Summary of June 2024 Annual General Shareholder Meeting Season Shareholder Proposals

- While the total number of shareholder proposals is comparable to the June 2023 general meeting season, the number of companies receiving proposals remains at a sustained high level in comparison with a few years ago.

- In addition to balance-sheet proposals, the number of governance proposals from activists is on the rise.

- Shareholders continue to exhibit harsh judgment on executives of scandal-burdened companies.

1. Sustained high level of Shareholder Proposals for the June 2024 general meeting season1

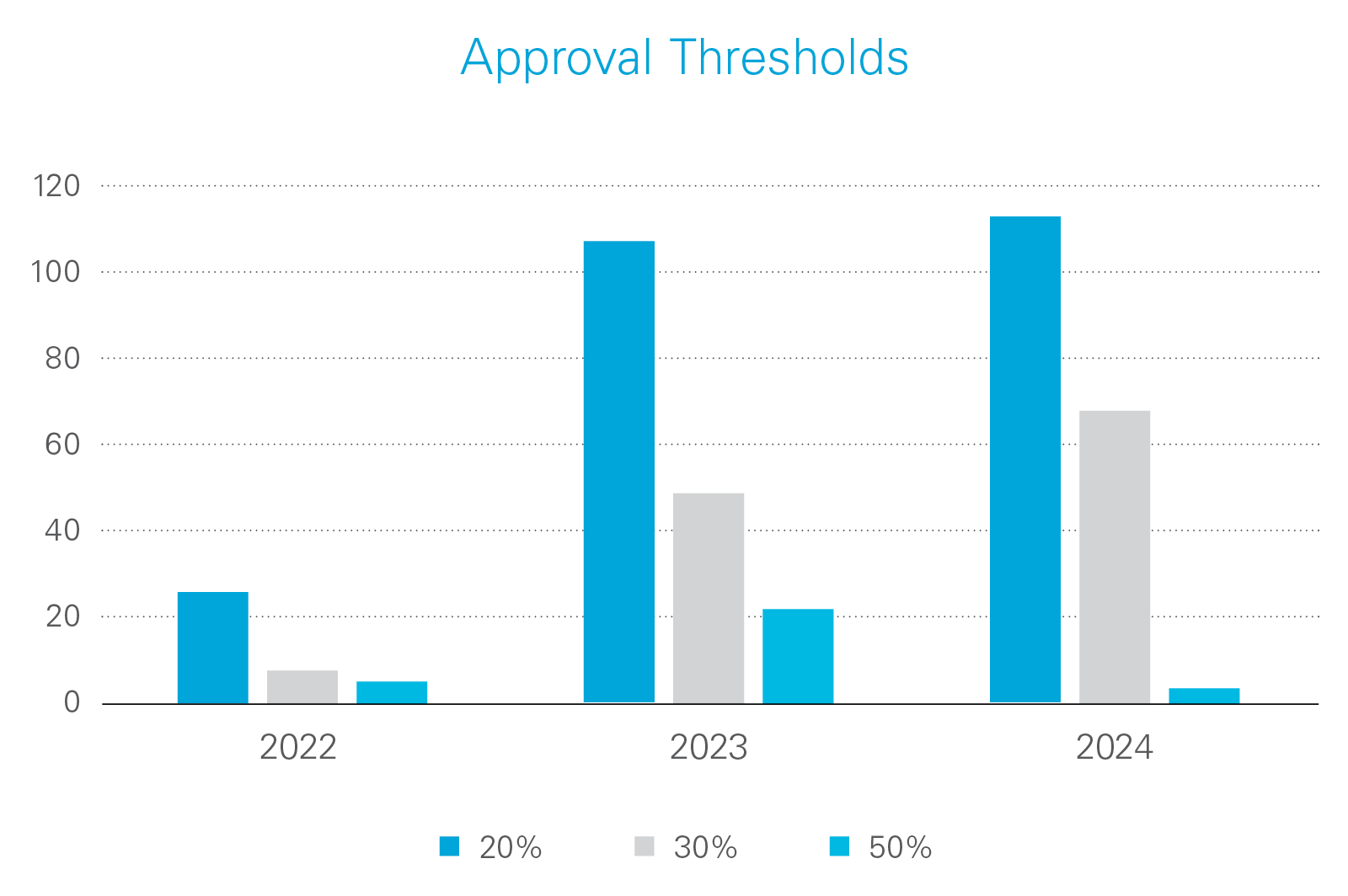

During the June 2024 annual general meeting season, shareholders made a total of 385 proposals to 91 Japanese publicly listed companies, nearly the same as in the June 2023 annual general meeting season. Compared to 2021, the number of companies subject to shareholder proposals has increased by 237%, and the total number of shareholder proposals has increased by 63%. Although the number of proposals remains the same as last year, only four (4) proposals this year received 50% or more support, compared to 21 in 2023. However, the number of proposals with 30% or greater support increased from 49 to 68, while the number of proposals with 20% or greater support rose to 113 from 107.

