Information regarding the antidumping duty petition on Large Top Mount Combination Refrigerator-Freezers from Thailand

12 min read

The Petition

On May 30, 2024, Electrolux Consumer Products, Inc. ("Petitioner") filed an antidumping duty ("ADD") petition on imports of large top mount combination refrigerator-freezers ("LTMCRF") from the Kingdom of Thailand ("Thailand"). The ADD petition alleges that imports of LTMCRF from Thailand are being sold in the United States at less than fair value (that is, "dumped"). Petitioner alleges that the domestic industry has been materially injured and is threatened with further material injury by the subject imports.

1. Petitioner has defined the products covered by the petition as follows:

The products covered by this petition are large top mount combination refrigerator-freezers with a refrigerated volume of at least 15.6 cubic feet or 442 liters. For the purposes of this petition, the term "large top mount combination refrigerator-freezers" consists of freestanding or built-in cabinets that have an integral source of refrigeration using compression technology, with all the following characteristics:

- the cabinet contains at least two interior storage compartments accessible through one or more separate external doors or drawers or a combination thereof;

- the lower-most interior storage compartment(s) that is accessible through an external door or drawer is a refrigerator or fresh food compartment, but is not a freezer compartment, however, the existence of an interior sub-compartment for ice-making in the lower-most storage compartment does not render the lower-most storage compartment a freezer compartment; and

- there is a freezer compartment that is mounted above the lower-most interior storage compartment(s).

For the purposes of the petition, a refrigerator compartment is capable of storing food at temperatures above 32 degrees F (0 degrees C) and a freezer compartment is capable of storing food at temperatures at or below 32 degrees F (0 degrees C).

Excluded from the scope are bottom-mount combination refrigerator-freezers, side-by-side combination refrigerator-freezers, refrigerators that have no freezer compartment, and freezers that have no refrigeration component. The scope of this petition also does not include top mount combination refrigerator-freezers with a refrigerated volume of less than 15.6 cubic feet (442 liters), sometimes referred to as "compact" top mount combination refrigerator-freezers or "apartment" top mount combination refrigerator-freezers.

The products subject to this petition are currently classifiable under subheading 8418.10.0075 of the Harmonized Tariff Schedule of the United States (HTSUS). Products subject to this petition may also enter under HTSUS subheadings 8418.21.0090, 8418.40.0000, 8418.99.4000, 8418.99.8050, and 8418.99.8060. The HTSUS subheadings are provided for convenience and customs purposes, but the written description of the merchandise subject to this scope is dispositive.

