Australia’s shift to a mandatory merger control regime has reached another milestone with the Government introducing the proposed laws into Parliament on 10 October 2024. If enacted, notifiable transactions that trigger certain financial thresholds closing on or after 1 January 2026 will require competition clearance.

Following consultation on an exposure draft of the revised legislation, the Australian Government has introduced the Treasury Laws Amendment (Mergers and Acquisitions Reform) Bill 2024 (the Bill) into Parliament. The Bill was subsequently referred to the Senate Economics Legislation Committee, with a report currently due on 13 November 2024.

This update outlines the key elements of the Bill, the changes post-consultation on the exposure draft (see our previous alert) and our recommendations on how best to prepare for the new regime.

Recap: What is happening and why does it matter

| Key Elements | |

| Mandatory, suspensory regime |

|

| Merger notification thresholds |

|

| Timelines |

|

| Substantial lessening of competition test |

|

| Serial acquisitions |

|

| Transparency |

|

| Waiver |

|

| Review |

|

Background

On 10 April 2024, the Federal Treasurer announced the Australian Government’s proposal to reform Australia’s merger laws, introducing a single mandatory, suspensory, administrative regime, with the ACCC as first instance decision-maker. The move to a mandatory, suspensory regime will align Australia with most of the world, with many of the procedural elements consistent with key jurisdictions including the European Union, United States and China.

On 24 July 2024, the Australian Government released an exposure draft of the proposed merger legislation, with the proposed merger notification thresholds released for public consultation on 30 August 2024.

The Bill proposes that certain transitional amendments to the Competition and Consumer Act 2010 (Cth) (CCA) will come into effect from 1 July 2025, with the new regime fully operational from 1 January 2026. After that date, parties to proposed transactions that satisfy the notification thresholds will be required to notify the ACCC and will be prohibited from completing their transaction until they receive ACCC approval.

When will a transaction need to be notified?