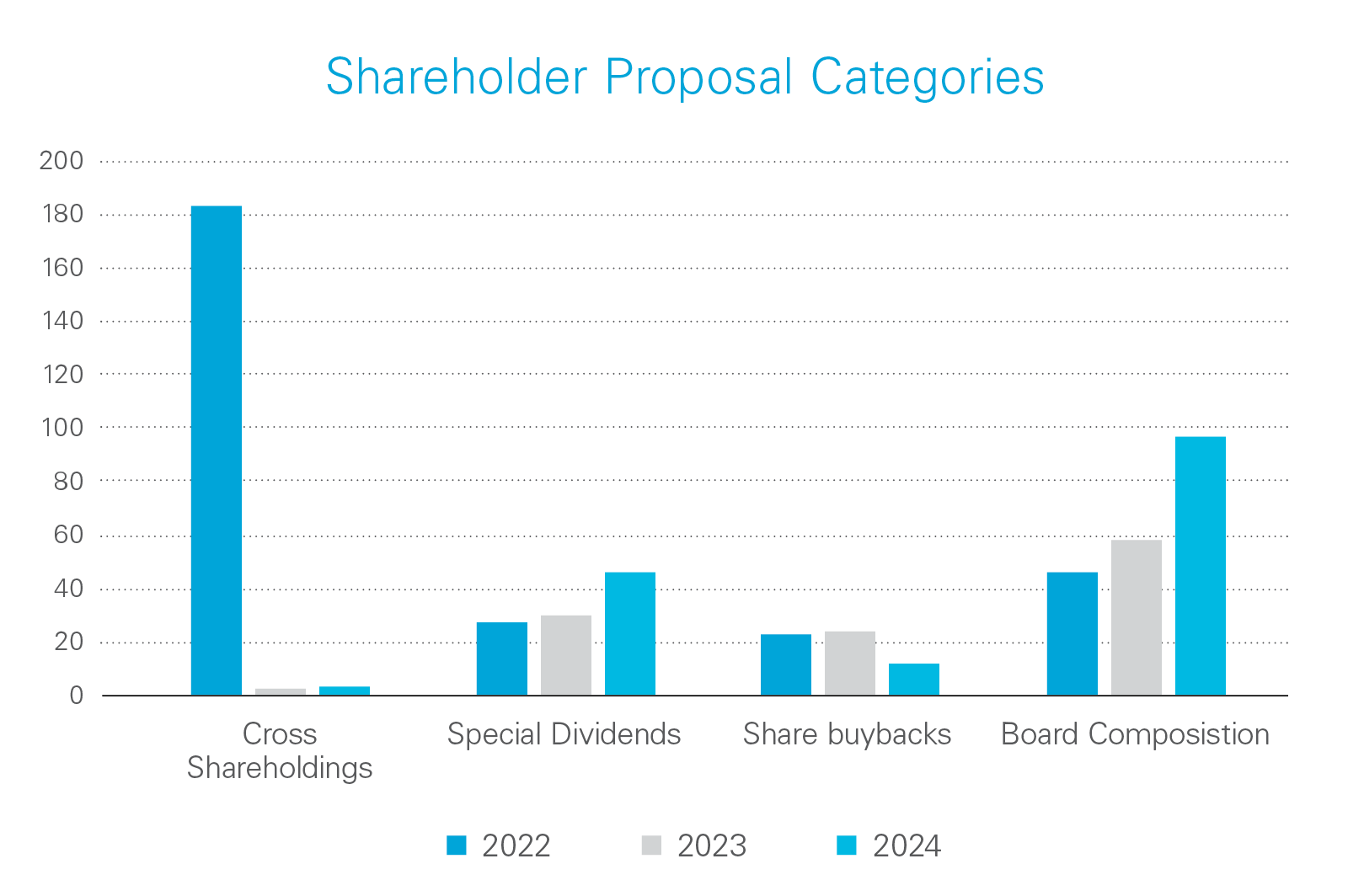

Of 385 shareholder proposals this year, three (3) called for selling shares or ending cross-shareholdings (up one (1) from 2023). 46 called for special dividends (up 16 from 2023) and 12 called for share buybacks (down 12 from 2023).2 97 called for changes to the composition of the board, up from 58 in 2023. Eight (8) called for changes to director compensation.

2. Strategic Capital wins three seats on Daidoh Limited board; Toyo president Kuwahara resigns one hour before shareholders' meeting

The number of shareholder proposals that garnered more than 50% support fell to four (4) from 22 compared to last year. Three (3) of these proposals were submitted to apparel company Daidoh Limited by Strategic Capital, a Japanese activist fund led by Tsuyoshi Maruki, a veteran activist investor known for his focus on traditional balance sheet issues.3 Strategic Capital proposed three (3) board nominees, receiving 51.73%, 51.15% and 50.70% support, respectively.4 Daidoh Limited has posted operating losses for 11 years in a row and has been at odds with Strategic Capital, which owns 32% of the company, over restructuring,5 On July 4, Daidoh Limited announced plans to increase dividends and repurchase treasury stock within a certain period of time as a way to enhance shareholder returns at the conclusion of discussions at a board meeting of eight (8) newly elected directors at this year's annual shareholders meeting. Strategic Capital sold its entire stake in Daidoh Limited the next day, according to an amendment report filed on July 12.6

The shareholder proposal with the highest support rating (57.3%) during the June proxy season was a proposal by UGS Asset Management to request a special dividend from Toyo Securities. To achieve this, however, Toyo Securities would have had to amend its articles of incorporation, which, pursuant to Japan's Companies Act, requires a 2/3 supermajority vote.7 8 Nevertheless, Toyo Securities did not leave the meeting unscathed. Toyo Securities had originally proposed the appointment of eight (8) directors, including President Yoshiaki Kuwahara. The company, however, which is 27% owned by activists, reportedly did not expect Kuwahara to be elected due to prior voting conditions, forcing the company to withdraw Kuwahara from its list of director candidates on the day of the annual meeting.9 10 Toyo Securities also received a low approval rating of 50% to 51% for its chosen candidates, a notably low approval rate for a company-proposed director.

