The Office of Financial Sanction Implementation's ("OFSI") Annual Review for 2023-2024 provides valuable insights into how the UK's financial sanctions regime has continued to develop. We explore some of the key trends for OFSI licensing and enforcement and what they mean for those navigating this complex compliance landscape.

The recently published OFSI Review1 provides an overview of the organization's actions from 1 April 2023 to 31 March 2024 (the "Review Period") in administering the UK's financial sanctions regime.2 OFSI's capacity to deal with licence applications has improved, which is a welcome development. Whilst enforcement numbers for the Review Period remain low, OFSI's greater resources and growing focus on a proactive, intelligence-led approach to enforcement means companies will need to ensure that compliance with UK financial sanctions remains a key priority for the foreseeable future.

Enforcement

The number of recorded enforcement cases declined from 473 in 2022-2023 to 396 in 2023-2024,3 with the vast majority (225) during the latter period relating to the financial services sector.

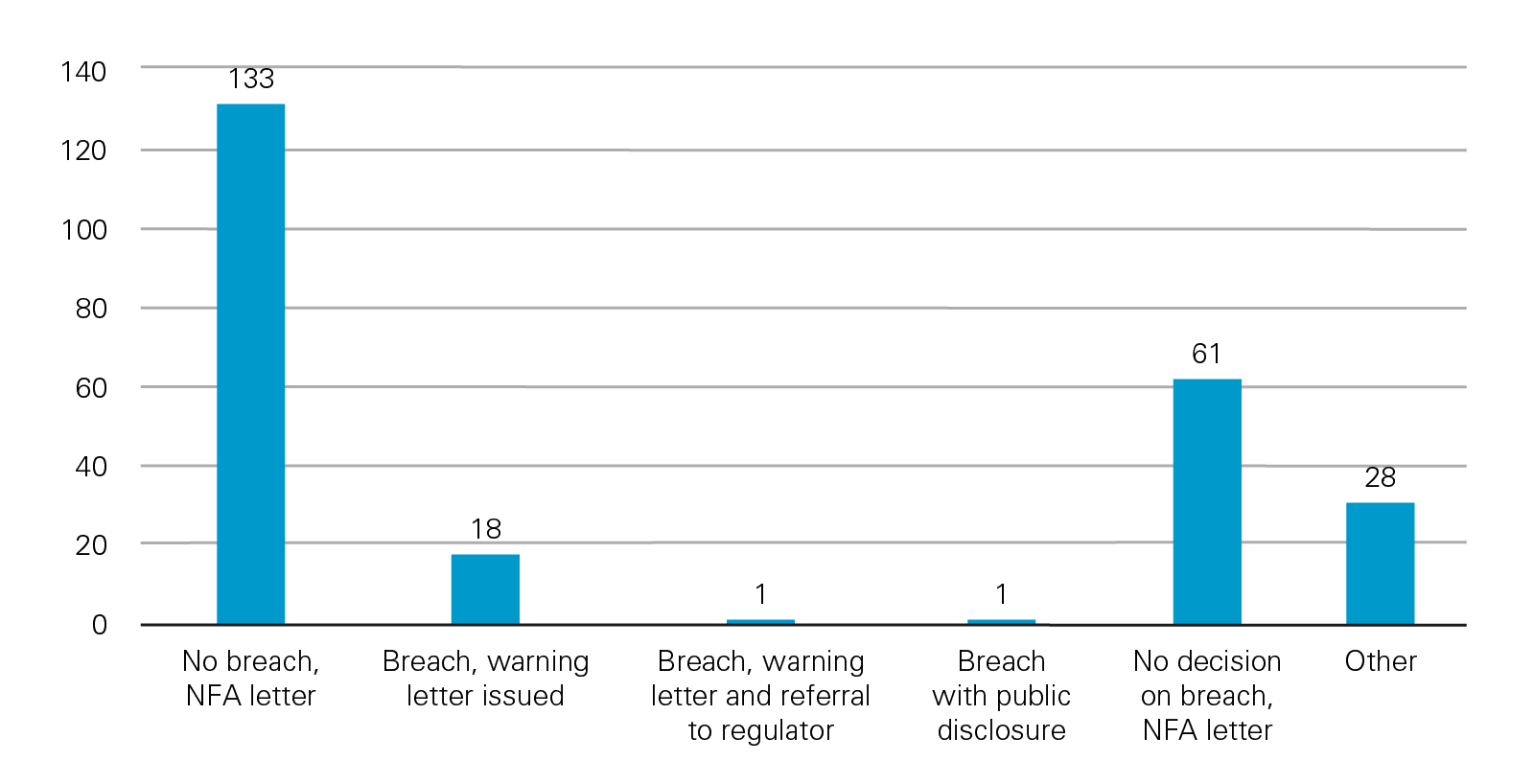

The OFSI Review nevertheless emphasizes the organization's commitment to robust sanctions enforcement and highlights the fourfold increase in OFSI's enforcement team during the Review Period. This appears to have contributed to the number of enforcement cases closed by OFSI, which more than tripled compared to the previous review period. It is notable, however, that the vast majority of these cases were closed without further action.

Furthermore, whilst there has been an increased use by OFSI of non-public warning letters (from 7 to 19, including one that also involved a referral to a regulator), public enforcement action remained disproportionality low, with only one example of OFSI's disclosure power during the Review Period.

Recent activity after the Review Period suggests that enforcement activity by OFSI may start to increase, however, with monetary penalties against a UK property management services company and a former Moscow office incorporated in the UK and linked to an international law firm, and a public disclosure against three charities, having already been handed down in the financial year 2024-2025.

Notably, the OFSI Review highlights that there are several pending OFSI cases linked to Russia's invasion of Ukraine, and further that "a number of enforcement cases are expected to result in a public outcome in 2025".