Notifiable transactions

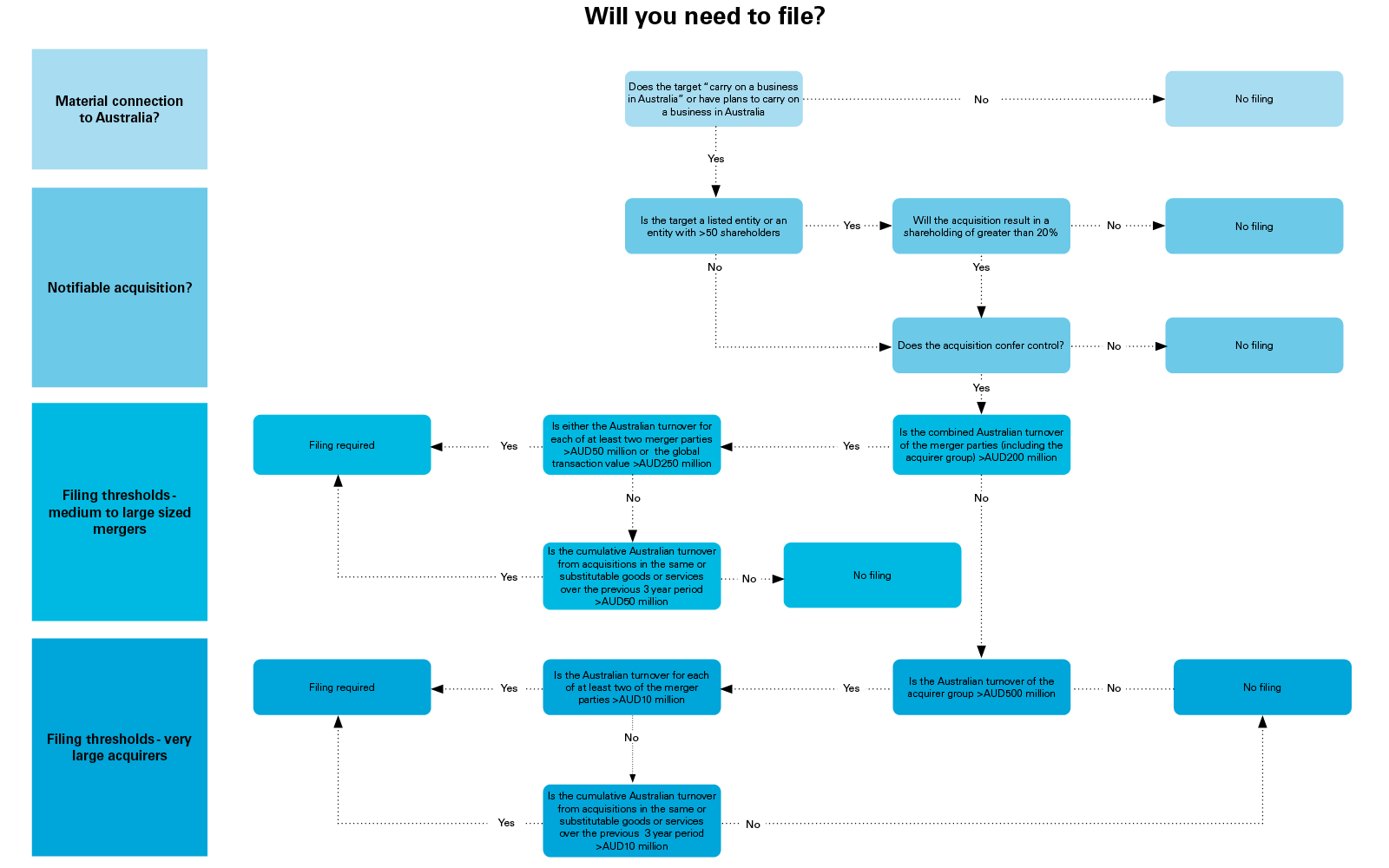

The proposed legislation will apply to the acquisition of shares in a body corporate or corporation, the acquisition of assets of a person or corporation, the acquisition of units in a unit trust, partnerships, as well as the acquisition of an interest in a managed investment scheme. An acquisition is required to be notified if:

- the target carries on a business in Australia or has plans to carry on a business in Australia; and

- the transaction results in the acquisition of control (broadly aligned with the definition in the Corporations Act 2001 (Cth), but with some modifications).

To minimise the impact on takeovers and capital markets, acquisitions that result in up to 20% voting power of publicly listed entities or unlisted widely held (greater than 50 members) companies will be excluded.

Importantly, even if a transaction does not meet thresholds, the proposed legislation envisages situations where the Minister can determine that certain classes of acquisitions will require notification. It is expected that subordinate legislation will be enacted after the Bill is passed, introducing additional requirements for specific industries.

Monetary Thresholds

The Bill empowers the Minister to designate the monetary thresholds for notification. The Treasurer has announced initial thresholds of:

- the combined Australian turnover of the merger parties (including the acquirer group) is at least $200 million (USD135 million); and either

- the Australian turnover is at least $50 million (USD33 million) for each of at least two of the merger parties; or

- if the global transaction value is at least $250 million (USD167 million); or

- the acquirer group’s Australian turnover is at least $500 million (USD335 million); and either

- the Australian turnover is at least $10 million (USD6.5 million) for each of at least two of the merger parties; or

- if the global transaction value is at least $50 million (USD33 million).

To address serial acquisitions a three year cumulative turnover threshold will apply for turnover calculations, requiring consideration of the total Australian turnover from all acquisitions in the same or substitutable goods or services over the previous three years.

Treasury will develop subordinate legislation which it will consult on later in 2024, into 2025.

Review Timeline

The timelines for review by the ACCC are consistent with previous announcements:

- Phase I determination: Up to 30 business days after the effective notification date, with the potential for a ‘fast-track’ determination after 15 business days. The fast-track process will likely be reserved for those technical filings which trigger the mandatory financial filing thresholds but are in unrelated industries or purely financial investments.

- Phase 2 determination: If the ACCC is satisfied that the acquisition could have the effect or be likely to have the effect of substantially lessening competition, a Phase 2 review will commence at the end of the Phase I period and end up to 90 business days after this date.

These timelines aim to provide businesses with certainty on ACCC decisions. The ACCC can extend these periods under certain conditions including:

- extending the Phase I or Phase 2 periods if there is a material change of fact impacting the notification;

- changing the notification date to the date that the ACCC becomes aware of a material change in facts;

- if the ACCC has not given a notice of competition concerns before the end of the 25th business day from the start of Phase 2 (by agreement with the notifying party); and

- if the notifying party seeks an extension of time to respond to a notice of competition concerns.

