The securitization or structured finance market has evolved from its early origins focused primarily on financial assets (e.g., mortgages, receivables, loans credit card accounts, etc.) to the world of non-traditional or esoteric securitizations with exciting new assets. The current market for non-traditional securitizations includes whole-business securitizations (e.g., franchised restaurants, franchised fitness centers, franchised service businesses, intellectual property licensing businesses), data center securitizations, music or media royalty securitizations, rental car or fleet leasing securitizations and fiber network securitizations. Whole articles could be written detailing each of the types of securitizations mentioned above; for simplicity, this article focuses on what types of businesses would be good candidates for non-traditional securitizations (whether in the industries mentioned above or otherwise).

What is a non-traditional securitization?

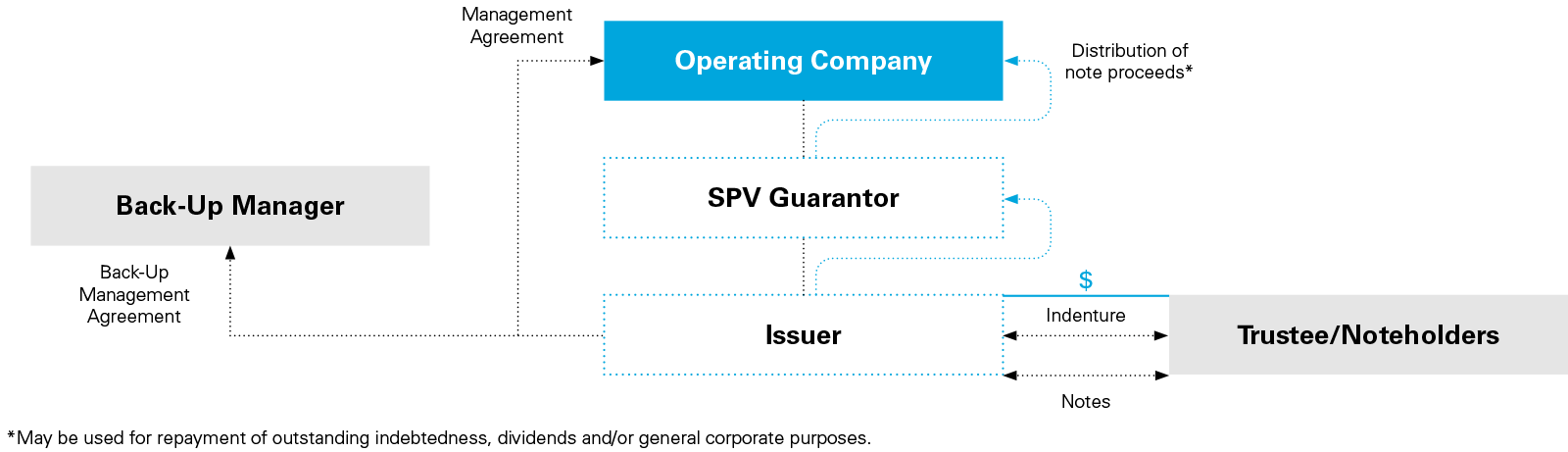

To begin, all securitizations start with a bankruptcy remote special purpose vehicle ("SPV") as the issuer (or borrower if the financing takes the form of a loan). While a traditional securitization is collateralized by financial assets that self-liquidate over time with servicing focused solely on collection, a non-traditional securitization finances specific cash generating assets and related contracts of a business that require some ongoing activities of the business in order to continue to generate revenue and cash flows. Due to its lesser-known position in the market, a non-traditional securitization is sometimes referred to as an "esoteric" securitization.

Generally speaking, a non-traditional securitization includes:

- Creation of the issuer as a bankruptcy remote SPV, which reduces the risk of voluntary and involuntary insolvency proceedings involving the issuer's assets;

- Reorganization the cash generating assets and related contracts of the subject business into the newly created SPV;

- Isolation of the cash generating assets from operating company risk via the transfer of those assets in a "true sale/contribution" and observation of separateness formalities to avoid substantive consolidation, which also reduces the risk that an insolvency proceeding of the subject business will affect the issuer's assets; and

- Collection of the cash flows from the isolated assets into a trust account, which cash flows are then distributed in a pre-approved manner via priority of payments or a payment "waterfall".

A non-traditional securitization structure often looks something like the below:

Why engage in a non-traditional securitization?