A more "proactive" approach to enforcement

As expected, the majority of OFSI's cases during the Review Period were derived from self-reports. However, the OFSI Review states that there has been "[a] greater emphasis on intelligence-gathering and proactive investigations [which has] enabled OFSI to uncover more breaches of UK sanctions". This is reflected in an increase in the number of cases that were not derived from self-reports.

An expansion of the sectors that are mandatorily required to report suspected sanctions breaches to OFSI (which includes breaches by third parties), OFSI's increased resources, and an emphasis on leveraging technology and the exchange of information with other UK and international agencies, are all likely to have contributed to this increase.

If this trend continues, organizations may find that the risk of failing to self-report in appropriate cases increases, particularly in circumstances where prompt self-reports can lead to significantly discounted monetary penalties. This was most recently demonstrated in the monetary penalty OFSI imposed a UK entity that operated a law office in Moscow on 11 November 2024, which was reduced by 50% due to the prompt and detailed disclosure of breaches by its UK parent firm. In contrast, the monetary penalty against the UK property management services company, which represented the first monetary penalty issued by OFSI that did not derive from a self-report, did not receive any discount.

Designations

OFSI continues to add designated persons to the consolidated list, with 564 new designations in the Review Period. This number has continued to rise in the financial year 2024-2025, confirming that sanctions screening continues to be an important part of a company's compliance programme. Recent UK designations target Russian military supply chains, including producers and suppliers of goods for Russia's military across Central Asia; North Korean generals and senior officials, who have deployed North Korean forces to Russia; a small number of additional Russian targets; further 'shadow fleet' vessels carrying Russian oil; and, for the first time under the Russia regime, a foreign financial institution. Earlier this year, the UK also designated Gazprom Neft and PJSC Surgutneftegas in alignment with the US.