While the increase in support for shareholder activism in Japan is not always evident in the statistics for a single year's annual general-meeting season, such upward trend in support illustrates the changing environment. In 2022, only 6% of activist fund shareholder proposals received 40% or more support, but this year nearly 25% received 40% or more support. Importantly, the passage of shareholder proposals is only one indicator of the success of activism in Japan. While it is not always clear how much influence activists have behind the scenes on listed companies as shareholders, a close look at the behavior of companies in which activists have been shareholders for many years gives some indication as to their influence. For example, Aizawa Securities, which has had U.S. activist Dalton Investments as a shareholder since 2017, raised its annual dividend for the year ending March this year from ¥26 to ¥39. In April, it announced a plan to return more than ¥20 billion to shareholders through dividends and share buybacks from the year ending March 2025 to the year ending March 2028.11

3. The TSE continues to press listed companies to improve their performance (e.g., improve ROE), and activists continue to focus on balance sheet proposals that receive strong support from shareholders

In March 2023, the TSE requested that all listed companies on the Prime and Standard Markets take "action to implement management that is conscious of the cost of capital and stock price" (the "Request").12 Following the Request, according to media reports, 64 companies increased their return of capital to shareholders despite forecasts of decreased net profits in 2023.13 On January 15, 2024, the TSE published a list of companies that have disclosed information regarding their compliance with the Request in order to inform investors which listed companies are taking action, with the hope of encouraging others to follow suit.14 The TSE also announced that it will update the list monthly.

In the meantime, shareholders continue to demand that companies raise their dividend payout ratios and pay special dividends. There were 52 shareholder proposals on dividends this year, up 33% from 39 in 2023. While none of the shareholder proposals received the majority support generally required to for such proposals to pass, there were seven (7) proposals with 35% or more support. The top proposal (43.73%) was a proposal by UGS Asset Management Co., Ltd. (Sunshine E Investment Partnership) that called for a 6% dividend on equity (DOE) from Sata Construction. Another 14 shareholder proposals received support between 20% and 35%. Interestingly, this year saw an increase in proposals requiring a specific DOE rather than a payout ratio. Most of last year's top 15 dividend proposals focused on a payout ratio, with only three (3) requiring a specific DOE. In contrast, DOE proposals accounted for half of the top 15 proposals this year.

Asset Value Investors and Strategic Capital have been persistent with requests for dividend proposals. In 2023, Asset Value Investors submitted two highly favored dividend proposals: a proposal for a 70% payout ratio was approved with 61.58% support, and a proposal for a 30% payout ratio for SK Kaken was the fourth-most supported dividend proposal with 35.14% support. Asset Value Investors took a more aggressive approach to SK Kaken this year, raising its payout requirement from 30% to 50%.15 Despite this much higher target, the proposal obtained a 31.68% support rate, signaling a potential increase of shareholder support for a higher payout ratio.16

Another persistent shareholder to note is Strategic Capital. In addition to successfully electing three (3) board nominees at Daidoh Limited this year, Strategic Capital also garnered high support ratings for its proposals for dividends from surplus to Toa Road and Bunka Shutter: The proposal to pay a 8% DOE dividend at TOA Road received 19.54% approval,17 while the proposal to pay a 100% payout ratio dividend at Bunka Shutter received 26.14% approval.18 Strategic Capital made a similar proposal last year (in collaboration with NAVF) to Bunka Shutter for a 100% payout ratio. Compared to last year's 21.47% approval rating, the proposal appears to be building up momentum, having gained more approval from shareholders this year.19

Companies trading below book value account for as much as 47% of companies in Japan's broad benchmark Topix index, while the figures for Europe and the U.S. are only 18.4% and 4.8% respectively.20 As the TSE continue to press Japanese companies to increase ROE and boost the appeal of the Japanese stock market to investors, it will be interesting to see whether more companies will follow the TSE's request and move towards faster growth by taking measures such as mobilizing their excess cash and other assets and reinvest them to boost company growth or reduce cost of capital by boosting dividends and thus the stock price.

4. Shareholders' Harsh Attitude toward Management following Corporate Misconduct

The number of shareholder proposals to change the composition of the board of directors increased from 59 in 2023 to 97 in 2024, with a significant showing at companies facing high-profile corporate scandals. For example, support for Hankyu Hanshin's proposal to reappoint CEO Kazuo Sumi as a director was 57.45%, the lowest this year.21 This is believed to be the result of an incident involving a theater member at the Takarazuka Revue, a member of the Hankyu Hanshin Group.

Sharp, which has posted a net loss for the second year in a row, announced on the day before its shareholders' meeting that Wu Po-Hsuan would step down as president and chief executive officer and Okitsu Masahiro would be promoted from vice president to president and chief executive officer.22 According to media reports, the two (2) years of losses stemming from the slump in the LCD panel business and the unusual announcement of a change in president on the day before the shareholders' meeting prompted a series of harsh comments on management responsibility. Both the reappointment of Wu and Okitsu as directors and the appointment of a new outside director were approved, but the approval rates were low, ranging from 60% to 63%.23

Both Sharp and Hankyu Hanshin appear to lack any traditional activist shareholders. Rather, both episodes appear to feature so-called "ordinary" shareholders who decided to become actively engaged in the management of the companies in which they held a financial interest.