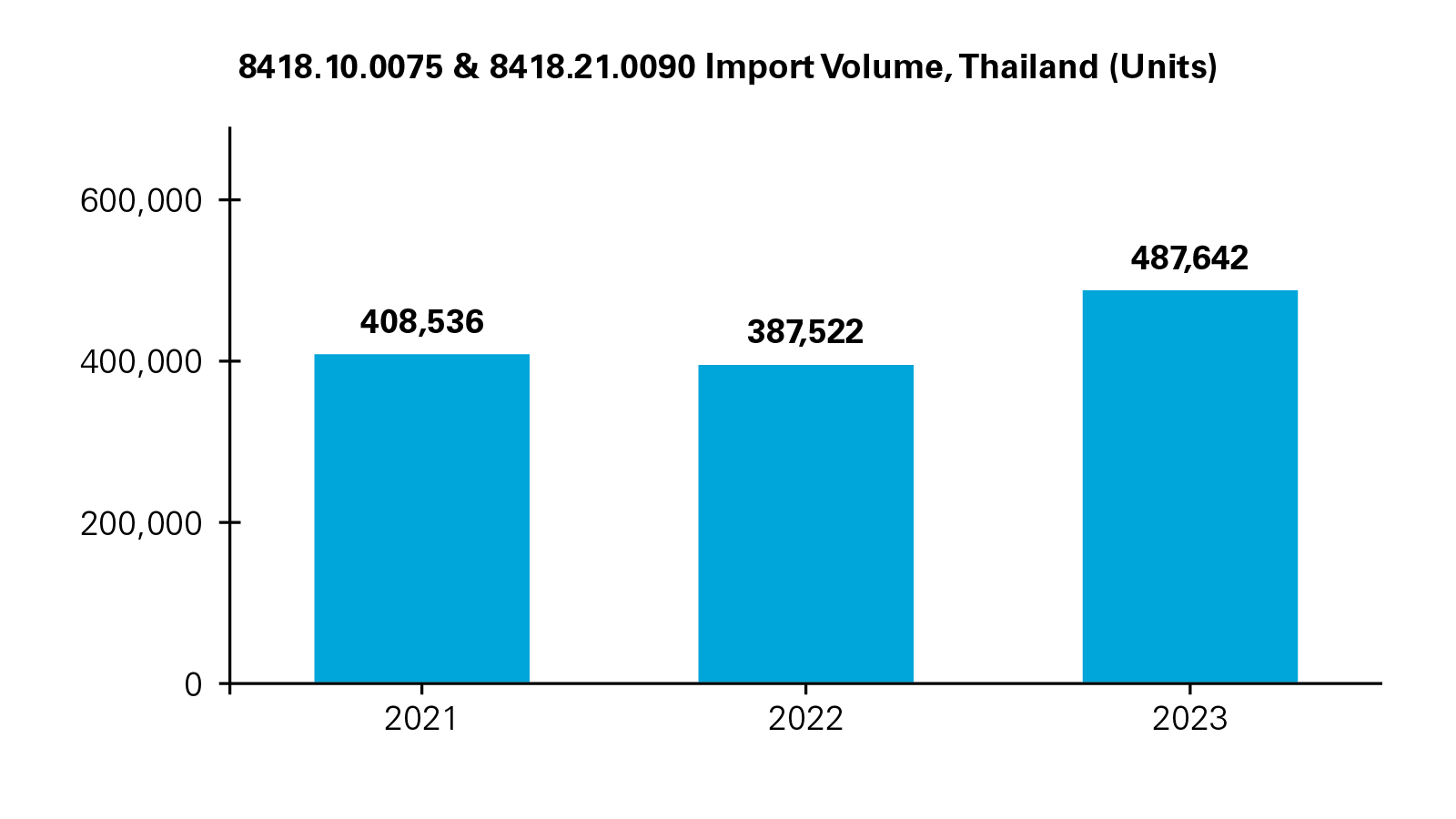

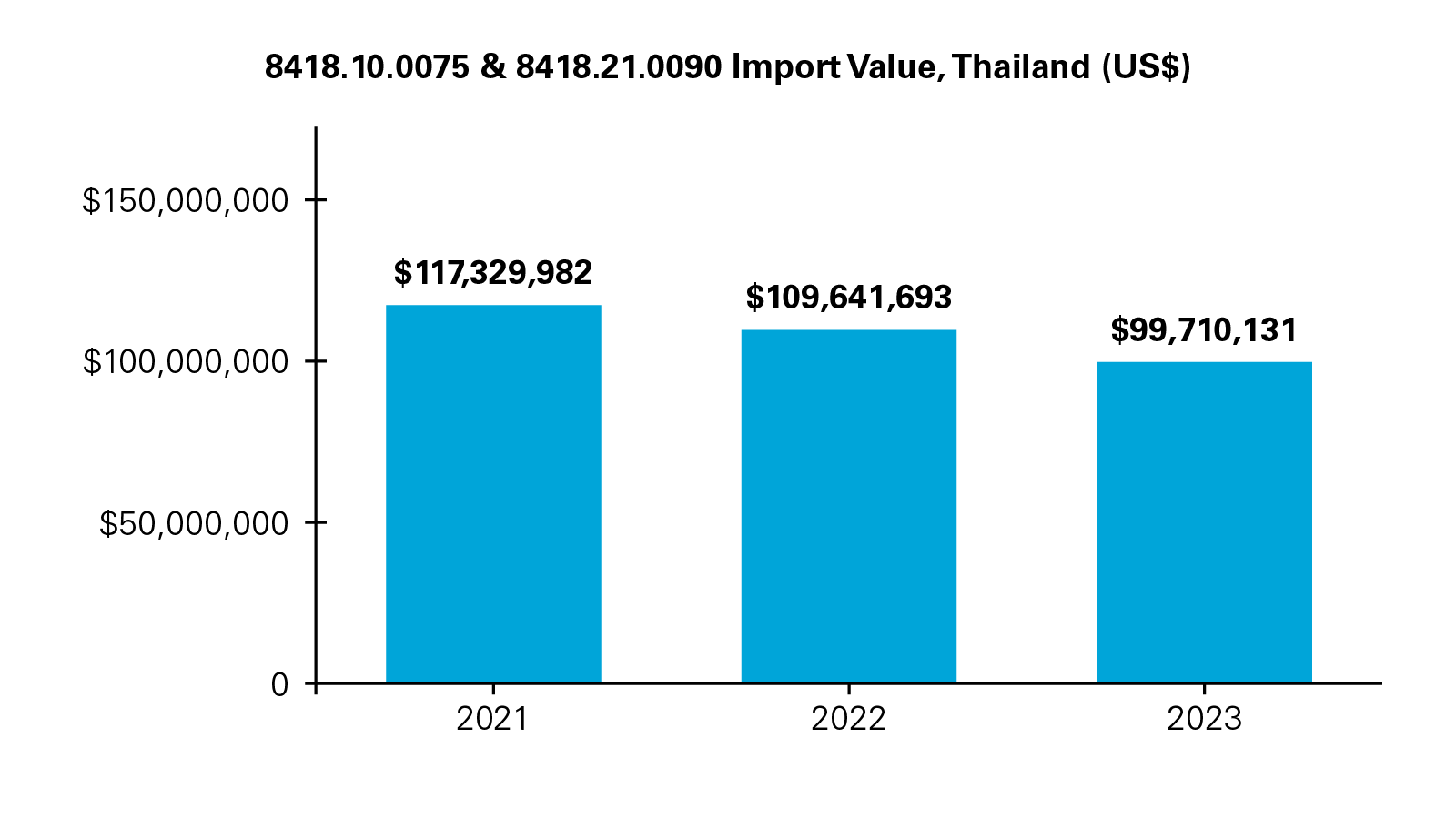

2. The petition alleges the following quantities and values for the subject imports over the period 2021 - 2023:

Overview of ADD proceedings

There are two phases – preliminary and final – of ADD investigations. The Department of Commerce ("DOC") will determine whether imports of LTMCRF from Thailand were dumped in the United States, and establish the antidumping duties that will be imposed. The International Trade Commission ("ITC") will determine whether imports of the subject merchandise are materially injuring, or threaten to materially injure, the domestic industry.

In order for final ADD to be imposed, both agencies must issue "affirmative" findings. We discuss below the steps involved in reaching such findings.

A. DOC Dumping Investigation

By June 19, 2024, DOC must decide whether the ADD petition contains the legally required information regarding Petitioner's standing, dumping, and injury to warrant initiating an investigation. The standard for initiation is low, requiring only that the ADD petition contains information that is "reasonably available" to Petitioner. Consequently, we expect DOC will initiate the ADD investigation by the June 19 deadline.

DOC will issue an ADD Questionnaire to, and calculate a dumping rate for, one or more Thai producers. These producers are referred to as "mandatory respondents." The decision of which producers will receive the questionnaire will be based on export volumes. DOC could choose only one producer to respond to the questionnaire if it is possible to account for 80%-85% of exports with just one producer. If not, DOC will choose two or more Thai producers.

The companies that are selected as mandatory respondents will receive dumping rates based on their actual data. If a company refuses to respond to the questionnaire, it will be assigned a dumping rate based on "adverse facts available," which is a punitive rate, typically based on the dumping rate calculated in the petition. The dumping rate alleged in the petition is 165.13%.