Compared to other traditional financings, there is an upfront investment of time and money for a non-traditional securitization. However, the longer-term benefits are plentiful and include:

- Cost savings – Cheaper cost of funding; driven primarily by the ability to achieve a higher rating in the securitization as compared to the pre-securitization operating business. The cost savings is most pronounced, and a securitization is most viable, when moving from a non-investment grade rating to an investment grade rating;

- Flexibility of Purpose – Non-traditional securitization debt has been used, among other purposes, to create a competitive advantage in acquisition financing, to recapitalize public companies and to invest in a brand refresh in a franchise business;

- Higher Leverage – Non-traditional securitization debt typically has higher leverage multiples as compared to traditional corporate debt;

- Efficiency over time – After the initial investment, for businesses that use the capital markets for debt financing, the business may use the structure to efficiently "re-tap" the market and issue additional debt;

- Covenant package – A more favorable covenant package than traditional corporate debt;

- Portability – Non-traditional securitization debt is generally more portable to new owners than traditional financings; and

- Limited recourse – Non-traditional securitization debt is non-recourse to the operating company/sponsor.

Hypothetical Non-Traditional Securitization Candidate

An example may be helpful. Non-Traditional Securitization Business ("NTS") has the rights to a library of copyrighted material1 (e.g., podcasts, films, etc.) and a digital distribution network and it sells the rights to use such material to consumers and third parties within the United States. NTS owns certain of the copyrighted material and has a perpetual license to use certain of the copyrighted material. NTS has been in existence since 1980 and has excellent records that have been maintained electronically. The copyrighted materials include long-standing classics and newly generated content that NTS regularly sources. NTS is rated "B", is owned by a private-equity fund and has an outstanding term loan debt facility. Employees of NTS are required to source the copyrighted material, generate sales to new and existing customers and to service the customers and underlying assets.

Why is NTS a good candidate for non-traditional securitization?

NTS checks a number of the boxes for a non-traditional securitization, including:

- Ratings – A non-traditional securitization is best where there is a meaningful increase to the rating of the SPV's debt versus the business as a whole. The rating increase is possible due to a "de-linking" of the corporate family rating and structured finance rating using certain asset-isolation principles (e.g., true sale and non-consolidation treatment). In this case, NTS would be looking to obtain an investment grade rating (i.e., "BBB") under structured finance ratings criteria;

- Valuable and transferrable assets – The copyrighted material that NTS distributes to customers is registered or licensed intellectual property that can be transferred and without any regulatory approval. Same for the digital distribution network; that is an asset that could be transferred with straightforward paperwork. While there may be some contractual restrictions on assignments, transferring to an affiliated SPV commonly works;

- Significant historical data and predictable cash flows – NTS has decades of data it can provide to investors and rating agencies to show performance through multiple economic cycles and changing consumer preferences. Investors and rating agencies can stress the impact of customer cancellations on cash flows;

- Serviceable assets – In a default or "manager" removal scenario, the assets of NTS could be serviced by a third party. While there likely is some NTS brand awareness and business acumen, customers are ultimately acquiring the right to consume the copyrighted material which will be owned by the SPV. The employees of NTS are important to the business, but in a default or manager removal scenario new sales agents can service the digital infrastructure sufficiently to pay off the securitization debt;

- Corporate Structure and Debt – While NTS has an existing term loan, that will be repaid using the non-traditional securitization debt proceeds as the proceeds of the securitization are likely higher than the term loan given the higher leverage multiples available in the securitization market. The private equity sponsor of NTS likes that the non-traditional securitization debt is portable; and

- Single Jurisdiction – The assets and cash generating contracts are all located within the United States, which simplifies any tax and currency exchange issues. While non-traditional securitizations of cash flows from multiples jurisdictions are possible, a cost-benefit analysis would be done on a jurisdiction-by-jurisdiction basis.

Assuming a non-traditional securitization of NTS could be structured to the typical legal asset-isolation principles of true sale and non-consolidation, it would make sense for NTS to explore issuing asset-backed securities backed by the cash flows of its underlying intellectual property portfolio and customer contracts.

While NTS is a hypothetical business and an intentionally obvious candidate for non-traditional securitization, the authors hope this article can be helpful to readers to consider whether a non-traditional securitization could make sense for their business. Each business and scenario requires analysis and attention to determine if a non-traditional securitization is viable, but the more boxes a company can check against the list above the more likely it is that a non-traditional securitization could make sense for the company. As noted above, to date the non-traditional securitization market has focused on intellectual property, franchise licenses, music/media royalties, data centers, fiber networks and rental cars, but the list of assets classes that have been subject to non-traditional securitization has grown significantly and will likely continue to grow.

1 While a copyright is used as the revenue source here, other intellectual property like trademarks and patents may also often provide adequate revenue source for a non-traditional securitization.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2024 White & Case LLP

View full image: Non-traditional securitization structure (PDF)

View full image: Non-traditional securitization structure (PDF)