5. Environmental Proposals

While environmental and climate-related proposals continue to be proposed every year and obtain a non-negligible percentage of support, the recent trend of waning support for these initiatives continues. At the general meeting of shareholders of Mitsubishi UFJ Financial Group, two (2) proposals submitted by shareholders were related to climate change. The first was a proposal to amend the articles of incorporation to require disclosure of information necessary for shareholders to evaluate directors' ability to effectively manage climate-related business risks and opportunities, which garnered 25.79% support. The second was a proposal to amend the articles of incorporation to require disclosure of information on how the company evaluates clients' climate change mitigation plans that garnered only 18.38% support.25 For Sumitomo Mitsui Financial Group, two (2) similar proposals were also submitted as shareholder proposals. The company saw 26.34% support for the first proposal and 24.21% support for the second proposal.26

Overall, support for environmental proposals in Japan remains weak. In 2024, the average support rate for environmental proposals was 20%, which was slightly above the average support rate of 18% for the 2023 environmental proposals. Furthermore, the majority of these proposals came from a small number of climate change activists, led by Asia Shareholder Action, the Australasian Centre for Corporate Responsibility, and Corporate Action Japan. The weak support for environmental proposals in Japan can be seen as part of the decline in global support for environmental proposals. For example, the average support rate for all environmental proposals in the US was 16%, down from 19% in 2023 and 30% in 2021.27 No environmental proposals were passed in Japan between 2020 and 2024. We will see if this trend continues.

List of Shareholder Proposals by Activist Investors at the June 2024 Shareholders' General Meetings

| Company | Shareholder who submitted the proposal | Topic | Approval percentage | |

| 1. | Toyo Securities | Sunshine F Investment Partnership (UGS Asset Management Co., Ltd.) | Partial Amendment to the Articles of Incorporation (Dividends of Surplus, etc.) | 57.30 |

| 2. | Daidoh Ltd. | Strategic Capital | Election of Six (6) Directors | 51.73 |

| 3. | Daidoh Ltd. | Strategic Capital | Election of Six (6) Directors | 51.15 |

| 4. | Daidoh Ltd. | Strategic Capital | Election of Six (6) Directors | 50.70 |

| 5. | Daidoh Ltd. | Strategic Capital | Election of Six (6) Directors | 49.96 |

| 6. | Daidoh Ltd. | Strategic Capital | Election of Six (6) Directors | 49.90 |

| 7. | Toyo Securities | Sunshine F Investment Partnership (UGS Asset Management Co., Ltd.) | Partial Amendment to the Articles of Incorporation (formulation and disclosure of a plan to achieve a PBR of one (1) or more) | 49.42 |

| 8. | Daidoh Ltd. | Strategic Capital | Election of Six (6) Directors | 48.96 |

| 9. | Toyo Suisan | Nihon Global Growth Partners Management (NHGGP) | Partial Amendment to the Articles of Incorporation (Disclosure) | 48.66 |

| 10. | Toyo Securities | Sunshine F Investment Partnership (UGS Asset Management Co., Ltd.) | Partial Amendment to the Articles of Incorporation (Deletion of Real Estate Leasing and Management Business) | 47.51 |

| 11. | Toyo Securities | Sunshine F Investment Partnership (UGS Asset Management Co., Ltd.) | Election of Five (5) Directors | 47.48 |

| 12. | Toyo Securities | Sunshine F Investment Partnership (UGS Asset Management Co., Ltd.) | Election of Five (5) Directors | 47.48 |

| 13. | Toyo Securities | Sunshine F Investment Partnership (UGS Asset Management Co., Ltd.) | Election of Five (5) Directors | 47.41 |

| 14. | Toyo Securities | Sunshine F Investment Partnership (UGS Asset Management Co., Ltd.) | Election of Five (5) Directors | 47.37 |

| 15. | Toyo Securities | Sunshine F Investment Partnership (UGS Asset Management Co., Ltd.) | Election of Five (5) Directors | 47.36 |

| 16. | Toyo Securities | Sunshine F Investment Partnership (UGS Asset Management Co., Ltd.) | Reduction of Directors' Compensation | 44.15 |

| 17. | Sata Construction | Sunshine E Investment Partnership | Appropriation of Surplus | 43.73 |

| 18. | Sankyo Kasei | Black Clover Limited | Amendment to the Articles of Incorporation Relating to the Disclosure of Measures to Realize Management with an Awareness of Capital Costs and Stock Prices | 43.00 |

| 19. | Sankyo Kasei | Black Clover Limited | Abolition of Measures Against Large-scale Purchases of the Company Shares (Takeover Defense Measures) | 43.00 |

| 20. | Hokuetsu Corporation | Oasis | Election of Five (5) Outside Directors | 42.69 |

| 21. | Hokuetsu Corporation | Oasis | Election of Five (5) Outside Directors | 41.98 |

| 22. | Hokuetsu Corporation | Oasis | Election of Five (5) Outside Directors | 41.96 |

| 23. | With us Corporation | Global ESG Strategy | Deletion of Article 38 of the Articles of Incorporation (regarding Organization for Determining Dividends, etc. of Surplus) | 41.93 |

| 24. | Hokuetsu Corporation | Oasis | Election of Five (5) Outside Directors | 41.87 |

| 25. | With us Corporation | Global ESG Strategy | Abolition of Takeover Defense Measures | 41.85 |