All other Thai producers (other than those that are issued the questionnaire) will be subject to the "All Others" Rate, which normally is calculated as the weighted average of the rates assigned to the mandatory respondents.

The ADD Questionnaire will request detailed information regarding US sales and home-market sales of LTMCRF (transaction-specific prices, direct selling expenses, movement expenses, etc.) and production costs during the period of investigation ("POI"), which will be the period of April 2023 through March 2024. DOC will also issue multiple supplemental questionnaires to clarify information reported in the initial response. The burden of responding to the questionnaires is significantly increased if: (1) companies affiliated with the mandatory respondent also produce and/or sell the subject merchandise in the targeted country; and/or (2) key materials used to produce the subject merchandise are purchased from affiliated suppliers.

Within 140 days after the ADD investigation is initiated (we estimate by November 6, 2024), DOC must make a preliminary determination of whether dumping exists and, if so, the estimated dumping margin for each company investigated (DOC can, and often does, postpone the preliminary determination for an additional 50 days). If DOC makes an affirmative preliminary determination, US Customs and Border Protection ("CBP") will suspend liquidation of entries of LTMCRF from Thailand and require importers to provide ADD cash deposits equal to the preliminary dumping margin calculated for the exporter multiplied by the entered value of the merchandise. Normally, the suspension of liquidation begins on the date DOC's preliminary determination is published in the Federal Register. However, if there are "critical circumstances," the suspension can apply retroactively to imports made 90 days before the preliminary determination is published.

DOC personnel normally visit the mandatory respondents' offices to verify the accuracy of the information provided in the questionnaire responses. This is normally done after the preliminary determination. If the questionnaire responses are incomplete or their accuracy cannot be verified, DOC will calculate dumping margins based on "adverse facts available," which normally means accepting the dumping margins calculated by Petitioner. The verification is one of the most difficult aspects of the investigation.

To verify a respondent's reported information, DOC will send a team of verifiers and require access to confidential information, including the mandatory respondents' accounting records, sales and cost systems, and other sensitive information. In recent practice, due to the COVID-19 pandemic, DOC has first required companies to provide information related to safety and pandemic-related precautions. In the event that DOC determines that it cannot conduct an on-site, in-person verification due to travel or safety concerns, it may conduct a "virtual verification" through an online platform (e.g., Webex) as an alternative.

Within 75 days after the preliminary determination, DOC will issue a final ADD determination (as with the preliminary determination, DOC can, and often does, postpone this deadline for an additional 60 days). DOC's final decision is based on the verified information, public hearings, and briefs submitted by counsel involved in the case. If a zero-dumping finding is made, or only "de minimis" levels (i.e., less than 2.00%) of dumping margin are found, the investigation ends. If DOC's final ADD determination is affirmative, the case proceeds to ITC for a final injury determination. DOC will also instruct CBP to continue to suspend liquidation of entries of LTMCRF from Thailand and require ADD cash deposits at the final dumping margins determined for each exporter. Individual companies receiving zero or de minimis rates are excluded from the ADD order (if issued).

B. ITC Injury Investigation

ITC is currently scheduled to make a preliminary determination (that is, the Commissioners will vote) no later than July 14, 2024. The preliminary investigation will move very quickly. The legal standard that ITC must apply in reaching its preliminary determination is very low. Essentially, ITC must issue an affirmative preliminary injury determination unless it is clear that the US industry is not being injured or is not threatened with injury. Any doubt requires ITC to continue the investigation. Because this standard is so low, it is extremely difficult to terminate an investigation at the preliminary stage. In the final injury investigation, ITC has considerably more time to conduct its investigation and consider the facts and arguments presented by the parties. The legal standard is also higher in the final phase. Therefore, foreign producers are more likely to succeed at the final stage of ITC's investigation than at the preliminary stage. Nevertheless, it can be advantageous for foreign producers and importers to participate in the preliminary phase of the investigation so they can frame themes and issues for ITC's consideration in the final phase.

