acquired at least 90% of the share capital covered by the offer ("market test"). If it is determined that it is not possible to use section 39a para. 3 sentence 3 WpÜG as a basis for adequate compensation then, according to the court, this does not bring an end to the proceedings in the squeeze-out procedure. For the purpose of calculating adequate compensation to be paid in the squeeze-out procedure, the Division, after consideration of all of the circumstances in the case before it, saw no reason not to characterise the amount as adequate compensation within the meaning of section 39a para. 1 sentence 1 WpÜG, given that it was approximately 25% higher than the exchange price ascertained in accordance with section 5 para. 1 WpÜGAngebV.

The decision by the Division – which is the sole court in Germany at which legal remedies can be pursued in squeeze-out procedures in accordance with sections 39a and 39b WpÜG – involved a number of important questions that are relevant for a variety of cases, which had yet to be answered by a high court. According to the Higher Regional Court of Frankfurt, this applies to the question of inclusion of an advance acquisition in the 95% threshold of section 39a para. 1 WpÜG, the question of the scope of the inclusion of advance acquisitions in the market test under section 39a para. 3 sentence 3 WpÜG, the question of whether and how the squeeze-out procedure is to be continued if the market test does not apply (particularly how adequate compensation is to be determined in the case of continuation), the question of the consequences that a temporary loss of rights in accordance with section 20 para. 7 sentence 1 AktG and section 44 para. 1 sentence 1 WpHG would have on the squeeze-out procedure, the question of whether the court must ensure certainty of payment of the compensation in every individual case involving a squeeze-out procedure – in other words, irrespective of whether the court considers this in fact to be necessary – as well as procedural questions.

Even though squeeze-outs are rarely undertaken in practice, the court's decision is highly anticipated for the impact it will have on evolution of the law.

Regional Court of Frankfurt: Stada shareholders' claims for additional payment not time-barred

During the takeover of Stada in 2017, the private equity investors Bain Capital and Cinven reached the (previously reduced) acceptance threshold of 63% during the additional acceptance period specified by law. They then concluded an agreement with the hedge fund Elliott in which the latter made an irrevocable commitment to vote at the Stada general meeting in favour of a domination and profit and loss transfer agreement, provided that the compensation paid to the outside shareholders was set at a minimum of EUR 74.40 per share. The shareholders who had accepted the public takeover offer had received only EUR 66.25 as consideration.

From the standpoint of these shareholders, the question arose as to whether they were entitled to claim additional payment based on the principle set down in the WpÜG that shareholders who belong to the same class of shares are to be treated equally. In May 2023, the Federal Court of Justice ruled that the irrevocable commitment constituted an agreement within the meaning of section 31 para. 5 WpÜG, entitling the shareholders to additional payment.

By judgment of 10 April 2024 (case nos. 3-05 O 532/23 and 3-05 O 572/23), the Regional Court of Frankfurt ruled that the limitation period for the shareholders' claims against the bidders to additional payment in the Stada takeover procedure first began to run in 2023 and therefore their claims were not time-barred. According to the court, the relevant limitation period began to run when the Federal Court of Justice published its decision in May 2023, not when the bidders and Elliott published their press releases. The court noted that the bidders and Elliott had published only two press releases, and there was nothing in them to indicate that the bidders had concluded a legally binding contract with Elliott. Accordingly, the court stated that the other shareholders were not aware of any agreement satisfying the requirements of section 31 para. 6 WpÜG, nor was there sufficient reason to believe they should have been aware of such an agreement. The court also held that the publication of its decision in a legal journal is not sufficient for finding that the shareholders should have been aware of the facts giving rise to the claim.

The court also ruled that when shareholders lodge a complaint, they are entitled to interest from the date the litigation becomes pending, which in this case was when the complaint was served. The court refused a more extensive claim in analogous application of section 38 WpÜG, which relates to mandatory offers, holding that this was not a case of unintended oversight by the legislator.

The Regional Court's decision is not final and binding.

Relevance of the exchange price for determining the adequate compensation paid to outside shareholders in the case of structural measures after a takeover

After completing a takeover procedure, many bidders seek to conclude a domination and profit and loss transfer agreement (DPLTA) or carry out a squeeze-out. As a rule, the shareholders must be paid compensation in shares in the case of these structural measures.

Shareholders can apply to have the amount of the compensation reviewed in a valuation proceeding (Spruchverfahren). In January 2024, the Federal Court of Justice again confirmed the relevance of the exchange price for determining the adequacy of the compensation paid to outside shareholders in the case of a DPLTA. The court ruled that using the company's exchange price is a suitable method for estimating the value of an outside shareholder's investment for the purposes of section 305 AktG. It also held that a company's market value is suitable for determining both its current and its future revenue prospects with sufficient certainty, such that it can be the basis for determining adequate fixed compensation as required by section 304 para. 2 sentence 1 AktG (order of 31 January 2024, Az. II ZB 5/22, confirmation BGH, order of 21 February 2023, Az. II ZB 12/21).

Both the Higher Regional Court of Karlsruhe (order of 16 April 2024, Az. 12 W 27/23) and the Higher Regional Court of Frankfurt (order of 9 February 2024, Az. 21 W 129/22) have made similar decisions on the determination of adequate compensation in the case of a squeeze-out.

Bidders will certainly welcome the fact that the relevance of the exchange price for determining the compensation price has now been repeatedly confirmed, as this will considerably reduce the risk of valuation proceedings. It also limits the current arbitrage possibilities for shareholders in post-takeover integration measures.

Outlook

With Zalando's takeover of ABOUT YOU, the year 2025 started with a transaction volume exceeding EUR 1 billion. Another development to watch will be the progress of TSR Recycling and Papenburg's takeover bid for Salzgitter.

At the start of 2025, the media were again focussed on the possible takeover of Commerzbank by UniCredit, which had further increased its stake at the end of last year.

It is difficult to predict how the market for the takeover of listed companies will develop in 2025. The DAX 40 posted record growth in January 2025, and it remains to be seen whether high takeover prices will discourage potential bidders.

In terms of legislation, it will be interesting to see whether new draft takeover laws will continue to be pursued, whether the existing WpHG reporting thresholds will in fact be subject to a critical review, and whether the reporting obligations will be reduced.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2025 White & Case LLP

View full image: DAX 40 in 2024 (PDF)

View full image: DAX 40 in 2024 (PDF)

View full image: Number of offers 2017 – 2024 (PDF)

View full image: Number of offers 2017 – 2024 (PDF)

Transaction volume and number of transactions 2017 – 2024 (PDF)

Transaction volume and number of transactions 2017 – 2024 (PDF)

View full image: Average offer volume 2017 – 2024, in EUR billion (PDF)

View full image: Average offer volume 2017 – 2024, in EUR billion (PDF)

View full image: Number of cash, exchange and mixed offers 2017 – 2024 (PDF)

View full image: Number of cash, exchange and mixed offers 2017 – 2024 (PDF)

View full image: Share of delisting procedures in which an agreement was concluded in advance of the transaction (from 2018)

View full image: Share of delisting procedures in which an agreement was concluded in advance of the transaction (from 2018)