| 26. | Hokuetsu Corporation | Oasis | Election of Five (5) Directors | 41.82 |

| 27. | Hokuetsu Corporation | Oasis | Election of Five (5) Directors | 41.82 |

| 28. | Tenma | LIM Japan Event Master Fund | Partial Amendment to the Articles of Incorporation (Disclosure of Individual Compensation for Directors (excluding outside directors and non-executive directors.)) | 41.72 |

| 29. | Hokuetsu Corporation | Oasis | Election of Five (5) Directors | 41.30 |

| 30. | Hokuetsu Corporation | Oasis | Election of Five (5) Directors | 41.28 |

| 31. | Hokuetsu Corporation | Oasis | Election of Five (5) Directors | 41.28 |

| 32. | Sanyo Kasei | Black Clover Limited | Appropriation of Surplus (Dividend in Kind) | 40.70 |

| 33. | Japan Pure Chemical | HIBIKI PATH VALUE FUND | Partial Amendment to the Articles of Incorporation (Organization for Determining Dividends of Surplus, etc.) | 39.99 |

| 34. | Hokuetsu Corporation | Oasis | Determination of Basic Compensation Amount for Individual Outside Directors | 39.16 |

| 35. | Hokuetsu Corporation | Oasis | Determination of Remuneration for Granting Restricted Stock to Outside Directors | 39.06 |

| 36. | Hokuetsu Corporation | Oasis | Removal of One (1) Representative Director | 38.17 |

| 37. | Hokuetsu Corporation | Oasis | Dismissal of Four (4) Outside Directors | 38.15 |

| 38. | Tenma | LIM Japan Event Master Fund | Appropriation of Surplus | 38.15 |

| 39. | Hokuetsu Corporation | Oasis | Dismissal of Four (4) Outside Directors | 38.15 |

| 40. | Hokuetsu Corporation | Oasis | Dismissal of Four (4) Outside Directors | 38.04 |

| 41. | Hokuetsu Corporation | Oasis | Election of Five (5) Outside Directors | 38.03 |

| 42. | Hokuetsu Corporation | Oasis | Dismissal of Four (4) Outside Directors | 38.02 |

| 43. | Hokuetsu Corporation | Oasis | Determination of Fixed Remuneration Amounts for Individual Outside Directors | 37.60 |

| 44. | Nissan Shatai | Strategic Capital | Amendment to the Articles of Incorporation Related to the Establishment of the Minority Shareholder Protection Committee | 35.40 |

| 45. | With us Corporation | Global ESG Strategy | Deletion of Article 18 of the Articles of Incorporation (Deletion of Provisions concerning Introduction of Takeover Defense Measures, etc.) | 33.82 |

| 46. | Bunka Shutter | Strategic Capital | Addition of Compensation Disclosure Conditions to Performance-Based Compensation and Stock Compensation for Representative Directors | 33.06 |

| 47. | With us Corporation | Global ESG Strategy | Partial Amendment to the Articles of Incorporation (Application of Takeover Defense Measures to Parties Related to the Founder) | 33.01 |

| 48. | SK Kaken | AVI JAPAN OPPORTUNITY TRUST | Appropriation of Surplus | 31.68 |

| 49. | SK Kaken | AVI JAPAN OPPORTUNITY TRUST | Partial Amendment to the Articles of Incorporation | 31.54 |

| 50. | Komeri | Northern Trust (Nippon Value Investors) | Partial Amendment to the Articles of Incorporation (Organization for Determining Dividends of Surplus, etc.) | 31.45 |

| 51. | With us Corporation | Global ESG Strategy | Partial Amendment to the Articles of Incorporation (Policy on Dividends of Surplus) | 31.31 |

| 52. | With us Corporation | Global ESG Strategy | Partial Amendment to the Articles of Incorporation (Handling by Directors of Interviews with Shareholders) | 31.21 |

| 53. | Keisei Electric Railway | Palliser Capital Master Fund | Partial Amendment to the Articles of Incorporation (Establishment of Provisions on Capital Allocation Policy and Management of Investment Securities) | 29.89 |

| 54. | The Hachijuni Bank | LIM Japan Event Master Fund | Partial Amendment to the Articles of Incorporation (Disclosure of Individual Compensation for Directors) | 29.75 |

| 55. | Bunka Shutter | Strategic Capital | Amendment to the Articles of Incorporation Pertaining to Disclosure of Strategic Shareholdings Less than the Cost of Capital | 29.73 |

| 56. | Tokyo Cosmo Electric | Global ESG Strategy | Appropriation of Surplus | 29.38 |

| 57. | With us Corporation | Global ESG Strategy | Partial Amendment to the Articles of Incorporation (Restrictions on Appointment of Directors of Consolidated Subsidiaries) | 28.99 |

| 58. | With us Corporation | Global ESG Strategy | Partial Amendment to the Articles of Incorporation (Criteria for Appointment of Directors) | 28.97 |

| 59. | With us Corporation | Global ESG Strategy | Partial Amendment to the Articles of Incorporation (Restrictions on Appointment to Directors and Management by Former Directors or Officers of Other Companies in the Same Business) | 28.92 |

| 60. | Yodogawa Steel Works | Strategic Capital | Amendment to the Articles of Incorporation Pertaining to Organization for Determining Dividend of Surplus, etc. | 28.86 |

| 61. | Dai Nippon Printing | Monex Activist Mother Fund | Election of Directors | 27.70 |

| 62. | Kinden | HIBIKI PATH VALUE FUND | Appropriation of Surplus | 26.70 |

| 63. | Tokyo Cosmos Electric | Global ESG Strategy | Partial Amendment to the Articles of Incorporation (Handling by Directors of Interviews with Shareholders) | 26.66 |