ITC will base its preliminary injury determination primarily on information received in responses to the questionnaires sent to US producers, US importers, and foreign producers. Typically, the ITC circulates these questionnaires to parties within two to three business days of the filing of the petition (i.e., on or around June 4, 2024); and sets the deadline for them a week before the Staff Conference, discussed below (i.e., on or around June 13, 2024). It is important that foreign producers timely submit responses. Otherwise, ITC likely will accept Petitioner's allegations, resulting in an affirmative preliminary injury determination.

ITC Staff will conduct a conference on or around June 20, 2024. At the conference, interested parties will have an opportunity to present oral testimony and answer ITC Staff's questions. Afterwards, parties will have an opportunity to present written arguments (and supporting exhibits) in post-conference briefs, which will be due on or around June 25, 2024.

In the final phase, the ITC conducts a more thorough investigation, with a much higher standard of injury. For the final phase, the ITC crafts more detailed questionnaires for issuance to US producers, US importers, and foreign producers, as well as (unlike in the preliminary phase) for issuance to US purchasers. Before issuing the questionnaires, ITC Staff circulates draft questionnaires for the parties' comments, which is an important opportunity to ensure the questionnaires solicit information needed to support the defense. After issuing and receiving responses to the questionnaires, ITC Staff prepares a report summarizing and discussing the information and data reported in the questionnaire responses, as well as information compiled from the preliminary phase of the investigation and ITC Staff's independent research. The ITC Staff's report is important because it is a key document relied upon by the Commissioners in evaluating whether the US industry is materially injured or threatened with material injury because of the cumulated subject imports. After issuance of the ITC Staff report, parties have approximately one week to submit briefs ("prehearing briefs") presenting their arguments supporting or opposing an affirmative determination of material injury (or threat thereof). Normally one week after the deadline for prehearing briefs, ITC holds a public hearing at which the Commissioners (i.e., the decision makers) preside. During the hearing, both sides – Petitioner in support of ADD and the foreign producers and US importers/purchasers opposed to ADD – will each have one hour to make an affirmative presentation, followed by a question-and-answer session with the Commissioners. For the defense, in particular, it is critical that industry witnesses (such as importers and US purchasers) opposed to the imposition of ADD participate and testify at the ITC hearing. After the hearing, the parties have approximately one week to prepare "posthearing briefs," which typically focus on rebutting the other side's arguments and answering specific questions raised by the Commissioners at the hearing. Several days before the date of the ITC's scheduled vote, parties have one last opportunity to submit final comments in the case. Unlike the preliminary phase, which takes place over the course of approximately six weeks, the final phase normally takes place over the course of approximately four months.

Calendar of proceedings

The table below provides key deadlines* for the DOC and ITC ADD proceedings.

| ITC Issues Foreign Producer, US Importer, and US Producer Questionnaires | June 4-5, 2024 |

| Foreign Producer, US Importer, and US Producer Questionnaires Due | June 13, 2024 |

| DOC Initiation | June 19, 2024 |

| ITC Preliminary Conference | June 20, 2024 |

| ITC Post-Conference Briefs | June 25, 2024 |

| ITC Preliminary Determination | July 14, 2024 |

| DOC Issues ADD Questionnaire | July 24, 2024 |

| DOC ADD Questionnaire Response Due | August 14, 2024 |

| Supplemental ADD Questionnaire Responses | Summer / Fall 2024 |

| DOC Preliminary ADD Determination | December 26, 2024 |

| ADD Verifications | Early 2025 |

| DOC Final ADD Determination | May 10, 2025 |

| ITC Final Determination | June 24, 2025 |

| Order Issued | July 1, 2025 |

* Please note dates are approximate. To the extent a deadline falls on a weekend or holiday, the event will usually occur the preceding or next business day.