Importantly, the proposed legislation denotes that a business day does not include the period between 23 December and 10 January.

Substantial Lessening of Competition Test

For mergers, the meaning of substantially lessening competition is extended to include ‘creating, strengthening or entrenching a substantial degree of power in any market.’ This intends to target acquisitions by dominant firms of small or nascent competitors, capturing incremental changes in market power that the ACCC considers amount to a substantial lessening of competition. In addition, establishing a position of substantial degree of market power in another market that a dominant firm did not previously operate in may also constitute a substantial lessening of competition.

A previous proposal to amend the meaning of substantially lessening competition throughout the entirety of the CCA has been abandoned.

Filing Fees

Filing fees are yet to be determined and will be set on a cost recovery basis. Fees may be charged either by the ACCC or at the Minister’s direction if it is determined that an application will be subject to Phase 2 review, the application was materially incomplete, was misleading or contained false information, it is a public benefit application, or additional material is provided due to a material change of fact.

Transitional Arrangements

The Bill provides that:

- voluntary notifications of acquisitions can be made under the proposed legislation from 1 July 2025;

- the mandatory notification requirements will not apply to an acquisition if, between 1 July 2025 and 31 December 2025, authorisation is granted or the ACCC advises that no action will be taken; and

- the merger authorisation process will be retained until 31 December 2025, with any application for authorisation required to be made on or before 30 June 2025.

From 1 January 2026, all transactions that meet the notification thresholds must be notified.

Parties who are granted authorisation or clearance in the second half of 2025 will need to ensure that the acquisition is put into effect within 12 months. It will also be critical that parties transacting during that period understand the changes to the CCA and determine whether they are caught by the new regime.

Business Implications: what does this mean for your transaction?

In light of the extensive consultation on the Bill to date, it is likely that the reform package will be passed with little to no changes. Businesses should consider the following in their transaction planning:

- Start planning now: If you are currently planning on executing a transaction with completion dates extending into the tail end of 2025, consider whether you can accelerate your transaction to ensure completion prior to 31 December 2025. If there is a risk of completion occurring post 31 December 2025, a voluntary filing in H2 2025 under the new regime may be appropriate.

- Transaction documents: Agreements evidencing the transaction will need to reflect appropriate conditions precedent to completion and accurately reflect the regime under which the parties are seeking merger clearance. Sunset dates should also be considered carefully with additional time factored into overall transaction timelines for the transition into the new regime, including the potential for pre-notification requirements which will extend the statutory timeframes.

- Be accurate in document creation: Parties and their corporate advisors should be mindful that all descriptions of competitors, competition, market shares and markets in information memorandums and other important documents are accurate and properly reflect competitive dynamics and market realities. The ACCC routinely requests production of documents considered by the board in approving a transaction, and we expect this to be formalised and potentially expanded under the new regime.

- Unique implications for firms holding market power: The proposed amendments to the substantial lessening of competition test will require parties to consider their acquisition strategy and whether any acquisitions (including serial acquisitions) will result in a material increase in their market share. Parties who are looking to vertically integrate and move into another level of the industry will also need to actively consider competition law risks from the outset.

- Unique implications for minority interests and private equity: The determination of when an acquirer will exercise control, as well as the calculation of group turnover for the purposes of monetary thresholds, is expected to be complex and time consuming. Private equity sponsors and managed fund investors in particular should consider consulting with legal counsel early (even when acquiring minority interests) to determine whether a filing will be necessary and, if so, accommodate it into their overall transaction plan.

- Expect a messy transition period: As with any new regulatory regime, we expect the transition to the new regime may not be smooth sailing, with potential timing implications for obtaining clearance. Parties should consider addressing these risks by analysing potential competitive implications early and allowing sufficient time for obtaining clearance.

This shift from the previous voluntary system to a mandatory regime requires businesses to be vigilant in understanding their obligations to minimise legal and regulatory challenges. Increased compliance costs and the need for detailed documentation will become standard, making it imperative for companies to consult with legal counsel early in the transaction process. Staying informed and prepared will be critical to successfully operating within this new regulatory framework.

Building on our experience with many similar laws worldwide, the White & Case global antitrust team is uniquely positioned to assist in navigating the new Australian mandatory merger regime.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2024 White & Case LLP

View full image: Will you need to file (PDF)

View full image: Will you need to file (PDF)