| 64. | transcosmos | Northern Trust (Nippon Value Investors) | Partial Amendment to the Articles of Incorporation (Cancellation of Treasury Shares) | 26.62 |

| 65. | Tokyo Cosmo Electric | Global ESG Strategy | Partial Amendment to the Articles of Incorporation (Policy on Dividends of Surplus) | 26.60 |

| 66. | Bunka Shutter | Strategic Capital | Appropriation of Surplus | 26.14 |

| 67. | Ishihara Chemical | Nippon Active Value Fund | Acquisition of Treasury Shares | 23.72 |

| 68. | Toda Corporation | Longchamp SICAV (Dalton Investments Inc.) | Acquisition of Treasury Shares | 23.68 |

| 69. | Kumagai Gumi | Oasis | Appropriation of Surplus | 22.90 |

| 70. | Ishihara Chemical | Nippon Active Value Fund | Amendment to the Articles of Incorporation concerning the Number of Outside Directors | 22.74 |

| 71. | Toyo Suisan | Nihon Global Growth Partners Management (NHGGP) | Partial Amendment to the Articles of Incorporation (Management of Subsidiaries) | 21.97 |

| 72. | Toyo Suisan | Nihon Global Growth Partners Management (NHGGP) | Revision of Amount of Remuneration for Directors and Determination of Remuneration Ratio for Directors (Excluding Outside Directors) and Remuneration for Allotment of Restricted Shares | 21.81 |

| 73. | Nihon Kagaku Sangyo | ESG Investment Partnership | Amendment to the Articles of Incorporation Pertaining to Appropriation of Surplus | 21.73 |

| 74. | Nagahori | Re Generation | Appropriation of Surplus | 20.80 |

| 75. | The Hachijuni Bank | LIM Japan Event Master Fund | Appropriation of Surplus | 20.57 |

| 76. | Bunka Shutter | Strategic Capital | Amendment to the Articles of Incorporation Pertaining to Disposal of Strategic Shareholdings Less Than the Cost of Capital | 20.02 |

| 77. | Toyo Suisan | Nihon Global Growth Partners Management (NHGGP) | Appropriation of Surplus | 19.69 |

| 78. | Toa Road Corporation | Strategic Capital | Appropriation of Surplus | 19.54 |

| 79. | Kyokuto Kaihatsu Kogyo | Strategic Capital | Appropriation of Surplus | 19.32 |

| 80. | Nihon Kagaku Sangyo | ESG Investment Partnership | Amendment to the Articles of Incorporation Related to Anti-Takeover Measures | 19.08 |

| 81. | Nihon Kagaku Sangyo | ESG Investment Partnership | Reversal of Contingent Reserve | 18.69 |

| 82. | Bunka Shutter | Strategic Capital | Addition of Compensation Clawback Provisions for Directors | 18.51 |

| 83. | Yodogawa Steel Works | Strategic Capital | Amendment to the Articles of Incorporation of Cancellation of Treasury Shares | 18.31 |

| 84. | transcosmos | Northern Trust (Nippon Value Investors) | Cancellation of Treasury Shares | 18.17 |

| 85. | Yamato | Sunshine E Investment Partnership (UGS Asset Management Co., Ltd.) | Appropriation of Surplus | 17.51 |

| 86. | Nihon Kagaku Sangyo | ESG Investment Partnership | Amendment to the Articles of Incorporation Regarding the Sale of Strategic Shareholdings | 17.28 |

| 87. | Yodogawa Steel Works | Strategic Capital | Amendment to the Articles of Incorporation Regarding the Shareholder Benefit Program | 17.19 |

| 88. | NHK Spring | Longchamp SICAV (Dalton Investments Inc.) | Approval of Amount of Compensation for Restricted Stock Compensation Plan | 16.82 |

| 89. | Nippo | Global ESG Strategy | Appropriation of Surplus | 15.76 |

| 90. | Osaka Steel | Strategic Capital | Partial Amendment to the Articles of Incorporation (Number of Directors, etc.) | 15.37 |

| 91. | Nippo | Global ESG Strategy | Partial Amendment to the Articles of Incorporation (Policy on Dividends of Surplus) | 14.86 |

| 92. | The Hachijuni Bank | LIM Japan Event Master Fund | Purchase of Treasury Shares | 14.84 |

| 93. | Sumitomo Densetsu | Monex Activist Mother Fund | Appropriation of Surplus | 14.73 |

| 94. | Nippo | Global ESG Strategy | Partial Amendment to the Articles of Incorporation (Handling by Directors of Interviews with Shareholders) | 14.57 |

| 95. | Osaka Steel | Strategic Capital | Partial Amendment to the Articles of Incorporation (Formulation and Disclosure of a Plan to Achieve a PBR of one (1) or More) | 14.51 |

| 96. | Keihanshin Building | Strategic Capital | Determination of Granting Restricted Stock with Stock Price Conditions to Directors | 14.03 |

| 97. | Toyo Suisan | Nihon Global Growth Partners Management (NHGGP) | Purchase of Treasury Shares | 13.97 |

| 98. | The Hachijuni Bank | LIM Japan Event Master Fund | Partial Amendment to the Articles of Incorporation (Verification of Purpose of Strategic Shareholdings and Disclosure of Results) | 13.68 |