List of foreign producers and exporters

| Name of Producer/Exporter | Address | Website | Phone Number | |

| 1. | ARCELIK HITACHI HOME APPLIANCES (THAILAND) LTD. | 610 Moo 9, Kabinburi-Korat Road (K.M. 12), Nongki, Kabinburi, Prachinburi, Thailand | https://www.arcelik-hitachi-homeappliances.com | +66 2 018 2700 |

| 2. | ATOSA CATERING EQUIPMENT (THAILAND) CO., LTD. | Thanon Phraeska, Phraek Sa Mai, Samut Prakan, 10280, Thailand | https://www.atosathailand.com | +66 2 258 7198 |

| 3. | BEKO THAI CO. LTD. | 360 Moo 3, Tambol Nonglalok Rayong 21120, Thailand | https://www.beko.com | +66 2 044 2356 |

| 4. | CHUANGLI ELECTRICAL APPLIANCES (THAILAND) CO., LTD. | 768 Moo 8 Phananikhom, Nikhom, Phatthana, Rayong, 21180, Thailand | http://www.ctoria.com | N/A |

| 5. | FISHER & PAYKEL APPLIANCES (THAILAND) CO., LTD. | 7/252, 7/282 Moo 6 Amata City, Rayong Industrial Estate, Mapyangporn, Amphur Pluakdaeng, Rayong 21140, Thailand | https://www.fisherpaykel.com | +66 2 919 7371 |

| 6. | HAIER ELECTRIC (THAILAND) PCL | 446, Village No. 9, Kabin Buri-Nakhon, Ratchasima Road, Kabinburi, Tenong Ki Sub-District, Prachinburi, 25110, Thailand | https://www.haier.com/th/?spm=cn.nation_index_pad.country_20230413.1 | N/A |

| 7. | KANG YONG ELECTRIC PUBLIC COMPANY LIMITED | 67 Moo 11, Debaratna Road (K.M. 20), Bangchalong, Bangplee , Samutprakarn 10540, Thailand | https://www.mitsubishi-kye.com | +66 2 337 2900 |

| 8. | MIDEA REFRIGERATION EQUIPMENT (THAILAND) CO., LTD. | No. 18/16 Moo. 8, Khao Khansong Sub-District, Sriracha District, Chonburi Province, 20110, Thailand | N/A | N/A |

| 9. | SANDEN INTERCOOL (THAILAND) PUBLIC COMPANY LIMITED | 97-97/1 Moo 3 Tambol Banmoe, Amphur Promburi, Singburi 16120, Thailand | https://sandengroup.com/ | +66 36 699 410-16 |

| 10. | SHARP APPLIANCES (THAILAND) CO., LTD. | 64 Moo 5 Bang Pakong, Chachoengsao, 24180, Thailand | https://th.sharp/en | +66 02 855 8888 |

| 11. | THAI SAMSUNG ELECTRONICS CO., LTD. | 313 Moo 1, Sriracha Industrial Park, Sukhapiban 9 Road, Tambon Beung, Amphur Sriracha, Chonburi, 20230, Thailand | N/A | N/A |

| 12. | THAI TOSHIBA ELECTRIC INDUSTRIES COMPANY LIMITED | 129/1-5 Moo 2 Tivanon Road, Thasai Sub-district, Mueang Nonthaburi District, Nonthaburi Province, 11000, Thailand | http://www.toshiba-ttei.com/ | +66 02 588 3010 |

| 13. | TOSHIBA CONSUMER PRODUCTS (THAILAND) CO., LTD. | 144/1 Moo 5, Bangkadi Industrial Park, Tivanon Road, T. Bangkadi, A. Muang, Pathumtani, 12000, Thailand | https://www.toshiba-lifestyle.com/th-en/about-us/group-of-companies | +66 2 501 1400 |

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2024 White & Case LLP

View full image: 8418.10.0075 & 8418.21.0090 Import Volume, Thailand (Units) (PDF)

View full image: 8418.10.0075 & 8418.21.0090 Import Volume, Thailand (Units) (PDF)

View full image: 8418.10.0075 & 8418.21.0090 Import Value, Thailand (US$) (PDF)

View full image: 8418.10.0075 & 8418.21.0090 Import Value, Thailand (US$) (PDF)