Licensing

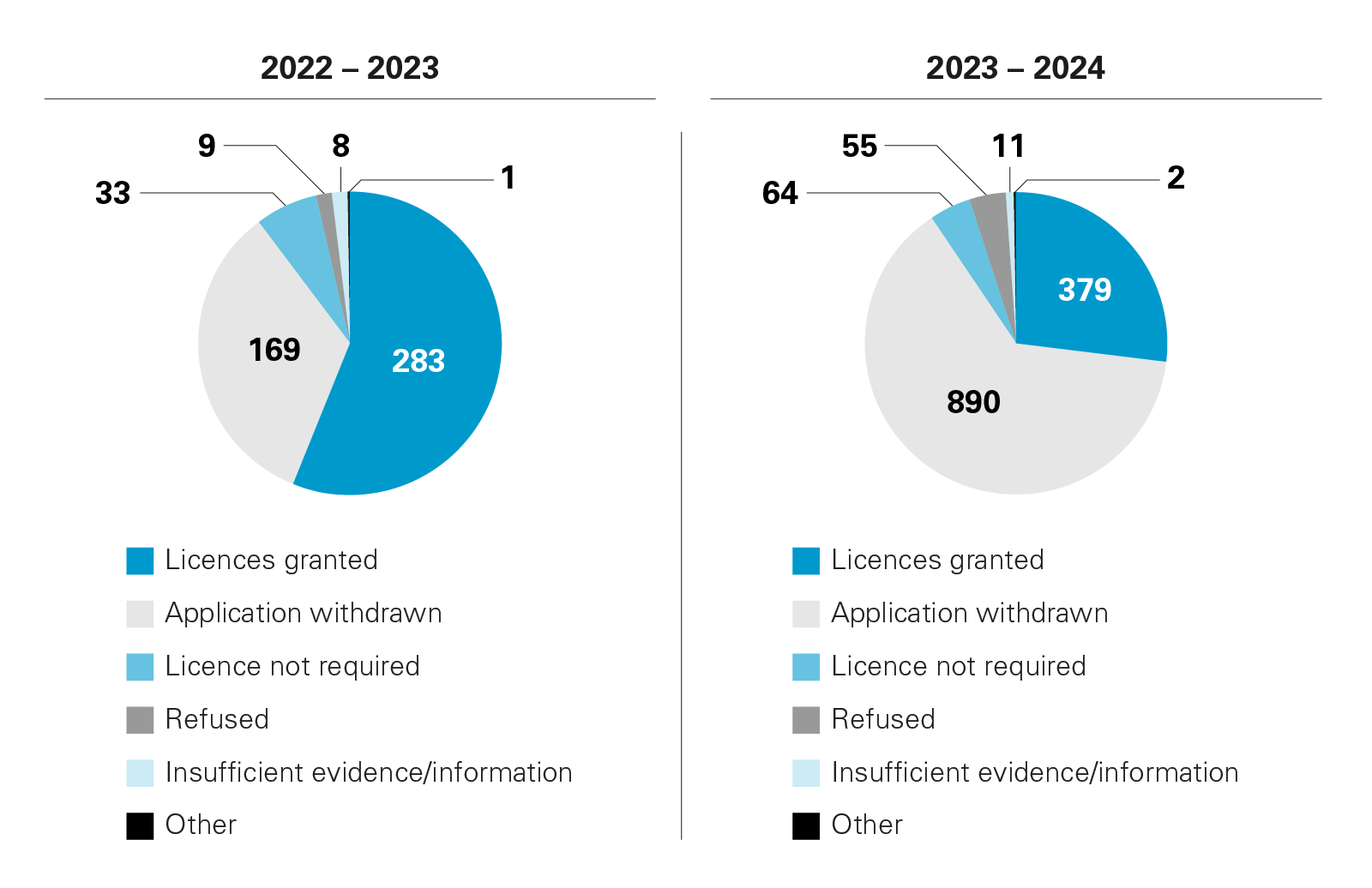

A further welcome development is that OFSI's increased resources seem to have contributed to an improvement in its capacity to make licensing decisions, which were taken on 1,401 cases during the Review Period, a nearly 180% increase compared to the previous reporting period. OFSI partly attributes this increase to refining its processes for proportionality and efficiency, enabling it to resolve properly completed applications more quickly. OFSI's licensing team also increased fourfold in the Review Period, which generally helps improve confidence that OFSI can manage the large application volumes it currently faces.

The figures increased significantly for licences granted, determinations that licences were not required, and licences refused. This is despite the parallel increase in withdrawn applications, many of which were withdrawn following the issuance of general licences or due to multiple licences covering the same subject matter.

Russia-related licences continued to represent the majority of licences issued, including 11 out of 16 general licences and 252 out of 379 specific licences.

The OFSI Review does not include information on the standard processing times for OFSI licence applications. This contrasts with the reporting approach taken by ECJU (which sets out its performance against its 20- and 60-day targets as well as median processing times). Processing times therefore remain difficult to estimate, and businesses will need to take into account that licences sought from OFSI can still take some time to obtain.

Ruth Benbow (White & Case, Knowledge Manager, London) contributed to the development of this publication.

1 OFSI, OFSI Annual Review 2023-24: Engage, Enhance, Enforce, available here.

2 The OFSI Review does not address the administration of the UK's trade sanctions by the Office of Trade Sanctions Implementation ("OTSI") or the Export Control Joint Unit ("ECJU"). For the latest (2023) ECJU Annual Report, see here.

3 Excluding in relation to the oil price cap sanctions.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2025 White & Case LLP

View full image (PDF)

View full image (PDF)

View full image (PDF)

View full image (PDF)