| 99. | Airport Facilities | LIM Japan Event Master Fund | Partial Amendment to the Articles of Incorporation (Disclosure of Individual Compensation for Directors) | 12.97 |

| 100. | Osaka Steel | Strategic Capital | Partial Amendment to the Articles of Incorporation (Formulation and Disclosure of Business Plan concerning Reduction of Greenhouse Gas Emissions) | 12.96 |

| 101. | Rinnai | Dulton | Acquisition of Treasury Shares | 12.54 |

| 102. | Osaka Steel | Strategic Capital | Dividend of Surplus (Special Dividend) | 12.40 |

| 103. | Yodogawa Steel Works | Strategic Capital | Amendment to the Articles of Incorporation concerning the Formulation and Disclosure of a Plan to Achieve a PBR of 1 or More | 12.34 |

| 104. | Fukuda Denshi | Japan Absolute Value Fund | Election of Two (2) Directors | 12.06 |

| 105. | Osaka Steel | Strategic Capital | Partial Amendment to the Articles of Incorporation (Prohibition of Funding through Deposits or Loans with Nippon Steel Corporation) | 11.97 |

| 106. | Fukuda Denshi | Japan Absolute Value Fund | Election of Two (2) Directors | 11.73 |

| 107. | House Foods Group | Longchamp SICAV (Dalton Investments Inc.) | Amendment to the Articles of Incorporation concerning the Composition of Outside Directors | 11.67 |

| 108. | Fukuda Denshi | Japan Absolute Value Fund | Elimination of the Maximum Amount of Remuneration for Outside Directors | 11.57 |

| 109. | House Food Group | Longchamp SICAV (Dalton Investments Inc.) | Acquisition of Treasury Shares | 10.10 |

| 110. | Nippon Fine Chemical | Nippon Active Value Fund | Acquisition of Treasury Shares | 9.88 |

| 111. | Toyota Motor Corporation | Kapitalforeningen MP Invest | Partial Amendment to the Articles of Incorporation | 9.17 |

| 112. | Keihanshin Building | Strategic Capital | Amendment to the Articles of Incorporation concerning the Formulation and Disclosure of a Plan to Achieve a PBR of 1 or More | 9.14 |

| 113. | Airport Facilities | LIM Japan Event Master Fund | Appropriation of Surplus | 8.24 |

| 114. | Nihon Kagaku Sangyo | ESG Investment Partnership | Appropriation of Surplus | 7.80 |

| 115. | C.Uyemura | Longchamp SICAV (Dalton Investments Inc.) | Amendment to the Articles of Incorporation | 7.71 |

| 116. | Airport Facilities | LIM Japan Event Master Fund | Partial Amendment to the Articles of Incorporation (Verification of Purpose of Strategic Shareholdings and Disclosure of Results) | 7.35 |

| 117. | C.Uyemura | Longchamp SICAV (Dalton Investments Inc.) | Acquisition of Treasury Shares | 7.31 |

| 118. | Airport Facilities | LIM Japan Event Master Fund | Acquisition of Treasury Shares | 7.04 |

| 119. | Wakamoto Pharmaceutical | Nanahoshi Management | Reversal of Contingent Reserve | 6.91 |

| 120. | Fukuda Denshi | Japan Absolute Value Fund | Revision of Amount of Remuneration for Directors | 6.47 |

| 121. | Wakamoto Pharmaceutical | Nanahoshi Management | Partial Amendment to the Articles of Incorporation Relating to the Disclosure of Measures to Realize Management with an Awareness of Capital Costs and Stock Prices | 6.16 |

| 122. | Wakamoto Pharmaceutical | Nanahoshi Management | Appropriation of Surplus | 5.88 |

| 123. | Wakamoto Pharmaceutical | Nanahoshi Management | Partial Amendment to the Articles of Incorporation Relating to the Submission of Annual Securities Report prior to the Annual General Meeting of Shareholders | 5.62 |

| 124. | Wakamoto Pharmaceutical | Nanahoshi Management | Partial Amendment to the Articles of Incorporation Regarding the Equity in Greenhouse Gas Emissions from Strategic Shareholdings | 5.47 |

| 125. | Wakamoto Pharmaceutical | Nanahoshi Management | Partial Amendment to the Articles of Incorporation to Include the Disclosure of the Number of Laboratory Animals Acquired by Species as the Purpose of the Articles of Incorporation | 5.31 |

| 126. | The Hachijuni Bank | LIM Japan Event Master Fund | Partial Amendment to the Articles of Incorporation (Sale of Strategic Shareholdings) | 4.58 |

| 127. | The Hachijuni Bank | LIM Japan Event Master Fund | Partial Amendment to the Articles of Incorporation (Conversion to a Domestic Standard Bank) | 3.56 |

| 128. | Airport Facilities | LIM Japan Event Master Fund | Partial Amendment to the Articles of Incorporation (Prohibition of Appointment of Former Officials of Japan Airlines Co., Ltd. or ANA Holdings Inc.) | 2.98 |

| 129. | Airport Facilities | LIM Japan Event Master Fund | Partial Amendment to the Articles of Incorporation (Sale of Strategic Shareholdings) | 2.64 |

1 Unless otherwise cited in this document, all figures in this document are calculated by White & Case based on search results on XeBRal ADDS and other published materials.

2 Includes proposals regarding Audit and Supervisory Committee Members.

3 DAIDOH LIMITED, INC. "Notice Concerning Receipt of Written Notice Concerning Shareholder Proposal and Opinion of the Board of Directors of our company" May 24, 2024 https://www.daidoh-limited.com/pdf/2024/20240524_03.pdf

4 DAIDOH LIMITED, INC. "Extraordinary Report " July 1, 2024 https://disclosure2.edinet-fsa.go.jp/WZEK0040.aspx?S100TYV2

5 DAIDOH LIMITED, INC. "Notice Concerning Revision of Shareholder Return Policy and Dividend Forecast (Increase of Dividend) " July 4, 2024 https://www.daidoh-limited.com/pdf/2024/20240704_01.pdf

6 STRATEGIC CAPITAL CO., LTD. "Change Report (Large-Scale Short Term Transfer) " July 2024 12 https://disclosure2.edinet-fsa.go.jp/WZEK0040.aspx?S100U0YS

7 Toyo Securities Co., Ltd. "Notice Concerning Opinion of the Board of Directors of our company on Shareholder Proposal " May 2024 13 https://www2.jpx.co.jp/disc/86140/140120240513593375.pdf

8 Toyo Securities Co., Ltd. "Extraordinary Report " June 28, 2024 https://disclosure2.edinet-fsa.go.jp/WZEK0040.aspx?S100TXFD

9 Nikkei Asia, "Japan's Toyo Securities president ousted by activist investors," June 27, 2024. https://asia.nikkei.com/Business/Finance/Japan-s-Toyo-Securities-president-ousted-by-activist-investors

10 Toyo Securities Co., Ltd. "Notice of Partial Withdrawal of Proposal for Submission to the 102 Ordinary General Meeting of Shareholders" June 26, 2024 https://www2.jpx.co.jp/disc/86140/140120240626537255.pdf

11 Aizawa Securities Group, Inc. "Notice Concerning Strengthening Shareholder Returns - Measures to Realize Management Aware of Capital Cost and Stock Price" April 26, 2024 https://www2.jpx.co.jp/disc/87080/140120240426578406.pdf

12 Tokyo Stock Exchange, Inc. "Request for Measures for Realizing Management Aware of Capital Cost and Stock Price" March 31, 2023 https://www.jpx.co.jp/news/1020/20230331-01.html

13 Nikkei Asia, "Japan Inc. annual dividends at record levels again," June 8, 2023. https://asia.nikkei.com/Business/Markets/Japan-Inc.-annual-dividends-at-record-levels-again

14 Tokyo Stock Exchange, Inc. "Announcement of the List of Companies Disclosing "Measures for Realizing Management Aware of Capital Cost and Stock Price"" January 15, 2024 https://www.jpx.co.jp/news/1020/20240115-01.html

15 SK KAKEN CO., LTD. "Notice Concerning Opinion of the Board of Directors of our company Regarding Shareholder Proposal" May 13, 2024 https://www.sk-kaken.co.jp/wp/wp-content/uploads/20240513-6.pdf

16 SK KAKEN CO., LTD. "Extraordinary Report" June 28, 2024 https://disclosure2.edinet-fsa.go.jp/WZEK0040.aspx?S100TXHS

17 Toa Road Co., Ltd. "Extraordinary Report" June 28, 2024 https://disclosure2.edinet-fsa.go.jp/WZEK0040.aspx?S100TXFL,,

18 Bunka Shutter Co., Ltd. "Extraordinary Report" June 20, 2024 https://disclosure2.edinet-fsa.go.jp/WZEK0040.aspx?S100TORW

19 Bunka Shutter Co., Ltd. "Extraordinary Report" June 26, 2023 https://disclosure2.edinet-fsa.go.jp/WZEK0040.aspx?S100R4RA

20 Nikkei Asia, "Tokyo bourse pressures CEOs with list of firms that are reforming," January 15, 2024. https://asia.nikkei.com/Business/Markets/Tokyo-bourse-pressures-CEOs-with-list-of-firms-that-are-reforming

21 Hankyu Hanshin Holdings, Inc. June 17, 2024 https://disclosure2.edinet-fsa.go.jp/WZEK0040.aspx?S100TMQP

22 Sharp Corporation Notice of Appointment of Directors June 26, 2024 https://corporate.jp.sharp/ir/pdf/2024/240626-1.pdf

23 Sharp Corporation Extraordinary Report July 1, 2024 https://corporate.jp.sharp/ir/event/shareholder_meeting/pdf/24giketuken.pdf

24 Mitsubishi UFJ Financial Group, Inc. Notice of Convocation of the 19 Ordinary General Meeting of Shareholders June 27, 2024 https://www.mufg.jp/dam/ir/stock/meeting/pdf/convocation2406_ja.pdf

25 Mitsubishi UFJ Financial Group, Inc. Results of Exercise of Voting Rights (Extraordinary Report) July 1, 2024 https://www.mufg.jp/dam/ir/stock/meeting/pdf/exerciseofvotingrights2406_ja.pdf

26 Sumitomo Mitsui Financial Group, Inc. Extraordinary Report July 2, 2024 https://disclosure2.edinet-fsa.go.jp/WZEK0040.aspx?S100TZ67,,

27 ISS Insights, "In Focus: Shareholder Proposals in the 2024 U.S. Proxy Season," August 5, 2024. https://insights.issgovernance.com/posts/in-focus-shareholder-proposals-in-the-2024-us-proxy-season/

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2024 White & Case LLP

View full image: Approval Thresholds (PDF)

View full image: Approval Thresholds (PDF)

View full image: Shareholder Proposal Categories (PDF)

View full image: Shareholder Proposal Categories (PDF)